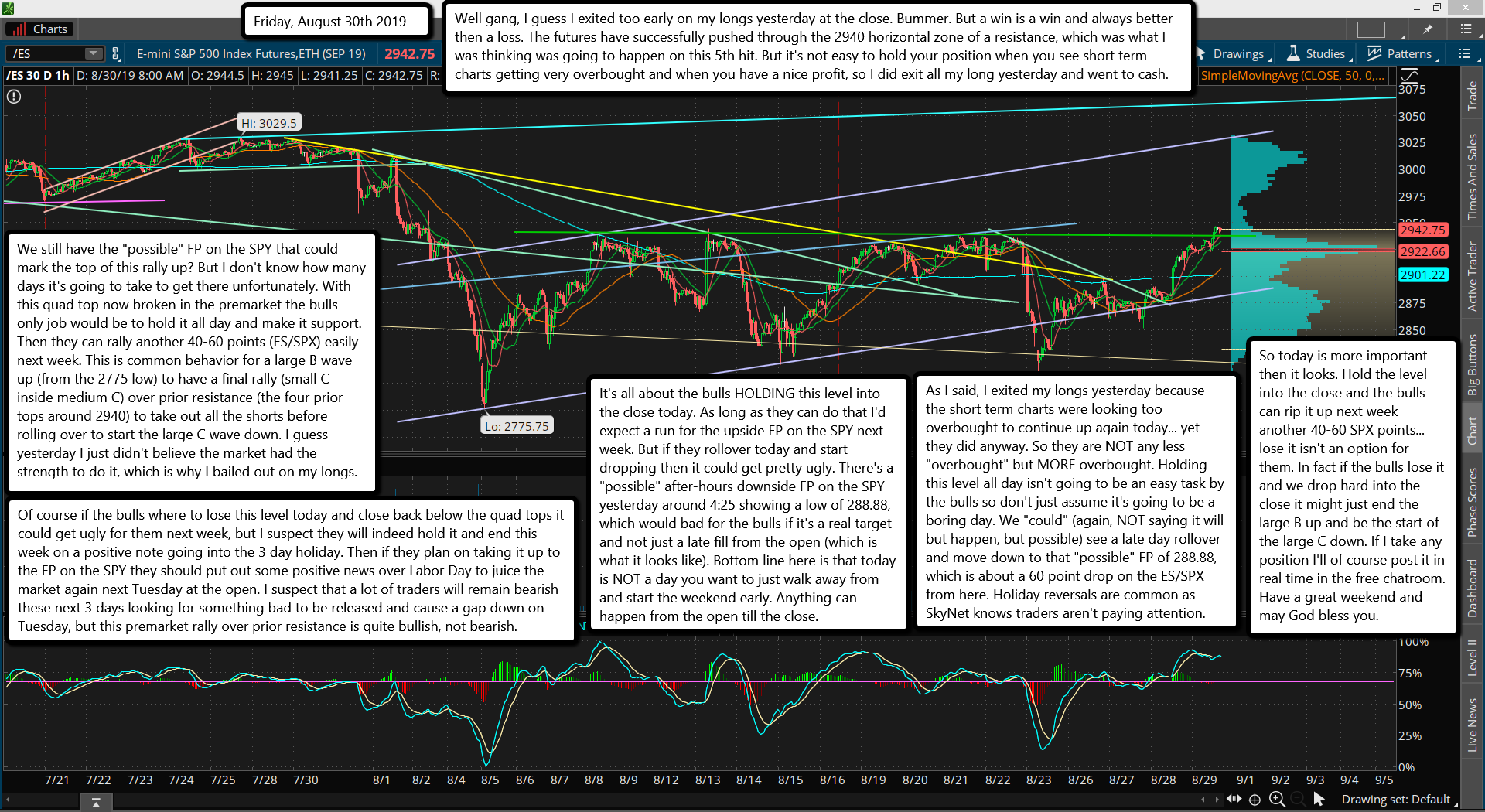

Well gang, I guess I exited too early on my longs yesterday at the close. Bummer. But a win is a win and always better then a loss. The futures have successfully pushed through the 2940 horizontal zone of a resistance, which was what I was thinking was going to happen on this 5th hit. But it's not easy to hold your position when you see short term charts getting very overbought and when you have a nice profit, so I did exit all my long yesterday and went to cash.

We still have the "possible" FP on the SPY that could mark the top of this rally up? But I don't know how many days it's going to take to get there unfortunately. With this quad top now broken in the premarket the bulls only job would be to hold it all day and make it support. Then they can rally another 40-60 points (ES/SPX) easily next week. This is common behavior for a large B wave up (from the 2775 low) to have a final rally (small C inside medium C) over prior resistance (the four prior tops around 2940) to take out all the shorts before rolling over to start the large C wave down. I guess yesterday I just didn't believe the market had the strength to do it, which is why I bailed out on my longs.

Of course if the bulls where to lose this level today and close back below the quad tops it could get ugly for them next week, but I suspect they will indeed hold it and end this week on a positive note going into the 3 day holiday. Then if they plan on taking it up to the FP on the SPY they should put out some positive news over Labor Day to juice the market again next Tuesday at the open. I suspect that a lot of traders will remain bearish these next 3 days looking for something bad to be released and cause a gap down on Tuesday, but this premarket rally over prior resistance is quite bullish, not bearish.

It's all about the bulls HOLDING this level into the close today. As long as they can do that I'd expect a run for the upside FP on the SPY next week. But if they rollover today and start dropping then it could get pretty ugly. There's a "possible" after-hours downside FP on the SPY yesterday around 4:25 showing a low of 288.88, which would bad for the bulls if it's a real target and not just a late fill from the open (which is what it looks like). Bottom line here is that today is NOT a day you want to just walk away from and start the weekend early. Anything can happen from the open till the close.

As I said, I exited my longs yesterday because the short term charts were looking too overbought to continue up again today... yet they did anyway. So they are NOT any less "overbought" but MORE overbought. Holding this level all day isn't going to be an easy task by the bulls so don't just assume it's going to be a boring day. We "could" (again, NOT saying it will but happen, but possible) see a late day rollover and move down to that "possible" FP of 288.88, which is about a 60 point drop on the ES/SPX from here. Holiday reversals are common as SkyNet knows traders aren't paying attention.

So today is more important then it looks. Hold the level into the close and the bulls can rip it up next week another 40-60 SPX points... lose it isn't an option for them. In fact if the bulls lose it and we drop hard into the close it might just end the large B up and be the start of the large C down. If I take any position I'll of course post it in real time in the free chatroom. Have a great weekend and may God bless you.