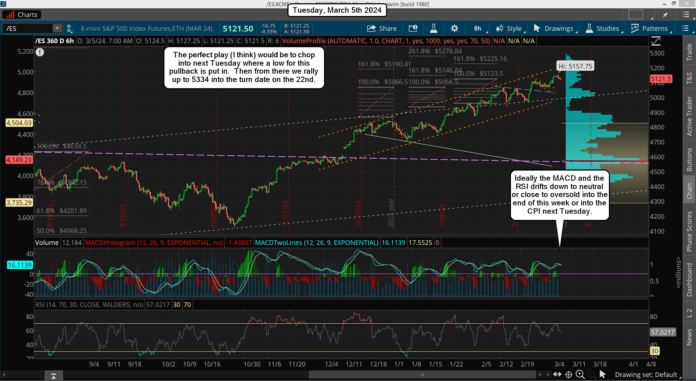

We may have topped yesterday for Tiny Wave 5 up with that late day squeeze up to 5157 as we sold off quickly after the close. I said yesterday that I was looking for the 5225 level per my FET (Fibonacci Extension Target), which I thought would be from Tiny Wave 5 up, but it appears finished to me now.

If so, then Small Wave 3 up ended too and now we should spend all week (possibly) drifting lower for Small Wave 4... which might be in an ABC pattern? Small Wave 2 down was a choppy mess that started from the 5123 high on 2/23 and ended at the 5060 low on 2/29, so that's 6 calendar days in total, and that pattern could be repeated in "time" but probably not in pattern.

They tend to alternative one or the other, and since we have lots of time left before reaching the next turn date on March 22nd I think the market will drag out this Small Wave 4 all week to burn that time, which leaves two weeks for Small Wave 5 up to play out. Therefore I lean toward an ABC down this time and another week or so in time to finish Small Wave 4... and it just might bottom right into the CPI next Tuesday, either before it or after it's released?

If the market can pullback to about 5100 into next week then that should be plenty of time to reset the short term overbought charts and allow another week plus rally to the 5334.39 upside level for my FET from the July 2023 high from the October 2022 low. That target should be hit (and pierced) before any good pullback (5-10%?) can happen, and ideally that's right into the turn date as well. It's really hard too forecast the day to day moves, but a week full of nothing but chop would be ideal I think.

And then they can used the CPI number rally the market up. Lastly, the futures will roll into the next quarters contract next Thursday into Friday, and it's estimated that the spread will be almost 60 point between it and the SPX cash, so keep that in mind.

Have a blessed day.