Are we in the Twight Zone?

This has been any extremely frustrating week for all bears... especially myself. Although I'll be a bull when the market points in that direction, I like being a bear better. But don't get me wrong... I'll go long if there's a good chance to make some money on it.

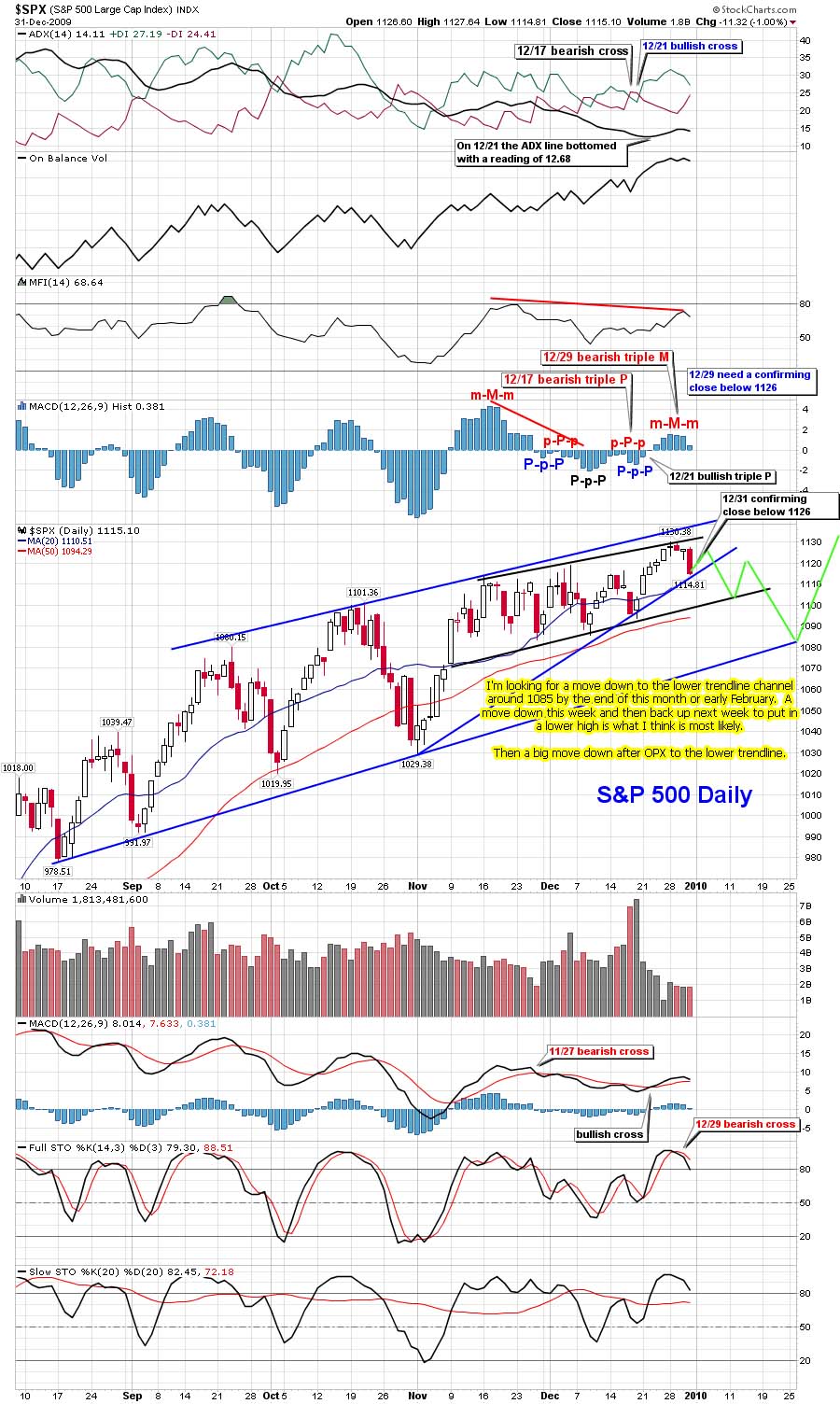

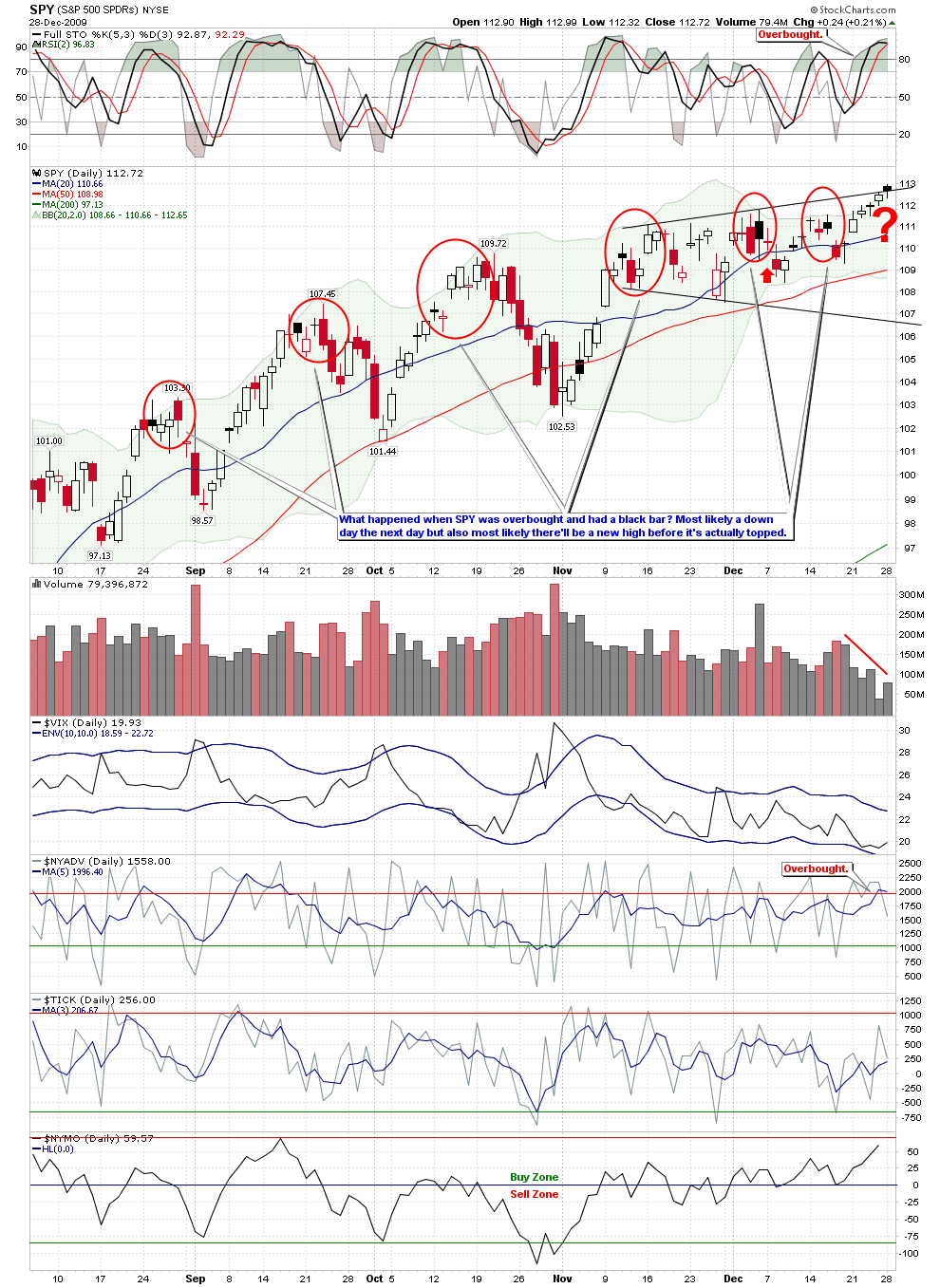

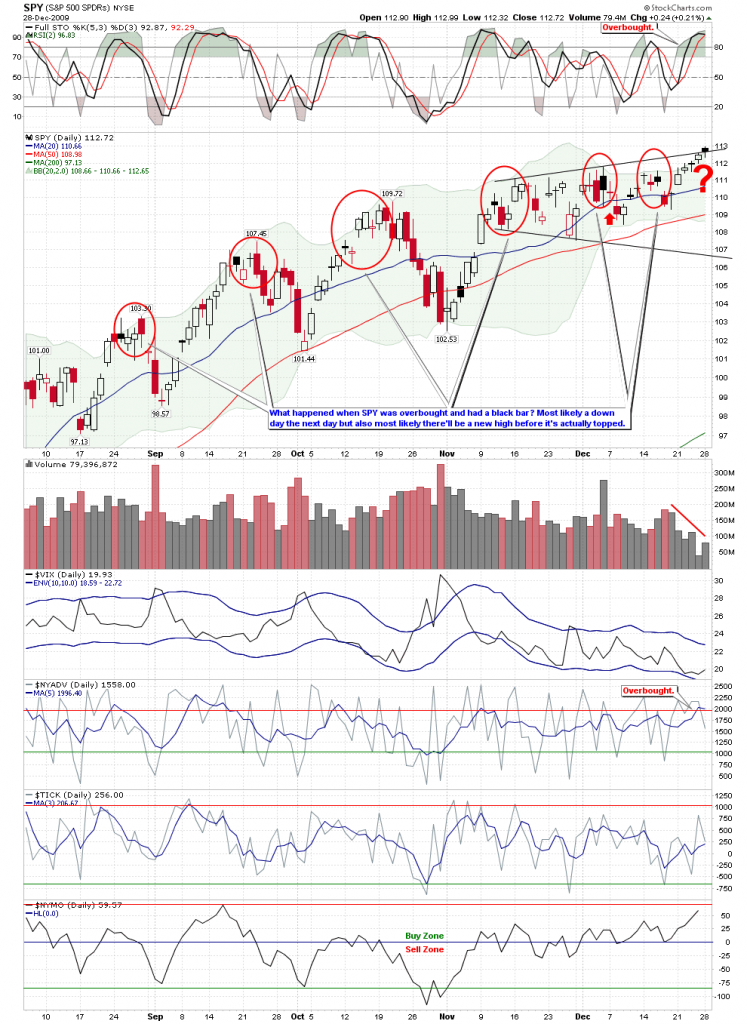

Problem is... this market should be heading down, but it's not? How can you go long when the technicals point down on so many different charts. Very few charts point up, and if they do... they are overridden by the larger time frame. If a 60 minute chart is bullish, but the daily is bearish, then you shouldn't take a long position (unless you are a day trader only), as the daily chart over rules the 60 minute chart.

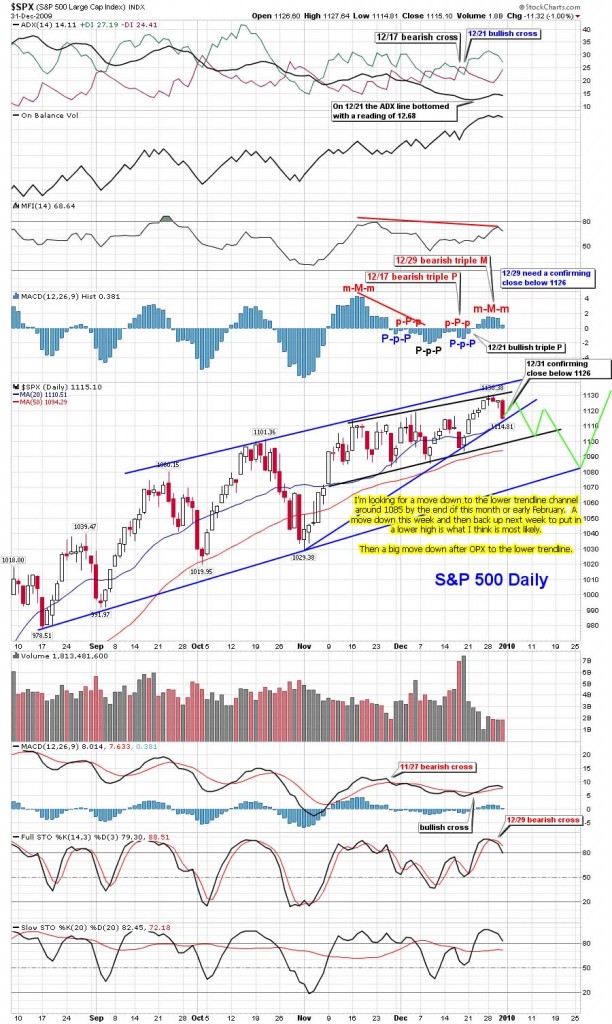

Going into next week, the market could actually continue this insane sideways up and down movement... all the way to option expiration. We are within just a few cents of hitting the 200ma on the USO (oil), which has very high odds of a bounce for at least 2-3 days. That will give the S&P an "up" move as the big oil companies, (that are in the s&p) will rally from the bounce up. This could stop any big down move in the market.

Then there is Gold. It is also getting ready to hit the 200ma too, which should cause a nice bounce up. That will again support the s&p, and prevent any big down move. It means that the market will be in this Twilight Zone as it bounces up and down, until gold and oil has their bounce done, and are ready to rollover to the down side again.

As for gold, I'm very bullish on it long term and think that it will explode next year. Oil is a different story, as demand has too come back for it to go higher again. I'm neutral on oil long term, but short term I'm looking for a bounce. Now for the wildcard... the dollar!

The dollar had another strong day Friday as it finally broke out of it's bullish consolidation trading pattern. The UUP (dollar) closed at 22.68, up 18 cents for the day. Another big move on Monday could cause a sell off in the market. The UUP will hit heavy resistance at 23.00, (which, by the way, a move from 22.68 to 23.00 is considered a big move in it). If the UUP hit's 23.00, the market should sell off hard, but it could be muted by oil and gold.

I'll be looking for some movement down next week, but I'm sure it will just bounce around some more... and not breakout of the zone yet. I'll be selling my shorts, at a loss of course, whenever I get a decent move down. If my positions weren't options, I might be able to get out without much of a loss. But, options get killed with time decay, and that's just exactly what the market makers want... to take you're money.

I have too say that I'm really getting tired of all the manipulation done by the government to keep the market up, and not let it correct naturally. It will come back to haunt them later on. In the meantime, I might have better success trading oil or gold, as I expect a huge bull market to occur in gold over the coming years. Oil... I'm not sure about long term, but both are ready for a bounce up next week.

Anyway, at this point, I don't see my prior forecast of a move down to 1070 area coming true. The S&P has so many different backup markets supporting it that any one of them can keep it up... (as long as we continue to have light volume of course). I don't see any heavy volume coming into the market until next year, after the holiday's. That means that commodities (oil), financials, gold, or the dollar can come into the rescue and keep the market up at any time.

Look forward... the only way I see the market falling hard at this point is for the dollar to get a huge rally up going, the financials to collapse, oil to fall hard on weak demand and large inventories, and gold to fall as investors flee to the dollar for safety. I do see all that happening next year, but as is for next week... it's unlikely.

Overall, I'm very disappointed, as it seems like all technical analysis's on the S&P is worthless... as they simply will not let is correct naturally. I spend a lot of time studying the market and where it should go, and I believe that it would have went there if I had made my forecast last year, or anytime before March of this year. I say that because of the massive printing of money that has been thrown into the market has changed all the rules.

You can't play poker fairly with someone who just prints more money to bet you whenever they run out. How can you ever beat them, even with a royal straight flush (spade high of course), by betting everything you have (as you can't lose on a royal straight flush)... only to have them go print some more money and raise the bet beyond what you have? That's what it feels like too me when I pick the right direction, but the time decay, and quick rally back moves, prevent me from getting out with a profit in time. You are forced to be a day trader only, which I'm not, as I don't have access to a computer all day... nor could I watch it all day, even if I did!

I'm sure many of you are also frustrated too. I know that there has always been some degree of manipulation in the market... but never to the degree that's it's at currently. They couldn't control the markets this much in the past, as they weren't printing trillions of dollars out of thin air... too be used to buy up the market, instead of stimulate the economy... of course.

Well, that about wraps it up, as I can't think of anything else too bitch about (I can really... but it's not worth wasting your time on, or mine!). If you plan on playing the market next week, you might look to buy gold once it hits it's 200ma around 108 on the GLD. It should rally back up to the 50ma around 113 currently.

Sorry my orginal forecast was wrong (or will be, as I now don't see it being accurate next week). The only way it could come true is for a huge rally in the dollar, which could (maybe) produce a big (20-30 points) down day in the market. Could we have a "Black Monday"? It's possible, but not likely. I just want to throw that out there, as technicals could easily support a "Black Monday", but oil and gold could stop it.

If... by some long shot, it does happen, I'd definitely be expecting it to rally back up before Friday. The "Current Pain" is now at 110 spy, so I don't expect any sell off to continue down. If you see it... get out of all shorts asap, as a rally back up will most likely follow it.

Red