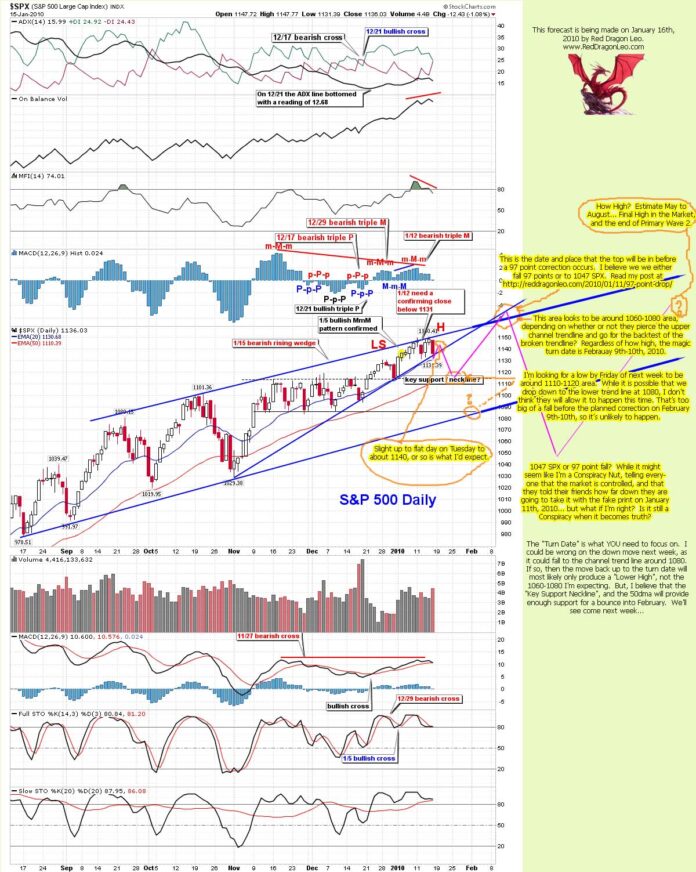

This weekend update is going to be a "KEEPER", as you should bookmark it and re-read it in about a month from now. Also, you should save the charts posted here. I'm going out a limb here by posting a "Turn Date" and stating how much I expect it to fall, but I've never been afraid to speak up when I have something important to say... so why stop now? The chart below states what I'm expecting to happen over the next few weeks. Study it hard!

I'm expecting a flat to slightly up day on Tuesday (Market's closed on Monday for Holiday). I'd say the intraday high could be around 114.00 SPY level. The market could close up or just flat on Tuesday, but after the close and throughout the rest of the week, there is a lot of important earnings out.

Tuesday

Before Market Open: C, PETS, AMTD

After Market Close: CREE, IBM

Wednesday (my b-day =)

BMO: USB, MS, WFC

AMC: EBAY, SBUX

Thursday

BMO: GS, UNH

AMC: AXP, COF, GOOG,

Friday

BMO: GE, MCD

I expect the market to view the numbers as bad, and sell off into the end of the week. The first target down is at 112.30 SPY, which is the horizontal support line at about 1115 SPX level. This is where the market should bounce. After that, there is the 50 day moving average coming in around 111.00 (daily chart), and a gap fill at 111.40 SPY (60 minute chart) that should provide good support for the down move coming. That's about 1103 SPX for the gap fill (60 minute chart).

The chart above shows a possible 5 wave down move to about 1100 spx would be a good place to stop the move down, as it would fill the gap on the 21st and be an important even number that the Bulls won't give up easy. It may not make it down that low, and instead stop at the 1115 area? I personally think that 1115 will stop the fall as 50 day moving average on the daily chart (not shown on the chart above) hasn’t been hit since November the 1st, 2009. Anytime the market has been away from a major trend line for that long, it should produce a multi-day bounce. So, this chart shows a possible move down further, but I don’t really think it will happen. From an Elliottwave point of view... the move shown is a 5 wave move down. I think it will only be an ABC wave pattern. Again, the big move down is coming February 9th-10th, 2010. Don’t get sucked into a bear trap too early.

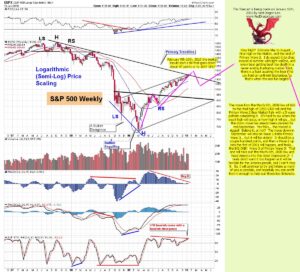

Moving on to a longer term I've posted another chart below that shows you where I'm expecting the market to go this year. I believe the move from the March 6th, 2009 low of 666 to the final high of 1250-1300 will end the Primary Wave 2 Bear Market Rally with a 5 wave pattern completing it. It’s hard to say when the exact high will occur, or how high it will go... but the down move has already been planned for mid-September.

Yes folks... the market is rigged! Believe it, or not? The move down in September will only be Wave 1 inside Primary Wave 3... but it will be violent! It should be a couple hundred points, and then a Wave 2 up into the first of 2011 will happen, and finally... the BIG ONE! Wave 3 of Primary Wave 3! That one will take out the March 6th, 2009 low and head America into the Great Depression 2!

I really don’t want it too happen as it will be horrible for the America people, but I can’t stop it. So, I will continue to try and inform as many of you as possible, and hopefully you can profit from it enough to help out those less fortunate. This is a special post and hopefully it will give you some help in planning your trading, not get caught long in February.

Of course I could be wrong, and if I am I'll gladly admit it... and not hide behind a lot of double talk like some people do. I'm clearly stating that I expect the market to go down next week, then up until February 9th-10th. Then a large move down that will either go 97 points down, or down to 1047 SPX? Which one... I don't know? It doesn't matter right now, as the most important thing is to get yourself positioned short before it starts.

I'll jump off that ship before it sinks, and on to the next ride up when I'm finally on it...

Red

You could be right….I expect EWI to get gamed again….they just went full tilt short AGAIN….

I like the m-M-m pattern on the MACD.

Elliottwave seems to work best after the move has happened… However, sometimes you can use it to forecast the next move, but I try to use a mixture of everything.

Hi Red,

1142 is the key level for next week. If we go above 1142, 1131.39 (Fri low) might have been the low and more upside (1160-1170) is possible.

JMHO

I think we go down to 1115 level and back up to 1160-1180 by February. So, yeah… we're on the same page. That February date is important… trust me on that one. Regardless of how high we make it too on that date, it's a big turn date.

Yep, I have 1115 as a key level too. I have two turn dates, one on Jan 29th and the second one around Feb 12th.

Thank you.

A low risk play would be to buy Feb 114 puts at 1142 with a stop at 1144. With Feb options, the risk to reward is good if we drop to 1115. If we go above 1142 and the stop loss is hit, we may lose 3% on the puts. On the other hand, if we indeed drop to 1115, the return on Feb 114 puts will be 40-50%. In summary, the risk is 3% and the reward is 40-50%.

That is true, but the market has been so heavily manipulated that a person can get killed on the whipsaw action, if their not quick to get out. I'm looking to play individual stocks only for now.

Once the February high is in, I'll go back into the SPY. I'm looking at IBM for a short canidate now. I'd like to see it get up to 133.50 on Tuesday, and then I'm thinking about short it with a 130/135 call credit spread.

Since the earnings are coming out after the bell, the calls are inflated in value now, and will go back down after the earnings are released. So, even if the stock goes up a little, the calls will be worth less.

I think IBM will sell off after earnings, as it is at a multi-year high right now. It's above the 1999 high and right at the 2000 high… which is the highest it's been this decade.

There was an intra-month high around 139, but I don't see it reaching there. The 133.50 is the 2000 high, and that should stop any further advance.

Amazon is another one I'm looking at, but I'd like to see it go back up some first.

I have AMZN on my watch list as well. I forgot to mention that 1130 is also a key level that must be broken to reach 1115.

I'm pretty confident that 1130 will break. Lot's of charts rolling over now… 1115 is our target.

Nice post !!!

http://eclipptv.com/viewVideo.php?video_id=9493

Intersting…….

JIM Rogers on Boom in Commodities…

http://eclipptv.com/viewVideo.php?video_id=9491

Thanks

Joe

I'm a fan of Gerald Celente. He tells it like it… calling a crook a crook! LOL!

Here's the chart I posted on a few other blogs that ads to your therory that earnings may be less then expected. Looks to me like it's beginning to break down now

RTH – http://screencast.com/t/YWQ1MjAwN

Great chart Jigsaw. That clearly shows that the Retailer's broke the trend line. Now all we need is another close outside it to confirm the down trend.

“Primary Wave 2 Bear Market Rally with a 5 wave pattern completing it”

if we use EWT, than 2,B and 4 are 3 wave corrections, not impulses.and if we get 5waves from bottom,(666 SPX) then I would expect more highs to come.

but very, very nice work!

excellent!

I only gave a possible EW count, as it's always easier to go back and make the counts fit… then to predict them going forward. It has it's place, but it's not always accurate.

But then again, what do I know? I'm not an expert in EWT.

yes, but under EWT rules there is no correction wave constructed of 5waves…pure theory, nothing more:)

but it's not too important thing.

you made very brave prediction it is helping me, and thanks for it.

cheers!

Nice stuff red – any possibility a Brown win tuesday might alter things? Think it might spur a big rally since it would be percieved as a move away from socialism.

I'll get right on that Moon… (rubbing crystal ball). I give Brown a 50% chance of winning! LOL.

Seriously though… I wish we would “move away from Socialism”, but the evil forces are pretty well in trenched in the system. It's going to be an up hill battle to defeat them. I'll cross my fingers though…

FTSE up today

http://iamfacingforeclosure.com/blog/2009/10/26…

Alt- crisis postponed? for another two years?

I guess if you own the printing press, you could pay off everyone's mortgage if you wanted too… of course that will never happen. The coming crash in the market will still happen later this year. Probably starting in September and going through the end of the year and into early 2011. They can't postpone what going to happen to the market. Another wave down is coming, with or without the ARM's delayed…

Agree on your thoughts about the 50, Red.

Thanks Red – always enjoy reading your posts. Time will tell.

Yes girl… time will time. Of course I'm not always right, but who is? I try to be correct, but I also try to write posts that entertain, educate, frustrate, and make people laugh… hopefully not at me! 🙂

Some how I think of you as being smarter now… must be the cool avatar? Good job girl!

Red

10 stars for your blog

10 stars for your blog