Wall Street is Coming under attack! Job losses, fake earnings, corporations defaulting on debt, bailout's for the rich, housing markets underwater... all spell a CRASH Coming! After all, how else can you paid off your debt... just wipe them out instead..."That's How"!

If you think that this is just another 10% correction, and that it's now over... you're dead wrong! It hasn't even started yet! Want the evidence? I'll direct you to the 3 charts below (found on Shanky's Charts... link on my Blogroll)...

Daily Chart

Weekly Chart

Monthly Chart

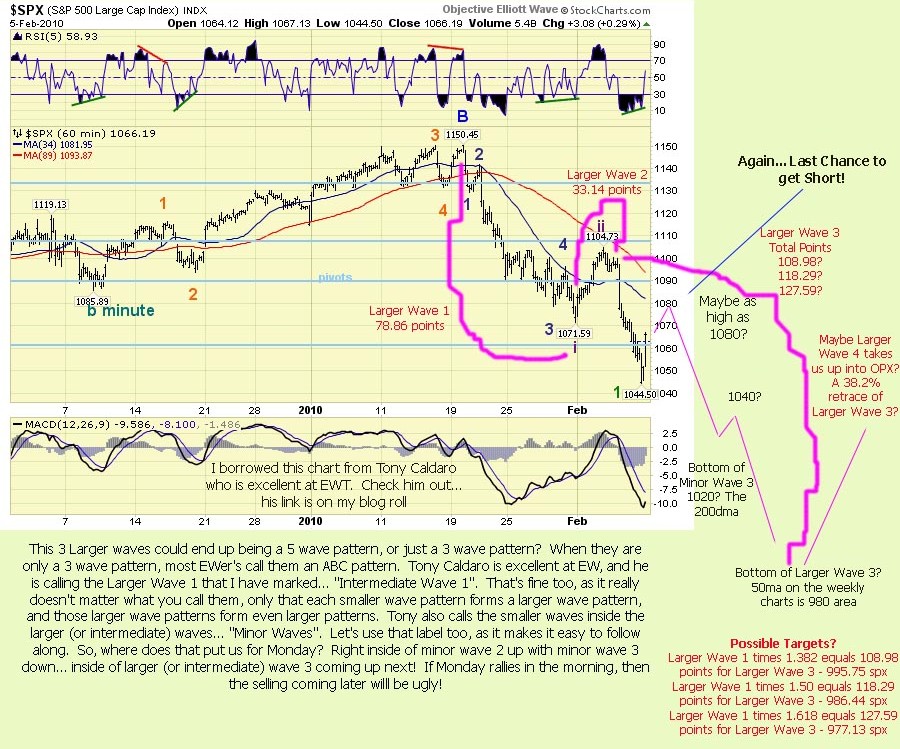

So, could Monday be a "Black Monday"? I don't know? But the rest of the week isn't looking good. Wherever we peak on Monday (1070-1080... or maybe we already completed minor wave 2 up?), the selling to come after that will be huge. It will be a minor wave 3 inside a larger wave 3... both inside Primary wave 3 (or C). It's going to be scary from here on out. At some point there will be "Panic Selling"... and I might not even want to make a daily post during those times?

Although I didn't create this bubble, I really don't want to be the center of an attention. As a matter of fact, I never created this blog to gain a following... only to post my thoughts. I don't use any type of marketing or even any other type of blog optimization technique's. I really don't want any traffic to the site. But apparently I have quite a few people reading it daily... that don't comment (which is fine).

I'm just looking to make enough money to retire on, and then relax and enjoy life a little. So, if my daily posts become weekly posts... you'll know why. (Not saying that I'll stop posting... only that I might take some time off at some point).

Moving on...

Here's what I see for next week... Monday should have the continuation of minor wave 2 up, inside of larger wave 3 down. When that ends, probably by midday Monday (but it could go into Tuesday?), the minor wave 3 down inside of larger wave 3 down will start. I think we will bounce on the 200dma (daily chart) around 1020, and come back up for minor wave 4 (still inside larger wave 3 down), and have another push down later in the week for minor wave 5 down (possible target... the 50ma on the weekly charts, about 980).

Remember, the 1000 level is important to the bulls, and a break of it would have the bears jumping on the short side faster then you can blink an eye! Then once all the bulls have sold out and the bears are on the short side... Bam! ...here come the buy programs to rally us back up for Larger Wave 4! How high? I don't know? But, it will probably be in line with option expiration on the 19th.

That's what I'd do if I were them

Red

P.S. Keep in mind folks... nothing is written in stone. This is only a forecast of the possible moves coming. If the government comes into the market again, with a "Stimulus Package Number Two"... it all changes. But for now, I believe they won't do that. Not until the banks get done unloading their shares (a few months?). Then they will come to the rescue again.

"Lather, Rinse... and Repeat"

RED, READ YOU DAILY.LOVE THE FACT THAT YOU ARE A STRAIGHT SHOOTER.NO DOUBLE TALK.RIGHT OR WRONG YOU TAKE A STAND.

Thanks TY… one should alway admit when they are wrong. I've been wrong on many occasions and I usually pay for it in my trading account. But, I'm still here…

Red,

G7 comments are bearish for markets. No Greek bailouts, just soothing words of assurance that we will manage. Markets are not going to like. They want to tax banks based on global agreement. All agree that banks must be taxed to pay for the crisis!. This is not going to go well for markets Monday (or next week).

I am new here and started posting right away to acknowlegde you deep understanding of markets.

I like your pictures as they are sending right message regarding markets.

Thanks Michigan… Comment away, I'll alway give you the best answer I can. Of course no one gets them all right, but I'll admit when I'm wrong too.

Monday could surprise a few people… that's for sure.

They want the banks to bail them out

http://www.reuters.com/article/idUSTRE61601W201…

Some how I don't think the banks are going to like that idea too well… hmmm, could this trigger a sell off? Inquiring minds want to know. LOL!

Thanks for the update redvettes…

Market action thus far surprised bears and bulls alike. Now bears are expecting a bounce Monday, Bulls are expecting a huge rally based on Friday afternoon action. A professional trader I know well is waiting to go short as he was waiting for his signals until now. He did not like to chase markets that were going down.

I am not positioned well either to take advantage of this correction. Actually, I lost money trading in and out.

Next week is very interesting..

We might just fall off a cliff after the possible bounce into the coming opx on the 19th… who knows? I'll just take it one day at a time.

Just my opinion, but I don't think this is a time to go long… unless you're a day trader of course. Since I swing trade, I'll only be looking for short positions over the next few months. I might dip my toe in the water for a quick long position, but I won't over stay my welcome.

Fantastic post, Red! Let's get ready to rock and roll. 🙂

Thanks girl… Looking forward to the big surprise coming next week! ha ha ha ha

Price movements could be indicating we are near a bottom here – gold shares (gg aem) went up 6% on Friday. The market could follow soon. It could be dangerous to go short here. Better to trade miners at moment.

I don't trade mining stocks, but good luck on that. Maybe the market will run to gold during the next downtrend, or maybe they will be unloading gold to cover margin calls? Just food for thought.

Red thanks as always for these briliant posts.

One thing troubling me though is that all our governments have doled out our hard earned tax money to Goldman Sacks and their cahoots to ramp up these markets then in the next few weeks as billions are wiped out then these taxpayer paid for assets become worthless but we still have to pay mega tax for a generation or two to pay for them anyway!

Dont seem right to me that! Shouldnt we be throwing some tea in a harbour or something?

LOL! Yes, let's start another Boston Tea Party!… But on a serious note, I'm more worried about WW3 breaking out in Yeman over the Stargate buried under the ocean. (Look out for staged terrorist events to happen which will take us to war, and cause a market crash. They call them False Flag Events).

http://www.youtube.com/watch?v=tYlJENPmPlI&feat…

Yes… it's real! And they all want control of it. The link above is just a short 10 minute clip. If you want to really understand what's going on, go watch this video…

http://www.youtube.com/watch?v=22S2TNMf8v4&feat…

Everyone needs to wake up and realize that we're not alone… and never have been.

You have been watching Babylon 5 too much, Red. The Shadows are back……. But Ivanova is soooo hot!

Red,

What is your take thus far. I sense someone is trying hard to hold-up S&P futures. As you may know past six months someone is manipulating futures midnight while public is asleep.

I wouldn't make too much out of the pre-market, as the volume is too light to predict what the normal hours will bring. Remember, we had over 400 million shares traded on the SPY Friday!

That's a Huge amount… and it's all big institutions selling. I believe they simply sold for about the first half of the day, and then left for an early weekend. That allowed the PPT to come in and rally in the last hour to close the Dow above 10,000.

It was just for show. Remember, they had the Super Bowl on Sunday. They didn't want the media to focus on the market, and they wouldn't… unless the Dow closed below 10,000.

So, they direct their attention to the Super Bowl instead. We also the Olympics starting this week… many things to distract the media while the market sells off.

It's the old magic trick… look at my 2 sexy assistants in their hot little outfits, while I'll escape from this cage or chains… you get the idea.

Hi Red,

Still short. Bullish EW bloggers all over the place. I'm beginning to think each person can make the technicals adhere to their own views. I'm staying short but if your mind changes, please let me know! It seems you might have information that others don't. Nothing about this market seems positive to me (if nothing else but increased volatility) but I am sure people were thinking the same thing back in July and October. If this week doesn't play out, I may have to re-evaluate.

Hang tight girl… even the bow of the Titanic rose up just moments before she sank. The market will do the same. By the end of the week, (probably much sooner), we will be saying hello to 1020 spx.

Click on the link by redvettes below. The banks aren't going to like being taxed, or forced to pay for this recession. The selling is coming…

OK – I will assume you know something I don't. While I do believe there are ugly things going on with our/other governments and I don't see anything rational about how the market has been going up, I am also aware that things can stay irrational longer than I can stay solvent. I will stay short though. Thanks for holding my hand!

I don't want to be rude to Red as I like him and think Red is a good guy. But Red has stumpled across the conspiracy stuffs and unfortunately is in on wild goose chase. I know he means well. But this adventure he is on, is unfortunately unproductive. Entertaining ?yes. Productive? Doubtful. It saddens me to see a rather brilliant mind on this wild goose chase of the shadows. May be I should drive down to whereever he lives and gives the man a good whack on the head. Some good old fashioned, wall to wall counselling. lol

LOL! Yes, I try to entain… but the charts tell the story SC, with or without and conspiray theroies. By the way, when does a conspiray theroy no long become a conspiray? Answer: When it's true…

Interesting day so far. Everyone expecting a bounce. We shall see.

hey Monica… Yeah it's a bit flat ain't it?

Very choppy. Can go in either direction (as usual :)). Trusting red, Serge and my gut. Staying short – will hang on through a bounce.

15 minute charts are ready to roll down, but the 60 minute chart is still going up. That's why it's choppy, and is putting in that minor wave 2 up that I talked about.

The larger time frames (Monthly, Weekly, and Daily) are all rolling over and will stop any advance the 60 minute chart makes.

Think of each chart as a rank in the military. The larger the time frame, the higher the rank. Lots of people thought there would be a rally, but as soon as the 60 minute chart finishes it's up, it will rollover and then start the minor wave 3 inside larger wave 3. That will probably be late today or tomorrow.

It could then be Black Tuesday, instead of Black Monday? Regardless, once all the charts are pointing down… it's bad news for the bulls!

Thanks Red – really appreciate you helping me learn. Why did you buy 106 puts and sell 101 puts? How does that work? Why would you do a spread if you are convinced it is going down? I am long all bearish ETFs but I don't like the way they track and would like to possibly switch some over to options. Problem is everytime I have bought options, I have gotten screwed because of the time decay and the fact that I don't understand them 100%.

The time decay works in your favor when you buy a “at the money” strike and and sell the “out of the money” strike. The further out the strike price, the quicker they loss value. Since you sold them for the higher price, which is used to help finance the purchase of the one's you bought, when you go to buy them back the time decay will make them cheaper.

So that way, you don't get killed on the time decay occurring on the one's you bought as much. They will also have time decay, but not as fast as the other's you sold, because they are further way from the actual price of the stock/etf.

I did the 106/101 because I don't see us going down any further then the 101-102 area before a bounce back up. That 102 area is the moving average line on the daily charts, and should produce a bounce.

I'll close out the spread when we hit that area, and wait until the bounce back up finishes, and then go short again. The next move down should take us to the moving average line on the weekly chart… around 980.

See the charts above…

Wow – thanks again. Let's say I take just 10K to do this. Does that mean I should use 5K to buy the 106 puts and 5K to sell the 101 puts? If we get to 102 on SPY, what kind of return would I be looking at? I realize that I could lose it all.

Look at this link..

http://bigcharts.marketwatch.com/quickchart/opt…

Now look at the price of the 106 puts. As of now, (and of course they will change some by the time you read this), the 106 has a bid of $1.53 and ask of $1.55. The 101 has a bid of $0.44 and ask of $0.45.

You must buy the 106 at the ask price of $1.55, and sell the 101 at the bid price of $0.44, for a difference of $1.11. Now, if the spy goes down to 101 by the end of the week, then the 106 will have a actual value of $5.00 plus whatever time value is left too.

The 101 will only have the time value left, and the volitility, which is determined by the price of the VIX. It will increase the value of both the 106 and the 101. Anyway, if the 101 is worth $1.50 because of higher vix, and the 106 is worth $5.50 (just guessing here), then the difference to close the position is now $4.00.

You would have paid $1.11 for each contract and sold them for $4.00… not a bad return, huh?

K – I am getting ready to do this. 8K on the 106 and 8K on the 101. Wish me luck.

Monica, it doesn't work like that. You will only paid the difference between the two, not equal amounts on them. You do a Vertical Put Spread, and it's all one transaction, with you only paying for the difference between the buy price of the 106, and the sell price of the 101.

Crap – didn't do it right. Think I bought way to many contracts. Bought 175 contracts on the 106 puts and I don't know how to do it as one transaction. Can I call you Red? Email me at monicajlevine@gmail.com

Once the 60 minute chart finishes it up move, we'll start to move down again. Should be done by late today, or early Tuesday.

I'm hoping for a bounce. that way feb puts get way cheaper. Also, the only ec. fig. this week is REtail sales thurs.

could be an excuse to tank the market

This is your bounce. By tomorrow the 60 minute chart will be rolling over, so today's your lucky day!

what are the approx odds of the $sp falling below the 200dma by friday or so?, now at 1018

Well, nothing is written in stone of course, as I originally thought that the 60 minute charts would have been rolling over today. That's why I guessed on Friday's post that it could have been a Black Monday.

So, it looks like I'm off a day. Regardless, I'd have too say that a minor wave 3 down, inside a larger wave 3 is going to be pretty powerful. The more wave 3's inside each other, the more powerful the move. Remember, we are also inside Primary Wave 3 (or C) down too!

I'm not an expert at EW, but I believe the wave 3's are commonly a percent of the wave 1's. Look at the last chart above as I show the 1.382%, 1.5%, and 1.618% predictions.

“A typical Wave 3 exceeds Wave 1 by, at least, 1.618 times, or even more….”

The above is common on the net concerning EW.

so wave 1 went from about 1150 to 1070. Thats 80pts

so wave 3 should be 80 (wave 1) X 1.618 = 128 pts.

wave 2 ended 1105 and then wave 3 follows.

so 1105 – 128 = 977 !!!! bingo $$$$$….Oh joy!

Tony codero's blog in congurent with the reasoning on Leo's blog. He say's we are now in a little 2 within a big 3 down.

Exactly! As you can see, that last chart is from Tony's blog. Of course I added my own thoughts, but I read a lot of different bloggers, and try to put all the pieces together.

Each one has their own expertise in TA's, EW's, Support and Resistance levels, etc… I then add what new events that are coming out, and then post the likely outcome.

I was off by today being Black Monday, as I overlooked the 60 minute chart on Friday's post. But, you can clearly see now, that by the end of today… all of the charts will be pointing down!

That's HUGE! And should produce a big sell off. The Monthly, Weekly, Daily, 60 Minute, and 15 Minute charts will all be insync tomorrow. I was early on my entry Friday, as I missed seeing all of these pieces of the puzzle.

Now, they are all lining up! Look out tomorrow, as this elevator is going down fast!

Hey Red

8 mins till the close ….Hows this for a good time to get the chute out?

Bulls = Colts

Bears = Saints

Super Bowl is tomorrow… I'm a day off!

Red, you are now my hero! Thanks for all your help today.

You're on lucky girl… you got in a better spot then me. I missed the 60 minute chart on Friday when I talked a about Black Monday, and got in at the wrong time.

You couldn't have picked it any better! Tomorrow we have the Monthly, Weekly, Daily, 60 Minute, and 15 Minute charts all pointing down!

On top of that, we are in a minor wave 3 down, inside a larger/intermediate wave 3 down, inside of Primary wave 3 down! Whew! That's a lot of Wave 3's! I'd be shocked if we don't fall at least 200 points tomorrow.

I'm really expecting more like 400 points, but I don't want to make hard predictions like that… instead I'll stay that we have extremely high odds of falling off a cliff tomorrow.

You now own me dinner! LOL!

I owe you more than dinner! Up $6700 on the 106s and down $2500 on the 101s. That sound about right to you so far? Just want to make sure I have it right.

That's correct girl… you're learning fast. The 106's will gain in value faster then the 101's will. As the 106's are now, or soon will be, gaining “Real” value with each point the market falls below 106.

All while the time still decay's on the 101's, and also while they are still “out of the money”. The goal is for the market to close at 101 on expiration. That way you would have to buy them back as they would expire worthless, while the 106's would be worth 5 points.

Of course we should be closing out that position before then, as I'm looking for 102 this week. That's when I'll close out the position, and you should too.

Keep in mind that we could pierce through the 102 level intraday, and then start a 1-2 day bounce back up. I'll be watching the 15 minute chart closely when we are at that time period and price.

I'll post it here when I'm looking to get out, so don't worry, I won't leave you in the dark.

You are awesome and I hope you make a killing.

Red I feel like i'm intruding here remember not to forget your old mates buddy! I dont do dinner though mostly just beer!

Do you think therell be much of a ramp up tonight ?

Nope…. I'm looking for a gap down to open the market tomorrow. And I'll tell Monica to buy you a beer too!

quick request

can you also state the $SPX/SPMarch with you SPY or etf lingo. I can't do etf's

Do you think they'll pause at the 200 day ma?

Leo will probably post later today.

Not sure what you are looking for exactly? If you can't do etf's in your trading account, then you will have to find out what you are allow to trade.

As for the 200ma… yes, I think we could hit that tomorrow? If so, I'd expect a bounce from it to create minor wave 4 up, inside of larger/intermediate wave 3 down.

That would allow for one more panic selling (minor wave 5) down to the 980 level… possible by Friday? We could sell off tomorrow, and then go sideways to slightly up into Thursday, and then sell off again into Friday.

That's about what I'm expecting to happen. That should complete larger/intermediate wave 3 down, and should produce an up move into OPX. If this plays out like this, I'll get out by Friday and wait for the up move next week to complete, before going short again.

Red,

Congrats – because you are the only bear who predicted right. All others were calling for decent bounce and some bears bailed out Friday afternoon fearing massive rally!!.

Tonight will be interesting to watch how those guys try to manipulate futures, or if they just give up and join the trend down.

Thanks Michigan… but it's only starting! Wait until they see what happens next. LOL!

Iran's Supreme leader Ayatollah Ali Khamenei said on Monday that Iran is set to deliver a “punch” that will stun world powers during this week's 31st anniversary of the Islamic revolution, AFP reported.

Do you have a link? Please post it if you do… Thanks.

http://www.foxnews.com/story/0,2933,585143,00.h… are also reports of stockpileing of uranium and inveiling of drones. certainly alot of saber rattling today.

try this instead. http://www.foxnews.com/index.html

http://www.reuters.com/article/idUSTRE6173II201…. hmm ,,Gulf of Aden..

Thanks ModyDoc… I'm going to use this information in my post tonight., if you don't mind?

absolutely,,, there are some interesting links here too..http://english.aljazeera.net/news/middleeast/2010/02/20102905431956447.html.. seems to be lots of aggression being voiced,,

http://www.reuters.com/article/idUSTRE6173II201…. hmm ,,Gulf of Aden..

Thanks ModyDoc… I'm going to use this information in my post tonight., if you don't mind?

absolutely,,, there are some interesting links here too..http://english.aljazeera.net/news/middleeast/2010/02/20102905431956447.html.. seems to be lots of aggression being voiced,,

try this instead. http://www.foxnews.com/index.html

Iran's Supreme leader Ayatollah Ali Khamenei said on Monday that Iran is set to deliver a “punch” that will stun world powers during this week's 31st anniversary of the Islamic revolution, AFP reported.

http://www.foxnews.com/story/0,2933,585143,00.h… are also reports of stockpileing of uranium and inveiling of drones. certainly alot of saber rattling today.

Do you have a link? Please post it if you do… Thanks.

Red,

Congrats – because you are the only bear who predicted right. All others were calling for decent bounce and some bears bailed out Friday afternoon fearing massive rally!!.

Tonight will be interesting to watch how those guys try to manipulate futures, or if they just give up and join the trend down.

Thanks Michigan… but it's only starting! Wait until they see what happens next. LOL!

quick request

can you also state the $SPX/SPMarch with you SPY or etf lingo. I can't do etf's

Do you think they'll pause at the 200 day ma?

Leo will probably post later today.

Not sure what you are looking for exactly? If you can't do etf's in your trading account, then you will have to find out what you are allow to trade.

As for the 200ma… yes, I think we could hit that tomorrow? If so, I'd expect a bounce from it to create minor wave 4 up, inside of larger/intermediate wave 3 down.

That would allow for one more panic selling (minor wave 5) down to the 980 level… possible by Friday? We could sell off tomorrow, and then go sideways to slightly up into Thursday, and then sell off again into Friday.

That's about what I'm expecting to happen. That should complete larger/intermediate wave 3 down, and should produce an up move into OPX. If this plays out like this, I'll get out by Friday and wait for the up move next week to complete, before going short again.

Red I feel like i'm intruding here remember not to forget your old mates buddy! I dont do dinner though mostly just beer!

Do you think therell be much of a ramp up tonight ?

Nope…. I'm looking for a gap down to open the market tomorrow. And I'll tell Monica to buy you a beer too!

Red, you are now my hero! Thanks for all your help today.

You're one lucky girl… you got in a better spot then me. I missed the 60 minute chart on Friday when I talked a about Black Monday, and got in at the wrong time.

You couldn't have picked it any better! Tomorrow we have the Monthly, Weekly, Daily, 60 Minute, and 15 Minute charts all pointing down!

On top of that, we are in a minor wave 3 down, inside a larger/intermediate wave 3 down, inside of Primary wave 3 down! Whew! That's a lot of Wave 3's! I'd be shocked if we don't fall at least 200 points tomorrow.

I'm really expecting more like 400 points, but I don't want to make hard predictions like that… instead I'll stay that we have extremely high odds of falling off a cliff tomorrow.

You now own me dinner! LOL!

I owe you more than dinner! Up $6700 on the 106s and down $2500 on the 101s. That sound about right to you so far? Just want to make sure I have it right.

That's correct girl… you're learning fast. The 106's will gain in value faster then the 101's will. As the 106's are now, or soon will be, gaining “Real” value with each point the market falls below 106.

All while the time still decay's on the 101's, and also while they are still “out of the money”. The goal is for the market to close at 101 on expiration. That way you wouldn't have to buy them back as they would expire worthless, while the 106's would be worth 5 points.

Of course we should be closing out that position before then, as I'm looking for 102 this week. That's when I'll close out the position, and you should too.

Keep in mind that we could pierce through the 102 level intraday, and then start a 1-2 day bounce back up. I'll be watching the 15 minute chart closely when we are at that time period and price.

I'll post it here when I'm looking to get out, so don't worry, I won't leave you in the dark.

You are awesome and I hope you make a killing.

Hey Red

8 mins till the close ….Hows this for a good time to get the chute out?

Bulls = Colts

Bears = Saints

Super Bowl is tomorrow… I'm a day off!