Bearish Monday... no wait, Bullish Monday! Let's settle this the old fashion way...

Today started out great for the bears, until about noon when the market found a bottom and reversed hard into the close, end up with a positive day, instead of a big sell off day. Funny thing was, I spotted another fake print on the ES futures at 1135.25, early in the morning, just when the market was starting to sell off.

The fake print only lasted 60 seconds or less, and then disappeared (which correlates to 1138.31 spx). After sell off to a low of 1112.75 (ES futures), I never dreamed we would rally back up to 1135.25 on the same day. Maybe the next day, but not on such a big sell off from the morning open of 1140 down to 1115... that's a 25 point drop!

Sheesh... I have to give to "them", as they had me fooled on that one. Even when I seen the bottoming tail around noon, I thought we would only go up a little bit, and then sell back off into the close. I think the toughest part is figuring out which fake prints will play out... and when?

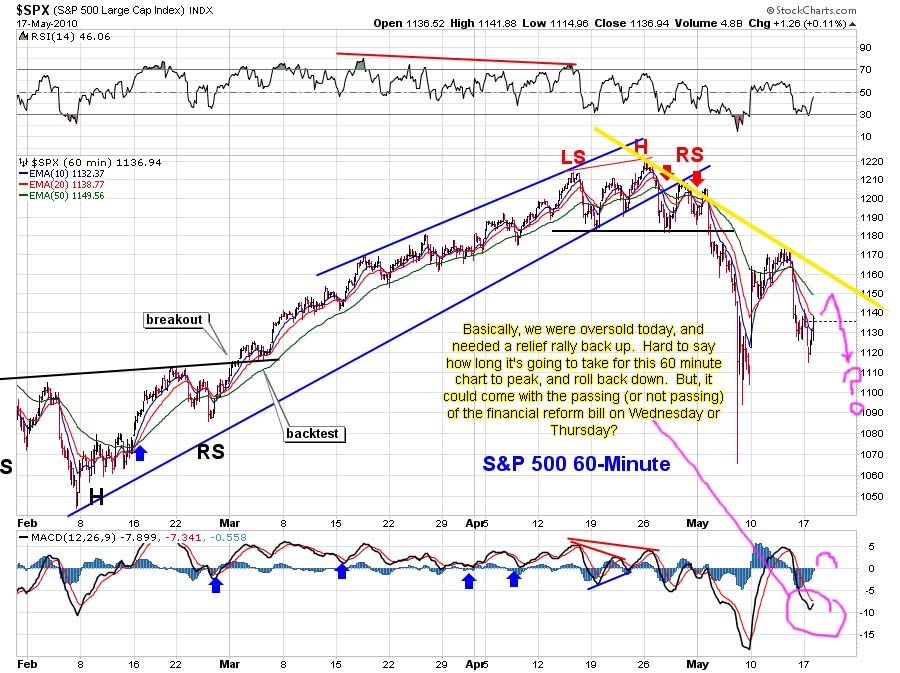

Anyway, as you can clearly see by this 60 minute chart, the market turned back up and is likely to go higher tomorrow until the 60 minute chart rolls back over to the downside again. This could last 2-3 days, if they really want to squeeze out the bears more.

This week is opx week, and it is true that they like to pin the spy on a level that allows them to pay out the least about of money to both put holders and call holders. Unfortunately, the market is heavily loaded up on puts right now.

The ideal place to close this market is 115 spy, as that level has a huge amount of put open interest on it. Of course that doesn't mean that we can't sell off hard again, and rally back up on Friday. I think that should be obvious to everyone now, as the market sold off 25 point today, and rallied back over 20 points of the decline.

Believe me, after seeing what happened last Thursday when the Dow dropped a 1,000 points, and recovered almost half of it in one day... anything can happen. But for tomorrow, the 60 minute chart should push us higher some. How far is any one's guess, as the daily and weekly charts are still pointing down, and should limit the upside some.

There is really no way to tell how high the MACD will rise on the 60 minute chart, before turning back down to the downside again? It could only rally up in the morning, and put in a much smaller histogram tower, and turn back down in the afternoon. Or, it could put in a huge histogram tower, taking 1-2 days to form.

It's probably going to depend on what the dollar, euro, oil, and gold do too... they are a key part of the markets' rally's, and sell offs.

On another note, looking for clues and reasons to cause a sell off to happen this week, the Senate is scheduled to vote on financial reform for the banks on this Wednesday or Thursday. If the bill is pasted, (and again here folks, this bill really won't hurt the banks. It's full of loop holes, and is all about politics and get re-elected), that "might" spook the market and cause another panic sell off.

I'm just reaching out here, as it's probably already factored into the market, or "they" already know the outcome. But again, the banks could dump the market again, blame it on the bill, and get reloaded with new long positions on the drop, by taking out everyone's stops out on the way down... just like they did last Thursday.

They already used the "fat finger" excuse last week, so they need a new one for this week. A financial reform bill, that would limit their profits (at least on paper, it would look that way), could be as good a reason as any to dump the market one more time.

So for tomorrow, I expect some upside until the 60 minute rolls over. If the gets too far back above 1150 spx, then I think the sell off might be over. However, I don't think it will, as I still believe there is more selling coming. I still don't see any signs yet of the daily chart making a turn back up, from a technical stand point. However, from a "candle pattern" point of view, today was extremely bullish.

A hard reversal from oversold territory to end up with a doji candle is something to be taking into consideration. I'd just like to see the candle form at a lower low then the 1065.79 low last Thursday, before I'm convinced that the "bottom" is in. Those candles work extremely well at tops and bottoms of markets.

But we haven't taken out last weeks' low yet, and that still makes me think that the candle is just a bullish candle, but not necessarily a "bullish reversal" candle. There will probably be some continued follow through on the rally tomorrow, and then possible another sell off by Thursday or so... with the blame to be put on the passing of the bill.

All speculation at this point, but it's just what I see in the charts that has me coming to these conclusions. Best of luck to both bulls and bears tomorrow.

Red

P.S. One more thing... by not having my charting software set to show the last 10 days (as I had it set for 3 days, 10 minute candles), I didn't notice that the 111.77 spy low was almost gap fill from the 111.30 low last Friday. Had I noticed that, and listened to my instincts, (seeing that fake print earlier in the morning today, about 114 even on the spy), I would have closed up my shorts and waited for this rally back up to get back in at a better price. But, I missed it... so I'm still short. Bummer 🙁

my gut tells me to be bearish just looking at the daily futures ESm chart. short term we're not done to the downside (I think)

Yeah… I'm with you Ben, but I'm still kicking myself for not taking some profit's today, when we hit 111.77 (almost gap fill at 111.30 from last Friday). I seen the bottoming candle form, but I just thought we would go back up and roll back down again in the EOD.

You win some, you lose some…. it's the story of my life.

Great post Red …. love how you tie the charts together 🙂

Let's just hope that they aren't able to pin the market to the 115 spy level this Friday, as that would really hurt my positions.

Let's not forget China. Down 5% yesterday What will it do tonight? Not open yet. and close to a key level according to McHugh (2,500) could “crash” if gets below 2,500. Don't bet your house on it.

Like I said, I'm still short… but I lighten up a little today. If it crashes tomorrow, on the next day… I'll be lovin' it!

Perhaps (only perhaps) Europe may do something about the Euro.

a 200pip move would cause the stocks to rally.

This is what Kathy Lien has to say: “This evening, the Eurogroup has another opportunity to support the euro. Finance Ministers in the euro area is meeting in Brussels to discuss the market’s reaction to their rescue package, developments in Greece, Spain and Portugal’s accelerated fiscal programs and the euro. Luxembourg Prime Minister Junker said the euro will be “intensively discussed by ministers” and perhaps this is his way of warning us that the discussions could turn into action. The only reason why the EUR/USD has stabilized today is because of the upcoming event risks and more specifically, the possibility of another sensational announcement from European policymakers. Therefore the answer to the second question of what investors should do going forward is to brace for a short squeeze. If policymakers decide to verbally or physically intervene in the euro, the currency could see an aggressive rally to the scale of a few hundred pips.”

Agreed….

The dollar put in a bearish reversal candle today, and the euro put in a bullish reversal candle too. This means a rally in the market could happen, and should happen. How far up is the question? Will it take out the 1150 area, and end the downturn?

I don't know yet, but something doesn't seem right about the market only having that one major sell off day last Thursday and not having a re-test day. Most of the time, there is a second leg down, that takes out the first legs' low. It could wait until opx is over I guess, and then sell off hard?

Reposting from the earlier thread:

I took the afternoon off, figuring to come back to some very nice numbers, and was disturbed to find not only my morning gains wiped out, but a loss for the day!

Things don't look so bad, though. You can drive a truck through the MACD curves, VIX and put/call ratios are poised for a comeback. On my principal (well, only these days) short vehicle, SDS, volume was largely upside, i.e., downside for the market.

Hey, if we have a rally in the morning followed by a sharp decline, we could have a Hindenburg Omen. 30 new highs today vs. 99 last Thursday. We're in the ballpark.

Re: May expiration puts, the operators could be holding a lot of them by this time. They were very cheap around 1170.

I may change my tune if tomorrow is not a bearish reversal, but I plan to stick through the day at least.

P.S. A similar candlestick pattern to today's occurred before the final bottom in early July '09.

Rip, my friend… you're starting to talk like Sundancer. LOL

Do you happen to have a chart of the July print you are talking about?

LOL! I am thinking of holding SDS as a long-term investment, btw. It has had huge trading volume lately, and I think has bottomed. I will happily sell at 1020, though, and buy back on the market rally.

Just look at any SPX chart for the candlestick. It's the third trading day of July '09.

Ahhhh…

I see it. It reversed back up hard from being oversold that day, and then closed with similar pattern to today. Then another 2 days of selling the following days, to finally bottom. Let's hope it does the same thing tomorrow too.

Great post red, Anna did warn today about this reversal and her instincts are pretty damn good. Well let's hope this offers a better opportunity to short from I blew out all my May puts this morning, what a relief.

Daneric EW on this blog list has us topping today at about 2:30 in a wave 2. How far down will wave 3 go? bottoms wed late? wave 4 up thursday? then wave 5 down friday??

http://danericselliottwaves.blogspot.com/

I think the unions in Greece start the march 11am EST on Wed.

Well that would be perfect timing with the march starting in Greece on Wednesday, and the Senate passing a bill to regulate the banks. A double whammy! If that happens, the market isn't going to like it.

It could very well be the news event trigger that we need in order to panic the market into selling, making some multiple wave 3's down. I like it. Let's hope it works out that way.

Also, as you can see from an earlier post last night, Rip Van Trader pointed out that the market makers could have been the ones buying all those puts, meaning that they might actually want the market to tank. Just a thought, as no one really knows for sure. I do know that in the past, they always like to pin it where they pay out the least… which would be the 115 spy level right now. We'll see I guess…

Carl’s morning call:

June S&P E-mini Futures: I think that last week's low at 1056 ended the correction from 1216. Yesterday's low ended the correction from 1174.

Today's range estimate is 1135-55.

1134.50- 1144 range last night (9.50 points)

1135-1155 estimate for today (20 points)

1143 currently, so estimate is -8 to +12 from here (bullish)

I think we are going a little higher then 1144, as 1150 seems like the most likely target. And if it breaks, we could see a lot more upside.

Well Duh… I miss read that. That was yesterday's range. OK… never mind. (Haven't had my coffee yet)

Good Morning Red.

Carl has a high of 1155 today 🙂

Good Morning Earl…

Yeah I finally caught it… just not awake and sharp yet.

Good morning everyone I called a reversal yesterday about 1pm and told every to go long (always have a hedge) 🙂

Looks like a sweet day long spy (tons) uso, mon, short BP (hedge)

Thanks Anna. I am staying short unless we have to consecutively hourly closes above around 1156. I can't be a swing trader so I have to go for the longer moves.

Hey Monica you should be fine then 😉 GLTY

Thanks Anna… Sold DRV, TZA, BGZ, FAZ yesterday at 1pm.

Bought SSO, hedged with SDS. A good day.

Sure thing happy to help 🙂

21 new highs at 9:38, SPX approximately 1146.

Go, bulls!! Not that I'm hoping for a Hindenburg Omen or anything. 🙂

Yeah right… well I like to see a short lived Hindenburg!

10:18 36 new highs, SPX 1145.38

Out of all long Spy calls near HOD

You should change your handle to “Quick Draw Anna”, as you move in and out of positions very quickly. LOL

that's how you play the game to win 🙂

Wee bounce then lower I do see 🙂

That's what I like to hear, as down is more fun. By the way, check your google chat… presents for Twinter and Harmony.

ok upload them to HOB 😉

They are already uploaded to HOB. Just copy the links, and give them too them by email.

Ok dokie thanks Falsie to 113.53

out sso

added to sds

Good job Wendel 🙂

How you hanging in there red?

The usual NewBear… biting my tongue and hoping for the crash to come this week, and not next week.

Might get a wee bounce here

Carl is now Long one unit at 1138.25

This sell off looks like a move down to fill this mornings gap. I don't know if it will go back up and retest the highs or just trade sideways until the 60 minute chart peaks and rolls back down? But, once that 60 chart rolls over, I think we will see a lot more selling come back into the market. Maybe tomorrow, or EOD today?

Carl has been either quiet or wrong lately. He's not quiet today, so that only leaves wrong 🙂

Looks like he bought after his projected low was tagged, which is what he should do if he believes his daily high is next.

I'm playing TZA today, so it's ok with me is Carl is wrong once more.

I play ultra shorts also but i have to say i wish i knew more about playing the puts and calls. My biggest issue is the dates out.

I think Anna's site would probably be the best place to start trading options.

I must agree with Earl on that too Jim. Anna is excellent at trading options. She likes to swing trade them for multiple days, but in this market, she sometimes goes in and out of a position intraday.

So, it's part swing trading, and part day trading… but not by choice of course. You have too take what the market give you. But if you are able to watch the tape during the day, she can really help you make money trading options.

Thanks for the tip . I will check it out.

Possible bull flag on EUR shorts be careful at least for a little while (ie: minutes lOL)

Back in EUR 1.2380 short

This is perplexing. Is wave ii heading towards done already?

The bounce almost entirely in the intra day yesterday.

Considering the triple digit swing today seems anemic.

I don't think wave 2 is done yet Jim. It might be topped already, and just chop around the rest of the day? We are waiting for the 60 minute chart to get overbought, and roll back down.

ETA on that is about the EOD, or tomorrow morning. Once it turns back down, and lines up with the daily and weekly chart… we'll see more selling.

But for now, the 15 minute chart is heading down, while the 60 is heading up. That's the battle between the 2 charts. When the both line up together, pointing down, a large drop should occur.

That's what I'm waiting on…. the weekly, daily, 60, and 15, all lined up together and pointing down. I see that happening by tomorrow morning.

Carl was wrong again 🙂

Hey there NewBear

Yeah — Carl takes one for the team 🙂

Well, I'm wrong a lot too. So I won't pick on Carl being wrong. LOL

I seem to be wrong on thinking that the 60 minute chart would roll over by the end of day (EOD) today… looks like it's rolling over now.

http://stockcharts.com/def/servlet/Favorites.CS…

The 15 minute chart is heading down too… this could get ugly by the EOD.

http://stockcharts.com/def/servlet/Favorites.CS…

With all the charts pointing down at the same time… it's what EW guys call a Wave 3!

Carl just sold one unit at 1131.00 (loss of 7.25)

Time to go long then.

I've seen that work pretty well — Carl gets stopped out — market rallies.

nice bounce after he got stopped out now I feel like going short

Hey there NewBear

Yeah — Carl takes one for the team 🙂

Short 1 lot EUR 1.2358

VIX has broken out according to my reckoning.

If the bears penetrate 1130, we look to be in very good shape.

Anna caught a fake print this morning at 113.32 spy, and we just hit it exactly at noon (est). The bottom might be in for today?

It does match up with the 15 minute chart, as it's acting like it wants to roll back up now.

print 114.25 @ 12:05

Thanks Diablos…

You and Anna must be using Think of Swim, as she seen it too… but I didn't. Different platforms I guess?

Looks like we were close enough as we tagged 114.19 just a little bit ago. Keep your eye's open for more.

SPY falsie to 114.25

Anna seen another fake print of 114.25… yet I don't see it? Frustrating how they show up on some charting platforms, and not on others.

If we back test that level, it will be perfect with a backtest of the downward sloping trendline on the chart I showed on this post above.

http://www.screencast.com/users/Annamall2/folde…

If it goes back up to 114.25, then it will be a nice bear flag pattern, and we should drop into the close.

Just wanted to say howdy and that I enjoy your blog. You are too hard on yourself! For a guy that has been at this for only a year I am very impressed.

Nobody gets it right all the time. TA is an art, thats for sure. You have been as accurate as anyone out there. I have the data to prove it ;-)>

Just call me the Hibert Digest of the blogoshere.

Thanks Gere…

I appreciate that. I am learning to read the charts better, I only wish I had the discipline to execute my trades better. It seems that I can find a bottom or top sometimes, but I don't bail on the position, take profits, and reload later. I guess that will come with time.

It will come after you have paid off your broker's condo and yatch. LOL

Yeah well, I think he already has that paid off from me by now. LOL

Mine is greedy. He keeps buying bigger yatchs. I am still paying through my nose.

It is hard, man!

I have talked to Mon about this often. Read up on position sizing. That is the true art!

The dollar is at a double top now, and if it can break above it, we could see more selling into the EOD.

Should see tall red pretty soon, I think.

Yeah, I think the move today was a stairstep move down, with a big sell off coming late today or tomorrow. I think this will be a wave 3 of 3 or something like that?

VIX just set a new high for the day… shouldn't be long now.

SPX having a rally according to stochastics, can't wait to see the downside.

Pressure is building across capital markets…

Oil fresh new lows

GS fresh new low

Ten year note is damn near a fresh daily closing low

HOD came into 8:48 cst(212*4) which means a SUN Ritual for the day

SPY 112.86 is Jan. TL today

Operators released the script to the general populace last night AH

http://www.flickr.com/photos/47091634@N04/46194…

I seen that print of 111.91 yesterday, but I wasn't sure if it was from the low yesterday of 111.77, and just a little bit off or something. That means that's probably going to be the low for today.

It's amazing how accurate these prints are. Anna caught two intraday prints, and they tagged them both today.

Hmmm, I wonder what tomorrow will bring?

just came home – oh glorious day. Thanks Sun!

Excuse my ignorance, but what site are these prints from so I can be more diligent about checking.

nasdaq.com

K.

How are they going to run this today.

OOPS here it comes.

“Fat Nose” from a guy that fell asleep on the keyboard… LOL

Money flow was flat on that last selloff, probably should have covered.

That's OK. it's not low enough yet.

VXX volume is more than double normal even w/ vix % not as high as they could be today.

So they may run it but the fear factor is building.

And the VIX is back above containment.

with AAPL trading 251's the fear is missing the move to $999

Gosh, is it that low???

just sold my vix calls because they expire tomorrow. Still have spy may/june puts and june vix calls.

This is looking ugly right now, as by the end of the day, the weekly, daily, and 60 minute charts will all be lined up point straight down! The 15 is oversold right now, and could the market a brief pause tomorrow… but it's not likely to last with so much overhead pressure above.

I think tomorrow will be “the crash day”, as all the charts tell me so. Let's keep a sharp eye out for fake prints, as I'd love too know our downside target ahead of time.

Hope so as I am loaded to the gills.

For those itching to go long something this week, popcorn would be a good option.

Max contain will be in the 1140's tomorrow.

Many people will see the double bottom being formed today, and will go long… I won't be among them.

Scalpers are controlling eod. I do not see a double bottom. i see 60 minute and 15 minute well below all averages with 20 about to break below 50and everything pointing down.

not a place I like to move long

🙂

For those watching the tape…

Take note of the time the operators started goosing the futures

2:12 CST

5 pts. in 3 minutes

It's all one big Ritual!!!!!!!!!LOL

For rituals to work we need to take CST instead of EST? 🙂

Yes

the Futures are traded in CHI-cago

Home of the CHI-cago Bulls & Bears

LOL!!!!!!!!!!

Let's see… they use 212 for the boiling point, 911 for the 9 1 1 emergency number, and 666 for the market of the beast. They also use pi (3.1416) sometimes, but not sure why on that one… but it's noted anyway.

Tomorrow is 05-19-2010… not sure if that mean anything from the ritual side? But all the charts will be pointing down tomorrow, so it must mean something too them.

You'll love this red, I had $666.01 cash in my account and the rest are SPY puts with Gold calls.

LOL… I love it NewBear! It's a sign of the crash coming, and I think it's tomorrow!

Pi & 212 are the Pi-llars of the CON-struct

212*Pi=666

(It's why I have a SUN & Pi in my AVA-Tar)

Ahhhh…

That's right. I forgot that 212 times Pi equals 666. I think I'm falling deeper into the rabbit hole. Maybe I should have took the blue pill, and lived in the fantasy instead?

Naaaaw…. that's just not me.

LOL

It doesn't!

Remember the episode of Star Trek when Mr Spock causes the computer to puke on Pi?

At least I think it was Star Trek. Al these grey hairs and a forget sometimes 🙂

Red,

5-19 is real familiar.

LOL

I just realized tomorrow is my wife's wedding anniversary. Mine too. Thanks for the heads up 🙂

Too funny Earl! Mine is next week and I almost forgot because I have been so caught up in the market!

Happy Aniversary, Mine is May 24th, 12 years, 8 of Marital bliss. LOL

Do you still have problems seeing the new post?

May 20 at almost midnight is a first quarter moon phase.

Maybe the reversal will be on the 20th?

May 20th is a full moon. Best have your longs picked by then!

Gracias. Trying to figure out what to get long. Call premiums will be too high so the choice is to do a call spread on the SPY, short the SPXU, or go long individual stocks or straight indexes. Not sure what the best choice is. I will be taking some of my money and buying silver then, with some gold, perhaps some swiss francs. Any other thoughts would be greatly appreciated.

Maybe water companies?!

go and buy a John Deere Combine, so when people ask what you do for a living you can say you harvest speculative capital!!!!!!!!!!!!!

You are getting funnier and funnier!

Seeing as the strong dollar fraud is the basis of the correction, I'd hold off on the metals for a little bit…but not for long. I think they will be the next rage.

I think stocks that held up well during the decline will blow off early. AAPL and PG are a couple of favorites. I don't usually deal in blue chips but they are cheap these days. I also like GE and Ford, which I expect will have their stock warrant issue with the UAW resolved when the market crashes.

I'll be looking at health care stocks that will benefit from the government teat.

There will be a short dead period after the crash when I expect there will be golden moments (down days) to buy calls. If we do go down to 980, heck, I'd buy them while the market is falling like the big boys do.

Thanks rip – wasn't planning to buy metals until gold reached 1050. Even if the market is falling though, won't call premiums make calls too expensive? And Red says to buy them at the money to avoid higher premiums, right? With the metals, i will be taking physical delivery – canadian gold coins and 10 oz silver bars. I will have to stay up tonight to stock pick – not one of my strengths!

I really don't know much about options. Probably Anna would be a good source of info. Which blog is hers?

I refer to stochastics charts to see where the stock is in its price trend. If you can catch one that's approaching 20 for a put or 80 for a call (on a one year chart) there should be a lot of price action coming up.

During our swing trading period, I was checking prices on AAPL options every day and got a pretty good feel for them. I'm going to look for a stock that trades in a channel and trade options constantly. Microsoft might be good for that.

Thank you. Anna's site is http://www.hotoptionbabe.com

Thanks!

Anna's specialty is trading options on stocks before earnings announcements, but she trades the indexes too. Her link is on my BlogRoll… Hot Option Babe

That would seem a tricky game. Hardly any stock reacts properly after an earnings announcement. Not immediately, anyway. You see prices suppressed, stocks with poor earnings jump, etc.

I'll have to check her out, thanks!

Well, I seen her make a lot good calls on earnings… Don't know how, but she has a high percentage correct.

It's a paid site now. We used to all hang out over there but she is more of a short term trader and I can't trade in and out so much so that;'s why I didn't subscribe.

Hot Option Babe is still free Monica, only Options BlackBoard is the paid site. And yes, she does move in and out of positions quickly, so you do need to be able to watch the market during trading hours.

yep.

almost in order

5min 50 20 10

15 min 20 50 10…20=115.22 50=113.37

60min 50 20 10 with the 10 and 20 =113.41

almost in order

Tomorrow should be one ugly day for the bulls…

This might be the time to put up a “Black Wednesday” post? I think I just had the day wrong the last 3 times…

you're too much, but one of these days yes, just a matter of time 🙂

Drum roll please . . . . . come on 111.91!!!!!!!!!!!!!!!! What a perfect way to end a perfect day.

SPY currently has 6 consecutive lower closes than opens on the 60 min

A positive last unit will open things up for tomorrow

So we want a positive up move here into the close, so tomorrow will fall?

yes, just has to be above last hourly close.

Oh – in that case 111.91 stay far far away!!!!!!!!!!!!!

we're safe. Bring on the popcorn!

Why is it that after the close, my account always decreases significantly between 16:02 and 16:10. Is Ameritrade skimming of the top?! I know they have to readjust things but why is it always down?

LOL…

They must think you are a rich girl, and decided to rob you. They don't do that to me, but I'm a poor boy…

OK – I am an idiot. It's because the indexes trade until 4:15PM! I learn something new everyday 🙂 And Red, I wish I was rich – I guess I could have married rich but instead I married an engineer! But, after listening to Sundancer, I am a heck of a lot richer than I was!

It's the Pi Ritual why the futures close @ 3:15 CST

3:15 is 1/4 past the hour

So 3:15 = 3 1/4 or 3.14 LOL

It's all ONE BIG RITUAL!!!!!!!!!!!!!!!

Hmmmm.

Why is it that after the close, my account always decreases significantly between 16:02 and 16:10. Is Ameritrade skimming of the top?! I know they have to readjust things but why is it always down?

Carl at day’s end:

1135-1155 estimate for today (20 points)

1115.25–1147.50 actual range today (32.25 points )

Market was 7-20 points below Carl’s range.

Trades: In /ES at 1138.25, out at 1131.00 (loss of 7.25 points)

Grade: D (lost some money)

Carl at day’s end:

1135-1155 estimate for today (20 points)

1115.25–1147.50 actual range today (32.25 points )

Market was 7-20 points below Carl’s range.

Trades: In /ES at 1138.25, out at 1131.00 (loss of 7.25 points)

Grade: D (lost some money)

The operators closed the $SPX right on purple daily containment

http://www.flickr.com/photos/47091634@N04/46197…

Should purple containment fail, it opens the door for teal weekly containment.

Look @ the beautiful setup

50 pt. slip zone below current level

and looky there,,afterhours action,, spy breaking through yesterdays low-support,, euro dropping again,, here we come teal weekly containment.. me thinks that green line will be a magnet

yep, green daily containment is co-relational to teal weekly containment

Hi Sundancer,

What do you make of the print to 115.03?

http://screencast.com/t/NDA1ZGVjY

Great catch Diablos…

That could be are target for tomorrow mornings' rally… if we have one? I'm not sure that we will break that downward sloping trendline though, as it will be in the 113 area tomorrow morning.

But, it could be Friday's closing price on the market? There is a ton of open interest on the put side at that level. Thanks again for posting it…

I'll need to see the actual trade to look @ the share volume

You're looking for share volume to sum 111

We already know we're going to new highs after this ritual so make an archive of those as we go down. Then plot those on a chart after we put the terminal low in & you'll have de-leverage checkpoints.

Hi Sundancer,

Why do you exclude the 192 and 224 as possible resistance points vs the 264, or at least, don't display them in your chart? Purely based on the big drop? And what about the 320 vs 360?

Thanks in advance

http://screencast.com/t/NGEyMTUyY

TNA opened up 3.8%, and the opening gap was filled. TNA was up 4.8% at it’s high, and closed down 5.2%.

An earlier gap from $59.03 to $60.04 was trimmed to $59.69 to $60.04

We are now in a New Moon Trade, which tends to favor TZA.

AmericanBulls had TNA with a possible sell today, and TNA closed down, so TNA was sold. I suspect the selling price will be the prior close. The TNA buy was at $55.66. TNA sold at $56.92, up 2.2% from the buy. (will confirm once AmericanBulls has today’s data)

AmericanBulls had TZA with a possible buy, and TZA closed up, so TZA was bought. I suspect the buying price will be the prior close — $6.10. (will confirm once AmericanBulls has today’s data)

TZA opened down 4.1%, and the opening gap was filled. TZA was up 6.5% at it’s high, and closed up 5.2%.

Volume for TZA today was 21% above the 1 month average. Good for TZA.

$RVX (VIX for $RUT) closed up 9.9% with TZA up 5.2%. No divergence Good for TZA

TZA had been down 3 days, up 2, down 1, now up one, but drifting up generally. Good for TZA.

The low for TZA was from sixteen days ago at $5.30. Today’s low was $5.80, 9.4% higher. Good for TZA.

Today, Ultimate Oscillator for TZA rose from 38.1 to 39.5 (+1.4) while TZA was up 5.2%. No divergence. Good for TZA.

MACD fastline & slowline are below zero but rising. Good for TZA.

Bollinger Bands for $RVX (VIX for $RUT): Today, $RVX climbed to and closed near the top Bollinger band. MACD both lines are rising. Good for TZA.

Bollinger Bands for $RUT: Today, $RUT had a long red candle that closed between the 50day moving average and the lower Bollinger Band. MACD appears to be falling. Good for TZA.

Down volume was 8.3 times the up volume on the NYSE.

TZA had a lower high & lower low & much higher close (good for TZA)

Money flow for the Total Stock Market:

$ 2,900 million flowing out of the market 2 days ago.

$ 21 million flowing out of the market yesterday.

$ 42 million flowing into the market today.

Neutral for TZA.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, Good for TZA for tomorrow.

Looks like richard Russell is in the news again. Jeeze

Do you have a link to Richard Russell?

The Daily view from Americanbulls

TNA was a likely sell for today, was down 5.15% today, and is now a Confirmed Sell. The buy price was $55.69 & the selling price was yesterday’s close $56.93, up 2.2% since the buy.

TZA was a likely buy for today, was up 5.4% today, and is now a Confirmed Buy. The buy price is yesterday’s closing price $6.10. TZA closed at $6.43 today, up 5.4% since the buy.

Of the stocks & ETFs I follow, these are to hold on to:

UUP(US Dollar)

RWM (-1x $RUT)

TWM (-2x $RUT)

TZA (-3x $RUT)

SRS (-2x RE)

DRV (-3x RE)

SCO (-2x Oil)

DTO (-3x oil)

ERY (-3x energy)

FAZ (-3x Financials)

EPV (-2x Europe)

SPXU (-3x $SPX)

QID (-2x QQQQ)

DXD (-2x DOW30)

The list to avoid:

IWM (1x $RUT)

UWM (2x $RUT)

TNA (3x $RUT)

IYR(1x RE)

URE(2x RE)

DRN(3x RE)

GLD (gold)

UGL (2x Gold)

USO(oil)

UCO(2x Oil)

ERX(3x energy)

GOOG

GS

DIA

SPY

QQQQ

QLD (2x QQQQ)

EWU(England)

The following are possible (but unlikely) buys tomorrow:

SLV(silver)

AAPL

AMZN

EWG(Germany)

EWQ(France)

EWX(emerging mkts)

The following are possible (and likely) buys tomorrow:

DRI

The following are possible (but unlikely) sells tomorrow :

DZZ (-2x Gold)

The following are possible (and likely) sells tomorrow:

none

Today was more Bearish than yesterday.

Action for TNA or TZA for tomorrow: Hold on to TZA, avoid TNA

Earl, Nice Work, thanks for the info.