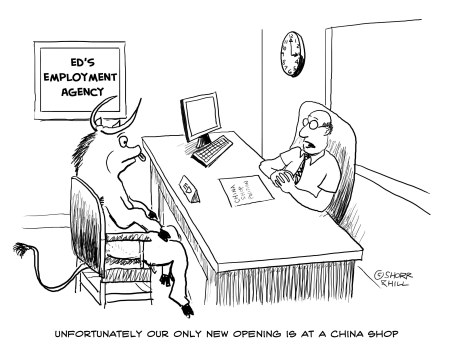

Unemployment is tough for the bulls it seems…

Today sold off again, for the 4th day in a row. Will it ever end, or has the bottom been found now? I’m not sure, as every chart I look at still seems bearish, with the exception of the 60 minute chart. Well, it’s only half bullish, as the histogram bars are rising up from oversold territory, and should cross the zero mark tomorrow.

But, the MACD still has turned back up on it, so it’s also a little bearish too. I think I’ve been waiting for so long for this moment to happen, that I don’t believe it’s actually here. I keep looking for a big short squeeze rally, to wipe out the bears again… but it hasn’t happened yet?

Maybe they are now torturing the bulls, by not letting them out of their longs? I don’t know, but I still have to stay that I expect more selling tomorrow too. Yes, it will be 5 days in a row, and a relief rally (aka… short squeeze, as in “relief for the bulls”) is overdue now.

However, the trend is now down… at least the short term trend. Longer term is yet unknown? Have we finally finished the Primary Wave 2 up, and are now in P3 down? I don’t know yet, but I do believe that if we continue down tomorrow, there won’t be any right shoulder around 1150 forming.

It’s too obvious now, as everyone sees it. So, I’m going with the charts… and they say we have more downside coming tomorrow. No big long post here, as I believe everyone can read the charts as well as I can by now. I can’t think of any reason to rally tomorrow, as I don’t think there is any major “market moving” news out… and the technicals are still point down.

So, just hang in there bears, as I believe another large leg down is coming. Keep in mind that Newbear posted that RationalNational (Rati) seen another fake print of 100.72 spy while in Anna’s chatroom. I have the same print, but I captured it on June the 4th. Should we tank hard tomorrow… I’d be looking for that print to be hit. There’s a reason it was put out on June the 4th, and again today… and that’s because they plan to go there soon.

Best of luck to us all gang...

Red

watch out $cpci is way down. this is the smart money I'm told and it means the big money (who is correct) the puts are low compared to the calls see stock charts.

this very low reading is correlated with market rallies

but I can't tell if (maybe) it can wait a couple of days

on jaywizz, jay says gap down tomorrow

rrman say gap up ????

in addition:

Jim Carolan is bearish till June 29 +or-

Persverento is calling for a huge correction June 28 (we'll see)

How bout me??? Don't listen to me

How about me? LOL…

Hell Ben… I'm guessing too! If it makes you feel any better, Cobra backtested 4 down days in a row (back to 2002), and if you went short at the close of the 4th day, and closed out your shorts at the close of the 5th day, you had an 80% success rate.

Go read his “after the bell” post…

http://cobrasmarketview.blogspot.com/2010/06/06…

In reply to a comment made in your last post, Anthony Allyn is well-armed from the Yahoo SKF board. I noticed he has quite a following from his public chart lists at stockcharts. He disappeared there for a while after March 2009 when he was still bearish. I was wondering where he posted these days. So he has a blog. I always enjoyed his style. He also had a knack for riling Kenny.

Here's his link…

http://stockcharts.com/def/servlet/Favorites.CS…

I also mentioned if SPX down 4 days in a row then there’re more than 70% chances a green day the next day. The chart below shows all the recent cases when SPX down 4 days in a row this is from cobra

I don't know what to think about the VIX print that IlliniKap posted, as it's clearly “Way Too High” to ever play out. Possibly, they actually made a real mistake, when posting a fake print? LOL

It could simply have the decimal in the wrong place? Maybe it's not 349.72, but instead 34.972… which could easily hit tomorrow, should we tank really hard.

Anyway, just food for thought. Here's a repost of the print… (Thanks for catching it IlliniKap)

http://reddragonleo.com/wp-content/uploads/2010…

Since you think 349.72 is “way too high” to ever play out, what odds would you give me if we were to bet on it? 😉

LOL Raised…

The odds I would give you, if the VIX ever reached 349.72, is a 100% that I would be leaving the country or hiding out with many weapons at my side.

I don't think we would ever be that high, even if the Dow was swing up and down a 1000 points a day. Maybe 5000 points would cause that kind of spike in the VIX… which would mean that America would be an extremely dangerous place to live.

U.S. Markets view before opening bell

http://niftychartsandpatterns.blogspot.com/2010…

If the market was going to bounce they would have done it by now. final GDP's out and it was a little weaker than expected. s&p dropped a few points.

Now at 9:55 U mich sent. With all the unemp. & that shit floating in the Gulf, people will be bummed out. Jawizz preliminary says drop at 10am perhaps hod.

Quadruple bottoms are too rare. if we head down to 1040 then we go lower and quickly (allow me to stick my neck out). Lower BB at 1044 – that would be a quadr. bottom so blow that one off. We can't even bounce to the previous days low!! at 1080 nor the middle BB 20dma!!

It appears to be toast. Atilla days 1015 The 38.(whatever) retracement is 1008. And I bet by EOMonth we hit 990 the middle monthly BB. Then maybe Wed, then we see the monster rally.

Tough call today Ben. I'm really not sure what's going to happen? We are getting close to a big short squeeze day, I believe. But it doesn't have too be today, as we have seen days times that have had more 6,7, and even 8 down days in a row. However, if today doesn't fall big again, then I'd be expecting Monday to be a short squeeze day.

The ideal thing to happen is to fall hard today, and let all the smart bears out, and trap the dumb bears into going short over the weekend. Then let it rally up Monday, at which time we would just wait to reassess it again, as look for another short entry.

Howdy Red

http://www.hotoptionbabe.com/blog/27-tgif-.html

MOTHER OF ALL CASPERS !!!!!!!!!!!!!!!

http://content.screencast.com/users/Annamall2/f…

LOL, I posted that on your blog last night. IlliniKap caught it, and posted on my blog yesterday. I miss it. Hey, can you repost the 100.72 spy print that Rati caught yesterday? Thanks…

Here you go red: http://content.screencast.com/users/rationalnat…

Thanks NewBear, I thought you had forgotten about. That looks to be showing up on the same day I caught it back on June 4th… We'll see I guess?

Let's keep our fingers and toes crossed.

I know a short squeeze is coming soon Newbear… I just don't want to see it until next week. Let's get the big sell off today, and get out with a nice profit. Let the dumb bears go short over the weekend, and the smart bears get out today.

FTSE is rallying this morning, but its intraday chart looks like crap, negative divergences out the kazoo.

Goldddddddddddddddddddddddddddddd

I feel like I am sitting on hot coals. Could bounce or fall hard – impossible to know.

Eur/Usd Breaks down from a head and shoulders and triangle pattern in hourly chart

http://niftychartsandpatterns.blogspot.com/2010…

You want to see any ugly chart, check out Ford (F). If the 200 SMA doesn't hold, watch out below!

We have to get through the 1070 level.

AAPL getting hit – this is very good for us bears.

Ford Motor, too. Another sentimental favorite.

Nice Rip, I just post the same thing. F looks like it's ready to freefall

Why would anyone be buying this POS market right now. Surprise, surprise, Q1 GDP keeps getting revised down. Shocking….not

Damn the locals. They are stuck long and trying to push it up. We need to crack 1070.

Divergence on TRIN this whole move up. Price going up and so it TRIN. We should head lower soon.

SP 500 Hour chart analysis

http://niftychartsandpatterns.blogspot.com/2010…

FALLING WEDGE OF S&P 500

http://niftychartsandpatterns.blogspot.com/2010…

We are banging on that 1071 level again… I wonder if we will get the rally to 1080 or not? It's looking pretty weak now. The dollar is holding it's ground too, and not selling off again like yesterday.

San, do have a chart of the euro/dollar?

jawizz sees big rally monday tues

“Next weeks power index will show a huge uptick for Mon & Tuesday

and concurs with an energy boost.”

I agree with a rally next week… especially if we sell off hard today.

Only thing is that Atilla said by end of next week 1130 will look like Mt. Everest.

Anyone want to explain to me how the RUT is actually up on the day?

It is small to mid caps that have a big stake in the economic recovery, aka the Emperor's new suit.

During a bear it should underperform SPX.

I hope so, anyhow. I have a lot of eggs in that basket.

I'd close out my shorts and go long. We are not going to break 1070 plus we are getting huge divergence with the RUT being positive

Well gang,

Today is “the big day”, as far as that Wilshire fake print goes. I only guessed at what I thought might happen on the day, and I guessed wrong. I thought it was going to be a high (DIA 118.16), but it might end up being a low?

I do see a rally coming next week, so I will be closing out my short today. I may even go long a small position? Who knows? It depends on how low we go today. But regardless, I won't be short over the weekend.

DOW JONES HAS A FALLING WEDGE

http://niftychartsandpatterns.blogspot.com/2010…

If it wasn't for the BS strength in financials, we would probably be down big right now. I never understood the mindset of “let's buy something now because we know a bill will pass even thought its bad for the underlying stock I'm buying”

Don't forget tonight is the full moon. Anthony still uber bearish about today.

http://stockcharts.com/def/servlet/Favorites.CS…

I've switched to bullish

Jawizz ain't so bearish now

Those of you short – don't forget to put trade triggers in in case of system failure.

Look like we finally broke that 1070 level, now it become resistance

A bear can only hope!

I have a trigger order in at 996. Are you going to go long at that point?

If we hit that fake print of 100.72 spy, (which I hope puts the spx in the low 900's) then I'll go long with a 100/105 August call spread for next week.

Thanks.

wait a second – wouldn't 100.72 be somewhere in the high 900s? Around the same level I mentioned?

I think so Monica. It's hard to say, because they don't away match up. When we hit 1065 spx on the flash crash, the spy hit 105.00. That was not normal, as usually the spy is a little higher then the spx.

Meaning, if the spx hit 1065 that day, the spy should have been 106.50 to 107.00, or if the spy was at 105.00, then the spx should have been 1040-1050 area. It's usually lower, but I don't know how to sync them up correctly.

I'm only guessing about them being in-sync at a 100.72 spy low. Of course we could easily pierce that level, and go on down to a point lower, that will match up with the low 900's on the spx… hard to say?

Lows are in for today/next few days. Go long. We tried to crack 1070, and we can't.

Never say never.

I just don't buy today's move down. Especially with relative strength in the financials and RUT relative to the other indices. Plus tons of positive divergence in STOCH, RSI and MACD on 60 and 30 min charts.

I will def. be buying the close or a retest of the days low.

I'm watching the real-time SPY chart on the NASDAQ website.

Downside volume looks strong and, when it's all said and done, that's usually where it's @.

These are times that try men's souls.

and women's! Even with the indexes being down, my account is barely up. It just sucks.

would this thing f**ng crack already!

Also, McClellanOscillator is higher today, even though price is lower. Another divergence

I agree with you that we are in for a giant bounce. The question is is it now, or is it EOD.

AAPL is very weak and it's key.

Yes, I agree with you… the market should rally soon. But, would you go long at these levels… on a Friday? I wouldn't, that's too dangerous. If a big sell off happens today, then yes.

But I believe that most professional traders aren't willing to go long over a weekend, until the market drops lower again.

Red I would go long. We've continued to build positive divergences since Wed. I would stay short, but the NYMO isn't off most of the time. It turned up on June 8th even though we made a lower low and we rallied from there. I might night trust MACD or RSI as much, but I think the NYMO divergence is much more reliable and today's the first today it is also diverging.

If we get much higher, I agree with you.

Here comes the rally…

we shall see. Not convinced yet.

Keep your eye on the dollar, and the euro (closing now at 11:30am est)

The witching hour is almost upon us.

Closed out my SDS and TZA calls. Still holding a couple of KBH puts. Waiting for a pullback to -800 or so on the TICK to go long. Take a look at the TICK guys, another divergence. Price is making lower lows today, but intraday TICK hasn't even gotten close to its intraday lows from yesterday.

I don't know if we are going to get the sell off today, or not gang. It isn't looking very bearish right now. Plus, we are going in the light volume lunch time period too.

Are they going to rally into the close, or sell off? Hard to say, but it's a little scary right now.

Red telltale signs of a sort of rally are there. You know something positive is going to come out of the G20 that will cause the Euro to rally starting sunday evening and in turn will cause equities to rally. That combined with all the divergences and lack of conviction to the downside today makes me doubt a large sell-off anytime soon.

still short but very nervous.

http://blog.afraidtotrade.com/

I will cover at SPX 1077.50

The dollar is getting hammer as usual…

Financial regulation is almost complete as lawmakers put the final touches on a new bill in the next few days. The financial stocks have been worried about this bill and have sold off accordingly in the last few months. As this saga is now coming to a close, the financial stocks like Goldman Sachs Group, Inc. (NYSE:GS), JPMorgan Chase & Co. (NYSE:JPM), Wells Fargo & Company (NYSE:WFC) and Morgan Stanley (NYSE:MS) are all starting to rally. Why when the bill is just about to be put into play are they rallying? Stocks much like the stock market and people are much more fearful of the unknown, rather than the known. Knowing exactly what these companies will have to now deal with gives investors, fund managers and traders an idea about future profitability and growth. They now have the facts on the table and can make an education decision. The unknown is always scarier than the known and in this situation, it proves correct. The financial sector is up today.

The market is hitting the upper trendline resistance from the falling channel. It needs to hold it back, if we are going to sell off anymore.

Closed all my shorts, now just waiting for an hourly close above 1077 on SPX before going long. Those of you short, are fighting the short-term trend reversal, which only results in pain. Better to take profits and sit on the sidelines for the next short entry.

I'm in cash but dont know yet which way this goes…look at spy on daily…on 5/13..14..17..18 four down days similar to this week and it stopped on the 200sma…then next day it looks like today and many thought held up by the 200 only to blast through it…I think I will wait till Monday to see what happens unless we drop down in the close…tough call here…

Fever just broke, I think.

Yep… rally is here now.

FALLING WEDGE S&P 500 UPDATED

http://niftychartsandpatterns.blogspot.com/2010…

Backtest the upper trendline now and not breaking

S&P 500 two minutes chart showing price consolidation

http://niftychartsandpatterns.blogspot.com/2010…

Lovely – I am still short.

just a little head fake to scare out the bears.

It's not a little headfake… it's a big one! LOL

the question is where does the headfake end?!

S&P 500 BREAKOUT Positive for short term. But the daily trend is still down

http://niftychartsandpatterns.blogspot.com/2010…

Love it. GDP revised down and absolutely no reason to rally, but we do. Time for the deadcat bounce. Target range of 1100 to 1107. Past 1107, and expect a full rally back to possibly 1131.