The following is an small excerpt from last weeks (1/21) Astrology Traders newsletter by Karen Starich. If you find this information useful and would like the actual dates provided to subscribers, click on the links below for more information.

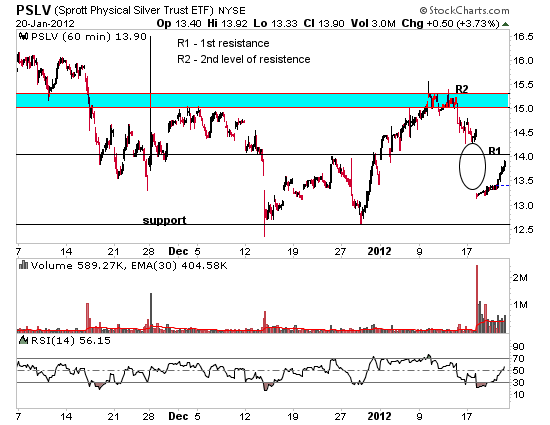

If you put in place an order for PSLV near $13.50, and it filled, from here I would hold and add on a dip. In essence Sprott has put in a floor near $13.20 on the PSLV. The Saturn oppose Jupiter (supply and demand) that I referenced last week, will carry into Friday January 27th, acts like a tug of war between the physical demand and the paper manipulation. Because of the Jupiter retrograde, the rare aspect is occurring three times, the first was in April 2011 right before silver almost hit $50.

The aspect, in it's final pass for 12 years, translates to a challenge of the corrupt CME/Comex gang following the MF Global scandal. This is a tug of war between supply and demand and is most certainly scaring the dickens out of JP Morgan and the CME/Comex gang's leveraged short positions in silver. Sprott is estimated at 1.5 billion in cash which translates to 40 to 50 million ounces of silver, far more than the estimated 31 million at the Comex. What Sprott is telling the market is trust the CME/Comex following the MF Global scandal, or trust Sprott Asset Managements viable 10 billion enterprise with a good reputation and massive growing customer base.

There could be a drop (subscribe for dates). There is risk for corrections (premium content) silver may start to make some very big moves up. Jupiter, as mentioned above, is making the last round of squares that have blocked silver since June. Often what happens with these aspects in a loop (retrograde) is by the final opposition the people have gotten savvy to the game and figure out a brilliant strategy to counter the opposition. There is still risk to the downside through January, however Sprott's move is reinforcing the good transits I see coming and giving confidence to the bulls now through these hard transits. Any correction should be viewed as an opportunity to buy long.

Related Posts:

SPX Analysis after closing bell:

http://niftychartsandpatterns.blogspot.com/2012/01/s-500-analysis-after-closing-bell_31.html

Facebook surprising that it isn’t registering the IPO closer to the Facebook date. I guess they chose the 1st so they could rush off to the Legatus Grand Summit and then the Superbowl.

I forgot to add that the Legatuseers will rush off to their private boxes at the Superbowl following the Summit so that they could cheer the Legatus Giants on and wash their money (with Mitt being the chief washer)

This kind of parallells a scene from John LeCarre’s latest novel, “Our Kind of Traitor” when all of the gangsters party in their private box at Roland Garros Stadium during the French Open Final then the next day, the chief washer signs over all the papers to his operation to Russian mob boss, the Prince.

Was LeCarre on to something there? His book is definitely topical.

After my Rooney Mara-Legatus posts, disqus became distorted again and I couldn’t post. It’s temporarily back to normal.

I was doing some changes Geccko, as I was trying to figure out why BigHouses’ avatar doesn’t show up here. But I finally gave up and put Disqus back to the original style.

This should be the grand jubilee celebration for Legatus. Founded in 1987, this is the 24th (888)anniversary.

If they hadn’t chosen the occultic date for this summit, 2-2-4,2012, which coincides with the infamous Facebook date, I wouldn’t have been so suspicious since the founder’s resume reads pretty clean. But then the Legatus Giants started their playoff run with a 2-24 win over the Falcons and followed that up by defeating the 15-1 defending (and 1929) champ Packers.

Interesting not too far after founding Legatus, Monaghan sold his Dominos pizza business to Bain Capital (Mitt Romney) and later sold his Detroit Tigers to a rival in the pizza business. Last week, the Tigers hit the news when they signed Prince Fielder to a 9year $214 million dollar contract.

During the last round of the playoffs, the operators pulled all the stops to get their favored teams though that will produce a rematch of the 2008 Superbowl, the Legatus Giants vs. the Belicheats, 2008 an underappreciated crash year.

Of course, the Giants were the 1987 Superbowl champs which I have mentioned several times. But it makes sense that this would be the ideal ritualistic matchup then in 2008 as it is now.

Belicheat was the defensive coordinator on that 1987 Giants championship team while the Giants current coach,Tom Coughlin, was on the 1987 Giants coaching staff also and now I am starting to see the stories on Bill Parcells being proud that two of those on his coaching tree will be facing each other in this SuperBowl (again) which casually alludes to the ’87 connection.

Of course, the Belicheats pulled a victory out of the hands of defeat when Ravens WR Lee Evans dropped a game winning touchdown pass or to be more exact, he treated it like a hot potato and held it up long enough so that the Patriot defender could knock it out of his hands. Then the Ravens kicker, a Pro Bowl like performer, missed a chip shot field goal two plays later at the end of the game.

The Giants game against the 49ers was plain ugly. The 49ers looked to be completely dominating the game but the 49ers kick returner managed to flub two punts and a fumble by the Giants running back #44 late in the game was called back by the refs in some sort of variant of the “tuck” rule that saw the Patriots move past the Raiders several years ago (2001) during the Pats first Superbowl run.

I didn’t see the end of 49er-Giants games since it didn’t really interest me (don’t like either team)and since I knew the outcome ahead of time so I missed out how those key plays played out.

Eli Manning, the Giants QB, had an interesting line though. He had 58 attempts and threw for the Tebow-time 316 yards.

It also turns out that the Steelers time of possession in their loss to the Tebow Bronco’s was 31minutes 6 seconds.

AMZN Nomura lowers FY12 EPS estimate from $2.08 to $1.89 and FY13 from

$3.90 to $3.52.===this is quite a return to growth rate, for 2012-2013

===

i guess 170-175, is the long term support.

2013 target price, based on 3.52 eps, is like a $300 price, if they go back to the old p/e.

here’s how to trade WLP 62-67 channel, click here.

http://zstock7.com/wp-content/uploads/2012/01/wlp-1-30mm.jpg

discus sends the comment above to my twitter, then 400 followers click on the link twitter provides, and they all land here, at red’s. where upon before leaving, they could click on an ad, to help red with site expenses.

pretty cool, huh!

LOL…

Very nice of you Z…

Thanks ol’ buddy!

🙂

i’m always looking for an edge, rofl.

ES Charts:

http://niftychartsandpatterns.blogspot.in/2012/02/s-500-futures-trend-update.html

5 U.S. Banks to go into Bankruptcy? Jim Sinclair on the Ellis Martin Report

http://www.youtube.com/watch?v=9802NwSSS6U&feature=player_embedded

Jim Sinclair of the father who started most of the US brokerage houses in the States and whose name reflects his mothers family the Sincliars, er Sinclairs? This guy should be trusted?

By the way, RED, excellent work onthe 1744 GOLD FAKE PRINT. That alone, is worth the eventual price of admission around here. Great stuff.

When did I post that? I can’t remember now… (must be getting old… LOL)

Put your bifocals on! j/k LOL!

You are “almost right”, as staring at 4 monitors all day will soon require me to bifocals!

Silver Channel and Range:

http://niftychartsandpatterns.blogspot.in/2012/02/silver-channel-and-range.html

Amazon charts: http://niftychartsandpatterns.blogspot.com/2012/02/amazon-chart-analysis.html

Well it was posted by someone on the stockmarketbloggers.com, and it was YOUR venue. Great FP.

By the way EVERYONE is turning bullish, just everyone. Its downright scary.

Arthur just told me the stock market is soon to crash.

Might have something to do with the fact that the pattern is somewhat similar to the pattern before the flash crash.

Funny how traffic on “Bear Blogs” almost disappears right before a crash. I guess everyone is sleeping now (hibernation).

AUDUSD Charts:

http://niftychartsandpatterns.blogspot.in/2012/02/audusd-resistance-level-and-target-zone.html

Where this market is going to this rally

If I had to guess (which is what I have to do anyway, I’d say to the FP on the SPY from last year… 138.86)

Here’s a nice little graph from your buddy Evil:

http://evilspeculator.com/wp-content/uploads/2012/02/20120131_inversevolume.png

Hedging volume w/inverse ETFs hasn’t dropped this far, this fast, since before the 2008 crash. Because inverse ETFs are relatively new, it’s probably the fastest drop ever.

That is an awesome chart, how does one get a regular look at that chart? Please and thank you in advance.

If you go to sentimentrader.com NOW, this graph is on the main page.

Edit: When I first posted it, there was a link to forbes.com. Don’t know if it still exists.

Saw that to..But the crooks keep pushing funny money into this market. This is getting unreal.This will go down in the history books.

From here until the “Big Kahuna,” I’m sure there will be several events each quarter that will make the history books…

All the bears are wiped out…

Sure makes you wonder if they plan on staging something right after Legatus? While there’s no signs of anything happening right now, that could change overnight.

Is that meeting this weekend?

The 2nd through the 4th…

Let’s see if something comes out this Sunday or Monday.

New Info from Fulford on Freedom Radio. 26 min long

http://kauilapele.wordpress.com/2012/02/01/benjamin-fulford-on-american-freedom-radio-1-31-12-mp3-of-bens-portion/

Thanks… I’ll listen to it now.

i got a good price on shorting ALL today. only thing is, I didn’t know they reported earnings today, because yahoo finance failed to post this info accurately—

they beat the street by 40%—

this is going to be an instant opening bell stop out.

once a year, yahoo gets me like this….

i have 2 possible scenarios for FEB

here’s what the DIA probably does…

http://zstock7.com/?p=6312#disqus_thread

reporting next 6 days–

yahoo won’t get me this time…

sun,tso,hnt,spg,apc,hum,pkx,sohu,veco,ko,akam,ctsh,cvh,

ice,v,wfm,cpo,gpi,ipsu,pep,pbi,

Sir Fred Goodwin of RBS to get de-kinghted this week…Looks like heads are starting to roll

http://www.theweek.co.uk/uk-news/fred-goodwin/44698/sir-fred-goodwin-get-de-knighted-week%E2%80%99#ixzz1lCHcZYbD

A Grim report issued by the Finance Ministry says United States Clearing House Interbank PAyments System has ground to a virtual halt..signaling that a major global economic collapse is currently underway and could very well likely enter into the dreaded free fall.

http://www.whatdoesitmean.com/index1559.htm

i’d like to see feb reach 130-131, over 2 a week period, DIA …or start 4 point ranging 128-124, or 129-125 within 5 days or sooner.

Crude Oil at 100 Day SMA:

http://niftychartsandpatterns.blogspot.in/2012/02/crude-oil-at-100-day-sma.html

Anna caught this FP on the SPY gang…

http://screencast.com/t/WhlT31CA

Looks like the upside target has been foretold for us sheep… thanks Anna!

Could be…but I’ve noticed there’s a big upside print before every cliff edge. Remember that one back in May? 137.18. Almost exactly the same as this one. Just something to watch out for.

Hi sweetie< do you have a screen shot of that FP I went back to that time and do not see it .. please post on hotoptionbabe.com ty 🙂

Yet another graph from Evil:

http://evilspeculator.com/wp-content/uploads/2012/02/2012-02-02_rydex.png

Interesting what happens almost every time the asset values converge – similar to the one I posted yesterday.

Dow: -11

Nasdaq: +11

S&P 500: +1

Any one can make inference of this 1 number.

Regards

Here’s another NFL tidbit I haven’t gotten to yet.

A 66 yard touchdown reception by NO’s Jimmy Graham in the 49er-NewOrleans playoff game where they flashed another 1987 albeit indirectly:

http://www.youtube.com/watch?v=pCA-PEi6SRg

Graham #80 catches the pass while #25 bounces off of him—80-25(7) ie 87 while NO’s #19 is in the foreground forming a 1987…..After he runs into the endzone (over the 4 or 49er logo), they reinforce the 87 if you didn’t get it the first time when NO teammate Sproles #43 runs up to congratulate him.

SF player #22 runs after him while #31 is the safety who misses him and #38 is the other NO defender in the picture.

Disqus is distorted again since I last posted so I really can’t post.

I have some similar stories in mind for the Legatus Giants wunderkind Victor Cruz #80 and some of his “amazing” TD plays.

In the SP today, a familiar two day pattern was put in similar to the October 28 and the July tops. Sort of the inverse hook pattern Attilla has mentioned in the past.

Copper Triangle pattern: http://niftychartsandpatterns.blogspot.com/2012/02/triangle-of-copper.html

ES Support and resistance lines:

http://niftychartsandpatterns.blogspot.in/2012/02/es-support-and-resistance-lines.html

Guys & Gals … Abdullah’s FAZ FP is coming $25. From there there should be some false flag to crush the market down to bring FAZ back to 300% return. It could be Iran/Israel war.

I’d look for the value to go a bit lower than $25. Remember we have the 137 & 138 SPY FP’s. Just like we over shot the 77 FP that Abdullah also caught. (Made it all the way to 81.50) That’s almost a 6% over-shoot. So I’m looking for a bottom around 23.50. Then again, if you are looking to go long on FAZ, I wouldn’t wait until the very bottom. When we have a FP of 83, you’d still have a great return.

I agree with Johnny on this one TS. I think the 137-138 FP’s will be hit, which should make FAZ dip below 25.

Hello, GG here.

I’ve become somewhat of a save-the-bear evangelist over at Daneric’s.

having been caught in many bear traps, I’ve focused on one thing. The bullish percentage.

this little bear is surviving the ravages of the largest market fires in history.

using one chart.

until this chart points down, truly down, I will not short.

http://stockcharts.com/h-sc/ui?s=$BPSPX&p=D&yr=0&mn=2&dy=0&id=p91623239522

-Cheers!

high probability short sells

AMTD,TXN

market gifts, if you want my real opinion:)

Dow Jones weekly chart: http://niftychartsandpatterns.blogspot.com/2012/02/dow-jones-weekly-resistance-level.html

Arthur says it T minus a few days.

Yup, the window starts Monday…this Friday ramp was great timing.

Er, what do you mean there is a big FP before every cliff edge? APCZ?

CSCO Weekly bullish engulfing:

http://niftychartsandpatterns.blogspot.in/2012/02/cisco-bullish-engulfing.html

GLD Weekend update:

http://niftychartsandpatterns.blogspot.in/2012/02/gld-weekend-update.html

I think I found 3 interesting articles that explain where

gold might trade, next few weeks.

Narrow Trading range for Gold, Is what I concluded.

http://zstock7.com/?p=6325

My little Superbow preview:

I mentioned previously the Legatus Giants wunderking WR Victor Cruz, who manages to turn opposing defenders into Keystone Cops as they attempt to tackle him and manage to him and run into each other instead. There are plenty of youtube videos on Victor Cruz, “Mr. Salsa” even some compilation videos. But his best TDs are his first against the Eagles this season, a 74 yarder when he caught a short pass when defender #24 bounced off him initially and then he managed to make #24 and #42s run into each other as they mistackled him……another long one against the Seahawks with the score at 19-14 when 2 Seattle defenders, one #25 went up to grap the ball but managed instead to tip it into Cruz’s hands, forming an indirect 87…#25 to Cruz’s #80—–and then the Jet’s 99yard TD reception where again he managed to elude 2 defenders who instead crashed into each other…..in the video we later see Giants player #9 cross behind QB# 10 to form a 19 and then in the next shot we see players form an 887 combo in the endzone.

Cruz #80 forms a dynamic duo with Hakeem Nicks #88—888……Nicks being the big playoff hero so far and a big participant of the 10-25-10 MNF matchup against the Cowboys when both teams #88 scored 5tds or 588, the same game in which Cowboys QB Tony Romo#9was knocked out for the season by Giants LB #59, an event which had been predicted to Kevin Depew the week before (see his twitter,might take several hours to dig it up though) by an ESPN producer although he was told Rodgers not Romo.

Giants LB #59 missed much of the season including the earlier matchup with the Pats (as did #88) and his return is considered one of the sparks to this playoff run.

On the otherside of the ball, our hero #87, the only #87 to remain of our glorious 87’s, has become the cause celebre of the Superbowl as pundit after pundit worry about whether he will play in the Superbowl or not. The more appropriate question should be how badly are they lying about his injury.

Too much melodrama there? As is the operators’ favorite NFL robot, #18 (666) Peyton Mannings’ (to quote an old time poster) quest to upstage the SuperBowl festivities with constant questions/updates to his playing status during the week his hometown Colts are hosting the Superbowl. He seems to be on a PR campaign to get the Colts to commit to a $28 million bonus due on March 8 despite many questions about his health. Colts owner Jim Irsay doesn’t seem to want to comply.

Irsay has been conducting his campaign on twitter. http://www.twitter.com/jimirsay If anything his twitter feed is littered with cryptic remarks, possible occultic numerology, and unusual cultural referenc es……Of course the infamous tweet came from Rob Lowe’s twitter account when he wrote that Peyton Manning would be retiring several weeks ago but Lowe’s twitter account isn’t as interesting as Irsay’s. (Irsay even made riddle linking Facebook to Forrest Gump and the Giants families)

The Belicheats are favored by 3 points even though the Legatus Giants beat them earlier in the season. The public seems to firmly behing the Giants though as the Belicheats seem to be universally reviled. Apparently, 60% of the betting money is behing the Giants, most all of it public money. So the question becomes does the grand ritual take precedence over the gangsta in Vegas getting their way.

The socalled wise guy expert was on the 4 letter morning radio show on Friday and claimed the largest book was projecting that the Patriots would be the winner but I don’t understand why such a book would be making such a projection available to the public. Anyway, it seems everytime this wise guy expert claims that the public is universally behind one team the team usually wins the game and against the spread.

WSJ had an article on the Legatus Giants founding family tree yesterday. The founder Tim Mara was described as a “former” bookmaker. He made his two sons co-owners when they were 14 and 22 to shield the team from creditors. Wellington, the Legatus member and one of Tim’s sons, was the longtime chief of the company and had 11 children. His oldest son is the Chairman now and described as a confidant to the NFL commissioner Roger Goodell…..confidant===handler……

From my own small search, it does seem that many in the family attended Jesuit institutions with many attending Fordham University in New York.

Rooney Mara’s older sister is an actress too (Brokeback Mountain) and has a clause in her contracts that allows her to take time off from work if either of her family teams,the Steelers or Giants make it to the SuperBowl so that she can attend the SuperBowl festivities.

Wellington’s widow, Ann Mara chided Terry Bradshaw after the 49ers playoff game while he was interviewing one of the Giants, for never picking the Giants. She will be in Indianapolis for the Superbowl. Her son should have told her that Terry is only playing his part in the grand ritual.

Is disqus still cutting off? I thought I fixed that issue? (well, not me… but disqus). What browser do you use to view this blog?

It’s still cutting off. I am at a location that uses Mozillo firefox right now.

I just switched back to the other theme option available from disqus… does it work now?

I went to IE and the post button does show now and this reply window is meticulous. Up above the post box does extend to the right margin but the post button can be seen.

I use FireFox, Opera, Google Chrome, Maxthon, Deepnet, Flock, Netscape, Safari, Avant, K-Melon, and Arora Browsers to test the site and it works on all of them. Only IE7 does it not work on. Anyway, it’s this disqus theme or the other one as they only have 2 options. Do you want me to keep it on this one?

Yes I would prefer this one otherwise I can only post itermittently.

the month after a GOOD earnings month, tend to trade like these 2 examples.

first chart DIA 130-131

second chart, top is in.

http://zstock7.com/wp-content/uploads/2012/02/dia-2-1mm.jpg

We now have a double confirmation that the top is in. The Time Magazine Cover the prior week and now a certain stock market related event that is hitting the news.

It’s playing out just like John LeCarre’s “Our Kind of Traitor”. So amazing and unusual. I guess LeCarre is part of the ritual. Probably the reason they remade and released his “Tinker,Tailor,Soldier,Spy”

The company that I associate most closely to the Arena Global Trading Corporation of LeCarre’s book has hit the headlines. Just as I mentioned a few days ago when the chief washer was forced to sign over his operation to the Prince something similar is occurring.

There was also a private Facebook IPO on Thursday so the insiders could have gotten enough money out so they really don’t need to worry how the real IPO performs. Then off to Legatus or the Superbowl festivities to party in their private boxes with the Legatuseers and now off to Switzerland for the corporate event.

These warlocks are good posting a 57 reading on the ISM non-manufacturing services reading while every country in Europe and Asia appears to be in recession. Right at a stock market top. German PMI was positive too for January but then again they did have negative retail sales in December.

One of my gurus mentioned US payrolls had the highest reading since the April 2011 report released in May. We know how that worked out.

21-17 Giants win. Nice analysis Geccko. 2+1 = 3, 1+7 = 8…3+8 = 11. I guess now what happens. Lol.

Did everyone see the illuminate symbols in Madonna 1/2 time show (Super Bowl) tonight? … Below is the video…I know it’s a copy.. I hope a clearer video will come out. Notice .25-.28 sec mark the Illuminate sign up top of her chair..In black… Their seems to be a number up there to… 25?

at the .35 sec mark the chair she is sitting in…also notice the head gear she is wearing…..2.49 min shows the one eye…She is famous to have this one eye…Illuminate symbol. At the 1.13 min mark there is an illuminate sign on the floor where madonna is standing on. It’s hard to see it on this video but it was very clear when i saw it on the TV.I hope a better video will come out.I’m sure there is more symbols but that was what caught my eye..

http://www.youtube.com/watch?v=UBiIVAbXPgU

Interesting…another time frame for a reversal w/Gann is 2/25.

The Legatus Giants prevail!!!!!!

Now all the financial pundits can harp on the how Superbowl indicator predicts a strong market for the rest of the year, over the next few days. Markets might remain bouyant until the corporate event takes place in Switzerland.

I did notice they flashed the 888 combo after Cruz’s TD in the first quarter (the Nicks-Cruz duo 80-88) but I haven’t really analyzed anything yet.

The Madonna halftime show was really interesting. They had the mind-controlled neurotic Niccki Manaj performing with here at one point while the other performer MIA flipped off the camera while lifting her M skirt. A lot of Vs flashing in the background….would have thought it was a David Fincher production.

I need to review that show several more times before I can get anything out of it.

Well Fincher did direct Madonna’s Vogue video so that might not be so farfetched.

spx is going down to 1290–here’s why!!!

http://zstock7.com/?p=6325#comment-430651397

ES Hour chart analysis:

http://niftychartsandpatterns.blogspot.in/2012/02/es-trend-analysis.html

EURUSD Trend update:

http://niftychartsandpatterns.blogspot.in/2012/02/eurusd-trend-update.html

I viewed the Madonna video today, wow, that was worse than anything I have seen before, it was Caligula gone bad.