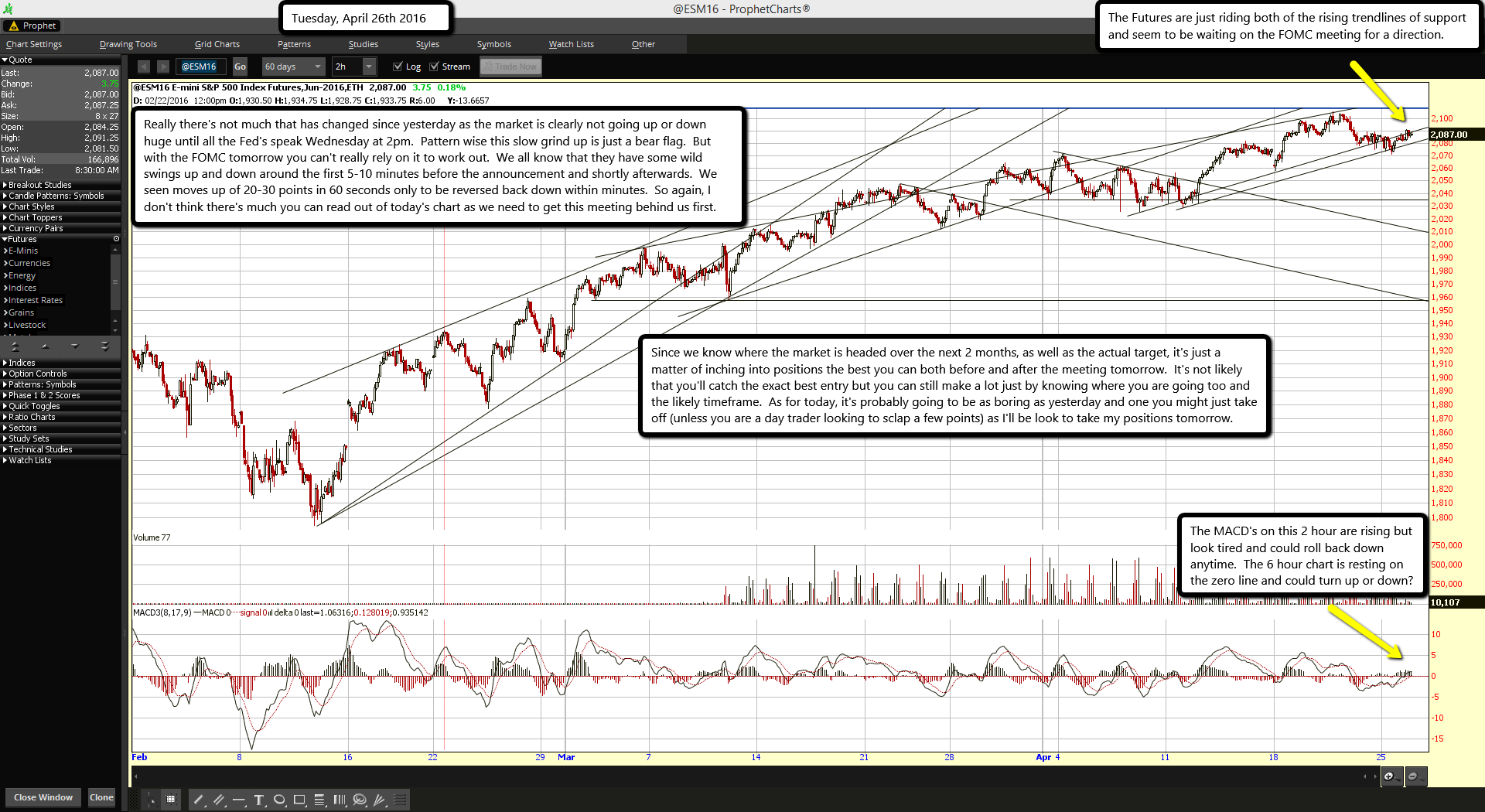

The Futures are just riding both of the rising trendlines of support and seem to be waiting on the FOMC meeting for a direction.

The MACD's on this 2 hour are rising but look tired and could roll back down anytime. The 6 hour chart is resting on the zero line and could turn up or down?

Really there's not much that has changed since yesterday as the market is clearly not going up or down huge until all the Fed's speak Wednesday at 2pm. Pattern wise this slow grind up is just a bear flag. But with the FOMC tomorrow you can't really rely on it to work out. We all know that they have some wild swings up and down around the first 5-10 minutes before the announcement and shortly afterwards. We seen moves up of 20-30 points in 60 seconds only to be reversed back down within minutes. So again, I don't think there's much you can read out of today's chart as we need to get this meeting behind us first.

Since we know where the market is headed over the next 2 months, as well as the actual target, it's just a matter of inching into positions the best you can both before and after the meeting tomorrow. It's not likely that you'll catch the exact best entry but you can still make a lot just by knowing where you are going too and the likely timeframe. As for today, it's probably going to be as boring as yesterday and one you might just take off (unless you are a day trader looking to sclap a few points) as I'll be look to take my positions tomorrow.