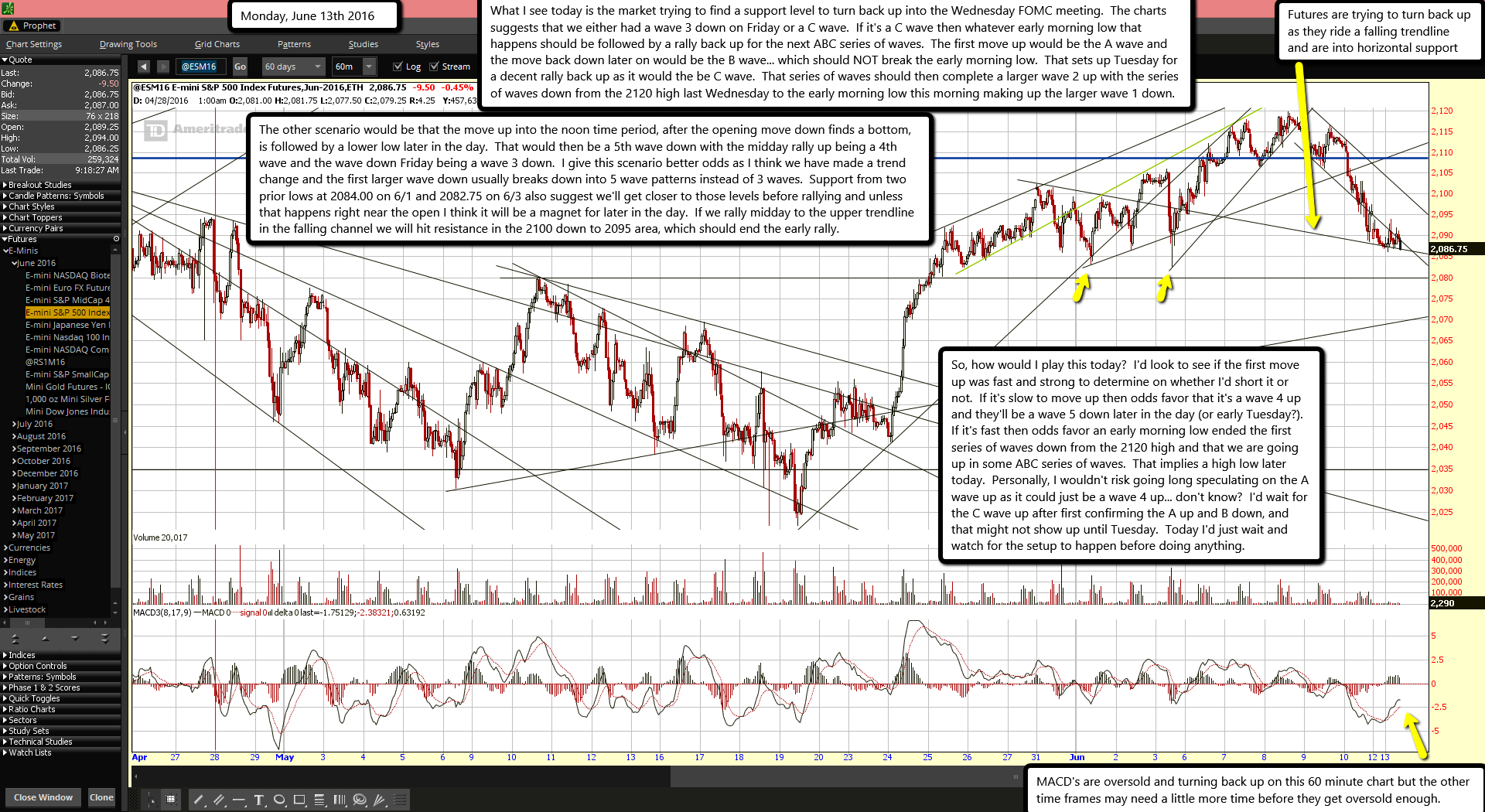

Futures are trying to turn back up as they ride a falling trendline and are into horizontal support

MACD's are oversold and turning back up on this 60 minute chart but the other time frames may need a little more time before they get oversold enough.

What I see today is the market trying to find a support level to turn back up into the Wednesday FOMC meeting. The charts suggests that we either had a wave 3 down on Friday or a C wave. If it's a C wave then whatever early morning low that happens should be followed by a rally back up for the next ABC series of waves. The first move up would be the A wave and the move back down later on would be the B wave... which should NOT break the early morning low. That sets up Tuesday for a decent rally back up as it would the be C wave. That series of waves should then complete a larger wave 2 up with the series of waves down from the 2120 high last Wednesday to the early morning low this morning making up the larger wave 1 down.

The other scenario would be that the move up into the noon time period, after the opening move down finds a bottom, is followed by a lower low later in the day. That would then be a 5th wave down with the midday rally up being a 4th wave and the wave down Friday being a wave 3 down. I give this scenario better odds as I think we have made a trend change and the first larger wave down usually breaks down into 5 wave patterns instead of 3 waves. Support from two prior lows at 2084.00 on 6/1 and 2082.75 on 6/3 also suggest we'll get closer to those levels before rallying and unless that happens right near the open I think it will be a magnet for later in the day. If we rally midday to the upper trendline in the falling channel we will hit resistance in the 2100 down to 2095 area, which should end the early rally.

So, how would I play this today? I'd look to see if the first move up was fast and strong to determine on whether I'd short it or not. If it's slow to move up then odds favor that it's a wave 4 up and they'll be a wave 5 down later in the day (or early Tuesday?). If it's fast then odds favor an early morning low ended the first series of waves down from the 2120 high and that we are going up in some ABC series of waves. That implies a high low later today. Personally, I wouldn't risk going long speculating on the A wave up as it could just be a wave 4 up... don't know? I'd wait for the C wave up after first confirming the A up and B down, and that might not show up until Tuesday. Today I'd just wait and watch for the setup to happen before doing anything.