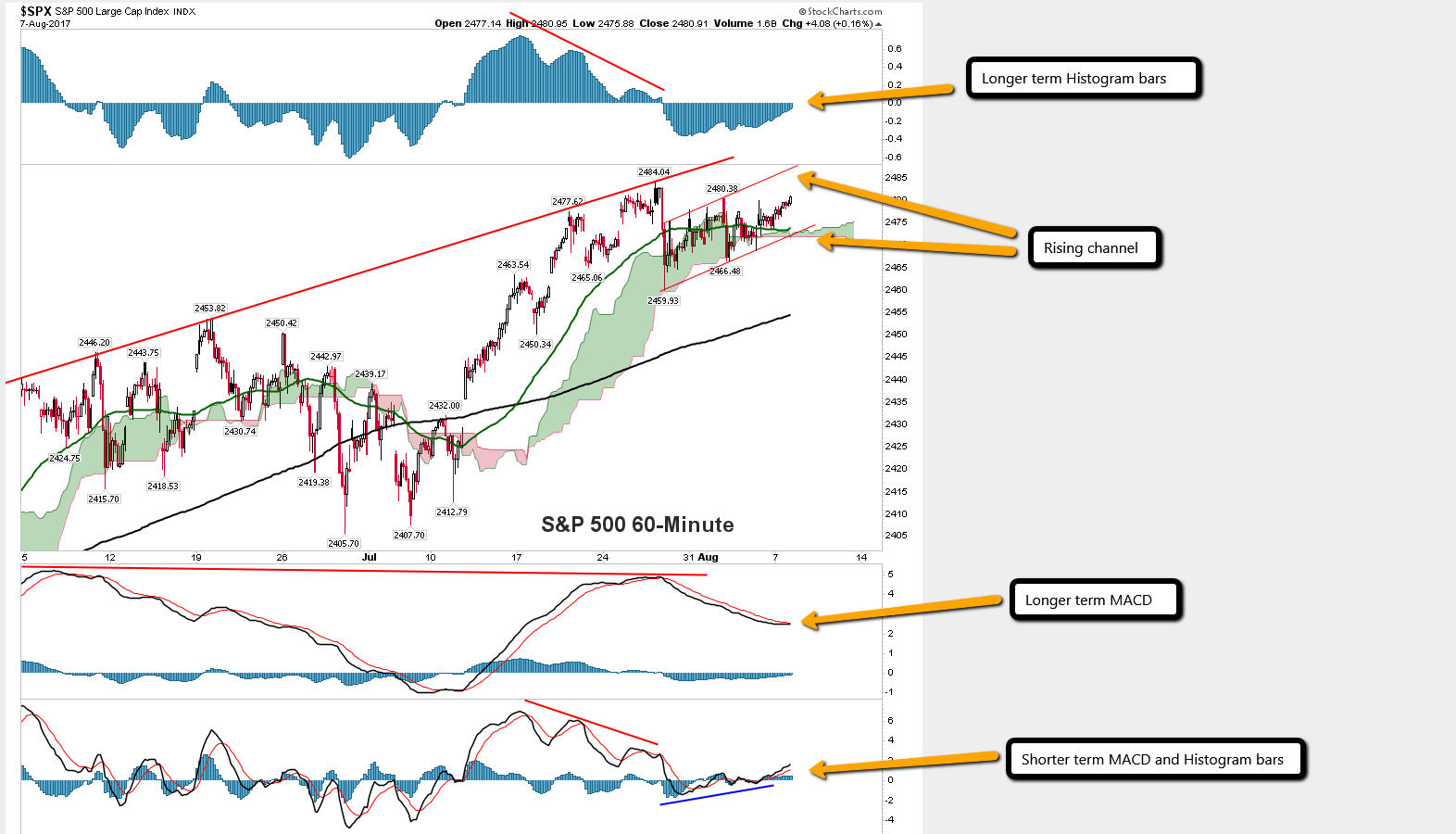

The 60 minute (longer term) MACD on the SPX cash did curl back up just a hair at the close yesterday. Now the two lines are touching and trying to turn bullish but haven't crossed quite yet. The histogram bars went up from that -0.2 level to just a tiny bit under the zero level as I thought they would. So while the futures chart shows no clear direction from a flat-lined MACD that just chops around the zero level the SPX cash is giving us some clues. It tells me that a little bit more time is needed to get that bullish cross on its' MACD's and a move into positive terrority on its' histogram bars. From a actually price level this move on the MACD's and histogram should produce a double top I'd think, or maybe a slightly higher high? But it's looking like it's going to take 1-2 more days for that to happen, whereas then it will overbought with newly created negative divergence.

The shorter term MACD on the SPX cash is point up and already made its' bullish cross last week. But it has multiple negative divergence on it already, so I don't expect it to go up really high like the prior peaks in the +5.0 - +5.5 levels. With it around the +1.0 level right now I think what will happen is that it will rise to about +2.0 - +2.5 by Wednesday (or sooner) while the longer term MACD gets a bullish cross that just doesn't really turn up much... kinda goes sideways. While all this happens we should see that grind higher continue to reach a double top or possibly a slightly higher high. My guess again is that we'll end this by Wednesday's close or sooner. That then suggests that we'll rollover on Thursday and/or into Friday and have a pullback of at least 20 SPX points.

The wildcard here is the Wednesday option expiration which might have too many calls up at the higher levels and force a pullback to pin the SPY at a lower level (like 247.0), and then resume the move back up early Thursday. Another possible scenario is that we finish the move up early Wednesday (maybe a gap up?) and then rollover later in the day to again pin the SPY to make the most calls and puts expire worthless. Overall though this market looks really determined to reach at least a double top this week, if not higher. The futures are just being used to keep the cash from rolling over until they want them to... and reading the futures chart is worthless right now, which is why I'm looking at the cash too. So that's my best guess on what should happen this week. As for the small move down right now before the open in the futures, I don't make much of it. Still looks choppy and range-bound too me, and that's problem all we'll see all day today I'd guess. It's a rising channel on the SPX cash and it's going to reach an end soon... whether that's a new high or double top I just don't know. But I don't see any signs this morning of a 20+ point drop coming. Maybe one will show up by the close? But I really think it will be later this week before we see that happen.