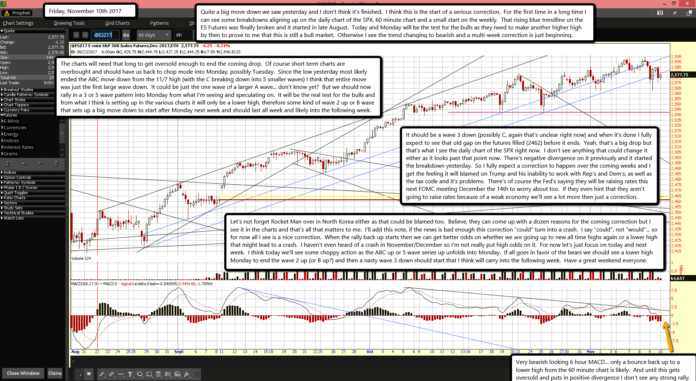

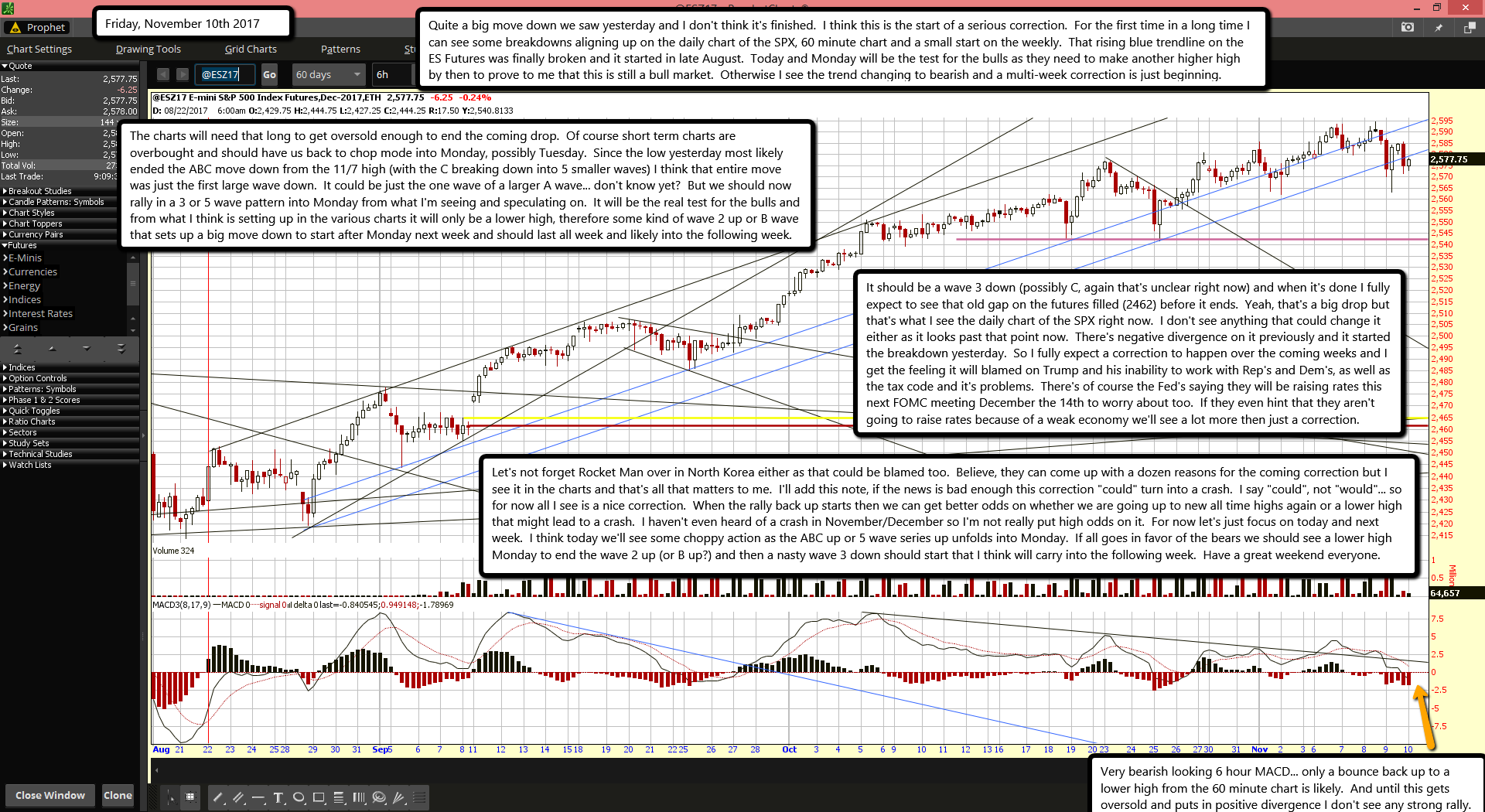

Quite a big move down we saw yesterday and I don't think it's finished. I think this is the start of a serious correction. For the first time in a long time I can see some breakdowns aligning up on the daily chart of the SPX, 60 minute chart and a small start on the weekly. That rising blue trendline on the ES Futures was finally broken and it started in late August. Today and Monday will be the test for the bulls as they need to make another higher high by then to prove to me that this is still a bull market. Otherwise I see the trend changing to bearish and a multi-week correction is just beginning.

The charts will need that long to get oversold enough to end the coming drop. Of course short term charts are overbought and should have us back to chop mode into Monday, possibly Tuesday. Since the low yesterday most likely ended the ABC move down from the 11/7 high (with the C breaking down into 5 smaller waves) I think that entire move was just the first large wave down. It could be just the one wave of a larger A wave... don't know yet? But we should now rally in a 3 or 5 wave pattern into Monday from what I'm seeing and speculating on. It will be the real test for the bulls and from what I think is setting up in the various charts it will only be a lower high, therefore some kind of wave 2 up or B wave that sets up a big move down to start after Monday next week and should last all week and likely into the following week.

It should be a wave 3 down (possibly C, again that's unclear right now) and when it's done I fully expect to see that old gap on the futures filled (2462) before it ends. Yeah, that's a big drop but that's what I see the daily chart of the SPX right now. I don't see anything that could change it either as it looks past that point now. There's negative divergence on it previously and it started the breakdown yesterday. So I fully expect a correction to happen over the coming weeks and I get the feeling it will blamed on Trump and his inability to work with Rep's and Dem's, as well as the tax code and it's problems. There's of course the Fed's saying they will be raising rates this next FOMC meeting December the 14th to worry about too. If they even hint that they aren't going to raise rates because of a weak economy we'll see a lot more then just a correction.

Let's not forget Rocket Man over in North Korea either as that could be blamed too. Believe, they can come up with a dozen reasons for the coming correction but I see it in the charts and that's all that matters to me. I'll add this note, if the news is bad enough this correction "could" turn into a crash. I say "could", not "would"... so for now all I see is a nice correction. When the rally back up starts then we can get better odds on whether we are going up to new all time highs again or a lower high that might lead to a crash. I haven't even heard of a crash in November/December so I'm not really put high odds on it. For now let's just focus on today and next week. I think today we'll see some choppy action as the ABC up or 5 wave series up unfolds into Monday. If all goes in favor of the bears we should see a lower high Monday to end the wave 2 up (or B up?) and then a nasty wave 3 down should start that I think will carry into the following week. Have a great weekend everyone.