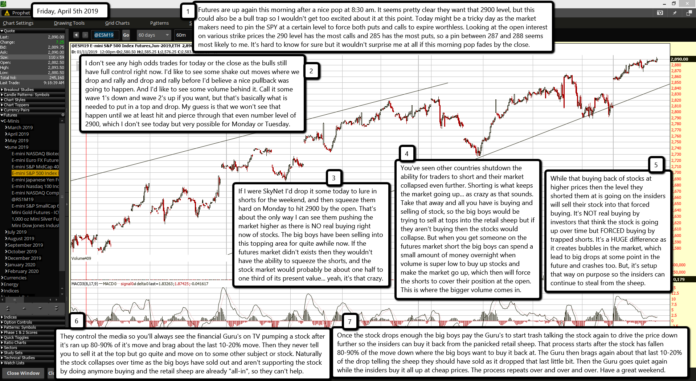

Futures are up again this morning after a nice pop at 8:30 am. It seems pretty clear they want that 2900 level, but this could also be a bull trap so I wouldn't get too excited about it at this point. Today might be a tricky day as the market makers need to pin the SPY at a certain level to force both puts and calls to expire worthless. Looking at the open interest on various strike prices the 290 level has the most calls and 285 has the most puts, so a pin between 287 and 288 seems most likely to me. It's hard to know for sure but it wouldn't surprise me at all if this morning pop fades by the close.

I don't see any high odds trades for today or the close as the bulls still have full control right now. I'd like to see some shake out moves where we drop and rally and drop and rally before I'd believe a nice pullback was going to happen. And I'd like to see some volume behind it. Call it some wave 1's down and wave 2's up if you want, but that's basically what is needed to put in a top and drop. My guess is that we won't see that happen until we at least hit and pierce through that even number level of 2900, which I don't see today but very possible for Monday or Tuesday.

If I were SkyNet I'd drop it some today to lure in shorts for the weekend, and then squeeze them hard on Monday to hit 2900 by the open. That's about the only way I can see them pushing the market higher as there is NO real buying right now of stocks. The big boys have been selling into this topping area for quite awhile now. If the futures market didn't exists then they wouldn't have the ability to squeeze the shorts, and the stock market would probably be about one half to one third of its present value... yeah, it's that crazy.

You've seen other countries shutdown the ability for traders to short and their market collapsed even further. Shorting is what keeps the market going up... as crazy as that sounds. Take that away and all you have is buying and selling of stock, so the big boys would be trying to sell at tops into the retail sheep but if they aren't buying then the stocks would collapse. But when you get someone on the futures market short the big boys can spend a small amount of money overnight when volume is super low to buy up stocks and make the market go up, which then will force the shorts to cover their position at the open. This is where the bigger volume comes in.

While that buying back of stocks at higher prices then the level they shorted them at is going on the insiders will sell their stock into that forced buying. It's NOT real buying by investors that think the stock is going up over time but FORCED buying by trapped shorts. It's a HUGE difference as it creates bubbles in the market, which lead to big drops at some point in the future and crashes too. But, it's setup that way on purpose so the insiders can continue to steal from the sheep.

They control the media so you'll always see the financial Guru's on TV pumping a stock after it's ran up 80-90% of it's move and brag about the last 10-20% move. Then they never tell you to sell it at the top but go quite and move on to some other subject or stock. Naturally the stock collapses over time as the big boys have sold out and aren't supporting the stock by doing anymore buying and the retail sheep are already "all-in", so they can't help.

Once the stock drops enough the big boys pay the Guru's to start trash talking the stock again to drive the price down further so the insiders can buy it back from the panicked retail sheep. That process starts after the stock has fallen 80-90% of the move down where the big boys want to buy it back at. The Guru then brags again about that last 10-20% of the drop telling the sheep they should have sold as it dropped that last little bit. Then the Guru goes quiet again while the insiders buy it all up at cheap prices. The process repeats over and over and over. Have a great weekend.