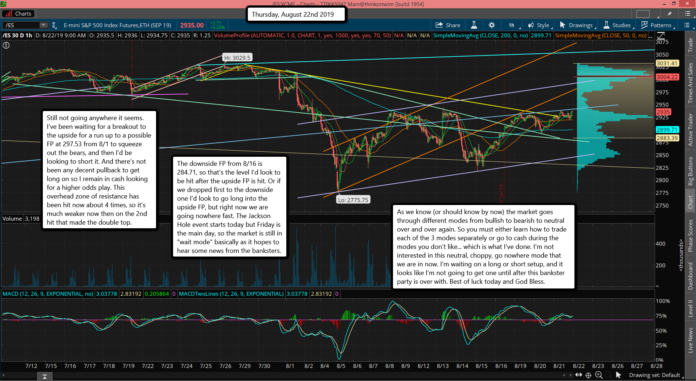

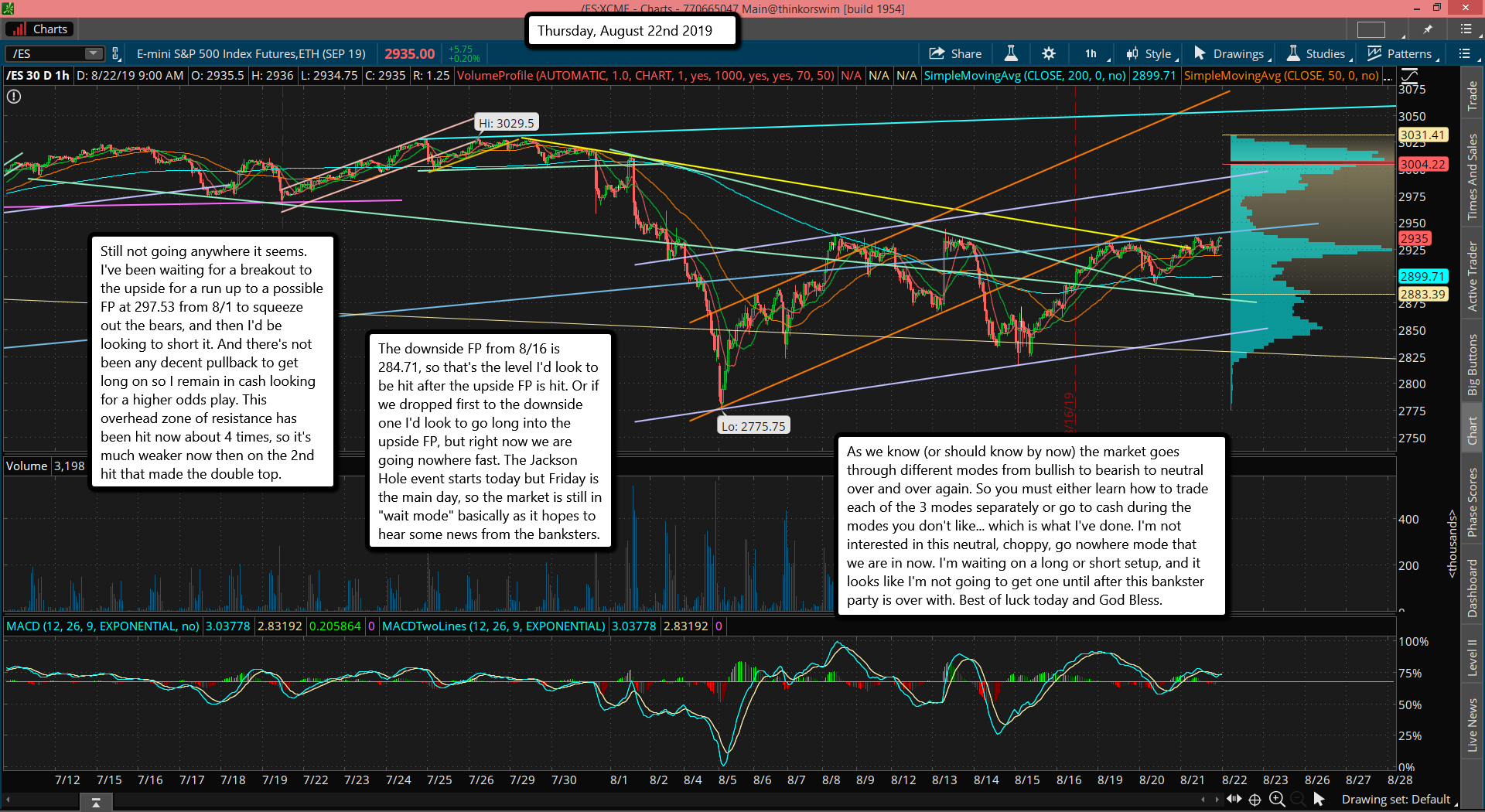

Still not going anywhere it seems. I've been waiting for a breakout to the upside for a run up to a possible FP at 297.53 from 8/1 to squeeze out the bears, and then I'd be looking to short it. And there's not been any decent pullback to get long on so I remain in cash looking for a higher odds play. This overhead zone of resistance has been hit now about 4 times, so it's much weaker now then on the 2nd hit that made the double top.

The downside FP from 8/16 is 284.71, so that's the level I'd look to be hit after the upside FP is hit. Or if we dropped first to the downside one I'd look to go long into the upside FP, but right now we are going nowhere fast. The Jackson Hole event starts today but Friday is the main day, so the market is still in "wait mode" basically as it hopes to hear some news from the banksters.

As we know (or should know by now) the market goes through different modes from bullish to bearish to neutral over and over again. So you must either learn how to trade each of the 3 modes separately or go to cash during the modes you don't like... which is what I've done. I'm not interested in this neutral, choppy, go nowhere mode that we are in now. I'm waiting on a long or short setup, and it looks like I'm not going to get one until after this bankster party is over with. Best of luck today and God Bless.