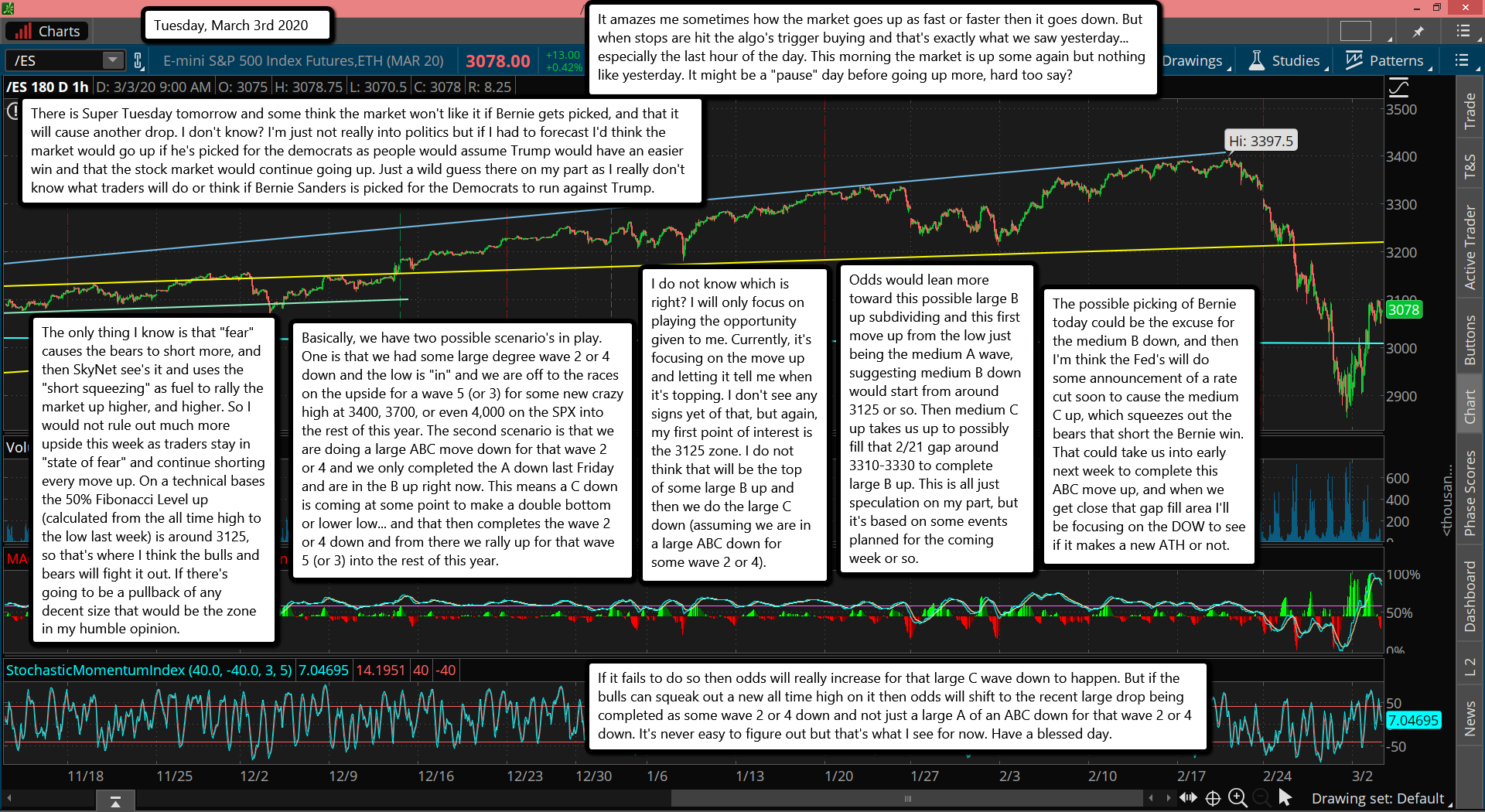

It amazes me sometimes how the market goes up as fast or faster then it goes down. But when stops are hit the algo's trigger buying and that's exactly what we saw yesterday... especially the last hour of the day. This morning the market is up some again but nothing like yesterday. It might be a "pause" day before going up more, hard too say?

There is Super Tuesday tomorrow and some think the market won't like it if Bernie gets picked, and that it will cause another drop. I don't know? I'm just not really into politics but if I had to forecast I'd think the market would go up if he's picked for the democrats as people would assume Trump would have an easier win and that the stock market would continue going up. Just a wild guess there on my part as I really don't know what traders will do or think if Bernie Sanders is picked for the Democrats to run against Trump.

The only thing I know is that "fear" causes the bears to short more, and then SkyNet see's it and uses the "short squeezing" as fuel to rally the market up higher, and higher. So I would not rule out much more upside this week as traders stay in "state of fear" and continue shorting every move up. On a technical bases the 50% Fibonacci Level up (calculated from the all time high to the low last week) is around 3125, so that's where I think the bulls and bears will fight it out. If there's going to be a pullback of any decent size that would be the zone in my humble opinion.

Basically, we have two possible scenario's in play. One is that we had some large degree wave 2 or 4 down and the low is "in" and we are off to the races on the upside for a wave 5 (or 3) for some new crazy high at 3400, 3700, or even 4,000 on the SPX into the rest of this year. The second scenario is that we are doing a large ABC move down for that wave 2 or 4 and we only completed the A down last Friday and are in the B up right now. This means a C down is coming at some point to make a double bottom or lower low... and that then completes the wave 2 or 4 down and from there we rally up for that wave 5 (or 3) into the rest of this year.

I do not know which is right? I will only focus on playing the opportunity given to me. Currently, it's focusing on the move up and letting it tell me when it's topping. I don't see any signs yet of that, but again, my first point of interest is the 3125 zone. I do not think that will be the top of some large B up and then we do the large C down (assuming we are in a large ABC down for some wave 2 or 4).

Odds would lean more toward this possible large B up subdividing and this first move up from the low just being the medium A wave, suggesting medium B down would start from around 3125 or so. Then medium C up takes us up to possibly fill that 2/21 gap around 3310-3330 to complete large B up. This is all just speculation on my part, but it's based on some events planned for the coming week or so.

The possible picking of Bernie today could be the excuse for the medium B down, and then I'm think the Fed's will do some announcement of a rate cut soon to cause the medium C up, which squeezes out the bears that short the Bernie win. That could take us into early next week to complete this ABC move up, and when we get close that gap fill area I'll be focusing on the DOW to see if it makes a new ATH or not.

If it fails to do so then odds will really increase for that large C wave down to happen. But if the bulls can squeak out a new all time high on it then odds will shift to the recent large drop being completed as some wave 2 or 4 down and not just a large A of an ABC down for that wave 2 or 4 down. It's never easy to figure out but that's what I see for now. Have a blessed day.