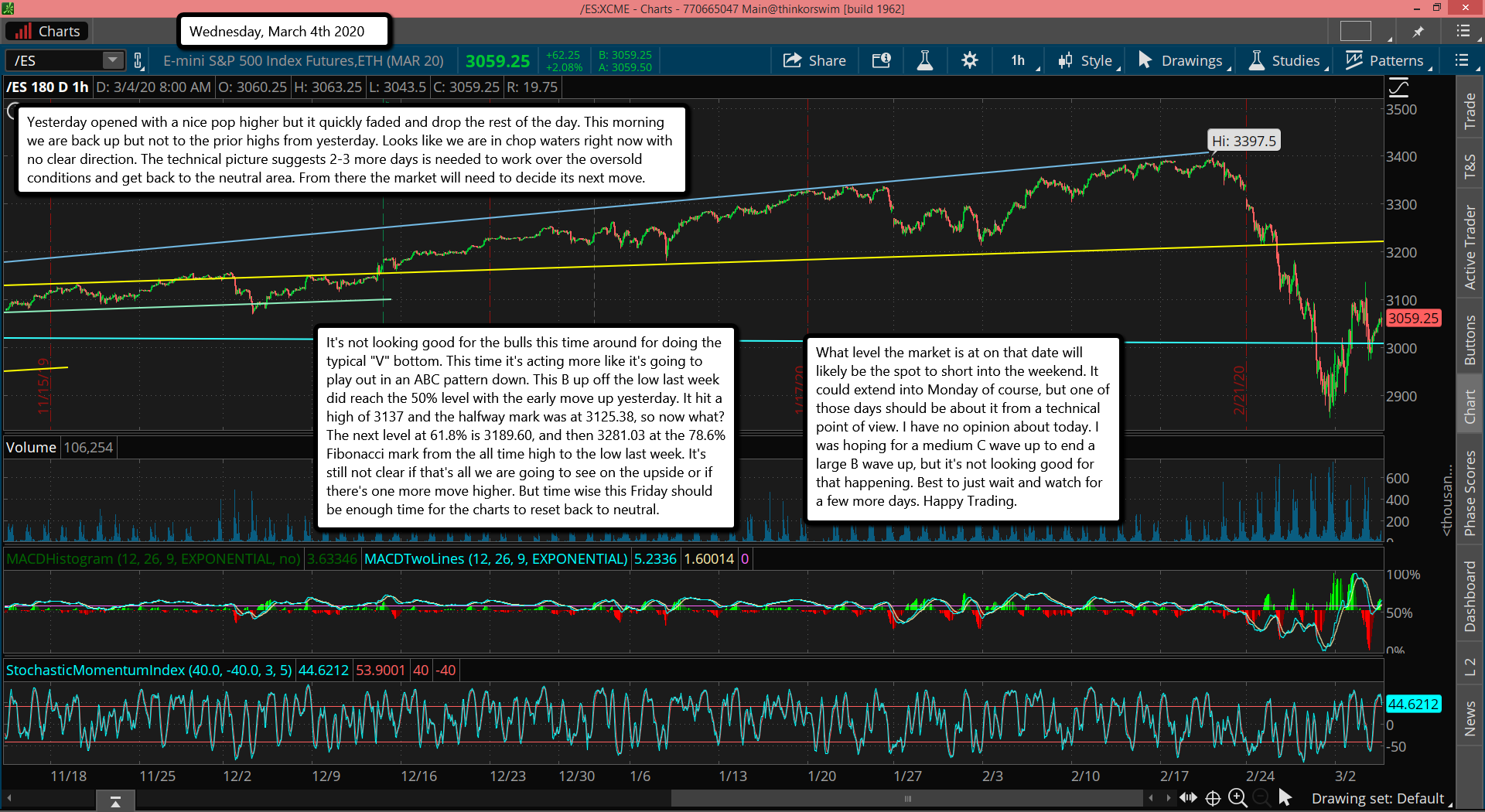

Yesterday opened with a nice pop higher but it quickly faded and drop the rest of the day. This morning we are back up but not to the prior highs from yesterday. Looks like we are in chop waters right now with no clear direction. The technical picture suggests 2-3 more days is needed to work over the oversold conditions and get back to the neutral area. From there the market will need to decide its next move.

It's not looking good for the bulls this time around for doing the typical "V" bottom. This time it's acting more like it's going to play out in an ABC pattern down. This B up off the low last week did reach the 50% level with the early move up yesterday. It hit a high of 3137 and the halfway mark was at 3125.38, so now what? The next level at 61.8% is 3189.60, and then 3281.03 at the 78.6% Fibonacci mark from the all time high to the low last week. It's still not clear if that's all we are going to see on the upside or if there's one more move higher. But time wise this Friday should be enough time for the charts to reset back to neutral.

What level the market is at on that date will likely be the spot to short into the weekend. It could extend into Monday of course, but one of those days should be about it from a technical point of view. I have no opinion about today. I was hoping for a medium C wave up to end a large B wave up, but it's not looking good for that happening. Best to just wait and watch for a few more days. Happy Trading.