We did not make a lower low yesterday, so I have to say that low on Wednesday was the end of an ABC down from the Monday high, with the C part bottoming on Wednesday. Then after hours the rally continued and it turned into a nasty bear squeeze that made a new all time high on the ES.

So we have two different paths here, depending on whether or not the SPX makes a new all time high at the open too, which is... ONE the entire ABC down was just a larger A wave and that we are in a B wave up now, which would subdivide into another ABC of course.

If so, then we should make a lower high (on the SPX cash, as again the ES has already made a new high) and then we'll see another drop for the C wave afterwards.

Or TWO, we make a higher high (over 5000) into early next week (probably Monday) to finally end the rally up and allow a multi-day (or week) pullback. It's looking like path TWO at this point, but if it's the first path then we won't see the top until the week of OPEX most likely.

Meaning the C wave down (after this B wave up finishes today) should drop to 4700-4800 into the end of next week. And from there we rally hard to 5000+ into the middle of this month. The Seasonality Chart points to a rally up into the 5th or so, which isn't perfect of course, but I have other reasons to think we will turn on Monday. If we are at a top then the turn will be down, and if we pullback into that day then it will be a bottom.

So far it's looking like we'll see the SPX cash make a higher high today, and if that happens it should carry into Monday where I think it tops out and then we start a pullback.

Sidenote:

I was watching Steve Bannon last night on Real America's Voice and he was interviewing a man that ran a hedge fund about the stock market. He said that there is trillions of dollars in the Treasury Fund that he thinks the Biden administration is pressuring Janet Yellen to put into the stock market to make him look good, which would be to get more votes of course.

Now I just focus on the techincals but they don't ever predict "price"... just suggest when "turns" will happen based on negative or positive divergences on the various time frames, and how the MACD's and RSI's are positioned. Pattern too is important and Seasonality as well.

So I can't tell you how high we are going but I do see 5000+ very soon, which could be just a small amount over it, or some crazy level of 5300, 5400, or higher, in some blow off top that drag out longer then I'm expecting it too. I'm really focused on "time" and of course the technicals. We are very likely going to top out this month as the Seasonality for March is very bearish, so odds of crazy highs are low I think.

Therefore, if there's ever going to be a large drop it likely going to happen in that month, or October, but I do not think it will last into this Fall. Just like with the 2020 top and crash, which was blamed on COVID, they will find something to blame the coming crash on too... which will be "after the fact" of course.

Getting back to listening to Steve Bannon yesterday evening... he mentioned that if China was to invade or just put a blockade in around Taiwan that would instantly cause a 25% drop in the stock market. This was his thoughts I believe, but it was just after the interview with the hedge fund guy.

While he's not a financial guy I do agree that shutting down our access to chips from them would cause a massive panic in the market, and let's be real here... if China was ever going to attack them it will be before Biden leaves the basement as they know Trump will not put up with it. They must attack while Pedo Joe is still in the White House. By "attack", I don't mean they have to use force and start a war with Taiwan, as it could just be a blockade (which makes more sense as they don't want to destroy their infrastructure).

What am I'm getting at you ask? I'm saying that we could be in the last stages of a blow off top that could setup a huge crash. I found the below quote on another site and I want to post it for everyone to to see and make up their own mind on it. I have not fact checked it, but I have no reason to believe it's not accurate.

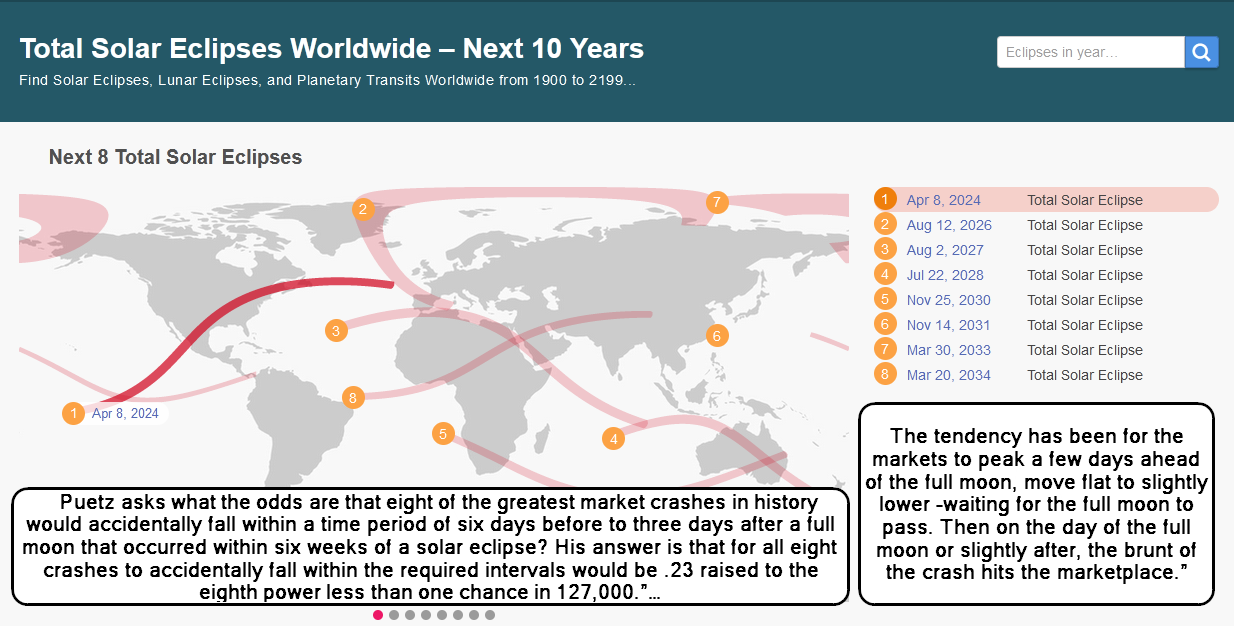

"Puetz asks what the odds are that eight of the greatest market crashes in history would accidentally fall within a time period of six days before to three days after a full moon that occurred within six weeks of a solar eclipse? His answer is that for all eight crashes to accidentally fall within the required intervals would be .23 raised to the eighth power less than one chance in 127,000.”

"The tendency has been for the markets to peak a few days ahead of the full moon, move flat to slightly lower –waiting for the full moon to pass. Then on the day of the full moon or slightly after, the brunt of the crash hits the marketplace.”"

So I looked up when the next Solar Eclipse is and put this on a chart for me to remember and note for the future. That chart is below.

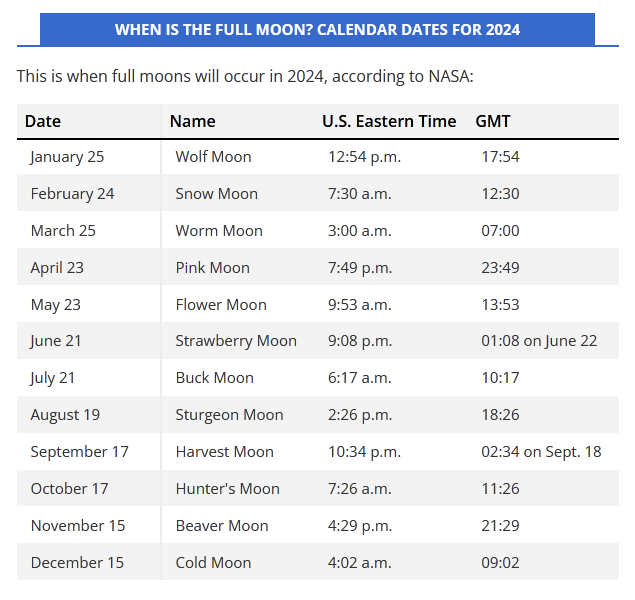

Then I went and looked up when all the coming Full Moons are for this year as you can see from the Solar Eclipse chart there's one this year on April 8th, 2024. That Full Moon Chart is below...

This tells me that there is a window this year of about 6 weeks in front or after a Solar Eclipse, and since the Eclipse is on April 8th, 2024, that would mean that it could top on the February 24th Full Moon or the March 25th one... that's "if" it's within 6 weeks BEFORE the Solar Eclipse.

If it's with 6 weeks AFTER the Solar Eclipse it could be the April 23rd or May 23rd Full Moon, but not the June 21st as that's more the 6 weeks from the April 8th Solar Eclipse. The February 24th Full Moon is just a hair over 6 weeks as the 26th would be exactly 6 weeks in front of April 8th. I'd say that's close enough.

I have to pay more attention to the February and March Full Moons because of how bearish the market is on the Seasonality Chart for the month of March. Could be be May? Yeah, I guess? There's that old saying "Sell in May and Go Away" so that is something to pay attention too as well.

For now though I want to see how high we go into OPEX this month. February 24th is on a Saturday so Monday the 26th would be the day for the heavy decline to start if it's another Puetz type crash. All we would need is for China to put a blockade around Taiwan and there's your reason for the crash.

And I believe the he means that the "brunt of the crash" would be equal to the C wave down in Elliottwave as you never see any crashes that happen right from the very top. Even the 2020 crash had an A down and B up first. So we could top here in a few days, pull back for the A down into late next week or even into early the week of OPEX. Then bounce back up for the B wave into the 26th, and that's where the crash would start from.

Have a great weekend.