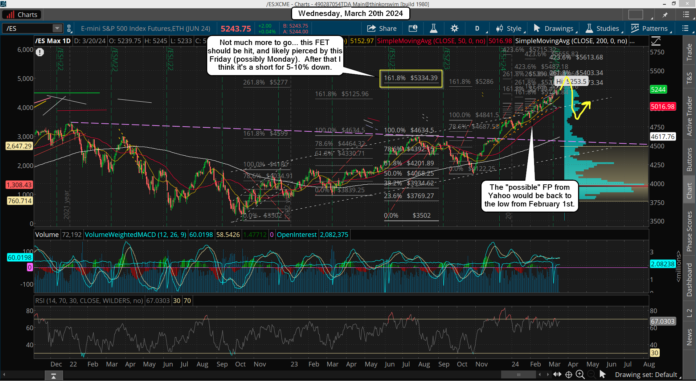

Today is the big day. The FOMC meeting at 2pm EST will decide the next big 100+ point move, which I think will be up. Sure there could be some wild swings up and down but by the close I expect the market to close up nicely. This is all setting up for a super nice short of 5-10% if we hit my FET (Fibonacci Extension Target) of 5334 on the ES, which it will likely piece it of course.

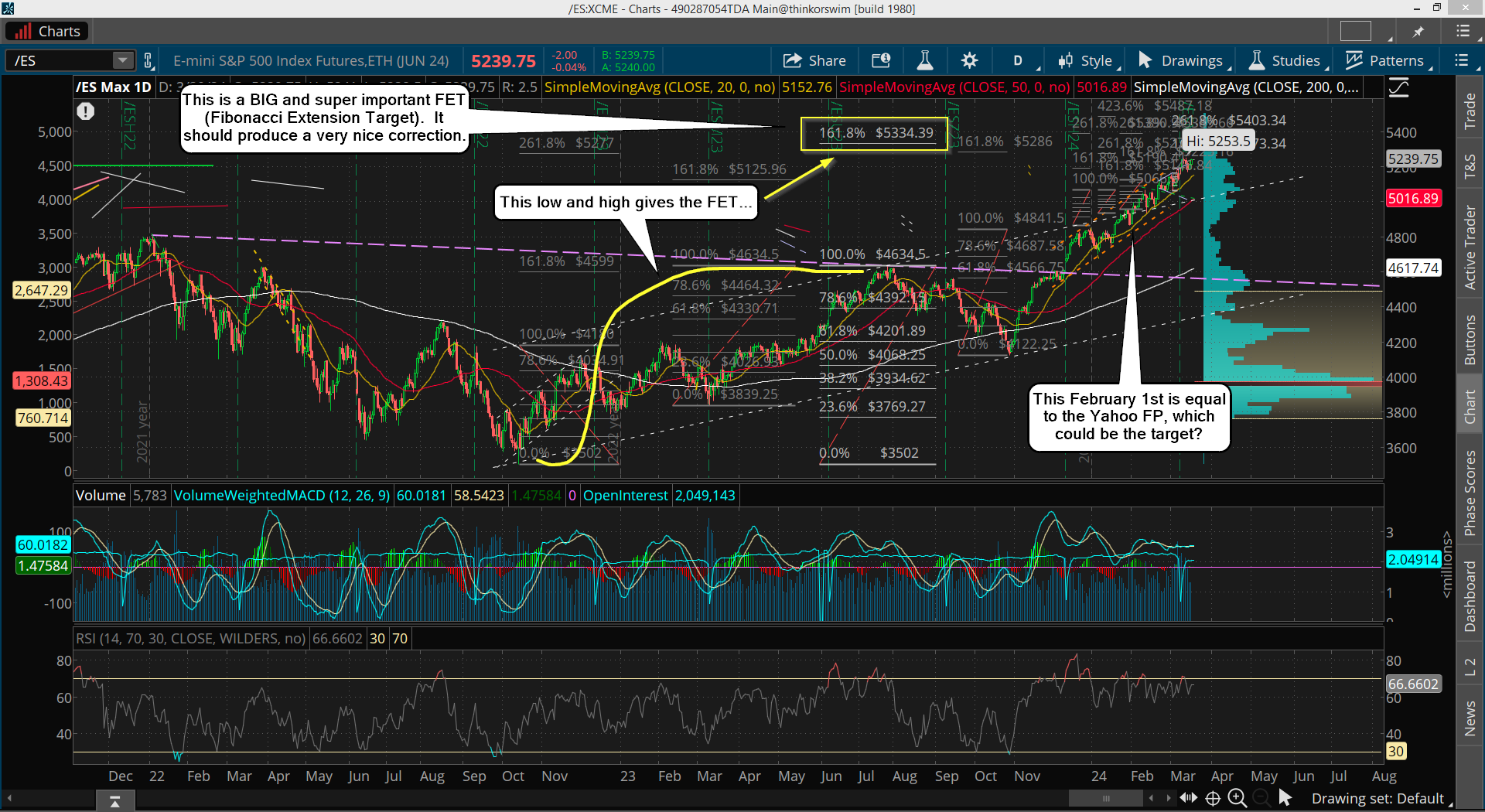

My FET of 5334 is based on the low from October of 2022 up to the high in July of 2023, which is a super important one because it's the largest one over the past 2 years. This means it should produce a pullback like the one that came after the July 2023 high, which was 11% and took 90 days to complete. Does that mean this coming drop will be last the same about of time? I don't know but the common theme is to flip between patterns, which I'd call that that one a slow choppy decline, meaning this one should do the opposite and be a fast drop with very few big bounces.

This is where it could drop to after we top...

Now I don't know if that will be accurate or not, as I've said previously about Yahoo FP's not be reliable because they show dozens of them and you don't know what is real and what is not. But this one is odd, and it only lasted about 2 or 3 days before it was removed, so it's possibly a real one? As you can see on the chart it's around the low of February the 1st, which on the ES is 4872, and on the SPX that would be 50-60 points lower.

Now if we top at my FET of 5334, then a drop to that FP would be just under 9%, and that's right in line with the 11% back in 2023. They won't ever match exactly but something nice and close would be perfect in my opinion. That's the bigger picture. Let's see if we rally to my upside target this Friday (possibly Monday). If so, I'll be shorting it.

P.S. I posted this yesterday...

Have a blessed day.

The lunar eclipse is Mondayish so it could hold up until then or Tuesday so we might have a flower moon denouement. .618 extension of the decline into October both in calendar and trading days targets Monday.

The decline into late October hit the low on the Friday before the lunar eclipse. The Fed meeting decision occurred on November 1, three trading days after the eclipse so it could set up a high here or on Friday. All the recent turns have occurred on a Thursday or a Friday.

Yeah, I’m cautiously about this “possible” big short as it’s never easy to pick a top. In fact it’s hard as hell. Most of the time you lose. But if there’s ever going to be a pullback tomorrow or Monday stands the best chance. I’m leaning more toward Monday right now.