A flat day on Friday as the market clearly is showing signs of exhaustion. At this point I think most all of the bears have given up on the lower low and are now looking for a higher low from the future coming pullback. I think that I would also be looking for a higher low if I did not have the 2 FP's on the SPY, but since I do have them I must keep the door open for them to be hit before another new all time higher high is put in.

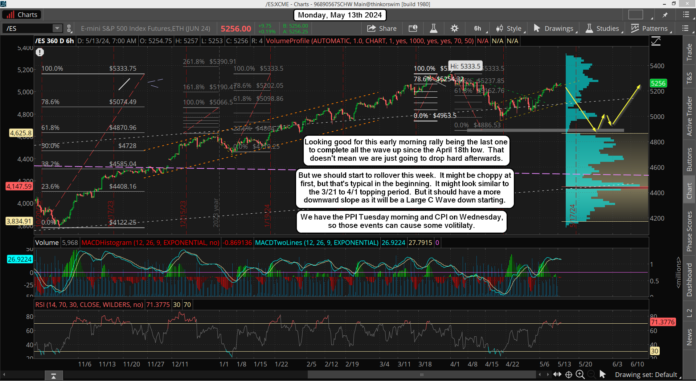

We are super close now to just that, and one might even say we are at a double top. But I think we need to be a little closer to say that, like it should be within 10-20 points in my opinion. I think we are closer on the DOW to hitting a double now, but even its' not there yet. And really it would be a triple top as we've already had a double top on it from the 3/21 high and the 4/1 high.

It doesn't matter really as we are within spitting distance of a double top (or triple) on all three of the major indexes, so a turn down is coming soon. Will it wait until after CPI this Wednesday or will it front run it and start today is the question?

If too many people are all looking for the same thing then we know it's not going to happen. So are there a lot of traders looking at the CPI as the likely "turn date"? I think there must be as most traders know it's coming so I'm leaning toward the market starting to pullback in front of that event and do the typical wild swings up and down after it, but when all the dust is settled we continue in the pullback.

This week though is probably going to be choppy as it should be the "topping week", and that's where the final smaller degree waves on the upside finish and the smaller degree waves on the downside form and overlap to setup the larger down waves. Those waves would of course the wave 3's inside the Large C Wave that should complete by the end of the month.

We have Memorial Day coming up on Monday, May 27th and the market will be close since it's a holiday, so I would not be surprised to that 3 day weekend used for the bottoming period. Many "turns" happen over a holiday weekend, and this one would line up perfectly with a bottom.

Meaning it happens before the weekend (Friday the 24th) or the few days right after the weekend (the 28th-30th). I'll be looking close at Friday the 24th as if we are around a double bottom from 4/19, then it's the perfect bull trap to make the market look bullish in the holiday but then do the flush out drop to hit the FP after it with all the bulls holding longs during those 3 days. You gap down on Tuesday the 28th and keep going until the FP is hit over the next day or so.

Then the bears will pile in short as the bulls give up, and that's when the low is really put in. Just a theory of course, but based on how common it is for the market to put in "turns" around holidays, so it's not out of the question to see it happen. Not much else to say until we start to rollover.

Lastly, here is last Fridays wave count, which has us in the final 5th wave up this morning, which would be Tiny Wave 5, inside Small wave 5, inside Medium Wave C, inside Large Wave B.

Have a blessed day.