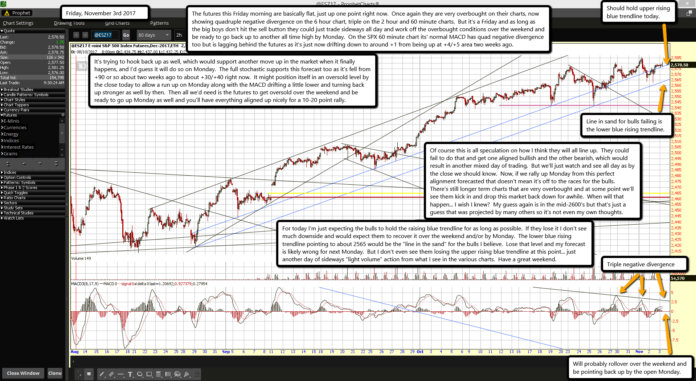

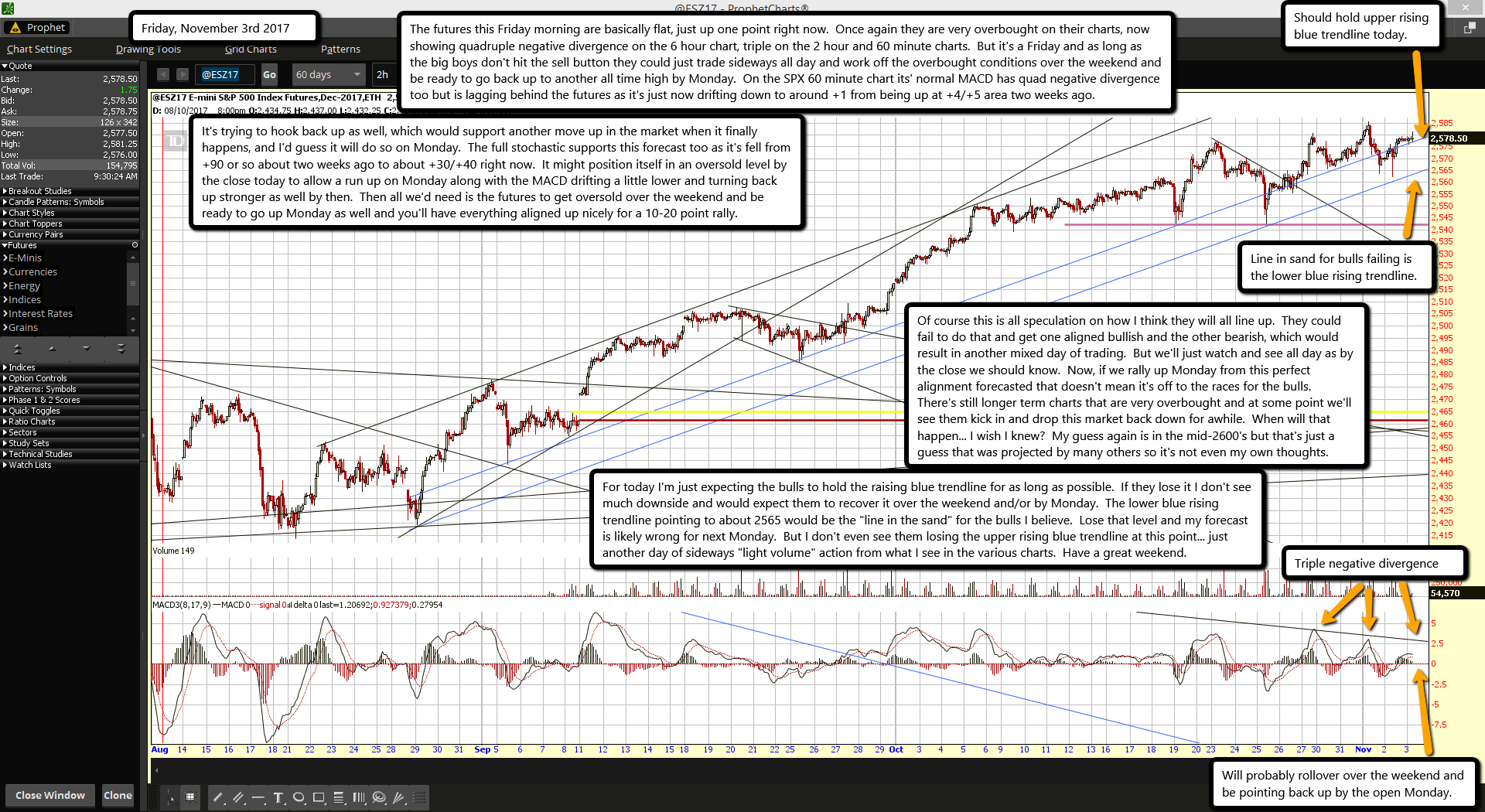

The futures this Friday morning are basically flat, just up one point right now. Once again they are very overbought on their charts, now showing quadruple negative divergence on the 6 hour chart, triple on the 2 hour and 60 minute charts. But it's a Friday and as long as the big boys don't hit the sell button they could just trade sideways all day and work off the overbought conditions over the weekend and be ready to go back up to another all time high by Monday. On the SPX 60 minute chart its' normal MACD has quad negative divergence too but is lagging behind the futures as it's just now drifting down to around +1 from being up at +4/+5 area two weeks ago.

It's trying to hook back up as well, which would support another move up in the market when it finally happens, and I'd guess it will do so on Monday. The full stochastic supports this forecast too as it's fell from +90 or so about two weeks ago to about +30/+40 right now. It might position itself in an oversold level by the close today to allow a run up on Monday along with the MACD drifting a little lower and turning back up stronger as well by then. Then all we'd need is the futures to get oversold over the weekend and be ready to go up Monday as well and you'll have everything aligned up nicely for a 10-20 point rally.

Of course this is all speculation on how I think they will all line up. They could fail to do that and get one aligned bullish and the other bearish, which would result in another mixed day of trading. But we'll just watch and see all day as by the close we should know. Now, if we rally up Monday from this perfect alignment forecasted that doesn't mean it's off to the races for the bulls. There's still longer term charts that are very overbought and at some point we'll see them kick in and drop this market back down for awhile. When will that happen... I wish I knew? My guess again is in the mid-2600's but that's just a guess that was projected by many others so it's not even my own thoughts.

For today I'm just expecting the bulls to hold the raising blue trendline for as long as possible. If they lose it I don't see much downside and would expect them to recover it over the weekend and/or by Monday. The lower blue rising trendline pointing to about 2565 would be the "line in the sand" for the bulls I believe. Lose that level and my forecast is likely wrong for next Monday. But I don't even see them losing the upper rising blue trendline at this point... just another day of sideways "light volume" action from what I see in the various charts. Have a great weekend.