I'm going to divide this update in two parts. The first part will cover the Goldman Sachs story and what the media won't cover, or tell you. Of course I can't prove any of it too be true, but I believe it is the closest thing to the "Real Story behind Goldman Sachs". The second part will cover the usual market forecast, and what I'm looking for over the coming weeks.

Part ONE: "What the media won't tell you about Goldman Sachs"

Let's go back a little on the history of Goldman Sachs, so that we can show that they are well connected, and have been behind all the crashes and rallies since at least the 1929 crash. For that, I'm going to let you re-read the article written by Matt Taibbi titled "The Great American Bubble Machine" (read or download pdf file here, from scribd). If you haven't read it, you should. It shows you how long Goldman Sachs and Company have been doing this to the American Public for almost a century now.

(I just uploaded the pdf to my site as well, just in case it disappears from scribd. I did have a hard time finding it again, as many sites took it down. Wonder why? Click Here to read it from my site. Be sure to save a copy... just 'right click' and then save).

You will no doubt-ably hear all kinds of stories about Goldman Sachs in the coming days and weeks, but what is really going on is just another way to steal the American Public's money... right in front of their eyes. Let's go over how this actually works first, and then how the scam is working currently.

The Theory Behind Supply And Demand...

The stock market supposedly works by supply and demand... right? If the demand for a certain stock, (in this example we will use Goldman Sachs as the stock in demand), is higher then the actual supply of the stock, then the price should rise as each stock certificate is viewed more valuable because so many people want to own it.

If the demand is lower then the supply, then the price should drop to a level that more people (the demand) are willing to buy it (the supply) at that price. But here is the problem with that situation... people wouldn't be able to buy and sell stocks almost instantly if they had to wait for the price to drop or the supply to become available, as some people hold stocks for years.

So, in order for the market to trade quickly, a middle man needs to be created (aka "the market maker") who steps up and provides instant buying and selling of the stock (liquidity), both when there is "too high of a demand, and no real stock available", and when "no demand is there, so they do some buying to create some demand".

Since there are so many stocks in various exchanges around the world, it makes sense to have people who specialist in trading certain stocks (providing liquidity)... who are known as "Specialist's".

How appropriate? makes good sense, right?

For example, if there is a total of 100 million shares (example only) of Goldman Sachs stock certificates issued, and only 90 million of those shares are actually in the public or institutions hands, then the remaining 10 million shares are sitting somewhere waiting to be put in circulation.

So, that means that those shares are up for sale, but maybe no one is interested in buying them at the current price. The "Specialist" has the job of trying to sell those stocks. But, if the public doesn't want them, then what can he do? He must wait for the price to fall to a level that the demand for the remain shares would be great enough for the people to want to purchase them, or purchase them himself, to create some demand. Seems simple enough... right?

Ok, now here is the tricky part... what happens when the demand for the stock overcomes the actually amount of shares available? What if this time there is a huge demand for the same stock, but still only 10 millions available, (and the other 90 million shares isn't for sale by the people or institutions that originally purchased them).

How do you sell what you don't have? That's exactly what happened during the last few months, as the market as floated up like it was on a sea of clouds. Goldman Sachs' stock also became in high demand, along with many stocks in the market too. Using this same example, what if the demand for their stock during this recent run up was 30 million shares, but again... only 10 million was available?

Here is where the "Planned" fraud and manipulation comes in...

You Borrow Shares That Don't Exist! And NO, that "in of itself" isn't illegal technically, as that is simply how you keep the liquidity in the market. The shares are suppose too exist, but you don't necessarily have to have them in your possession when you sell them. But, selling stock that there isn't any real paper certificate to back it up with, is basically "phantom shares"... which is illegal.

But, if you are Goldman Sachs, that's no problem, as you have already bribed the "Specialist" and the Securities and Exchange Commission (SEC), so you can pretty much get away with anything.

OK, so you simply sell phantom, or "virtual" shares of your stock, with the promise to put it back in the virtual vault at some future date. So how are you going to get the public to sell you back the stock you sold them at the peak of the stock market?

Simple... you create a scare in the market, the stock price drops, and you buy back the stock needed to replace what you sold at an over-inflated price, to the unsuspecting public.

Once the price collapses, many of the people in the "90 million" share group will be willing to sell their stock now, as they don't want to lose anymore money on the falling price. The supply of Goldman's stock is going to be abundant over the coming days and weeks as the price falls, (along with the demand shrinking).

Goldman will go in and buy back their stock once the market bottoms, keep the difference between what they sold it for, and the cost to buy it back, and give back the stock they borrowed from the virtual vault. That's basically the plan, and that's probably what's going to happen.

That one day fall wiped out $12.5 Billion Dollars worth of gains over the last 2 months. That's $12.5 Billion Dollars that they will basically make as a profit, minus any pointless fines the government will slap on them. How do they make a profit on their own stock when it falls over 13% in one day you ask? Simple... they don't own their own stock anymore... they sold it to the public, collected the money, and will re-buy it back at a lower price within the next few weeks, after the market finds a bottom (pre-determined by them too of course).

Lobbyists = Legalized Bribery

Goldman was of course most likely told ahead of time that the SEC was going to file charges, and Goldman probably told the SEC (current enforcement chief Robert Khuzami) to wait until they squeezed the last drop of cash from the retail investor, which produced the "Top" on the stock market. The SEC are bought and paid for by the 5-6 largest banks anyway, so of course they are going to do what they are told to do, or risk losing all those "donation's to their favorite charities"... the one's in their wife's' name, that they are the president of.

Yes my dear reader, the SEC will go after Martha Stewart for chump change, but turn a blind eye to the Goldman Gang. I suspect that the SEC has enough evidence to bury Goldman Sachs, JP Morgan, CitiGroup, Merrill Lynch, and Bank of America in grave that's deeper then the grand canyon. But don't count on any of it being released, as you don't rat on the person feeding you!

So why release the evidence now?

Timing, timing, timing... The Obama Administration just got through a crappy health care bill that most American's are still pissed off about. Now don't get me wrong, I'd love to see every American get health coverage. I just think that bill sucks! It forces you too pay a middle man (aka the Insurance company) to get health insurance. Other countries of the world, that have universal health care plans, pay a tax directly to the government, which reduces the cost tremendously because the middle man is gone. Their plan works, Obamacare won't!

Moving on...

Obama spoke several months ago about regulating the banks more. He had a bill that he wanted passed, but after he strong armed many of the senators and congressmen during the passing of the health bill, many of them don't support his bill to regulate the banks more.

So, how to you get that support back? Simple really... instead of attacking the banks publicly, you just expose some of their dirt to the public (which is one thing the government doesn't need to manufacture... LOL). That will of course make the public hate the banks, and then force the senators and congressmen to support your bill, as the public will demand the banks to be punished. What political official would go against what the public wants? Only one that doesn't want re-elected I assume?

Now, congress will be forced to back Obama's bill, even if they don't want too. Great move by Obama this time... I have too give him credit for that one. Of course I'd love to see the banks regulated more, but I suspect that the bill is full of loop holes, and it's designed to get the democrats elected in this years' coming fall elections, more so then regulated the banks more.

Regardless of whether the bill is worth a hoot or not, the timing is picture perfect. Of course you need to call your friends over at Goldman ahead of time, and tell them that you are going to call the SEC and have them bring charges on them, so they can finish up dumping all the shares they can to the naive public at the highest price possible. Plus, you need to get yourself positioned short, so you can make money on the fall of your own stock.

Poor Pete Rose... he got in trouble for gambling by betting against his own baseball team (supposedly... I personally don't believe Pete EVER intentionally tried to lose a game because of a bet he made. I like him, and don't agree with those who say what he did was wrong, and that he shouldn't be allowed in the Hall of Fame. Bullshit! He was a great player!)

Goldman on the other hand, can routinely short their own stock, and it's OK if they do it. Yeah right... one law for the common folk, and another law for the elite.

What Is The Current News Story On Goldman Sachs Really About?

So, now that you know the story behind Goldman and what there are really planning to do, you probably want to understand what the recent news story released is all about. It's not really all that complicated. They simply packaged together a bunch of debt, called CDO's (Collateralized Debt Obligation), and sold them... knowing full and well that they would go down in value, as the housing market collapsed. On top of selling "A Lemon", they also shorted the CDO's so they could profit from them as they fell in value.

It's no different then what they did in 2007, at the peak of the housing bubble. If you read the article by Matt Taibbi, he explains how they bankrupt Lehman Brothers short selling their stock (more phantom stock), and how they sold packages of mortgage backed securities to other large organizations and entities, knowing that the bubble was getting read to bust, and that those packages would fall in value greatly. They even took it one step further and took out insurance policies with AIG, to pay them money if people defaulted on those mortgages.

Also, they collected huge sums of money upfront when they sold those mortgages to the home owner (because many had bad credit), and then made the home owner pay the insurance premium on their own house in case of default, but the home owner wasn't the beneficiary... Goldman was! What a scam! These people don't make money honestly, with values and integrity. They make it by scamming the innocent public. A public hanging of these crooks wouldn't be justice enough to satisfy the evil deeds they've done.

So, To Sum It Up...

I believe that the Obama Gangster Gang (Obama, Geithner, Bernanke, etc..), and the boys at Goldman Sachs, got together and planned out every detail in to how and when they were going to release this news.

- They needed to wait until they had exhausted the market, and sucked in every last retail investor, producing a ridiculous 11,000 plus high on DOW.

- They needed to let enough time go by before causing the coming correction, so it wouldn't be blamed on Obamacare.

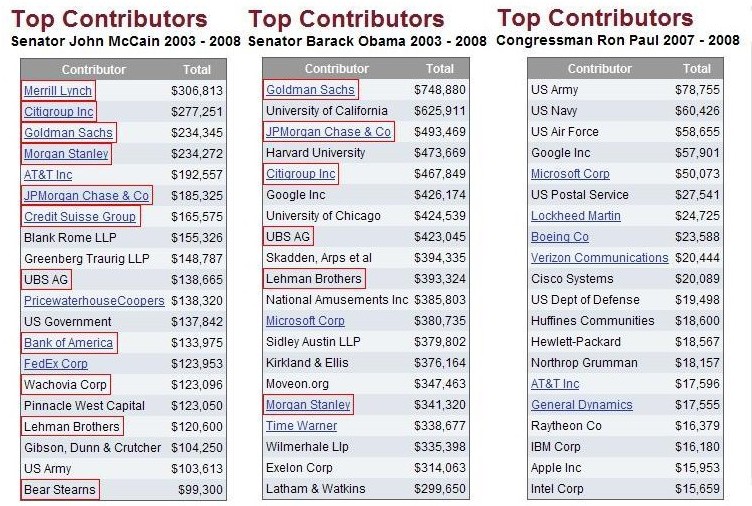

- And of course they needed to make sure the banks would profit from it too. After all, the banks paid for Obama's election... you don't really think he's out to get them do you?

Just A Side Note...

Now, as for the volcano erupting in Iceland, I hope that is was just coincidental, and not the government's HARPP machine turned on, causing the eruption... which will cause many stocks to fall as airlines can't fly, and products and services can't get delivered, etc... That will of course cost Billions of dollars in lost revenue for many industries, which is going to cause a sell off in the stock market.

I know that just about all the financial events are planned out and created by the government, so they can steal money from the public. But, I don't think they cause all the natural disasters, but I know some of them aren't "natural". I know they do have the ability to create hurricanes, earthquakes, and even cause volcano's to erupt. However, I'm going caulk this one up as just a coincidence. After all, the volcano could have just erupted when the market peaked, right? Everything in life isn't a planned event, is it?

...

And finally, Part TWO:

As for the market next week, I do think that the whole week will close down. I think Monday could have a small bounce up, or just a flat open, but end the day down. In fact, I'm leaning more toward a gap down open, but either way, I see the close negative.

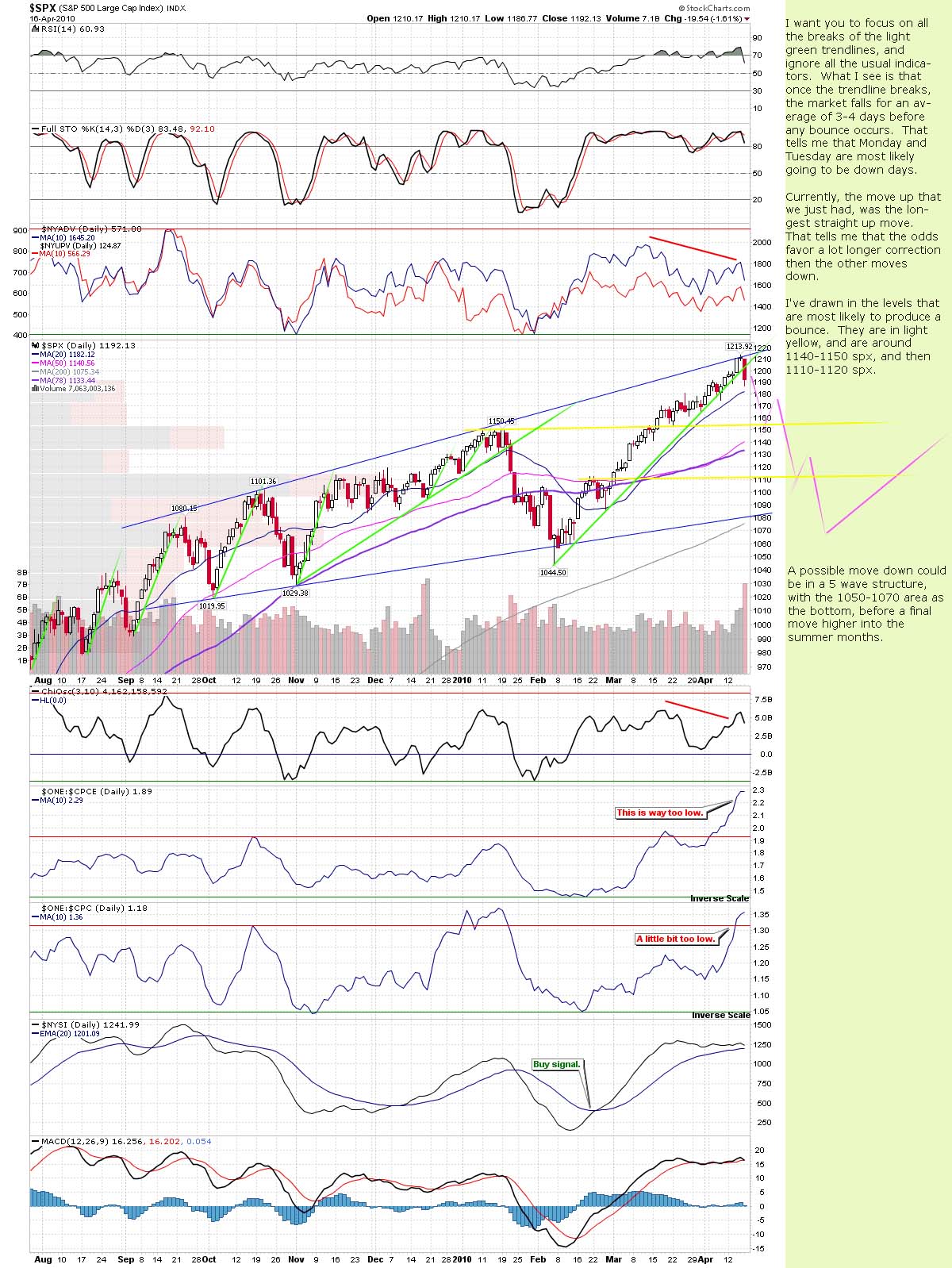

Looking back at past history, I see that almost every time the market finally broke rising trendline/channel, it fell for a least 3 days straight before producing any bounce. While a backtest is common when the market is trading with light volume, heavy volume rarely gives the bears a chances to get short with a backtest of the broken trendline.

Here on this chart I've drawn all the trendlines for the past sell offs in light green. Notice how the market fell multiple days in a row, without any backtest of the trendline. Once the line is broken, the bears don't get a chance to get short until the largest part of the down move is over with. That's why I suspect we will fall on Monday and Tuesday, at the bare minimum. We could fall more then 3 days in a row?

(Chart from Cobra's blog, with my notes on it)

I think our first area of support is around the 50 dma, coming in around 1140 spx currently. I do think the bounce will be short lived, and a continued fall down to the 200 dma around 1070 spx is likely the finally bottoming area before the market starts back up in "rally mode" again.

The move is likely to last 3-4 weeks, and then be over. After that, I think the market's will go back to light volume during the summer months, as it slowly grinds higher... waiting for the next staged event to be released, causing yet another sell off. What will it be then? Who knows? But you can bet your last dollar that the market will be at another peak, with record numbers of people bullish. The bear will be non-existent by then.

And of course... Goldman will profit from it too! After all, they've only been manipulating the market since "at least 1929", so what makes you think it's going to stop now? Even if you shut them down, the rats would just leave that burning building and find a new home in another one.

The more things change, the more they stay the same...

Red

P.S. These are of course just my thought's about Goldman and the market, and I could be wrong about any of it? I just try to piece it together with what little facts I find, and re-tell it in a story that makes sense. Your thoughts and opinions are welcome too be heard. After all, we still have "Freedom of Speech" here in America... don't we?

The fact that the SEC waited until the very day after OPEX to do this does suggest that they were colaborating on this but surely the very real harm being done to the “good” standing of Goldman makes it difficult to think that they would self harm in such a way, surely?

What do you mean by “self harm”? Goldman will get a small fine of a few million dollars, and that's about it. They just pocketed the difference between what they sold their stock for, and what they can now buy it back for.

That one day wiped out $12.5 Billion Dollars of gains, that took them about 2 months to make. They sold their stock to the un-suspecting public, at the highs, during the last 2 months.

They get to keep the $12.5 Billion as profit, because now they can go buy that same stock back for a much cheaper price, from the same people they sold it to.

I'd say a small $10-$100 million dollar fine (don't know yet what the fine will be?), in exchange for $12.5 Billion Dollar gain, is a great deal… at least for Goldman.

I posted a Boatload of charts. Indicators, not specific trade ideas….go with the flow. My favorite is the Fear Factor, screen cast herein

http://screencast.com/t/NzUxNmFhZ

http://oahutrading.blogspot.com/2010/04/boatloa…

Vix/VXV is very cool chart.

The Pound is getting pounded

Total market has a beautiful reversal set of candles

Stop by and comment please

NQ is weak while ES is bouncing a little. Volume on futures is very large compared to the average Sunday afternoon.

Thanks for stopping by Steveo…

Looks like the correction is finally here upon us. Hope you make a bundle in it.

I watched that video from 1981… very interesting.

yes but what fund manager would now want to own up to investors that they are doing any business with GS?

Carl’s morning call:

June S&P E-mini Futures: Today's range estimate is 1180 – 1193. I expect the drop that started from 1210 to end near 1163 sometime this week. Once the correction is complete a move to 1270 should start.

1182.75 – 1206 actual last Friday (23.25 points)

1181.50 low last night (1 point below the low last Friday)

1180-1193 estimate for today (13 points)

1184.50 currently, so estimate is -4.5 to +8.5 from here (bullish)

Thanks for always posting this Earl. I will see where the $NYMO is when we get to ES 1163. Could be that we make the move up to 11,816 from there (as he mentions) and then fall to 107.82 or so.

Well, we got our gap down… only to be filled as the computer bots go to town gobbling up the bears again. Same old shit!

the gap down was a double play for the bears

1. Gapped below weekly purple containment

2. Gapped below initiation debasement gap @ SPY 119.18 from 9.29.2008

Dancing continues with Max contain on the 60

$SPX 1192 is the number for the next couple of hours

Simple setup on the $DJI daily containment, should brown fail red is next (-2.3% away)

http://www.flickr.com/photos/47091634@N04/45349…

Maybe I need to go out there on the dance floor and whack the market in the ankle with a baseball bat… Let's see how well he dances then! LOL

Looks like the pressure is building at that level.

4 ravens just swooped down in front of my window and I have never seen them here. I hope that wasn't a sign for me!

LOL… they are coming for the bull carcass.

Or my carcass!

hopefully it was a sign of ill omen for the market! Man these suckers are big!

SPY still won't take a temporary divorce from the TL that it's been riding since March 09'

http://www.flickr.com/photos/47091634@N04/45344…

When it falls away from the TL, it falls hard

2.20.2009 (initiation gap)

7.2.2009 (initiation gap)

1.22.2010 (initiation gap)

Time element:

2.20.2009 – closing low came 12 TD's after break of TL

7.2.2009 – closing low came 6 TD's after break of TL

1.22.2010 – closing low came 12 TD's after break of TL

SPY closed above it's favorite TL

Let me guess… bad news for the bears! I hate that trendline.

But the QQQQs did not. Glass half full!

Expecting a rally that will fail, over the coming days. A rally that will spook the dispirited bears and reinforce the perma bulls.

Not so sure – we just broke support at 1186 ES.

Don't know. But it is usually the case when trend changes. A drop. Then a reversal that fails. More decline follows. But nothing is set in stone. 🙂 We have a hard fall here b/c of the near parabolic rise experienced. Either way, I am not complaining. 🙂

You were right SC.

You know gang… it's a little slow here today? I'd think you bears would be chatting away as we are finally starting to turn down. I'm puzzled about that? Did all the bullishness numb your tongue?

This is what we bears have been looking for you know! Open up your windows and yell out at the top of your voice… “Finally, the market is going to sell off!” Be excited gang…

(just kidding of course, you don't want to go to jail for being bearish)

Nobody wants to jinx anything Red.

Oh… Ok, I knew there must have been some reason to be so quiet.

Speaking only for myself, I'm riding the move back up. I'm with Daneric in thinking that some indexes will set new highs ($DJIA) before we head back down and correct for real. I think (hope) it is January all over again.

That's very possible dreadwin. I've been wrong too many times, and got my hopes up for a correction… that may never come?

Your chances will be much better when the dollar cooperates:

http://www.screencast.com/users/dreadwin/folder…

DTO (double short oil) seems to have a very reliable pattern (see caveat) with black candles. If this holds, markets/oil will bounce higher tomorrow, then correct a bit more, then rocket higher.

http://www.screencast.com/users/dreadwin/folder…

Nice charts dreadwin… thanks.

I do (unfortunately) think we will go higher tomorrow. Nothing is ever as easy as you want it too be.

But, I do still see the week as down.

Plain and simple GS and other bankstas are nothing but LOW CLASS GANGSTAS!!!

http://hotoptionbabe.com/2010/04/18/earnings-ea…

good read red

Carl now says:

My guess is that the ES will drop to 1175 or so, possibly later today or early tomorrow.

1182 currently, so -7 from here.

Thanks for the post Red. There was a follow up piece to the Rolling Stone article written in the WSJ about a month after original publication. Wish I saved it.

Even though they punched holes the size of the Icelandic volcano in the article it was still a take down of GS.

It is sad when there is no place to get fact based journalism anymore. Every rag has an agenda. The NYT used to be manna for the gods now it is fish wrap.

Again,

Thanks

From the looks of the charts, it could be Wednesday before we have another big down day. The 60 minute chart should peak by then, and roll over to the downside.

If tomorrow is another sideways to slightly up day, then that would also be the forming of a bear flag.

Wednesday will also have the Initial Claims, Continuing Claims, PPI, Core PPI, Existing Home Sales, and FHFA Home Price Index.

That's a lot of news which should push the market down… assuming they haven't changed their minds on taking it down.

As for earnings, we have Amazon, Microsoft, American Express, and Capital One on Wednesday.

I'd say that Wednesday will certainly be an important day for the market.

True. Serge is predicting an IBM miss. If that happens it will be huge. HPQ, CSCO and DELL will crumble like a sand castle!

I'd love to another doji tomorrow and 3 straight down days after that. This bullishness is so overdone. We need a correction badly. We'll see what happens after the bell I guess…

U got that right. They couldn't turn the QQQQ's green. I usually can not watch it but I did today. It was flirting with Mr. Green but no-go.

Lets see about HAL+1!!!! 🙂

be careful of the rogue gap up

SPY currently has 3 consecutive gap downs

What do you mean? Be careful shorting, or be careful going long? I'm certainly not going long for quite awhile, as I see this pops higher as shorting opportunities, not a new breakout to the upside.

Nevermind… I had to re-read the comment. You mean that we should expect some gap up day to come soon, before the selling continues.

Just another fake out, to squeeze out the bears again, and lure in more dip buying bulls. That day should be tomorrow, if I'm reading the charts correctly. Then some selling the rest of the week.

for those that are highly levered short, be careful as there is currently 3 consecutive gap downs, putting things in the top 93 percentile for a flat or gap up

Should the SPY gap up, a gap above 120.30 means we go to test 121.03

Why is that it 6,7, or 8 days up to get into the 93% range, but only 3 days down to be there? Seems a little unfair to the bears. Not that anything in this market is fair, but it just seems bull bias.

Yep there is always a bullish bias, it takes 7 consecutive SPY gap ups to get into the same percentile

There has to be for the scam to keep going

Remember Asset appreciation pays the interest expense

Carl at day’s end:

1180-1193 estimate for today (13 points)

1179.75–1194.50 actual today (14.75 points)

Nailed the high & the low.

Trades: No Trades today.

Grade: C (lost no money)

After $SPX closed @ 1192 on friday

$DJI closes today @ 11,092

TZA opened up 1.8%. Today’s gap was filled. TZA was up 5.7% at the high, and closed up 1.5%.

We are now in a New Moon Trade, which tends to favor TZA

AmericanBulls had TZA with a BUY-IF signal for today. Under AmericanBull’s BUY-IF rules, TZA would have been a buy at the open had TZA closed above the open, but TZA closed below the open, so at the close we know not to buy at the open. Yeah, time travel is important to getting this right. I will confirm this later with AmericanBulls, but it seems this trade remains in cash.

Volume for TZA today was the 2nd highest in the last 49 days (previous day was higher). Good for TZA.

$RVX (VIX for $RUT) was up 11% at one point today and closed up 2.4% today with TZA up 1.5%. No divergence.

TZA had black candles for 6 days, falling hard lately, but up nicely yesterday and up again today. Good for TZA.

The low for TZA 2 days ago was $5.80, the lowest TZA price ever. Today’s low was 19 cents higher. Good for TZA.

Ultimate Oscillator for TZA fell for 9 days, then rose yesterday from 23 to 27, and today from 27 to 29. The low reading of 23 was very near 20, which some will allow is a reasonable low point. Good for TZA.

MACD on the monthly chart has been flat far below zero for days, and remains that way today. Bad for TZA.

Bollinger Bands for $RVX (VIX for $RUT): Today’s long black candle (close below the open, but close was above yesterday’s close) closed above the Bollinger mid line (was at the bottom Bollinger band 3 days ago). MACD seems to be heading back up. Looks like $RVX might rise tomorrow. Good for TZA.

Bollinger Bands for $RUT: Today’s spinning top black candle for $RUT appears to be a continuation of the fall of $RUT. MACD might be topping. Good for TZA.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s black candle closed below the Bollinger mid line after closing above that Band three days ago. The upper Bollinger Band was flat today. This looks like the 4th day of a successful 3-day sell signal. Good for TZA.

TZA had a higher high, higher low and higher close – Good for TZA.

Money flow for the Total Stock Market was $5,934 million flowing out of the market yesterday, and $1,037 million flowing out of the market today. Bearish – Good for TZA.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, it looks good for TZA.

Hey Red I bet you'll like this.

http://dailyoptionsreport.com/blog/post/in-anot…

Thanks…

He said exactly what I thought was happening… just a political move by the democrats to get support for the bill to regulate banks more.

It quite obvious now, that if Obama really wanted to punish Goldman, he would have done so last year when Matt Taibbi published the story.

Instead, he just waits and releases the SEC hounds on Goldman when the timing works better for re-election for the democrats.

Sad really… many people hoped Obama would do something different, and make some real changes, by standing up to the crooks. But no, he's just another puppet, doing what his master's tell him to do.

The Daily view from Americanbulls

TNA had a SELL-IF signal today, and that signal continues tomorrow. The TNA buy was at $56.50. TNA closed at $62.67, up 10.9% since the buy. The candlestick today was a High Wave (great amount of indecision in the market).

TZA had a highly reliable BUY-IF signal today, and that signal continues tomorrow. The TZA sell price was $6.51. TZA closed today at $6.15, down 5.5% since the sell. The candlestick for today was a High Wave (great amount of indecision in the market).

Three recent TZA Buy signals have failed and may perhaps serve as a warning:

Buy at $7.33, sell at $7.14

Buy at $7.11, sell at $7.05

Buy at $7.04, sell at $6.51

For that matter, recent TNA Buy signals (until this last one) have also been uninspiring:

Buy at $55.36, sell at $55.43

Buy at $55.69, sell at $55.63

Buy at $56.50, up 10.9%

Summary of Positive $RUT based ETFs & a few popular ETFs & stocks (Market positive): -1

Hold: IYR(1x RE, down 1.12%), URE(2x RE, down 2.6%), DRN(3x RE, up 0.75%), QQQQ(up 2.36%), DIA(up 1.6%), UCO (2x oil, down 4.2%), AMZN(down 1.4%)

Transition to Market Positive: -1

Not very highly reliable BUY-IF: GOOG

Transition to Market Negative: -2

Highly reliable SELL-IF: IWM(1x), UWM(2x), SPY, ERX(3x energy)

Not very highly reliable SELL-IF: TNA(3x),

Low reliability SELL-IF: AAPL,

Market Negative: -2

Wait: USO(oil), GS

Comment: Mildly Bearish overall, Bearish Oil, Bearish $RUT, Mildly Bearish Real Estate

Action for TNA or TZA for tomorrow: Possibly Buy TZA, Possibly Sell TNA.

Earl, Thanks, Nice Post

Hey G…

Anna's on fire now with her trades in OBB. Have you been able to take any of the plays or have you been too busy to take advantage of them?

GS and AAPL to report tomorrow

whisper is not good for GS however.

http://www.earningswhispers.com/stocks.asp?symb…

GS and AAPL to report tomorrow

whisper is not good for GS however.

http://www.earningswhispers.com/stocks.asp?symb…

The Daily view from Americanbulls

TNA had a SELL-IF signal today, and that signal continues tomorrow. The TNA buy was at $56.50. TNA closed at $62.67, up 10.9% since the buy. The candlestick today was a High Wave (great amount of indecision in the market).

TZA had a highly reliable BUY-IF signal today, and that signal continues tomorrow. The TZA sell price was $6.51. TZA closed today at $6.15, down 5.5% since the sell. The candlestick for today was a High Wave (great amount of indecision in the market).

Three recent TZA Buy signals have failed and may perhaps serve as a warning:

Buy at $7.33, sell at $7.14

Buy at $7.11, sell at $7.05

Buy at $7.04, sell at $6.51

For that matter, recent TNA Buy signals (until this last one) have also been uninspiring:

Buy at $55.36, sell at $55.43

Buy at $55.69, sell at $55.63

Buy at $56.50, up 10.9%

Summary of Positive $RUT based ETFs & a few popular ETFs & stocks (Market positive): -1

Hold: IYR(1x RE, down 1.12%), URE(2x RE, down 2.6%), DRN(3x RE, up 0.75%), QQQQ(up 2.36%), DIA(up 1.6%), UCO (2x oil, down 4.2%), AMZN(down 1.4%)

Transition to Market Positive: -1

Not very highly reliable BUY-IF: GOOG

Transition to Market Negative: -2

Highly reliable SELL-IF: IWM(1x), UWM(2x), SPY, ERX(3x energy)

Not very highly reliable SELL-IF: TNA(3x),

Low reliability SELL-IF: AAPL,

Market Negative: -2

Wait: USO(oil), GS

Comment: Mildly Bearish overall, Bearish Oil, Bearish $RUT, Mildly Bearish Real Estate

Action for TNA or TZA for tomorrow: Possibly Buy TZA, Possibly Sell TNA.

Earl, Thanks, Nice Post

Hey G…

Anna's on fire now with her trades in OBB. Have you been able to take any of the plays or have you been too busy to take advantage of them?

Hey Red I bet you'll like this.

http://dailyoptionsreport.com/blog/post/in-anot…

Thanks…

He said exactly what I thought was happening… just a political move by the democrats to get support for the bill to regulate banks more.

It quite obvious now, that if Obama really wanted to punish Goldman, he would have done so last year when Matt Taibbi published the story.

Instead, he just waits and releases the SEC hounds on Goldman when the timing works better for re-election for the democrats.

Sad really… many people hoped Obama would do something different, and make some real changes, by standing up to the crooks. But no, he's just another puppet, doing what his master's tell him to do.

Speaking only for myself, I'm riding the move back up. I'm with Daneric in thinking that some indexes will set new highs ($DJIA) before we head back down and correct for real. I think (hope) it is January all over again.

That's very possible dreadwin. I've been wrong too many times, and got my hopes up for a correction… that may never come?

Your chances will be much better when the dollar cooperates:

http://www.screencast.com/users/dreadwin/folder…

DTO (double short oil) seems to have a very reliable pattern (see caveat) with black candles. If this holds, markets/oil will bounce higher tomorrow, then correct a bit more, then rocket higher.

http://www.screencast.com/users/dreadwin/folder…

Nice charts dreadwin… thanks.

I do (unfortunately) think we will go higher tomorrow. Nothing is ever as easy as you want it too be.

But, I do still see the week as down.