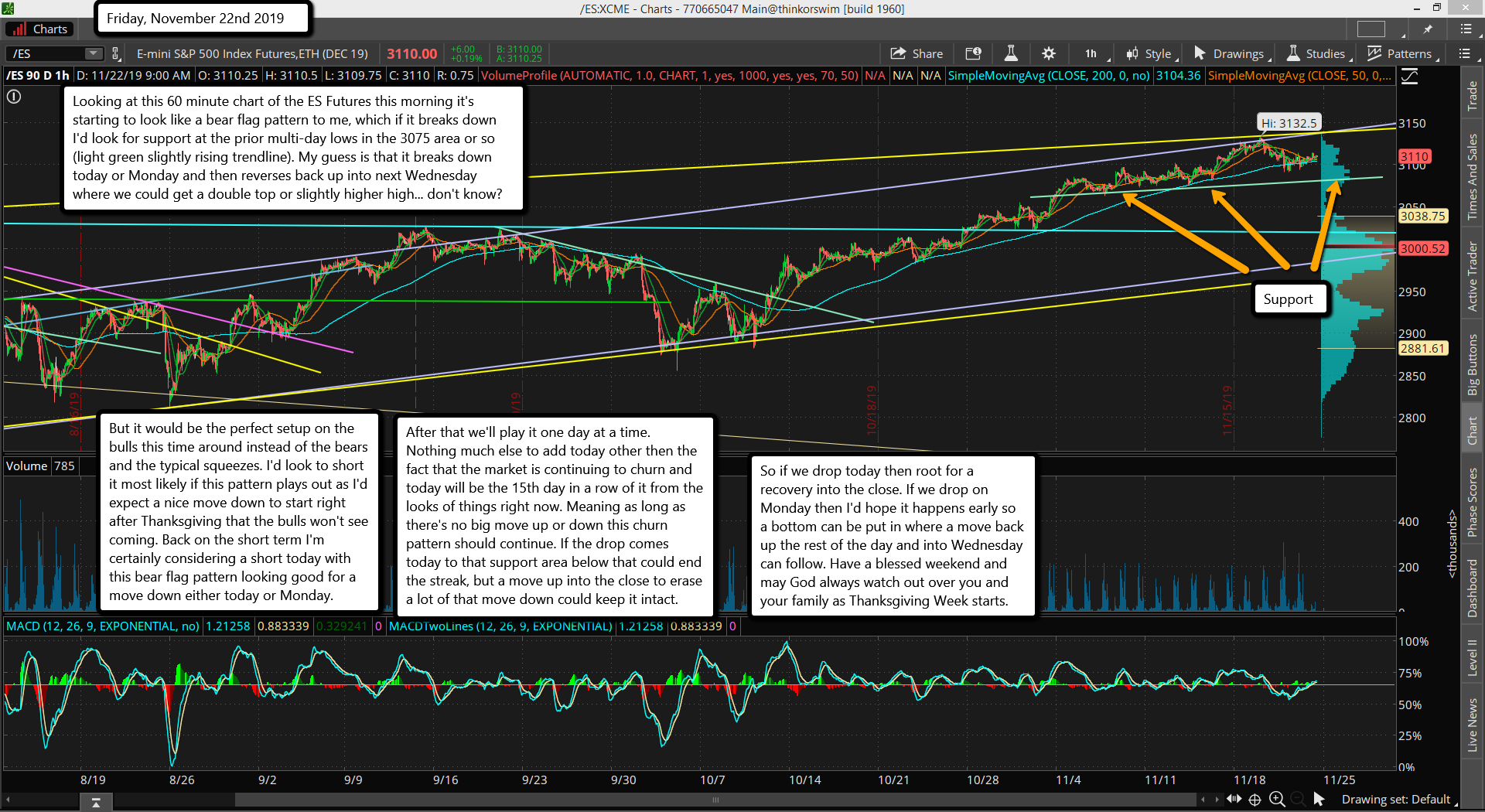

Looking at this 60 minute chart of the ES Futures this morning it's starting to look like a bear flag pattern to me, which if it breaks down I'd look for support at the prior multi-day lows in the 3075 area or so (light green slightly rising trendline). My guess is that it breaks down today or Monday and then reverses back up into next Wednesday where we could get a double top or slightly higher high... don't know?

But it would be the perfect setup on the bulls this time around instead of the bears and the typical squeezes. I'd look to short it most likely if this pattern plays out as I'd expect a nice move down to start right after Thanksgiving that the bulls won't see coming. Back on the short term I'm certainly considering a short today with this bear flag pattern looking good for a move down either today or Monday.

After that we'll play it one day at a time. Nothing much else to add today other then the fact that the market is continuing to churn and today will be the 15th day in a row of it from the looks of things right now. Meaning as long as there's no big move up or down this churn pattern should continue. If the drop comes today to that support area below that could end the streak, but a move up into the close to erase a lot of that move down could keep it intact.

So if we drop today then root for a recovery into the close. If we drop on Monday then I'd hope it happens early so a bottom can be put in where a move back up the rest of the day and into Wednesday can follow. Have a blessed weekend and may God always watch out over you and your family as Thanksgiving Week starts.