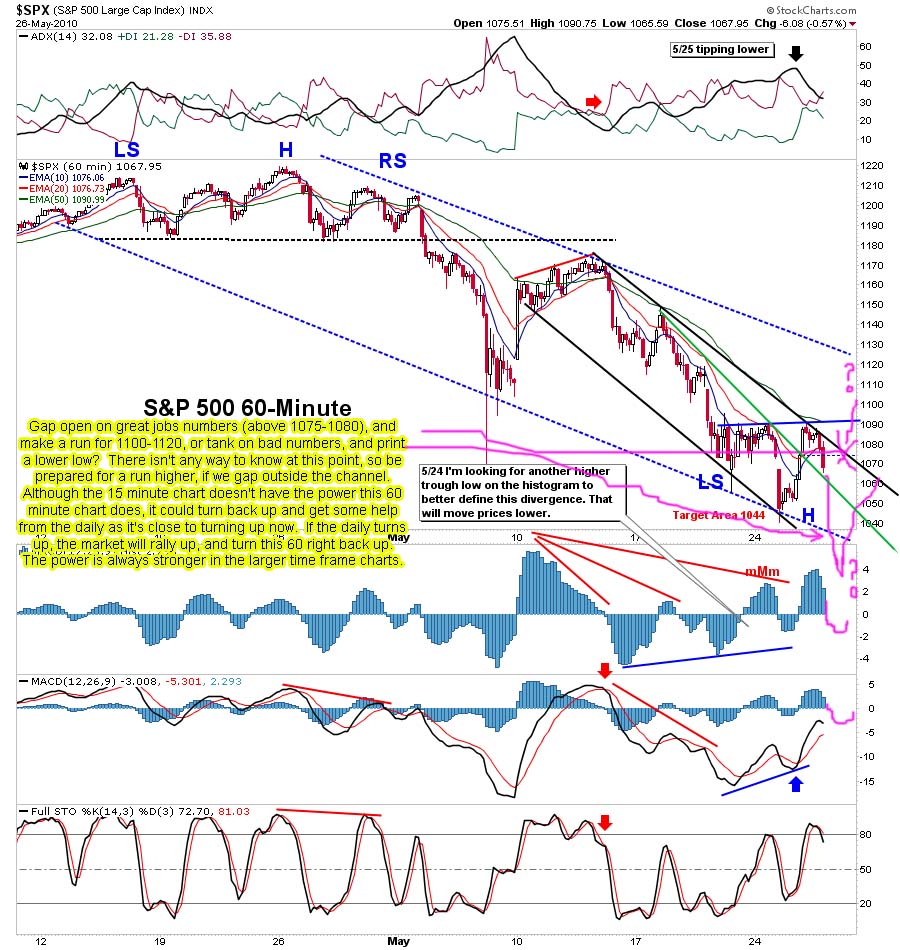

That's the 2 choices I see for tomorrow...

Today played out as expected, from Tuesday's post. The market ran up to 1090 spx, and hit a brick wall. It gaped up to get out the falling channel on the 15 minute, but couldn't get out the falling channel on the 60 minute chart. In order for the bulls to get out of that channel, I believe they must gap up above 1080 or so.

The bears will want to hold them in the channel of course. If they are able to, it will likely put in a new low on the spx, and hopefully put in a double bottom, or lower low on the qqqq's too. Based on the charts, the 60 is looking like it wants to push the market down in the morning, and the 15 is already oversold, and will likely turn back up when the 60 minute does.

The news out tomorrow on the job data could gap it up out of the channel, or cause it to sell off early on. Of course I'm short, and I'm wanting it to tank, but the market doesn't always do what I want it too do. The morning session will tell us the direction, and the 8:30 am jobs numbers will be the blame either way the market goes.

Red

P.S. This is a link to someone who seems to be well connected on the world events. Some people think he is crazy, and I'm certainly not going to agree with everything he claims... but the part about the Federal Reserve gangsters blowing up the oil rig certain got my attention. (By the way, the good guys in all these posts are the "Black Dragon Society", and the bad guys are the "Federal Reserve Board Nazi's").

So yes, some of those posts might be garbage, but if there is one thing I believe too be true, it's that certain forces inside our government are real, and are truly evil. They are part of the "New World Order", which includes about all the recent presidents of the past many decades.

However, I believe their rein of power will end soon. There are good guys fighting to protect us all too. I believe Ron Paul is one of those good guys, as he's still fighting to get the Fed's book's audited. The collapse of the Fed is coming, and those gangsters will slowly be arrested one by one. We are all part of something wonderful that's happening right now. Change is coming... and for the betterment of all the people of the world. I believe 2012 will bring on a positive change for all of humanity, and an end to the enslavement the Illuminati have keep us in for the last few centuries.

Ok, there's my "darkside" post. Now call me crazy, if you want too. It doesn't matter to me. I'm simply put out the news... it's up too you to believe it, or not?

Fail to plan, plan to fail (SPY) – here goes:

– if we gap down, bad sign look for short entry

– back testing 60min trendline, go long if we reverse off of line

– if we break 109.50, add longs

volume is my co-pilot and the last 60min candle down had volume

for you RDL, just caught a doozie of a ghost print at 2:49 am central on the futures, measures down to 1061.1

http://www.screencast.com/users/alphahorn/folde…

S&P 500 futures: 1,086 +25.10 +2.37%

plan addendum A: if weird **** happens, abort plan – wait for fog to clear

another ghost print just now measuring to the exact same place as the one 4 1/2 hours ago

http://www.screencast.com/users/alphahorn/folde…

Thanks Alpha…

They might go there sometime today, and rally back into the close? Looks like they don't want to dump the market hard this week. I guess they will wait until next week.

Thanks a lot alpha. Don't forget about the 24.10 print on the VIX though as well yesterday. Which way do we go first? Hard to know.

Maybe the open will be up 300 points with SPY at 1090 and the VIX at 24. I guess that would be a great opportunity to short.

Also, red saw one exactly there 106.11 SPY on the 25th and it looks like a real falsie to me.

I figure the UK rally has one more blast in it to take them to 5200 on the FTSE, which I think will be about 1100 for us.

Keeping my powder dry and hoping for a black doji.

VIX *could* double bottom today which would be choice.

Rip, remember I saw the print on it yesterday at 24.10. I will add to my shorts if it gets there and the spx is around 1090.

Carl’s morning call:

June S&P E-mini Futures: Today's range estimate is 1075-1100. I think the low at 1036.75 ended the drop from 1216. I expect to see a series of 20-30 point swings up and down within the 1060-1100 range over the next few days. Once the market stabilizes a move to 1300 will begin.

1055.50 – 1192 range last night (36.50 points)

1075-1100 estimate for today (25 points)

average actual range last 10 days has been 26.8 points

1088 currently, so estimate is -13 to +12 from here (neutral)

Looks like the market successfully gaped out of that channel on the 60 minute chart this morning. It will need 2 closes above the line to confirm it. That means this first candle that ends at 10:30am, and a second candle at 11:30am.

http://stockcharts.com/def/servlet/Favorites.CS…

It's already confirmed a close outside the 15 minute chart from yesterday. My guess it that it will walk down the top trendline on this falling channel, and close just above it at the EOD.

Then use it as a springboard to bounce up from into Friday, and possibly take out the 1090 resistance on light volume, as all the traders leave for the holiday weekend.

couldn't help myself. I just shorted more. I think that VIX print was just directional. 1090 should provide resistance. SHould – if it doesn't I close my position.

Monica ut oh…. I totally believe we see that 24.1 on VIX soon just be careful you wild woman!

Anna, how can you tell with no volume on it? Just because it's outside the normal perimeters?

it co-insides with my 1140 target

It will and go up to my target of 1140 or so inverse H&S on 15 min

Poor thang you must be hurting 🙁

I'm the markets' favorite whipping post…

I called you this a.m but no answer?

I must have been in the shower… sorry.

NP I am going long 1078 or so and not straight options or the VIX WILL CRUSH YOU!

don't think so anna. The vix could get to 24 but don't think we are getting much higher on the spy.

Yes a pullback to around 1078 or so then on to 1140 on Inverse H&S. is my target that would put the VIX around 24

ok – i'll keep it in mind.

ok just don't want to see my friends hurt 🙂

appreciate it. thank you!

🙂 good luck sincerely

I think we will gap fill today, and launch higher tomorrow, breaking the 1090 resistance level.

You will be really wounded then!!! not good!!!

You got room for a homeless dragon? LOL

oh shoot! that's painful I hope you were hedged!

You know me better then that…

OH no!! just added some spy puts here for day trade. VIX so low they are cheap!!

thanks anna

SPY Plan update:

– 60min looks like rising wedge

– entry point just under 108 or over 109.50

– inverse H&S still in-play

– break 109.50 is confirmation, break 106.75 cover

Not sure if the H&S is valid because forming of right shoulder was on a gap opening. I guess we'll see!

Red, I just got introduced to your site the other day. I must say I do find it very interesting. Anyway, my question is: your video calls for a topping point arond 11,800 on the Dow in late June due to the prints. It just so happens that Econominist/book writer Harry Dent calls for one last push higher into late June and frequently mentions 11,800 as a possible top before the crash. I don't subscribe to his news letters, I just periodically catch him on youtube, etc…I'm just wondering is your call and Harry's call being the same is a concidence or do you draw some influence from him?

I seen Harry Dent's video after I did my video, so NO he didn't influence me. Mine was based solely on the print at first, and then I went and looked at the monthly chart, and it looks like it would be a perfect backtest of the broken trendline.

So, technical analysis do back up the possibly high around that date. Of course it could also be a low, and a high would then happen later this year. Just trying to put the pieces together, but no way to know for sure?

http://en.wikipedia.org/wiki/Harry_Dent#Criticism

I am slow moving into long positions. After yesterdays swing and today news. Do not want to chase. but now s&P breaking 1090.

Looks like Anna called it.

🙂 thanks Jim I wish you to bank mucho denaro!!

Anna's hit ratio is one of the best.

Don't bet against Anna. For every time that you win, you lose 4-5 other times.

Caveat: She changes her positions constantly whenever there is profits to be scalped. So if you are not ready to follow her every step, you are going to get left behind in old positions she has banked the coins and discarded.

Hey SC you are too kind, got to feed 42 mouths a day plus me 🙂

yes I never marry a position as familiarity breeds contempt! heheh

Come visit HOB once in a while 🙂

“…familiarity breeds contempt…” LOL

We are going up….. buy all pullbacks.

They just took out a lot of stops just above 1090. Now it's time to start back down and sweep some more stops. I don't know how far of course, but a logical target is gap fill. Then rally again tomorrow.

I wish they would gap fill today, but that's not likely 🙂

A man can dream at least…

Anna , You must be long spy calls. How far out are you going if i may ask??

no I am long VIX putspreads (about 15) 🙂 and long GS and long GlD SPY suffers the most IV crush when the markets run up

Its been hugging the top of bb and RSI not getting above 70.

Looks like a move down to about 1085 might be setting up. That may be my initial long entrance. i agree the gap fill would be nice but it sure doesn't look like it will happen.

Yeah there won't be a gap fill today that I can promise you, be lucky if we dont' see /ES 1100 today I closed out puts with 07 loss each..looks like a base building here around 1092 – 93 to go higher

sorry bears I tried 🙂

here comes 1098

Today's tape looks really bullish. We're correcting sideways instead of down.

Yes Dread hi how are you sweetie..:)

the most I think down will be 1078-80 area before blasting off again to 1140-50 or so.

Hob is still free in case you didn't know 😉

It may be free but it just banned me! LOL

Something is wrong with your site, Anna.

SC what the heck?? not suppose 🙂

doesn't show up on settings that you were blocked??? someone else told me that I am checking it out

I got unbanned now. lol

Hey Anna, doing well thanks to this latest bullish move. I've been so busy with my own trades that I haven't had much time for blogs! But I'll stop by HOB when I get a breather. Hope your trades are going well!

jaywizz sees sell off into close (on bloglist)

can we get a 20pt sell off in the s&P? I'm wrecked today. Too tired last night to do the homework. went to bed trusting and saw up 25 pts. this am….. Crap

Anything is possible in this market? Wild swings up and down, to whip everyone out of their positions seem too be the name of the game so far. But, I'm not holding my breath on how far she pulls back.

Looks like a bull flag forming now. Could launch up higher again if it plays out? If not, a nice move down will happen.

Red – something wierd with the site … when i come to the screen – it takes me to te great depression blog post and not able to come to the current post .. need to scroll through posts from may 11 to reach here … could you have a calendar that would allow to link to the post by day ….

You probably need to clear your cookies and temporary files. That should fix it.

Man… Obama is the most long winded President in history. When will he ever shut up?

I kept screaming UNCLE knowing we will start to see some selling once he is done

Uncle, uncle, uncle, uncle… now tank you stupid pos market!

Doesn't look good for that scenario but my put spreads on VIX rocking 🙂

I'm glad your making money. I owe you that.

you don't owe me anything I told you I made my own decision, no one forced me…just sorry you aren't 🙁

I think we are close to top for day (ya think AnnaBanana)

And up again tomorrow too… which doesn't make me feel any better.

just looked at my 15min and noticed my open candle… open high and last is right but the low says 107.15

Look at Alphahorn's chart from earlier this morning. Same print in the premarket, only on the spx/es

jaywizz site is bearish for rest of today and into friday. But these guys are arcane. Do they use astrology?? that's spooky devil stuff?

rrman said…

bought tza at 6.92 will hold thru the weekend for the low of this down channel

also short /6e until the close then will go long for a big ramp after hours

1:36 PM

rrman said…

Jay chart 8 is the best to see the low it show tuesday as the low then ramp up into the 7th

we go down into the close then right at close ramp back up until 6pm central or so then big down into midday friday….

hi all – been out all day. Oh what fun tape. Still short.

I feel your pain.

glad we are at least suffering together!

As thought they are tanking the dollar hard!

some times it seems Jawizz group is full of it. Too weird for me to do or follow with any confidence

They just use Astrology and cycle patterns to forecast the market. I use technical analysis, news and fake prints. Just a different way to play the game.

No one ever gets them all right.

S & P 500 Triangle in hourly chart

http://niftychartsandpatterns.blogspot.com/2010…

Thank you

Looks like we are going to close at the highs of the day. Killed a lot of bears today, it seems.

Here's the thing, when you have a plan – stick to the plan

– went long on SPY after 109.50 (~109.80) as planned

– starting thinking about the +2% gap up (this can't last)

– exited the long calls (not planned)

This was one painful bear squeeze Pez…

the size of the gap up messed with my head. thought we would drop back down to set a higher low

When they decide to squeeze… bulls or bears, neither is usually given a chance to get out. The question now is… are there still more bears to squeeze, or do they want to squeeze out the new bulls from today?

Today's up/down volume is the final confirmation. We have a complete confirmation for the reversal. Panic selling + double spike up. And a break above the controlling teal line.

The trend has changed. Any dip is a gift to load up on longs and to close out shorts.

Correct SC….. buy all dips.

Short term in now in the bulls' hands… that I will agree with you on. But, until the 41.55 qqqq low is tagged, I'm not sure the bottom is in?

That low was tagged by some indexes but not others. There is no requirement that every index must tag its last low.

Red – why is 41.55 so important ?

It's the flash crash low on the NDX, and it hasn't put in a double bottom yet.

Did u see my post on the teal line … just saw it …

If we use the 100 WMA that you mentioned for the teal line …. we consolidated under it all day and then broke and closed above it on the last candle of the day ….

Line at 1099.09 …… LOL on the spx and 110.26 on SPY …. are they giving signals again ?

agree, but this gap down one day then gap up the next – is very concerning.

Those are not factors in the models I use. I do not have information regarding their value.

Using a 10 day average on a six month chart, we still appear to be pretty much within the average, about the same as the second week of May.

Are you looking at an hourly chart?

Carl at day’s end:

1075-1100 estimate for today (25 points)

1082.50–1103 actual range today (20.50 points )

Market was 3-7 points above Carl’s range.

For the past 10 days, average actual range is 27.0 points

For the past 6 days, the over night range has averaged 25.9 points.

Trades: No Trades

Grade: C (lost no money)

In the past 10 trading days, Carl has taken just one trade, a loss of 7.25 points.

Bear flag pointing at 970, if that's any consolation.

On what chart? Do you have a link?

Brain fade! I read the day as a bear flag. It would point to about 1050.

An aid to trying to determine trend is the Renko.

http://stockcharts.com/h-sc/ui?s=$SPX&p=30&yr=0…

Explanation is here.

http://stockcharts.com/help/doku.php?id=chart_s…

So can you explain what this means ?

It's information and explanation provided by stockcharts.

http://stockcharts.com/help/doku.php?id=chart_s…

In it's simplest explanation, when 2 squares are shown…. then heads up, a new market direction should be considered. Evaluate your positions.

We got 2 new white squares today.

Got it – though we got it on the downside too in July / Aug …. how many days are in 1 box …

The boxes are based on price, not days. Today we got 2 new squares. If you look at the dates at the bottom of the chart, it can take several days for just one square.. or you can get several squares in 1 day.

From stockcharts…. interpretation:

Hollow bricks are bullish, black bricks are bearish – that's the simplest interpretation of Renko charts. Renko charts may be most useful in identifying trends and trend direction. Because they screen out moves that are less than the Brick size, trends are much easier to spot and follow. In order to avoid whiplash periods, some people wait unto 2 or 3 bricks appear in a new direction before taking a position.

POSTING AGAIN AS IT IS IMP …. Just saw this

If we use the 100 WMA that you mentioned for the teal line …. we consolidated under it all day and then broke and closed above it on the last candle of the day ….

Line at 1099.09 …… LOL on the spx and 110.26 on SPY …. are they giving signals again ?

What the heck. Let me give it a shot.

1099.09 110.26

The msg says ” 10[To] call 911. 2 [too] 6 [sick] ” Call 911, b/c the bear is too sick!!

RDL,

correction,

Jobs report is next Friday +500,000–go long

What do you mean… +500,000, go long? 500,000 jobs number? Some how, I don't think the market would like that number…

CORE PCE Friday, 0%, I wished I had shorted Gold stocks. I shorted BTU and FCX, close enough.

Long MON 50.0, hero to zero, play.

DIA 104, 20 day, that's where I'd really like to go 70% short..Might get there next week.

We are now in a Full Moon Trade, which tends to favor TNA.

TNA opened up 7.9%, and the opening gap was not filled. TNA was up 13.2% at it’s high, and closed up 13.0%.

AmericanBulls had TNA with an unlikely but possible BUY today. TNA was a buy at the open ($47.63) if the price closed above that. Yeah, time travel is required to get it right. TNA is a Hold for tomorrow.

AmericanBulls had TZA as a Wait today. And TZA was down today, so TZA will be a Wait again for tomorrow.

Volume for TNA today was 11% above it’s 1 month average. Good for TNA.

Volume for TZA today was 3% below it’s 1 month average.

$RVX (VIX for $RUT) closed down 12.7% with TNA up 13%. No divergence. Good for TNA.

TNA closed today above the previous 5 daily closes. Good for TNA.

The recent low for TNA was 2 days ago at $38.94. Today’s low was $46.50, 19% higher. Good for TNA.

Today, Ultimate Oscillator for TNA rose from 42.2 to 52.2 (+10) while TNA was up 13%. No divergence. Good for TNA.

MACD fastline is < 0 rising, slowline < 0 falling. Seems to be forming a bottom. Good for TNA.

Bollinger Bands for $RVX (VIX for $RUT): Today, $RVX fell below the Bollinger mid line (20 day MA). The fast MACD line is pointing sharply down, the slow line is falling. 3 days ago was the 3rd day of a 3-day sequence ending in a $RUT buy signal, it finally seems to be happening. Good for TNA.

Bollinger Bands for $RUT: Today, $RUT had a tall white candle headed up and away from the bottom BB. MACD fast & slow lines are rising. Good for TNA.

NYSE Up volume was 36 times the down volume. Good for TNA.

TNA had a higher high & higher low & much higher close (Good for TNA)

Money flow for the Total Stock Market:

$ 2,671 million flowing out of the market yesterday.

$ 3,708 million flowing into the market today.

$ 610 million flowing out of the market today.

Bad for TNA.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, Good for TNA for tomorrow.

The Daily view from Americanbulls

TNA was an (unlikely) possible buy for today, but closed above it’s open price, so TNA was bought at the open, and remains a Hold for tomorrow.

TZA was a Wait today, was down, and remains a wait for tomorrow.

Of the stocks & ETFs I follow, these are to hold on to:

IWM (1x $RUT), UWM (2x $RUT), TNA (3x $RUT)

GLD (gold), UGL (2x Gold)

SLV(silver)

UCO(2x Oil)

ERX(3x energy)

DRI

GOOG

SPY

The list to avoid:

UUP(US Dollar)

USO(oil)

RWM (-1x $RUT), TWM (-2x $RUT), TZA (-3x $RUT)

SRS (-2x RE)

SCO (-2x Oil), DTO (-3x oil)

ERY (-3x energy)

FAZ (-3x Financials)

DZZ (-2x Gold)

The following are possible (but unlikely) buys tomorrow:

SPXU (-3x $SPX)

QID (-2x QQQQ)

DXD (-2x DOW30)

The following are possible (but unlikely) sells tomorrow :

AMZN

GS

QQQQ

The following are quite likely buys tomorrow:

EWG(Germany)

EWQ(France)

EWU(England)

EWX(emerging mkts)

IYR(1x RE), URE(2x RE), DRN(3x RE)

AAPL

DIA

The following are quite likely sells tomorrow:

QLD (2x QQQQ)

DRV (-3x RE)

EPV (-2x Europe)

Summary: Very Bullish

New Sell today on ERY (-3x energy)

New Buys today on IWM (1x $RUT), UWM (2x $RUT), TNA (3x $RUT) , GOOG

Action for TNA or TZA for tomorrow: Avoid TZA, Hold TNA

Red, thanks, I've got your message and this is to try on your DISQUS. Nice discussion here!

Hey Cobra…

Looks like you showed up fine here. Must have been a temporary problem with disqus, and now fixed.

Thanks for stopping by… love your charts by the way. You are an execellent chartist, and I read your posts regularly.

Red

Thanks. I start to get notification about the DISQUS comment now. Looks to me DISQUS is not very stable, having problem very frequently.

Hey Cobra – love your posts – amazing stats – don't know how you keep up every day 🙂

Thanks. 🙂