February 9th, 2014 Update

Why will the huge stock market correction happen real soon?!

…by Ali Firoozi Yasar

I am not being paranoid here and aside from the cycle-work, there are clear reasons that a dramatic decline in the stock market is on the way. Actually, it could strike any day now. The market is just hitting pre-crash tops, we being at the beginning of a new bull market is all over the financial media and companies are still reporting positive earnings but you folks should be aware that the stock market is on the verge of another huge decline.

The annual S&P 500 consensus earnings per- share is expected to come in a lot lower than originally predicted. You see, estimates were so close to $125 in January 2012, and now have dropped 10% to only $112. In spite of the warning sign of declining earnings, the S&P keeps on going up.

The investors and traders are extremely bullish on the stock market now. As a matter of fact, the reading is getting close to a 10-year high, and most of you guys can tell from experience what happens if market sentiment is at extreme levels one way or the other. If the small traders are so bullish, you’d better be cautious. You know better than anybody else that what happens to sheep?! Sheep gets slaughtered.

Actually, I could name many other factors but now we have enough evidence and clear reasons (aside from my work) that the stock market is awaiting a drastic correction which could result in a dramatic stock market decline, 50% unemployment, and 100% annual inflation starting this year.

The charts I showed you in my last post the general trends of the market. In other words, the market may or may not exceed the levels I indicated on the charts. Actually, I only wanted to warn you guys to be prepared for the “unthinkable”.

I hope, you guys will consider this a wake-up call, especially those who are not prepared or willing to admit an ugly truth.

May you profit handsomely,

Ali

_____________________________________________

February 3rd, 2014 Update

...by Ali Firoozi Yasar

As most of you folks are ware, we have recently received important news about the economy: GDP, Weekly jobless claims and pending home sales data and also an additional $10-billion QE tapering through the FOMCs latest statement.

The annualized GDP rate sounded OK. Consensus was for a reading of 3.0% but in fact, the 4th Q estimate 22% in three months. The weekly jobless claims were supposed to show a reading of 327,000 but the actual data was a bit quite worse, at 348,000 new jobless claims. And eventually, the pending home sales data came out which was really terrible! You see, economics’ consensus was for a small depression of -0.5%; however, the actual release was -8.7%.

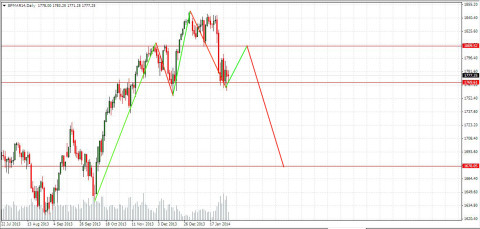

Please check out the chart No.1 below. As I had already anticipated, the market topped out and the prices kept on moving down, finding support at the 1761.00 area. You see I am not so precise on the charts as I solely intended to show you the model, not focusing on the exact price&time levels.

Now check out chart No.2, even though the markets will do what they are supposed to do, the main- stream analysts and advisers attributed the brief rebound on January 31st to the better then expected GDP figures and they would still like to see if the rebound is able to maintain the momentum to the upside, hoping the prices will go to the Moon, not knowing there are not many buyers left and it is time for a good break.

The prices will bounce real soon, back-testing 1810.00 area in order to suck in more retail traders, or we could see the market rally briefly, then a sideways chop, after that a drop to the lower levels as indicated on the chart. You see, my business cycle suggests that the U.S economy is ailing now; you may also see bad earnings reports during the coming days, adding fuel to the flame, consequently the market will have to correct and have a good break before it starts recovering again.

May you play it safely and profit handsomely,

Ali

_______________________________

When will the stock market bubble burst?

...by Ali Firoozi Yasar

Hello folks!

Hope all is well with you guys. I know it has been a long while since I last posted on Red’s blog. I have been super busy at work, so my apologies for the long absence. But now it's important to get you all this update as the time is near.

The stock market is at a critical moment! Goldman Sachs has suddenly decided to warn all of us that the stock market could decline by 10 percent or more in the coming months! But are they just honestly trying to warn their clients that the stocks have become overvalued at this time or is it just another agenda at work?!

Whether it is an agenda or not the stock market has just entered a very dangerous zone. Stocks are massively overpriced and investors have been borrowing huge amounts of money to buy stocks. Consequently, the margin debt at the New York Stock Exchange is truly at a crazy level!

These kinds of behaviors and signs actually indicate that another bubble burst is on the way. On top of that the state of overall U.S. economy is getting worse while the market is soaring to new highs. It is not a good sign folks. The U.S economy is in a very bad condition now, in fact it's in a much worst condition then it was the last time we had a major crash back in 2008.

Employment is much worse now that it was at that time and the U.S banking system is more ailing with more debts than it was back then. It owed about 10 trillion dollars but today the debt has increased to more than 17.2 trillion dollars. The market keeps on fooling the masses with this illogical bubble, but this "fooling" can't continue.

I highly suspect this massive stock market bubble will not last for much longer, and a lot of financial market experts are now advising and warning their clients to prepare for a substantial pull-back. You see the market was manipulated by the Fed in early August when a dramatic decline was due.

A lot of people had already been aware of that, which was probably the reason for the delay until now. The bottom line is... the energy of the current run has fully been drained and the Fed is not able to fight it any more.

Actually, it can be likened to a man who has been holding a big weight over his head for a little while but now his energy is getting depleted. So he takes a quick shot of Adrenaline to keep him going a little longer (aka "more printed money secretly injected into the market... [most likely]), and you know it's his 4th, 5th, 6th shot or more? With each time the effects last a shorter time compared to the one prior, and I think this is the last shot before the weight is dropped!

As mentioned above, the market was manipulated by the Fed in early August and it has been tolerating the burden since then. They are not able to hold it up anymore. This is actually what I see in the S&P500 based on the cycle work and harmonics. I am afraid I cannot give out much information here as it could be leaked and copied.

I believe the market will put in another high but the length of the rally will be relatively smaller, then a sharp decline to the 1350 area is possible. After that, a rally back up to new highs (the 2100 area is very possible) will probably follow. You see, it can be a huge opportunity to enter the market with a large short position when the time is right. As soon as the decline kicks off there will not be a major pullback to re-enter so you would want to make sure not to miss the ride at the very top.

May you profit handsomely,

Ali

Email: info@divinechartpatterns.com

http://www.divinechartpatterns.com

____________________________________________________________

The Date For The Coming Crash Has Been Given To Us By The Elite Themselves

...by Red

(to watch on youtube: www.youtube.com/watch?v=g3kZh_RjXjA)

Email me for password...

red (at) reddragonleo (dot) com

[protect password="1440"]

Last Thursday and Friday we seen the start of a very nasty correction that is coming and should last all of February and into early March before bottoming. While I did not know the exact date of the top it appears now it was last Wednesday, January the 22nd. In my previous post I mentioned that it was possible that traders would start selling off a week or two ahead of the coming FOMC on the 28th and 29th, as well as the debt ceiling deadline on February 7th... and it looks exact like that's what's happened.

From here I'm now expecting a short term bottom sometime Monday and a rally into Wednesday the 29th when Bernanke speaks. This rally should take us up to the 1825 SPX area to just under the 1850 prior high. There's a downward sloping trendline there that should stop the bulls on this bounce, which will be some type of wave 2 up with the recent selloff being the wave 1 down.

The price level isn't as important as the time period as we know that around 2:15pm on Wednesday there is extremely high odds that the rally will end shortly before the FOMC minutes are released. Whatever Bernanke says I fully expect it to be negative for the market and will start the wave 3 down into Thursday and Friday of this coming week. I would expect the current low of 1790 to be taken out on this next wave down.

This will be Bernanke's last speech before the new woman takes over as Fed Chairman. I previously speculated that the big downturn move would happen either at the FOMC meeting on the 29th or the debt ceiling deadline on February 7th. Looks like it's going to be the 29th for nasty wave 3 down to happen.

Then when the 7th comes up and they are unable to reach an agreement I'd expect another dump to happen. However, if we rally early this week as I expect and then dump from Wednesday to Friday I'd expect some type of bounce the following week on "hope's and prayer's" that they will say something positive on the 7th to end the selloff.

But I doubt that will happen as I believe the elite themselves are giving those of us awake and listening the exact road map of what is coming. In this video by IMF head Christine Lagarde she (strangely) starts off her speech by discussing numerology (fast forward to the 6:30 minute mark and start playing the video), and she talks about the importance of the number "7"... which she makes reference to by saying the following quote:

"2014... drop the zero, 14... 2 times 7... that's just by way of example"

(to watch on youtube: www.youtube.com/watch?v=ZUXTzVj5-uE)

Really? Example my ass! You are clearly saying that 2-7-14 is an important date! That's February 7th, 2014 of course, which is right in the middle of the 3 day Legatus meeting held February 6th to the 8th, and also happens to be the debt ceiling deadline date. Do you believe in coincidences? I don't... not with all the other "buzz words" that she drops in her speech.

- 2014 will be a magic year (meaning what? will you pull a rabbit out your hat? will you steal money from the sheep without them seeing you do it?)

- 100th anniversary of the first world war in 1914 (strangely when I researched what happened to the DOW back then it was closed down for several months due to the first world war starting. are we expecting the same here? REFERENCE: http://www.ritholtz.com/blog/2013/02/most-long-term-charts-of-djia-are-wrong, http://measuringworth.com/DJA, https://www.globalfinancialdata.com/gfdblog/?p=1426 )

- 70th anniversary of the Bretton Woods Conference that gave birth to the IMF. (The delegates deliberated during 1–22 July 1944, and signed the Agreement on its final day. REFERENCE: https://www.google.com/search?q=first+bretton+woods+conference+date&ie=utf-8&oe=utf-8&aq=t&rls=org.mozilla:en-US:official&client=firefox-a&channel=fflb Not sure what the hidden message was here?)

- 25th anniversary of the fall of the Berlin wall (Destruction date: November 9, 1989... but what is she hinting at here? Is the "buzz word" the "25th"or the "fall"? Does the 25th mean a certain future date or does the word "fall" indicate that the market will fall hard?)

- 7th anniversary of the financial market jitters. (again with the focus on the number 7... meaning what? are we looking for another move down similar to 2008?)

- The crisis still lingers... (clearly this means we are going down again)

- It will not happen randomly... (of course not, it's always planned)

- "Global growth is still stuck in low gear" (Hmmm... just a fall guy to blame I guess? We tank and it's the fault of slowing global growth)

- It will not be without downside risks, and significant ones (referring to inflation... or was it really meant to refer to the stock market?)

- We are seeing rising risks of deflation... (good for us sheep but bad for them)

- Global growth slowing down as the economy cycle turns... (the "buzz word" that stands out to me there is "cycle turns")

- Risk of capital runs... (You really mean the gangsters are moving their money out the market before the collapse)

- Dry run back in May of 2013... (Ah yes, the old test where Bernanke hinted at pulling money out the market last year)

- There could still be some rough waters ahead of us... (another clear warning that they plan on taking the market down)

- Overall, the direction is positive (meaning after the downturn the market we'll go back up again, which should be a final Primary Wave 5 up with this coming correction next month being a nasty Primary Wave 4 down)

- 95% of the income growth went to the top 1% (Duh... nothing new there as that was always the plan! Steal from the sheep and give to the wolves)

- Tapering will have too be very well timed... (again, she's clearly staying that we are going to withdraw money from the market)

- Central banks will have to "undo" what they've done... (and again, more references to cutting back the stimulus?)

- Removing the threat of the debt ceiling... (meaning what? They won't set one, or make it unlimited? I don't know what she means with this sentence?)

- A stress test will be done in 2014... (Why? You already know the banks would all fail. I guess they have to blame the correction on something)

Ok, there your shortened version of what Christine Lagarde is really saying to us sheep. By now you should be about 99% confident that we are going down hard this February. They've clearly told us sheep the truth and you can't blame them if you weren't listening.

Then there's this late find by dchrist81 on the last post (http://reddragonleo.com/2013/12/16/global-currency-reset-planned-within-the-next-90-days) that I find very interesting as the Olympics start this coming February 7th through the 23rd (http://www.olympic.org/sochi-2014-winter-olympics).

(to watch on youtube: www.youtube.com/watch?v=08_8cfysk-Y)

Now I really don't think we are going to have another False Flag event in the Olympics but I must say that it starting on the 7th with Legatus on the 6th-8th and the debt ceiling on the 7th is some might strange coincidences.

Red

[/protect]

How do we get passcode?

red great fan of yours but this password thing aint the brightest..just putting my views..

There is a reason I protected that post. It too detailed. I only want those who request it to get access. Password is being emailed too you.

thanks man..its fine if you actually give out to ppl who are interested..i think everyone interested should be able to see it..

More signs of of something bad coming in the market: http://www.forbes.com/sites/gordonchang/2014/01/26/china-halts-bank-cash-transfers-2/

A pop on Tuesday for the usual Fed pop day. Just basing this on the analog to a past historical epoch for the Nasdaq (actually 2 different epochs—–and I’ve brought them up here ad infinitum).

Dow is really outside/below its lower Bollinger Band so its due for a pop to get back to it but it looks like the Russell 2000 rode its lower band lower for a day back at that historical epoch before the pop (it’s in a similar position right now).

And we’ve got the Grand Ritual Bowl next week in NYC but I don’t get the meaning of the the 2 teams involved in particular Seattle. Which means the ritual might already be in process. They celebrated the 12 th fan concept in Seattle last weekend ad nauseaum as expected even adorning the Space Needle with a 12 flag LOL and displaying a 12 on one of the buildings in the Seattle skyline. And the typical numbnut PEDHAWK fan thinks its about him.

The NFL and the networks really did jump the shark with that Seattle -SF game last week but I will discuss that and the new mind-controlled mega-heel #25 of the PEDHAWKs (probably setting him up as a foil to the savior Popgun) later. (It actually isn’t anything new but his exposure just went mega-viral)

12 definitely means 111 but what else does it mean? 12=1+2?

ES Chart analysis: http://niftychartsandpatterns.blogspot.in/2014/01/es-chart-analysis_27.html

GOLD Trend Analysis: http://niftychartsandpatterns.blogspot.in/2014/01/gold-trend-analysis.html

I’m looking for a choppy day today, with a smaller wave 1 up and wave 2 down to happen. Then a smaller wave 3 up all day Tuesday, with the smaller wave 4 down and 5 up to happen before Bernanke speaks at 2:15 pm on Wednesday. This should make up a larger wave 2 up from the low on Friday and setup a larger wave 3 down to happen into the close and to the end of this week.

Certainly worth referencing again:

Best guess for the bounce high is 1810 area: http://screencast.com/t/JEc4Zc3e

ES update: http://niftychartsandpatterns.blogspot.in/2014/01/es-chart-update_27.html

Anyone wanting access to my recent post must email me for the pass code.

The Nasdaq followed suit. Traded down to lower BB and below 50 day average only to finish the day above the 50 day average. 3 down days off the top. There should be a big pop tomorrow with Apple being the catalyst? I heard Apple was downgraded earlier on the day….just so happening before its earnings release after the close.

Same pattern that preceded those recent Fed decision meltup days. Makes lower low earlier in the session, rallies and then drops into the close but not making new intraday lows…..the formation of a A up B down, then C up???

SPY Analysis after closing bell: http://niftychartsandpatterns.blogspot.in/2014/01/spy-analysis-after-closing-bell.html

I can see one reason for Seattle making it to the Superbowl. It means that both teams will be original AFC teams which means that no matter who wins the Super Bowl, the stock market LOSES!!! The operators keep the Super Bowl indicator amazingly accurate. Of course, after the SB, I bet we get a contrarian rip off your face rally…..among other reasons.

Seattle probably the only team in the NFC that is an original AFC team. I was expecting the operators to get San Francisco into the SB so that we could have an old fashioned 80’s (1987) themed NFC beatdown of the AFC with the Broncos playing their traditional 80’s role. I mean they even brought Elway back to the Bronco’s where he orginally played the role of Tebow’s stern daddy figure but now they can use him for the ’87 ritual. And boy does he look like an a-hole these days so the role is fitting.

SF has a huge public backing so Vegas prospered with favorite Seattle winning but strangely Seattle opened as the favorite even though Denver with Popgun has a huge national following. Predictably the line has moved so that Denver is a favorite. But who benefits? I can’t imagine Popgun and his record-breaking 55 TDs has been propped up for this all these years to become a pick six machine in the Grand Ritual Bowl but then again it would give dramatic flair to the SB. Popgun has some interesting numerology in terms of years (37 years old) and weeks.

Anyway, the PED Hawks are the only team that could get me root for Huckleberry Popgun, QB to the masses, with all of their DBs jacked up on roids including #25 whose so deformed from them that he looks like a vampire and makes the Legatian priest seem like Brad Pitt in comparison. Still I don’t think I can get myself to root for him.

Parts of this message may self destruct in the future.

Apple was hit hard in after hours but the Nasdaq has been recovering. The Nasdaq did open lower in the prior two instances.

Well, it appears the Seahawks spent their first year in the NFC West. (1976) But I still consider them an AFC team. They spent the majority of their history in the AFC. 1977-2001.

They are owned by one of the Microsoft co-founders so are they representative of the tech bubble??? Apparently, the SF 49ers are the most bullish team based on the SuperBowl indicator so that maybe a reason for their failure against the PED Hawks.

Gold and gold stocks in particular have been following another historical epoch in the markets right down to the exact timeline. In another Friday during the third week of January, a certain group of indices topped and dropped down to their early year lows only to rally back to their Jan highs by early March. I don’t know if they can match that analog if a certain little ritual plays out in the meantime but gold and gold stocks are pretty beaten down already.

ES Chart analysis: http://niftychartsandpatterns.blogspot.in/2014/01/es-support-and-resistance-levels.html

Bank of America Trend update: http://niftychartsandpatterns.blogspot.in/2014/01/bank-of-america-trend-update.html

Nasdaq didn’t pop like I expected today but it did put in an inside day. Unusual action for a fed day and the state of the union address day. Makes me worried that something in tonight’s speech might ignite things. I need to look at some data. A certain little component of a certain indicator was putting in a triple bottom low over the last few months and is bouncing today. Maybe there’s room for a bounce to the O area.

Geccko, we should rally tomorrow (at the open most likely) to produce some kind of smaller wave 3 up. The target is that 1810 SPX area. Then I’d expect the market to drop into a smaller wave 4 down into the FOMC meeting.

Once it comes out I’d expect the “mis-direction” first move to be to the upside to quickly complete the wave 5 up and take out bears that put stops right above the 1810 area. Then I think we’ll rollover and sell off into Thursday. But I think we’ll stay above the current low of 1772 and close over 1784 for the end of the week.

Nasdaq version got to the same -66 area yesterday as it did back in 2000 but it did this after it’s flash crash, then rallied to the 0 line. Nasdaq futures are higher now but I wouldn’t be surprised if everything gets reversed tomorrow after a gap up higher…. by the Fed decision…..it is 1-29 after all.

There should be a rally to 3550 $ndx…..then let’s see how things play out.

Only thing is is a known misdirection artist is calling for the same scenario.

Then Tom DeMark is calling for a break of SP 1752 following an upclose to say that a heavy decline has begun.

Yes, I think the level to short is the 1810-1815 area on the SPX… and I think we’ll see it near the open. It only makes sense to put in the high early in the day as I’m sure there will be some selling before the FOMC meeting at 2:15pm.

And while I do expect a shakeout move to the upside right after the minutes of the meeting are announced it’s not worth taking that chance if we see the 1810-1815 area hit in the morning.

Maybe the FOMC “shakeout” doesn’t happen and the market just drops from whatever Bernanke says (or doesn’t say?). Either way, the shorting zone should be in that area and waiting for a quick move up after the meeting is too risky to chance in my opinion.

The break of the 1752 should happen as I could easily see 1700-1725 being hit. I don’t know if we will get it this week or not but I certainly think one should be short before Bernanke speaks.

Hi Red, I am still lurking around here. I sent in my request for the update from Ali. No response yet.

Email me again…

APPLE Analysis after closing bell: http://niftychartsandpatterns.blogspot.in/2014/01/apple-analysis-after-closing-bell_29.html

ES Chart update: http://niftychartsandpatterns.blogspot.in/2014/01/es-chart-update_29.html

Long is the way to go! Looks like we came close to our 1810 SPX area after the bell yesterday as the futures soared up to 1800. Then this morning they dumped them and put in a higher low of 1768.50 ES. Clearly they didn’t want the bears to short at 1810 SPX area so they did the move overnight when they couldn’t take a position.

I was expecting an A wave up from the 1772.95 SPX low a few days ago to hit the 1810 area, and the a larger wave 5 down to break that low. This current move up from 1772.95 looks like a wave 4 up and inside it we have a 3 or 5 wave pattern. The A wave up started yesterday and I think we are in the B wave down this morning.

That leaves a C wave up to complete the larger wave 4 up, which I now suspect they will do after the FOMC meeting. Too many people are now expecting a big dump after Bernanke speaks so I’m thinking they will fool us all again and actually rally it up afterwards.

So, at this point I think long is the way to go until that 1810 area is reached. Then we’ll see if that appears to be the end of the wave 4 up or if it gets extended into a 5 wave pattern instead of a 3 wave pattern. If it ends up “not” being an ABC wave up then everything changes and we could actually have completed the move down from the 1850 high to the 1772 low and are on our way back up to make a new high.

Yeah, that sounds crazy with the charts looking so bearish but you know how they like to fool everyone. Then there’s the possibility that this move down this morning was truncated 5th down. That means the whole down move is over for at least a week. We could rip up much higher then everyone expects.

This is a common practice by them to get everyone bearish and then squeeze them to new all time highs. While I’m not sure one way or the other on the new highs I firmly believe long is the way to go for awhile. Look to the 7th of next week before even thinking about shorting big again.

Let me also add that while I think “long” is the way to go right now I’d still exit around 1810 area to re-evaluate the charts again. I’m still not sure on this 5th wave down scenario? If completed then we rally for awhile… and by that I mean a week probably.

If the 5th wave down isn’t finished then we should drop one more time from the 1810 area of resistance. This time it should break the current low of 1772 SPX and possibly hit 1750 area as previously suggested.

This is a tricky area right now but I do believe they will rally up from the FOMC meeting. The question will be… “will it hold”? That I can’t answer yet. I will say that there is NO positive divergence yet in the short term charts. This implies another lower low yet to come… and then a rally all of next week.

Thanks Mr. Red….hmmmm 100 dma.

Kudos to Marcel….nice and thanks!

All my best; Seawind

It’s a tough call either way Seawind. Just a feeling more then anything that they will squeeze the bears after the FOMC meeting and rally up to that 1810 area. Most everyone seems bearish on that meeting so you have to think that they will do the opposite.

Of course Thursday should then “also” do the opposite of what most traders will be thinking at the close today. So if Bernanke says something really positive then traders “should” be thinking that that selling is over with.

That’s when you would drop the market one more time into a final 5th wave down to end the whole first larger wave 1 down from the 1850 high. Then you rally all of next week while all the traders have flipped to bearish again at the bottom of that 5th wave.

These people are masters at tricking the sheep and that scenario makes the most sense to me… if I were a gangster like them.

Since we have been selling off for a week now in front of the announcement of the Fed tapering another $10 Billion (which they just did with the FOMC minutes being released) you have to ask yourself if we have “sold the rumor and will buy the news” just like they do with stocks?

You know they love to “buy the rumor” (of expected good earnings) on some stock a week or so before they announce them. Then once they turn out to be good (as expected) they “sell the news”. Only this time I think the opposite is happening and we are about to start a rally up to at least that 1810 area for starters. They are holding the market up right now above the Monday low of 1772 SPX and that’s a “tell-tale” sign that they are luring in bears before a squeeze.

blah blah blah. Does anyone else see the pattern here? Has this site ever been right with any market call? Ever?

Then go short and lose your shirt. Odds favor a nice move up from here. I don’t know the future and no one does. I can only go with the odds.

WORD.

Word UP Darth Gerb!… 🙂

The operators are good. They had me fooled. Of course, I thought there would be a Fed statement today which I didn’t find out about until just before the open. I was so worried about their usual Fed release shenanigans. That’s ok. Everythings back on the timeline which wouldn’t have been the case if there was a rally today.

Russell 2000 did what the Nasdaq should have done yesterday.

Nasdaq version of a certain component rallied to -36 back in 2000 on its equivalent day from that year. Yesterday, it popped to -41….

I am still leaning bullish for the short term, but if they lose 1770 SPX by the close today the market will drop like a rock. But if they hold the line they should bounce for several days. The weekly chart needs to hold 1768 by the close on Friday. So if they are going to stay above that they better not let it collapse here. This is the line in the sand Geccko… lose it and the bears win!

SPY Analysis after closing bell: http://niftychartsandpatterns.blogspot.in/2014/01/spy-analysis-after-closing-bell_30.html

After perusing the chatter on the blogosphere, it seems that the posters—-errr–the bears—-errr—the trolls have universally gotten out of their shorts today. Everyone is looking for a rally apparently over the next two days including the best tell, astro-energy dude.

MMM reports before the bell. Its earnings might provoke a nice reaction. Fellow Dow stalwart, Boeing, got taken apart today. Interesting that I haven’t seen anyone mention MMM but I see a flood of calls on QCOM and FB.

It won’t take much to get the Dow and SP below its December lows. The retail stocks have already dropped below their December lows. Once that gets taken out, a waterfall decline should unfold quite quickly. I don’t know where DeMark gets SP 1752 as his trigger, the December lows should be a pretty simple waypoint.

The European markets had the sweetest looking reversals today ala a similar time double 6 years ago although they finished off their lows. The Nikkei currently is putting in an impressive reversal as well.

As for the 2000 model, the Nasdaq and Russell 2000 both closed below their 50 day averages and lower BBs just as they did back then. A certain component of a certain little indicator also finished in a similar position.

Well, in 2 instances I looked at the markets actually rallied presumably from the open and in the 2000 case up to the lower BB so maybe no monster MMM miss. (attempt at a reverse jinx). Tomorrow===1-30-14 or 27???

Blackberry resistance levels: http://niftychartsandpatterns.blogspot.in/2014/01/blackberry-resistance-levels.html

GOLD Weakness at 200 SMA: http://niftychartsandpatterns.blogspot.in/2014/01/gold-weakness-at-200-day-simple-moving.html

$ndx got to its 3550 target that I was looking for 2 days ago basically. Went up and hit its now declining 20 day ema—RSI 14 hit the 50 level just as it did back in a certain historical epoch.

Boeing continued to get hammered and its chart looks just plain ugly. MMM was down as well. Euro and gold both were hammered.

Now let’s see if we can get to DeMark’s target of 1752 off an upclose. Need to check out comments from the blogoshphere. One dude who so far has been right but nevertheless I am suspicious of had us rallying on Friday.

The charts say we rally in the morning on Friday but could easily drop back lower into the afternoon. However, with Google tanking afterhours and taking the Nasdaq down with it we might not go up tomorrow at all? Too hard to tell right now? They could reset the short term futures charts afterhours and turn them back up by the morning.

We might levitate tomorrow, as they like a green market for the weekend shows, WE HAVE SUPERBALL!!! but next week will there be enough earnings and will there be no bad news out of emerging markets to keep us up? That’s to be seen.

Tricky market Amy. Looks like they couldn’t hold the gains yesterday.

APPLE Evening star candlestick pattern: http://niftychartsandpatterns.blogspot.in/2014/01/apple-evening-star-pattern.html

We have a possible wave 3 (or C?) up from the low today… which means we “could” go green by the end of the day and really climb higher then many will expect. It’s very possible, but of course not something I can say will happen today. Could be pushed out until Monday?

Silver Descending triangle: http://niftychartsandpatterns.blogspot.in/2014/01/silver-descending-triangle-pattern.html

SPX Update: http://screencast.com/t/k07GwlTR

hey Red, That doesn’t make sense.

If we break above the 50 day MA..this market will surely break new highs.

Recent price action is a 5 day wide bear flag. Weekly charts are bearish – for the second week in a row..first time since Nov’2012.

—

If we break <1767 next week,..we'll drop hard to 1710/1690….then we'll know 1850 was a key intermediate 3' top.

—

regardless..have a good weekend!

Gold support and Resistance levels: http://niftychartsandpatterns.blogspot.in/2014/02/gold-support-and-resistance-levels.html

I am moving my target for a low out to Tuesday or Wednesday. Everything is muddled at this point. Not really oversold but also don’t like seeing inside day red bars for a lot of indices on mildly negative breadth. A lot of hollow candlesticks as well. But then again indices were held up on monster earnings pops from Goog and CMG and I doubt we have any pre-opening earnings releases like that on Monday morning.

I had a low for today because it was the first day after a new moon which has seen a first wave bottom in 3 instances for 3 historical epochs. It still might produce a bottom. Plus we would finish the month down and there would be endless chatter about the January barometer. Plus the start of Yellen’s new term. And a possibly negative Superbowl indicator triggering. All the ingredients in place for a rip roaring in your face contrarian start of the new month rally.

Except the market did not achieve the ideal configuration for a first wave bottom. No final washout to get the pundits in a hysteria and blather endlessly about the January barometer. In a certain historical epoch that the Dow is following quite impressively, the low came in place within the first 3 trading days of the new month. The Dow also did close below its December lows ever so slightly. The $vix looks bullish and is still making new highs. And the euro looks like it’s in a complete freefall at the moment.

Hmmm, might have gotten an HO signal…..or observation???? 68 new highs and 80 new lows for $nyse according SC. That’s right around the threshold for a signal.

Just a little tidbit of my Superbowl preview:

Denver was a Superbowl participant in the two Superbowls surrounding the event of 1987 ie the lesser grand ritual and they were destroyed both times 39-20 by the New York Giants in January 1987 and 42-10 by the Washington Redskins in January 1988. They were led by QB #7 who returned to the team a few years ago in some sort of executive capacity where he functions as the de facto team leader.

It is worth noting that the 1987 champion New York Giants might not be playing in this year’s Superbowl but their spirit will be there.

They were also champs in 2008, 2 years ago, following the Superbowl won by the 1929 champion Green Bay Packers. They also lost to last year’s champion Baltimore Ravens in the 2001 SB, 34-7, the culmination of the 2000 tech bubble bursting season and in the midst of the tech meltdown on January 29,2001.

In an interesting coincidence, both of this year’s SB participants, the Denver Broncos and the Seattle Seahawks played the Giants during the year and both played at their stadium in New Jersey(the Meadowlands). Both teams defeated the Giants. The Giant’s QB is Popgun’s brother. He has won 2 SBs to Popgun’s 1.

SPY Analysis after closing bell: http://niftychartsandpatterns.blogspot.in/2014/02/spy-analysis-after-closing-bell.html

Superbowl Preview part deux:

The betting line on the SB seems like a trap line. The Broncos, led by Popgun and his record-breaking 55 TDsd, the highest scoring offense of all time, and with an average large margin of victory are only favored by 2.5 pts and this after Seattle opened as a slight favorite. One would think the betting public would jump all over this line considering the popularity of Huckleberry Popgun, the QB of the people with a net worth of somewhere around $200 million, and his endless hype and gazillion commercials. The public likes to bet on favorites and marquee teams led by marquis players. Considering that Denver has only won one game by 7 points or less all year so the line really doesn’t make any sense unless Seattle is truly the better team which will be brought up in SB preview part deux deux.

So on the theory that the operators should benefit the most out of any outcome then Seattle should win the game but they should also win it dramatically to keep up with the 1987/88 SB similarities.

Then there is the recent case of SB 45 when the Patriots came in led by Tom Brady and his record breaking stats with the highest scoring team of all time only to lose to the 1987 champ Giants.

Denver will win. It’s already planned and setup for them. All the big games are rigged as too much money is bet on them.

So much for that new “sports” contact. He was dead wrong on that call. Good thing I don’t bet on the games.

It was mentioned a few days ago that Seattle with the NFL’s top ranked defense finished first in scoring defense, turnvovers/(margin), and yardage allowed, the first team to do it since the 1985 champion Chicago Bears, widely considered the top defense of all time and a team that crushed the AFC champion in the Superbowl. The next year another team with a smothering defense the New York Giants pummeled the Broncos in the 1987 SB.

And here’s how some of the similarities to this season compare to the season leading up to the 87 and 88 SBs. Denver, the AFC champion feasted on teams from the inferior AFC and the NFC LEAST. Seattle slugged its way through the much superior NFC and materialized as the NFC champion. They played in a division that featured 3 teams with a winning record and a fourth one that finished 7-9.

Denver had a similar bend but dont break style defense to its 80s counterpart. They gave up 24 pts a game during the season that was masked by Denver’s high octane offense. They dropped that total to 17 pts in the playoffs but they played some weak playoff teams and those games were at home. The Patriots in particular had a very depleted squad with their best offensive and defensive players already out for the season. The Denver squad of 86-87 did lead the AFC in scoring points allowed but no one compared them to the Bears, Giants juggernaut squads of the time.

This year’s Seattle squad also had a ridiculous low yards per pass attempt allowed which is probably the most vital defensive statistic in this pass happy era. It doesn’t help that their DBs are so jacked up that they’re like linebackers roaming around in the secondary and they play an aggressive bump and run type coverage that they almost dare the refs to throw flags. But considering there have been only 7 pass interference calls made in the playoffs, their aggressive tendency doesn’t seem to be in any jeopardy from the refs.

Bill Polian mentioned 5 metrics for a SB champion that favored the Seahawks over the Broncos.

Among them were rushing attempts on the season, turnover margin, and ypa allowed (mentioned above but that might have been a 6th metric).

And historically the team with the NFL top ranked defense in the SB has generally won the SB.

This was the case in the 1990 SB when the top ranked defense of the Giants squared up against the high octane offense of the Buffalo Bills and defeated the Bills 15-13. The Bills were coming off putting 50 pts in the AFC championship game and 40 pts a week earlier.

I It’s going to be a case where Popgun’s NFL worst arm is going to be brought back to reality.

A great video about the power of GOD… http://www.youtube.com/watch?v=qAxGTZNVd80

Illuminati messages in halftime show http://www.youtube.com/watch?feature=player_embedded&v=v6lP7RJ6ORU

Dow Jones chart update: http://niftychartsandpatterns.blogspot.in/2014/02/dow-jones-testing-200-day-sma.html

It’s pretty simple here now… either we rally into this coming Friday the 7th and put in a lower high around 1810 area or we continue down in the 7th and put in a bottom. If we continue down then the Legatus meeting will be a turn to the upside with a new rally starting which should continue into July.

If we start climbing back up tomorrow and tag 1810 area then that would setup a massive wave C down starting next Monday and continuing for 3 weeks or more. I don’t know which one is going to happen as today went deeper then I expected. It’s a toss of a coin at this point.

SPY Analysis: http://niftychartsandpatterns.blogspot.in/2014/02/spy-analysis-before-opening-bell.html

I’m thinking now that based on the charts we should rally into mid to late next week. This implies that we almost (or are?) finished with the first larger Wave 1 down from the 1850 high and will soon be starting the larger Wave 2 up.

Since the Wave 1 down took about 3 weeks we should have around one week up for the Wave 2… which should be choppy and look like some type of ABC pattern when finished. This pushes out the 7th as a likely top and moves it to next week sometime.

If this is correct they must squeeze out the bears in this wave 2 up and that means they must go above 1800 SPX. I don’t know how high or what date we will top but next week is the more likely time period to try to get short before the larger Wave 3 down starts.

Of course is all off the table if we make a new high above 1850, but from a technical stand point the damage that has been done doesn’t support that theory. Whatever the upside target is next week I think it’s a HUGE shorting opportunity.

I’m actually praying this doesn’t happen but it’s really looking bad on the charts right now. And with the Fed pulling out money from the market twice since late last year it doesn’t look like this one is going to be another “Bear Fake-out” like in the past.

We have been given the “approximate” date and road map so we really must take this one very serious this time. Past Legatus meeting have had “turns” in the market either during the meeting or shortly after the meeting. This time I think it will be shortly after the meeting as that makes more sense with the charts.

Throw in the fact that the free money supply of $85 Billion has been reduced to $65 Billion with the last two $10 Billion Dollar cuts and it all spells disaster!

I’m going to low my upside target bounce to around the 1770-1780 area as we’ve yet to find a short term bottom and bounce. Based on what I’m now see I’m expecting the rally to start tomorrow or Friday, but it should only be a small choppy A wave up and B wave down (to put in a higher low).

Then the C wave up should happen Monday and end Tuesday morning somewhere in the 1770-1780 SPX zone. Therefore I believe Tuesday the 11th will be the top of a very short lived wave 2 up with the entire move from 1850 down to the current low being the wave 1 down.

If so, then Tuesday should be the best spot to short before the crash wave 3 down starts. I guess it could start this Friday the 7th but there is usually one quick wave up to shake out a few bears and get some bulls long. It should be fast and up hard, but end just as quickly.

Possibly Obama says something positive over the weekend to spark this strong bounce? Since a lot of bears will hold their shorts over the weekend I’d think there would be head fake move up before the crash. I’m counting today’s move down as a smaller 5th wave down inside a medium 5th wave down (that started at the 1798 high), inside a larger wave 1 down from the 1850 high.

The downside target is the 1725-1730 area to end this final smaller 5th wave down, and medium 5th wave down and larger wave 1 down. So, the entire wave 1 should end in that zone and allow for a larger wave 2 up.

This larger wave 2 up really shouldn’t last more then 2-3 days even though the larger wave 1 down lasted over 3 weeks. If we were still in a bullish phase then the wave 2 up could last over a week, but since we are in a bearish phase now any rally will be shorted hard.

This coming crash wave is going to scare a lot of people and I’m sure I’ll be one of them. I just have to keep focused and remember that my downside target low should hit in about 3 weeks, which is around the end of February. So by the 28th I’d look to sell. My target is around 1500 area on the SPX.

I’m going to move my target for a low to Friday. This is about where the 377 year cycle should kick in.

We haven’t gotten the washout I’ve been expecting and certain indicators are still muddling back and forth in negative territory but not really oversold yet. A certain component of a certain indicator reversed back down today while the indicator finally dropped below its 50 day average. The Nasdaq version is actually even more negative in both indicators.

There’s a lot going on overseas overnight tonight (actually early morning) and it is 3 years 9 months from a certain event.(1372 days) 31 weeks from July 4 as well. And the final washout from a certain analog to a certain historical epoch did occur on the Thursday Friday of the first week of the new month.

I’ve been reading some recaps of Tom DeMark’s remarks today and he is incorrect on his trading day count. Today is 24 TDs. He seems to be indicating that a decline over the next two days would bring on the watershed event. I disagree. I see next week as super bullish as the new Fed chairman will be conducting some important speeches in D.C. which should be greeted by the standard meltups in the markets.

I still think there needs to be a final washout. Trading day wise the market was due for a bottom at 23 tds but the correction was really too shallow at just under -6% to really be a bottom. Yellen doesn’t speak until Tuesday so there is room for 2 days down.

I am getting some contra trollish indications that there will be a decline tomorrow. I guess DeMark is the new Prechter. Throw him on to CNBC (and explain the double ninen analog) just prior to juicing the markets. Well the analog comparison is toast so the operators can now open the trap door.

It is 2-7 tomorrow and guess what happened on this date 85 years ago???

It’s James Deen’s 28th birthday tomorrow, star of the Canyons, my 2nd or 3rd best film of the year. Lindsay Lohan is 27 years 7months5days old tomorrow.

My top film of the year: Rush followed by The Canyons and Hunger Games.

Rush: The German Grand Prix of August 1, 1976 depicted in the film was 13,703 days ago tomorrow.

I think we are going to tag that 1775-1780 spx area tomorrow and the drop on Monday… but I think it will only be a B wave down with today’s move starting the A wave up. Then probably a C wave up on Tuesday to complete the entire wave 2 up. Could hit 1800-1810 area on the 11th-12th before rolling back down again.

ES chart update: http://niftychartsandpatterns.blogspot.in/2014/02/s-500-futures-chart-analysis.html

Considering how high we have went today I’ll be looking to go short over the weekend. We have completed a 5 wave pattern up from the 1737 low and could just be in the first A wave of a larger ABC pattern inside wave 2 up.

This would imply that we drop Monday into a B wave down that puts in a higher low (maybe 1750-1760?) and then rally back up to 1800-1810 for the final C wave inside a larger wave 2 up.

However, if that’s not the pattern and then it’s possible we have completed the larger wave 2 up with just 5 smaller waves inside it, instead of an ABC pattern.

Therefore, picking a spot sometime today to short seems wise as we have high odds of either a higher low happening on Monday from a B wave down, or a break of the current low and the start of the crash wave 3 down. Either way if you are short you can catch a nice move down.

If it’s just a B wave down then you can exit the short sometime Monday and even go long the C wave up too? Then short again from a higher level for the start of the larger wave 3 down. And of course if this is all we get on the upside then the move down next week should be really ugly as will likely be the start of the larger wave 3 down.

The charts look very bullish right now, so shorting is going against the grain.

Based on today’s strong move up this could easily continue into Tuesday the 11th of next week. While we should pull back slightly on Monday I wouldn’t expect much on the downside that day. Then back up again into Tuesday seems likely.

From there we’ll have to re-evaluate everything to see if Legatus was a bottom (it started on the 6th) or a top (as we are in the middle of it now)? The charts look very bullish on the short term and move upside seems likely early next week. Only some unknown shock could take the market down hard on Monday, and I have no way of seeing what that is?