__________________________________________

July 29th, 2015 ... before the FOMC meeting Update

Possible New High Coming On The SPX

(to watch on youtube: www.youtube.com/watch?v=NrW3R1IC6kA)

I'm losing my bearishness right now as the weekly chart is getting into oversold area where "turns" usually occur. Bears beware, we could see a new high coming soon.

July 29th, 2015 ... after the FOMC meeting Update

Well, the Fed's said nothing about a rate hike at today's FOMC meeting. So that rumor last week of a .35 rate increase in September was NOT confirmed yet. I suspect the retail traders will view this as positive and buy the market now. That tells me we will top out tomorrow or Friday instead.

I posted on the blog (in the comment section) the following after I did this newest video update...

"While I think we are "close" to having a breakout to a new high soon I just can't get excited about going long with the VIX so low and all those bulls still onboard from the 2040 SPX area over the last several months. If SkyNet would just flush them out with some drop to 2000-2020 I'd become a bull again.

__________________________________________

... But Will It Be Accurate?

(to watch on youtube: www.youtube.com/watch?v=7RbAJz5nzLE)

As we all know the Elite that run the world 100% control the "Main Stream Media" (MSM) and constantly mislead the sheep that watch TV, read the newspaper or listen to the radio. But what about the Internet? Do they control it fully too? NO is the answer as we sheep have the opportunity to publish our own thoughts on blogs like this or various social media outlets. However don't just assume that "they" are still busy spreading their "dis-information" stories throughout the Internet to dis-credit true and factual information as I'm 100% positive they are do that every day.

Remember, their entire "motto" of life is to do everything in their power to steal from you, poison you, lie to you, use you, and kill you off when you are no longer a profitable debt slave. So you should NEVER assume that even though they are bound to tell in advance of the things they plan to do to you that they will do it in a timely manner where you can profit from it... as the opposite is true.

While I think Lindsey Williams is probably a very good man and truly wants to help people I also think his elite source gives him information that is timed to benefit the elite by "suggesting" though his leaked messages that us sheep go long gold near the top, short the dollar near the bottom and of course miss the entire move down recently in oil.

Without a doubt if you traded from his information you would go broke!

(to watch on youtube: www.youtube.com/watch?v=gtN5QqH6LLM)

Of course he clearly doesn't tell you to trade from what he tells you but we all know that people will still listen to his stories and base their trading around the trend that they expect to happen from his information. This would again result in losing you money as every thing he's told us over the last 5+ years hasn't been correct. The dollar hasn't crashed, gold hasn't went up strongly and oil... well he claims his elite contacts never caused the sharp move down as that was apparently all done by Obama trying to push Russia president Putin.

Well, regardless of whether or not the elite crashed oil or Obama we sheep never seen it coming and didn't profit from it... so the facts are still the same, "You can't trade off Lindsey's information (unless you do the opposite?)", as it's clearly been wrong since I've started to follow him. That's been 5-7 years now I guess.

Since I wasn't following him when he claims to have successfully told everyone in advance of the 2004-2008 big move up in oil and the fall back down hard into the 2009 low I can't know if that was timed out where the sheep could have profited from his information or not? I only know that since I've known about him his information has been wrong.

So how do you use this information if it's timed to get the sheep into the stock market on the wrong side when the prediction is expected to happen?

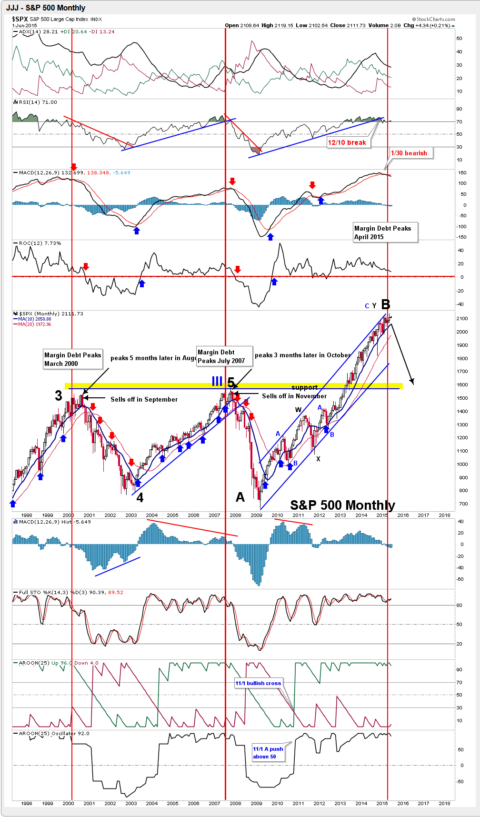

Simple really... you assume we'll be bottoming when this September, 2015 Stock Market Crash is forecasted and looking for a shorting opportunity several months in advance of it. When I look back at the 2011 mini-crash I notice that we had the most powerful crash wave (the wave 3 down) in August and then we had 1-2 months of a wild and crazy wave 4 up before the final wave 5 down to 1074 SPX early October low.

Clearly it was very tough to make any money on the wave 5 down as you would have be shaken out many times as the wave 4 up had so many ups and downs in it that most bears would have be puking their guts out from week to week waiting on that final leg down. The big money (and safer wave to ride) was being short from late July, 2011 into the early August low for the wave 3 down. This is the wave I personally want to catch (if possible?) and just pass on the expected wild ups and downs in September and October of 2015.

Past evidence on prior moves down is clearly shown in these charts of the DOW as explained in this video about "The Shemitah"...

I've looked a several other video's about The Shemitah and how it points to September 13th, 2015 as being the "Elul 29" and just like this one the best. It's done by someone named James Trivette, a preacher I guess? Anyway, I think it's well worth your time to watch.

(to watch on youtube: www.youtube.com/watch?v=Wu6QWOWat6Q)

"Sidenote: I looked up the solar eclipse years here... http://earthsky.org/astronomy-essentials/dates-of-next-lunar-and-solar-eclipses#2015"

Eclipses in 2015

March 20: Total solar eclipse

April 4: Total lunar eclipse

September 13: Partial solar eclipse

September 28: Total lunar eclipseEclipses in 2016

March 9: Total solar eclipse

March 23: Penumbral lunar eclipse

September 1: Annular solar eclipse

September 16: penumbral lunar eclipse

My thoughts on this forecast again of something bad happening (like a stock market crash) in or around September 13th, 2015 are that it will be a bottoming period, so we should be looking to get short much sooner. When you ask? We'll as most of you long time follows of this site know all about Legatus I'll point out that we have a meeting this coming June 15th-17th, 2015 and coincidentally an FOMC meeting June 16th-17th as well.

That meeting is the one that many people are expecting the Fed's to tell the market that they will be raising interest rates in September of this year. While I don't know if they will state that news in that meeting I do believe that if they do say it we'll see a top in the market as traders will start bailing out long before the actual rate hike happens 3 months later. So by the time September comes the bulk of the panic should be over with... which again leads me to believe it will be a bottoming period.

This also tells me that we should have another big "Wave 3" down (the crash wave) somewhere before that September 13th "Shemitah"date and/or September "Interest Rate Hike". Past history tells us that August is a bad month for the market and if you look at 2011 you'll see that the biggest move down was indeed in August, not September.

Quite possibly we will top in mid-June and start the first waves 1 down and 2 up from there until late July where another big crash wave happens into August? Of course it shouldn't follow the 2011 pattern exactly as that would be too easy for us sheep to figure out... and you know "they" won't make it easy for us to profit from. If fact they will do everything in their power to make us lose all our money so they can take it from us as they profit wildly from the crash they created.

What about Legatus?

In that Legatus meeting I'm sure they will make the final decision on whether or not the "Stock Market Crash" is still on for 2015 or if they are going to push it out one more year into 2016. I don't know the answer of course but I do believe without a doubt that it will happen before Obama leaves office as they want to blame this whole crash on him. He will be the "scapegoat" for the coming collapse even though it was planned many decades ago.

In that Legatus meeting I'm sure they will make the final decision on whether or not the "Stock Market Crash" is still on for 2015 or if they are going to push it out one more year into 2016. I don't know the answer of course but I do believe without a doubt that it will happen before Obama leaves office as they want to blame this whole crash on him. He will be the "scapegoat" for the coming collapse even though it was planned many decades ago.

These elite are just a bunch of crust old white vampires that will get a kick out of setting up the first black gay American president... which is why they put him in office in the first place I'm sure. I kind of feel sorry for him in some ways as it's not his fault for what's coming. But they seem to have NO Feeling at all of compassion for other humans and will do whatever it takes to fulfill their sick agenda.

I can't tell you the exact date of the top or the bottom (assuming the crash still happens) as I'm sure that any date I put out there will (could?) be off simply because I said it would happen. I'm just saying that if too many people (sheep only, as the elite know the date) discover the exact day the market will top then they will be forced to change it.

I remember back in 2013 when I did several posts saying that we'd top on May 22nd, 2013 because it was right in the middle of a Legatus meeting and a ritual "33" day (http://reddragonleo.com/2013/05/06/we-are-just-weeks-away-from-the-start-of-a-200-or-more-point-drop-in-the-spx). I told everyone about it for 2-3 months prior to it happening. I thought it would be the top for the year, and we'd crash from there into a low later that year. While it did top out and drop from 1687 SPX to 1560 by June 24th it wasn't the high of the year, nor was it a crash.

I don't know if they plans were changed or not (due to the fact that there could have been too many sheep aware of the date after I posted it?), but I've changed a lot since then in my charting analysis and simply post what I think is possible, but give NO promises of "it will be the top" or "we must crash"... as I now know how quickly "they" can change the plans to make us blog writers and stock market forecasters look like fools.

Therefore I'll just point out "possibilities" with some supporting evidence that whatever date or time frame I might a forecast for "could" be accurate. My personal trading method today is "day trading", and I've do very well with this method over the last year or so... much more profitable then trying to forecast which direction the market will be going at a week or two from now.

This is one of the main reasons I don't post as much anymore. The other reasons are that the better I get at day trading the less information I can find out there to post on that will be correct in the near future. There just isn't enough "darkside information" available that is accurate. Ritual numbers and ritual dates are too abundant to call everyone of them and expect a turn in the market.

So I just do my best to post comments on whatever the current blog post is, which are there to inform everyone of what I see short term for the market. Then I re-post via my twitter account. Sometimes (if I remember?) I post it on my facebook account too.

Why is Walmart closing stores around the county claims plumbing problems and then NOT filing for a plumbing permit?

There's a lot of posts around the internet talking about the mysterious closings of all these Walmart stores for some plumbing problems and then blacking out all their store windows and hiring police officers (not security guards as most stores would) to guard the place. Then on top of that are all these military vehicles being spotted going to these stores. Are they planning on marshall law in the near future to put the sheep in? If so, what event would cause this?

Walmart Closing Five Stores For 'Plumbing Problems'

http://crooksandliars.com/2015/04/walmart-closing-five-stores-plumbing

Military vehicles are being shipped to a closed Texas Walmart ahead of Jade Helm? (Photos)

I know we've seen of a lot this stuff before in the past and nothing ever became of it (at least in the "stock market crash" forecasting), but it's still worth knowing about as at some point in the future I'm sure they will do something bad to us sheep so they can put these Walmart stores to use locking up certain people that go crazy when the economy collapses and they have no job, no home, and no food to eat.

Whether all this happens in late 2015 or they push it out until 2016 is unknown, but I firmly believe it will start before Obama leaves office. If the Fed's decide to announce the future interest rate hike in September, 2015 during this coming June 16th-17th FOMC meeting then we should all expect it to start this year. If not, then possibly they decide to push it out one more year?

However, I certainly get the feeling that it will start this year... bottom in Sept/Oct and rally up into 2016 before they pull the rug out completely and slaughter this fat pig of a market. Let's face it... the monthly chart of the SPX looks eerily similar to the 2011 period before a nasty mini-crash happened.

What about any FP's? (fake prints)

I don't have any new ones (on the large scale) but I'm still thinking this old one from January 2014 "could" still be in play. It's one showing the NYA at 11334.65 high.

There's also the old TVIX FP showing 35.9599 from 11/14/2013...

So not much to say on that subject. Those prints could both be nothing as they are old and plans could have changed from then to now. But I wanted to include them should the market put in a top in mid-June and start crashing into September as they could be targets?

I'm still not sure all the pieces are in place for the total collapse though as the ECB is still supporting their markets in Europe with their version of Quantitative Easing and isn't scheduled to end until September of 2016 (https://www.ecb.europa.eu/press/pr/date/2015/html/pr150122_1.en.html). But, that doesn't mean we can't get started this year here in America and have the first larger "Wave 1" down, followed by a mufti-month "Wave 2" up into mid-2016. Then the "Super Crash Wave 3" down into the end of 2016 and probably some of 2017 could happen.

In both the 2000 and 2007 tops and crashes that followed we had a month chart that produced a wave 1 down and wave 2 up before their wave 3 "crash wave" down happen... therefore we should expect something similar to happen this time around as well. That gives us a strong possibility that it will indeed start in 2015 but get worse in 2016. So let's keep our minds sharp and open to the fact that we do have some very good odds of a major turn down this year.

Final Clues: Has the elite already warned us of "The Crash Date"?

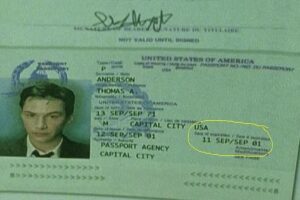

As we go back to September of 2001 we remember the both the movie called "The Matrix", TV show called "The Lone Gunmen" and the famous episode of "The Simpsons" where we were told in advance of something BIG happening on 9/11. In the matrix it was shown on Neo's expiration date that said 9/11/2001. On the lone gunmen episode it was a hijacked plane that was on a collision course for the twin towers, and finally on the Simpsons it was the cover of a flyer that showed the twin towers in the background with a big $9 to the left of it for the cost of the pamphlet.

As we go back to September of 2001 we remember the both the movie called "The Matrix", TV show called "The Lone Gunmen" and the famous episode of "The Simpsons" where we were told in advance of something BIG happening on 9/11. In the matrix it was shown on Neo's expiration date that said 9/11/2001. On the lone gunmen episode it was a hijacked plane that was on a collision course for the twin towers, and finally on the Simpsons it was the cover of a flyer that showed the twin towers in the background with a big $9 to the left of it for the cost of the pamphlet.

No one but the insiders knew what that all meant as I seriously doubt it if there was one "red pill taker" sheep that seen all three (or just one or two) of those messages and figured out the meaning before it happened. If so, he or she certainly didn't post it on the internet for all to see (not that many would have seen it anyway as youtube wasn't around back then).

No one but the insiders knew what that all meant as I seriously doubt it if there was one "red pill taker" sheep that seen all three (or just one or two) of those messages and figured out the meaning before it happened. If so, he or she certainly didn't post it on the internet for all to see (not that many would have seen it anyway as youtube wasn't around back then).

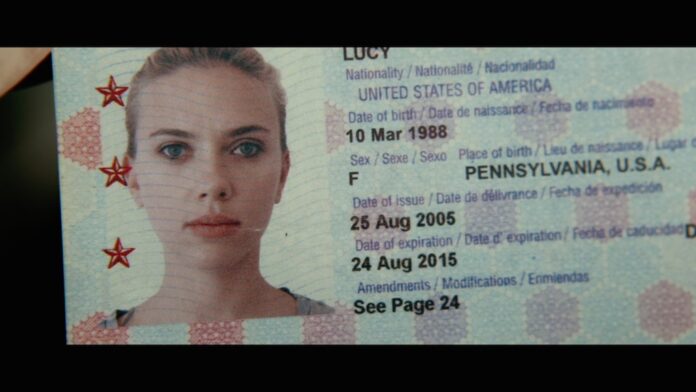

So I'm not going to tell you what I've seen that points to another date of something really bad happening but instead tell you to think like the matrix and go watch a movie called "Lucy" with Scarlett Johansson and you'll see the date I think we're going to crash. Enough said...

Red

P.S. Interesting how VERY BEARISH the week after the June 15th-17th is, which is based on prior history.

Just more evidence of a very important week starting June 15th and ending on "Triple Witching" Friday the 19th...

More about the Dark Web:

ES Futures Update: http://screencast.com/t/IrfzDJYfj

If something doesn’t happen tomorrow or possibly Friday, then I don’t know when it will occur. 6-4 of course has the best hits. ie 10(5-5), 79,64+15 ie SP low of 666.79, 24 or 12-12 or 33 ie 212 or 23.

Then there’s the Black Dahlia hit, 68 (14)years 140 days from the BD event or 68 (14) 4months 20 days later on 1-15-47 or 711 or 25-11…tomorrow is also 10-15 or 25. Also 1441 weeks 3 days from the lesser grand ritual.

Yesterday was the 37th full moon since the grand reunion and it basically opposed Mercury and Mars. This evening it moved into Capricorn where it will join the loose grand cross. The Zodiac symbol of the BD Avenger appears to be a grand cross on the Zodiac. Of course, we have already passed the pure grand crosses but maybe the 37th moon has special Mayan meaning. I have read in the past that 37 is a special Mayan number.

6 years 4 months 27(ie 117 or 14)days from the original Tebow 316 game and 3years 4-27 (779) from the 2012 version.

Plenty more stuff as well but we’ll wait and see.

Down some next week is likely Geccko, but bigger move should be the week after option expiration.

If we gap down Friday morning it’s like a short term bottom and a long setup into the close that day.

It’s 24 Aug 2015 on Lucy’s passport expiration BTW. Just passsing down the knowwwllleedge.

Good to see some people doing their homework. Just don’t spread it around please as of right now there next to nothing on the internet or youtube about it.

I also found some article about Lucy where the guy thinks it’s about Lucifer. He points out how she cares less about individual humans the smarter she gets(shoots the one cab driver for hesitating etc) and portrays almost all the humans except the scientists as really stupid or outright evil etc. Apparently the Illuminati like to make crazy movies with odd symbology.(Shrug, more likely some weird rich guy paid for it for amusement / director just weird or wanted to stir stuff up) The director did say it was 10 years in the making… also it is a pretty weird coincidence both movies happened to have figures that turned from normal human into God(At least the first Matrix alone) via technology.

It certainly has a hidden mean in the movie for sure… what the message really is… I guess that’s anyone’s interpretation? But when you add new TV shows like the one coming out called “Humans” I do think the bulk of the message is that we (they) plan on making some major upgrades to our (their) bodies with technology.

Well it’s definitely the next stage of human evolution, using our minds to exponentially evolve faster than the usual natural selection. With gene manipulation, stem cell research, greater understanding of beneficial bacteria, nanotech, and the apparently exponential growth “Internet of Things” will lend to the development of pretty much anything, the future is going to get interesting both in what’s going to be made and how the world’s going to deal with humans living to like 200 or heck, immortality could be practically around the corner for the richest. Of course, the poorest will never get close to this treatment, and it very well may be performed in secret years before anyone knows… not as a conspiracy, if I was that rich and getting something like that done, I wouldn’t want anyone to know… jealousy, fear etc.

Sadly, I can almost see why things would have to get a little more controlled with stronger tech, and there’s probably going to be some real social disruption brewing… lots of people are still violent beings and there’s too much money to be made off that. I just hope I can make enough money on the downturn before things really go bad and move to Singapore. 🙂

Yeah Bruce we normal humans (the poor one’s) won’t likely see (or have

the availability to get access too…) any technology that will extend

our lives to 200+ years. But it does talk about a 1,000 year millennium

in the Bible, so possibly the generation after us will benefit from it?

My thoughts are that we won’t make that higher high in June but will have

one last “higher high” in July sometime. Someone posted this on Twitter and I have to agree that I think we’ll see the high for the year in July, not June.

“SPX Since 1950 June has never been the high for the year and this year is typical behavior… Late June/July more likely for summer rally.”

GO SLOW on NORTON!!!!!……………ONS Jr. Market

GO SLOW on Cielo.

Looks like we’ll see a short term bottom this morning and bounce most of the day.

Short term charts are bullish but the market doesn’t feel bullish (feels bearish to me), so I’m doing nothing today.

Not much change by the close as short term chart still oversold and pointing up but daily is down.

More info or mysterious Walmart closings: http://www.inquisitr.com/2024232/jade-helm-wal-mart-underground-tunnels-conspiracy-theory-footage-inside-closed-walmart-what-are-cops-trying-to-hide/

If a gap down Tuesday morning I think we’ll bottom quickly and rally into the close and/or early Wednesday.

I think we’ll go up today but I’d like to see a retest of this mornings premarket low first.

OK, rented and just watched movie…..Didn’t see hidden clues other then maybe near end when Morgan F. says Too much power could destroy civilization but we already know that. Will try again & pay less attention to movie and watch background things!

Remember that it’s related to the Matrix movie. What was exposed in that movie is also exposed it this movie.

2nd time seen a bunch that could have meaning, guessing you don’t want it posted…..Will say though I take/see Lucy as a leader to keep hope for human survival over the money/power hunger people.

You can post all the additional stuff you found as I could have missed it?

see if you read in some of these quotes/lines, sights…

translator on phone said he studied @ International High school of NY

1st guy they try drug on, his shirt says “youth in Revolt”

Morgan F. point on Dolphin radar?

quote: Kids in Europe going to love this drug!

3 places its going: Berlin, Paris, Rome

CPH4 is like an atomicbomb in a 6th week old baby

her passport only has LUCY on it, no last name

her passport has her from Pennsylvania, USA

Morgan F. had 6734 pages of research

alot of mention/pics of China in movie

These just maybe a few things that might mean something?

“her passport has her from Pennsylvania, USA”

Top Hacker Reveals U.S. City to be Nuked in 2015

https://www.youtube.com/watch?v=7bKxymV_9uc&spfreload=1

… city named by this top hacker mentions Pennsylvania

http://www.nytimes.com/2014/11/11/world/europe/for-guccifer-hacking-was-easy-prison-is-hard-.html?_r=2

Could pull back a little in the morning but I think after that we’ll rally nicely the rest of the day to 2100+

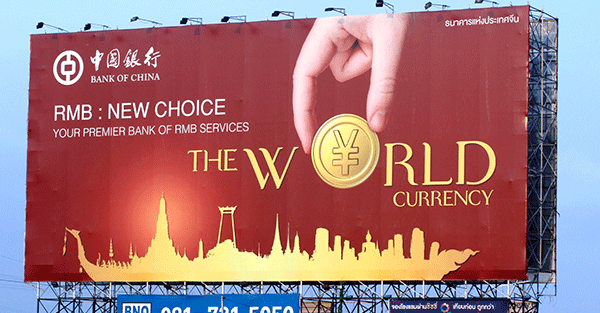

Lindsey always said the dollar would be dead. http://www.goldcore.com/us/gold-blog/gold-at-64000-bloombergs-china-gold-price/

?bac752

?bac752

LOL… another reference to the “New World Order”.

Good article: http://news.goldseek.com/GoldSeek/1433768066.php

Upside today likely limited. Will probably end the day with a doji candle or slightly up/down.

Futures look like they have more room to go down today. So I don’t expect this to turn positive and rally. Some bounce… yes, but odds say we close down today. Then early next week back up again.

Famous towers of the world: http://10mosttoday.com/10-most-famous-clock-towers-in-the-world/

Notice one is in Philadelphia, Pennsylvania?

You lost me on this one?

The capital of America is currently what?

… Washington, D.C. right?

The capital of America when George Washington was president was what?

… New York City is the correct answer.

Neo’s passport shows what city?

9/11 happened in what cities?

Lucy’s Passport shows what state?

GO SLOW on 9 W. 38th St.!!!!! 66 year anniversary tomorrow.

Oil service stocks holding on strong & moving up

ES Futures look oversold too me. I suspect we’ll bottom early today and reverse back up for a rally.

some of the oil stocks been holding up….PBR good, CHK bottoming.

Once again VXX fades not good for swing, only works for a 1 day hold!

SPY Update: http://screencast.com/t/Y3UmOcXlllQ

16767 days tomorrow (6-16) from the moon landing.

GO SLOW on Haight!!!!!! The Summer of LOVE is set to begin…..The Summer of ’42.

BDA and his cult set up shop in Frisco in ’67 to warp the minds of the incoming and blossoming flower children.

ES Futures charts pointing up nicely. Should rally today.

Interesting tweet: https://twitter.com/timseymour/status/610450357693624320 Points to August 15th

No… he said trading days.

Aka.. the FOMC of Sept 17th.

–

ps. enjoy rest of the week.

Do you have a link to that info? Thanks

I don’t understand.

The tweet you highlighted said 66 days… which simply takes us to the FOMC of Sept 17th. Nothing more than that.

–

*all the FOMC dates are listed at the start of each year.

see lowest line : http://bloomberg.econoday.com/byshoweventfull.asp?fid=466473&cust=bloomberg&year=2015&lid=0&prev=/byweek.asp#top

Just wanted to see if you had seen the actual comment by Mike Hartnett, but I guess not.

okay… I looked.

I can understand the view.. but I disagree. It doesn’t take account of capital flows, QE, share buybacks… those are the key issues.. before this bubble blows up.

Found one… http://247wallst.com/economy/2015/06/16/7-years-of-zero-rates-have-created-a-new-twilight-zone/

Soon the bear will come out, but today’s he’s otherwise busy.

Soon the bear will come out, but today’s he’s otherwise busy.

Let’s see if LeBron and his CAVS get eliminated tonight. Kevin LOVE, #42, once again injured and missing the CAVS playoff run. In his place, the Aussie has been receiving a lot of the spotlight, media attention. LOVE does have the Beach Boys connection…..GO SLOW on Sunset Blvd.!!!!! He looks like he could be part of the BDA cult.

I did recently notice that SMOKY from the Big Lebowski wears a CAVS bowling shirt. SMOKY who has a problem going OVER THE LINE. “Smoky this isn’t NAM. There are rules here.”

Anyway, tomorrow is 7-7 ie 711 but I am not too sure if anything will materialize. A component of a certain little indicator is just bouncing around in minor negative territory. Might have to wait another week. But if there is hard turn down tomorrow might have to look at the LeBron #s.

The CAVS Thrice missing in action…..#s2,23(5),42

Oops Love is now #0 with CAVS. #2 was born in Australia interestingly enough and has almost the identical birthday to LOVE though 0 is a couple of years older.

#2 is 1212 weeks 2 days old tomorrow.

Looks like some chop going into the 2pm FOMC meeting, and then up into the close I suspect.

Someone I know gave me a statistic about Wednesday’s that he backtested to the 1980’s. The stat’s are that any Wednesday of any given week only put in the high or low for that week just 7% of the time. The other 93% of the time the high or low was put in on Monday/Tuesday or Thursday/Friday.

His theory was that most of the time Wednesday’s are a “continuation” day. Meaning that whatever direction the market starts on Monday/Tuesday it goes through Wednesday and concludes on Thursday/Friday. Since we have put in a higher high today then Monday or Tuesday this suggests that Thursday (or Friday) should put in a higher high then today.

While that higher high could be just a penny or 10 points higher this does make me a little hesitate to short today into the close. The Fed’s also don’t like to be the blame for everything they created and caused. They want to be the hero for all the bad things that happen to us sheep.

Of course anyone with half a brain should figure it at that ALL wars are created for profit that allow the gangsters in the White House to act like Hero’s out to save us sheep from some big bad wolf in the middle east or wherever. The reality is that “they” are the big bad wolf and it’s all an illusion.

So we should expect the Fed’s to ACT like they are interested in our best interest in determining on “when” to raise interest rates. Naturally they will say it’s not their fault and they had to do it to save us sheep. We know it’s done to save their bankster buddies. Anyway, point being is that I find the market usually turns 1-2 days after a Fed meeting and NOT the day of the meeting.

I see the slopping down trend line on the SPY @ 215 area!

So I would guess they push it to that, then watch if we reverse or break above it

I don’t see us going that high yet… maybe in July sometime? But right now I’m thinking we rollover and head down next week as it’s a very bearish week. Possibly slightly higher tomorrow and then down? But NO new high yet.

sorry, mis typed…should of been SPY 211.5 for that downward trend line I was talking about…see pic

By the way Doug, did you figure it out? (I posted a reply down below to your question).

Yes, your explaination let me figure it out…THANKS

ES Futures look ready to rollover this morning before the open. Upside is very limited I believe. I think today will be a down day.

Well, I guess there are a lot of bear stops up here as it’s going higher then I expected.

This rally looks and feels like a massive bear squeeze and not the start of a new long lasting grind higher.

tell how more of a squeeze because flatlines @11am…then 12noon, game playing again to squeeze on low volume for the lunch hour…but no continue on last 30 minutes. Options x week is always games w/news tricks

Yeah, I really only expecting about 2110 SPX or so (+/- 2-3 points). This was a much bigger squeeze then many people expected I’m sure. Tomorrow is a tough call as it’s option expiration (triple or quad witching), and we all know how they love to manipulate it so they don’t have to pay out the put holders.

My thoughts are that if we open flat to up we’ll chop around early in the day and into the last hour or so we’ll sell off. Or, if we gap down they will find an early morning low and bounce it back up into the close to retrace most of the move down.

So on a move up I’ll look to short (again) into next week (actually I have some June 30th puts, so I’ll get more of those to bring down the cost). If we gap down I’ll look to bail out on my current puts and wait for a rally the rest of the day to decide on whether or not I’ll go short over the weekend.

I’ll probably wait as even though next week is a very bearish week there’s always bounces to get short at. So getting in on a Friday and chancing a gap down on Monday really isn’t worth the time decay in my opinion.

The short term charts going into the close today are very, very overbought. So if you are trapped short from today I think they’ll be a decent pullback tomorrow at some point to bail out at a smaller loss (depending on what you bought and when of course).

Short wise, didn’t short anything, did buy back VXX today.

Will hold into next week, want to hold longer if possible or looks correct for longer hold!

As more trouble happens in Europe tho, I see more of their money will keep moving over into our markets as their markets are on thin ice!

One thing that makes me ???? a nice correction is that too many lately again calling for one! Telling me they WANT ONE because they know & can buy for a big leg up later to come!

Short term False Crash is possible, but hard to nail just yet!

Yeah… I personally think that even if we drop to below that 2040 SPX zone to take out all the bulls’ sell stops that have been long from those multiple hits over the last several months they will stop and reverse back up into mid to late July to make a new all time high again.

I do think they will get up there near 2200 (+/-some) before a final top for this year is seen. Then down in August, and hopefully not the false flag event… but just a nice correction.

I know you follow charts,

FYI, I’m changing to follow more World Wide happenings, games played and using trend lines w/support & resistance.

Look at this chart and can see how they GAP over trendline Monday to shake Long options, then today GAP back over to shake Puts out.

It’s quite common for them to gap over resistance levels.

see on 60 min chart

they gap over 200 DMA & trendline to start squeeze

SkyNet is such a well oiled machine. You gotta love how well time the release of a possible Greece deal lines up with the need to start a bear squeeze. http://www.businessinsider.com/the-euro-is-going-bananas-over-reports-of-a-bailout-deal-for-greece-2015-6

Looks like a “pause” day. Probably sideways until the close, and then should have some small selling

Interesting http://www.amateur-investor.net/AII_Weekend_AnalysisJune_20_15.htm

SOOO many angles.

Hard to figure how to trade off it. Been trying to set up for A CRASH which failed to happen so many times.

FYI, had info this week on local stuff that got me scared…HATE hearing local stuff.

Yeah, it’s tough. I’ve been there too many times in the past where I traded off news and lost my butt. Now I just day trade and don’t worry so much about trying to catch “The Big Crash”. But I’m still very aware that one is coming.

Whether it’s this Fall or not I don’t know? I’m not as confident on a crash this fall but next June to December of 2016 I’m very, very confident that we’ll start a big crash in that period.

ES Futures update: http://screencast.com/t/vJdilo3B

I don’t see and high odds trades today. Just watching and waiting for now.

We are VERY, VERY overbought right and every time frame is rolling over. Only the extremely light volume seems to be holding it back from collapsing. We “should” tank Tuesday, but…

They could get the futures oversold by tomorrow morning to keep the down move limited, as then the futures will try to push the market up while the SPX cash will try to go down. Meaning the actual price level won’t have the mojo to drop 20+ points like it really should and instead just fall 5-10 points… and probably chop most of the day while it trys to go back up.

We all know too well how they manipulate the charts to prevent big drops. So while my analysis suggests we’ll drop 20+ points over the next day or I won’t rule out some trickery here until this Greece crap passes. Greece is the wildcard and it can be used to produce some fake out spike up, so I’m cautious here. It just “feels” like they aren’t going to let it drop much regardless of what the charts say.

ES Futures Update: http://screencast.com/t/zm1MPgma

once AGAIN…NO FEAR in the markets!

$VIX, $VXV….So VXX has falling!

What else can ya say 🙁

I think we drop tomorrow…

Ya, the one thing….SPY 2 days LOW volume and guessing squeezed a lot of the shorts out is that. As High volume would of shown new longs entering also!…Still no fear again tho!…..Do I believe?

Low volume is common for the summer time but also is a sign that there are very few “new longs” coming into the market at these levels. Of course there’s no fear until the market starts to sell off.

But my reasons for thinking tomorrow will be down have nothing to do with those factors and instead are just based on seasonality of this week being bearish, SPY up at double top zone, and most importantly a VERY Overbought chart.

The 60 minute, 2 hour, and 4 hour charts are overbought on both the futures and the cash for the S&P500 and the weakness today just smelled rotten for any breakout tomorrow. So a little bit of “gut feeling” in there but the charts really say “I’m overbought and ready to fall now”.

“…they are determined to make a new high on the SPX and DOW

as the Nasdaq and Russell already have.”

… their real concern should be the Transports!

Downside could be limited today as the futures act like they want to turn back up on the 60 minute chart. The 2 hour could go either way and the 4 hour is still pointing down, which should keep some downward pressure on the 60 minute chart. The SPX cash is still overbought on it’s 60 minute chart and acts like it wants to turn back up too.

But considering how high up the MACD’s are at on that chart I just don’t see a big rally from these levels. I can only think that today might not be that much of a down day. Thursday is yet to be known as we need to see how today closes first.

Short term charts are neutral to oversold. Shorts be cautious here as a Greek deal tonight could cause a bear squeeze.

Why Is The EU Forcing Nations To Adopt ‘Bail-In’ Legislation By The End Of The Summer?

http://theeconomiccollapseblog.com/archives/why-is-the-eu-forcing-european-nations-to-adopt-bail-in-legislation-by-the-end-of-the-summer

“not a single bank account in the European Union will ever be truly safe again.”

WOW… great article. Thanks.

I read a ways back that they were surprised the outcry was far less then then expected from the banking collapse in Cyprus

ES Futures Update: http://screencast.com/t/tdSXAFfS2X

Looks like 35.95 on TVIX may be reverse split objective if market finally corrects.

I was thinking the same thing a day or so ago when I seen the split… LOL

http://screencast.com/t/pNjy4fGskyg

adjusted for splits (!?)

Well, you know that FP is very old now… but the elite plan decades into the future so they would have known when they planned on doing this split I’m sure.

Hope you all understand THE DECAY EFFECT on TVIX.

If you don’t I will GLADLY explain.

TVIX is dangerous to hold for a long period!

Totally agree… I never play that instrument. But using it to trade the SPY is how I would do it (not that it’s part of my TA work).

Another review of our favorite pastor-whistleblower…. https://www.youtube.com/watch?v=plyp2rzWbgA

ES Futures Update: http://screencast.com/t/bsK5C09Q

The longer the market chops around sideways today the less likely we’ll see the move up to that falling trendline around 2112 (and going lower) on the ES Futures. We could fail to hold support later today and drop into the close if the bulls don’t make a move soon. I’m personally on the sidelines today as I now see now clear direction.

Today is 25000 days from the BD event.

Check out the early evening skies as Quetzi approaches Jupiter for the inevitable union.

It looks like the point of no return for Greece. Their lifeline will be yanked referendum or no referendum.

Monday is 6-29 or the 611 from the Simpson’s clock but I don’t believe that is when we’ll see denouement materialize. There is an even more clever disguised 6-11 coming up with all of the requisite astrology included.

Yes we needed Mars to enter Cancer before anything could materialize thus the markets were in limbo for a week and got the inevitable bounce based on a “positive turn in Euro-Greece negotiations” as the operators continued their game of whipsaw with the markets.

Russell 2000 and IBB did pop above the upper BBs earlier in the week putting in a doji top above them on Tuesday which is a pretty reliable topping pattern.

Greece – Banks and Stock Market closed on Monday. We will open -500 in the DOW and S&P will see 1875 this week.

We’ll be very oversold at the open. I’m expecting a bounce into Thursday. Don’t know how high, but I see the end of this week being the best time to short into the end of July.

Great minds think a like.

Last bounce before the cliff dive…

you thinking 1 day crush, then bounce Tuesday into Holiday?

Yes, this panic selling should end Monday (Tuesday at the latest), and then a rally into Thursday where I’ll look for a short into July 31st.

Larger put order expiring July 17th http://www.screencast.com/t/GdSQ2UBt7LS

Last Friday produced a 5th HO signal (Hindenburg Omen). Keep in mind, it only means a correction/crash is ‘on the clock’. For past history read: https://www.technicalindicatorindex.com/subscribers/guest-articles/Main%20Line%20InvestorThe%20Past%20Performance%20of%20the%20Hindenburg%20O%85.pdf

Red, Looks like your call of an early start to the correction( vs.the October time frame) is looking very accurate. How do you see this playing out?

I see a choppy rally into this Thursday. Then I think the next 3 weeks will be down, and down BIG!

The premarket low today of 206.81 SPY should be tested today (or Tuesday morning?) and then I think we’ll see a bounce into Thursday.

Blew right through that premarket low… LOL. Not a good time to be a bull I think! I will NOT be going long into Thursday but will just wait it out until then before looking for a 3 week short.

Looking like the set up is short for 2 weeks then I believe FOMC bounce. Distribution has been ocurring all year, so who’s gonna buy at these levels? Although all are waiting (impatiently) for a bounce, we should be sitting out til massive selling occurs for better entry point and odds. GL

Possibly one more flush down tomorrow and then a rally into Thursday I think. So I’ll be shorting this Thursday for 2-3 weeks if it works out like this?

SPX 4 hour chart: http://screencast.com/t/DOC0QwOxtpy

SPX 60 minute chart: http://screencast.com/t/qW7BHTwgNZ5