I'm going to divide this update in two parts. The first part will cover the Goldman Sachs story and what the media won't cover, or tell you. Of course I can't prove any of it too be true, but I believe it is the closest thing to the "Real Story behind Goldman Sachs". The second part will cover the usual market forecast, and what I'm looking for over the coming weeks.

Part ONE: "What the media won't tell you about Goldman Sachs"

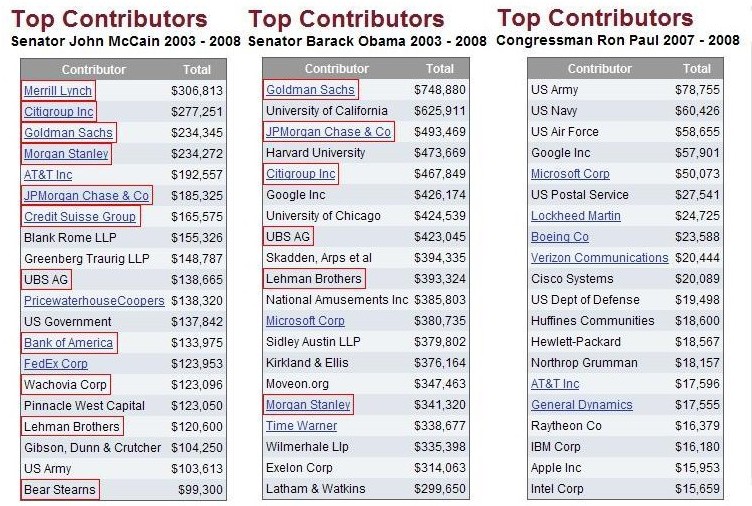

Let's go back a little on the history of Goldman Sachs, so that we can show that they are well connected, and have been behind all the crashes and rallies since at least the 1929 crash. For that, I'm going to let you re-read the article written by Matt Taibbi titled "The Great American Bubble Machine" (read or download pdf file here, from scribd). If you haven't read it, you should. It shows you how long Goldman Sachs and Company have been doing this to the American Public for almost a century now.

(I just uploaded the pdf to my site as well, just in case it disappears from scribd. I did have a hard time finding it again, as many sites took it down. Wonder why? Click Here to read it from my site. Be sure to save a copy... just 'right click' and then save).

You will no doubt-ably hear all kinds of stories about Goldman Sachs in the coming days and weeks, but what is really going on is just another way to steal the American Public's money... right in front of their eyes. Let's go over how this actually works first, and then how the scam is working currently.

The Theory Behind Supply And Demand...

The stock market supposedly works by supply and demand... right? If the demand for a certain stock, (in this example we will use Goldman Sachs as the stock in demand), is higher then the actual supply of the stock, then the price should rise as each stock certificate is viewed more valuable because so many people want to own it.

If the demand is lower then the supply, then the price should drop to a level that more people (the demand) are willing to buy it (the supply) at that price. But here is the problem with that situation... people wouldn't be able to buy and sell stocks almost instantly if they had to wait for the price to drop or the supply to become available, as some people hold stocks for years.

So, in order for the market to trade quickly, a middle man needs to be created (aka "the market maker") who steps up and provides instant buying and selling of the stock (liquidity), both when there is "too high of a demand, and no real stock available", and when "no demand is there, so they do some buying to create some demand".

Since there are so many stocks in various exchanges around the world, it makes sense to have people who specialist in trading certain stocks (providing liquidity)... who are known as "Specialist's".

How appropriate? makes good sense, right?

For example, if there is a total of 100 million shares (example only) of Goldman Sachs stock certificates issued, and only 90 million of those shares are actually in the public or institutions hands, then the remaining 10 million shares are sitting somewhere waiting to be put in circulation.

So, that means that those shares are up for sale, but maybe no one is interested in buying them at the current price. The "Specialist" has the job of trying to sell those stocks. But, if the public doesn't want them, then what can he do? He must wait for the price to fall to a level that the demand for the remain shares would be great enough for the people to want to purchase them, or purchase them himself, to create some demand. Seems simple enough... right?

Ok, now here is the tricky part... what happens when the demand for the stock overcomes the actually amount of shares available? What if this time there is a huge demand for the same stock, but still only 10 millions available, (and the other 90 million shares isn't for sale by the people or institutions that originally purchased them).

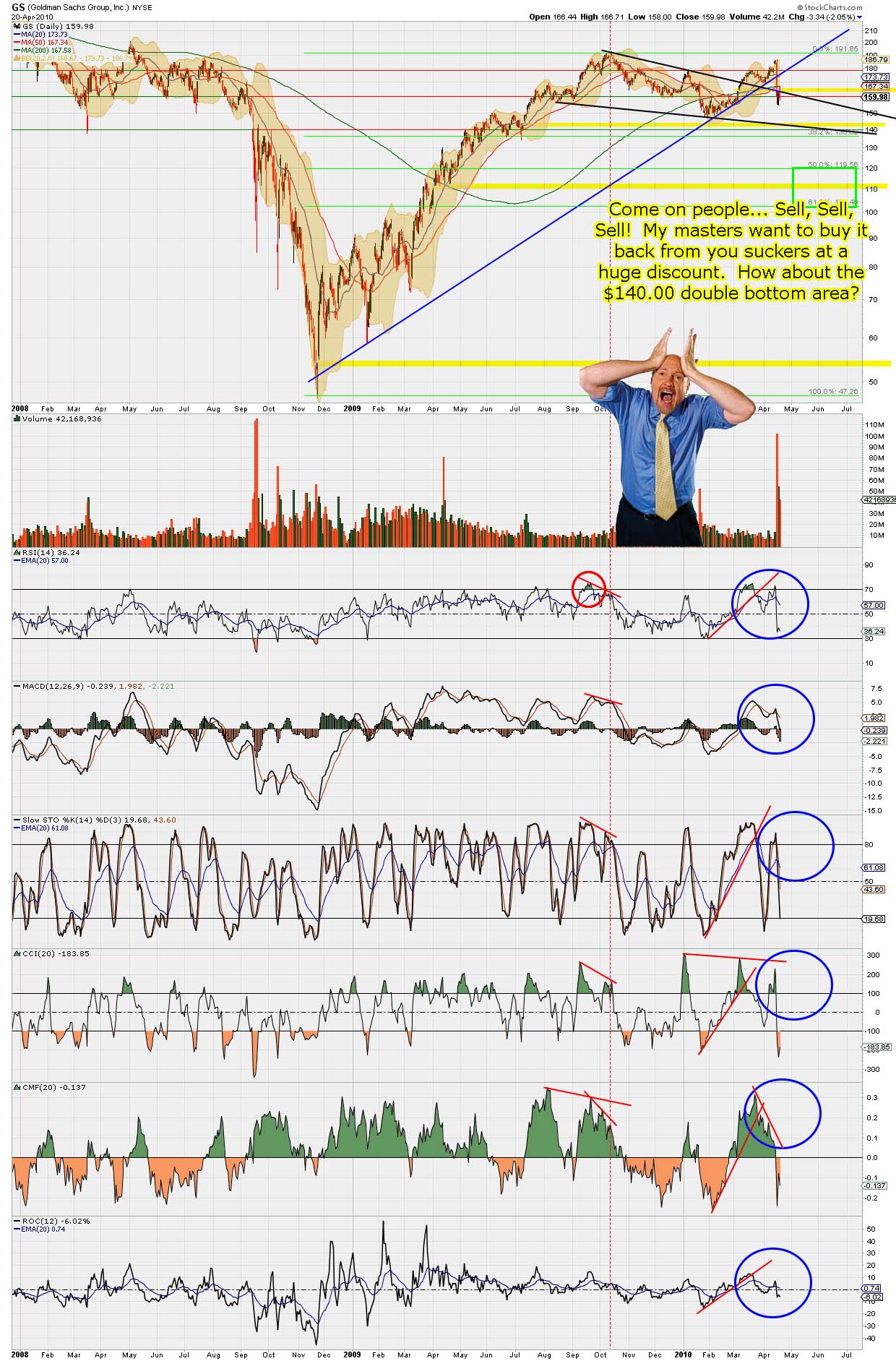

How do you sell what you don't have? That's exactly what happened during the last few months, as the market as floated up like it was on a sea of clouds. Goldman Sachs' stock also became in high demand, along with many stocks in the market too. Using this same example, what if the demand for their stock during this recent run up was 30 million shares, but again... only 10 million was available?

Here is where the "Planned" fraud and manipulation comes in...

You Borrow Shares That Don't Exist! And NO, that "in of itself" isn't illegal technically, as that is simply how you keep the liquidity in the market. The shares are suppose too exist, but you don't necessarily have to have them in your possession when you sell them. But, selling stock that there isn't any real paper certificate to back it up with, is basically "phantom shares"... which is illegal.

But, if you are Goldman Sachs, that's no problem, as you have already bribed the "Specialist" and the Securities and Exchange Commission (SEC), so you can pretty much get away with anything.

OK, so you simply sell phantom, or "virtual" shares of your stock, with the promise to put it back in the virtual vault at some future date. So how are you going to get the public to sell you back the stock you sold them at the peak of the stock market?

Simple... you create a scare in the market, the stock price drops, and you buy back the stock needed to replace what you sold at an over-inflated price, to the unsuspecting public.

Once the price collapses, many of the people in the "90 million" share group will be willing to sell their stock now, as they don't want to lose anymore money on the falling price. The supply of Goldman's stock is going to be abundant over the coming days and weeks as the price falls, (along with the demand shrinking).

Goldman will go in and buy back their stock once the market bottoms, keep the difference between what they sold it for, and the cost to buy it back, and give back the stock they borrowed from the virtual vault. That's basically the plan, and that's probably what's going to happen.

That one day fall wiped out $12.5 Billion Dollars worth of gains over the last 2 months. That's $12.5 Billion Dollars that they will basically make as a profit, minus any pointless fines the government will slap on them. How do they make a profit on their own stock when it falls over 13% in one day you ask? Simple... they don't own their own stock anymore... they sold it to the public, collected the money, and will re-buy it back at a lower price within the next few weeks, after the market finds a bottom (pre-determined by them too of course).

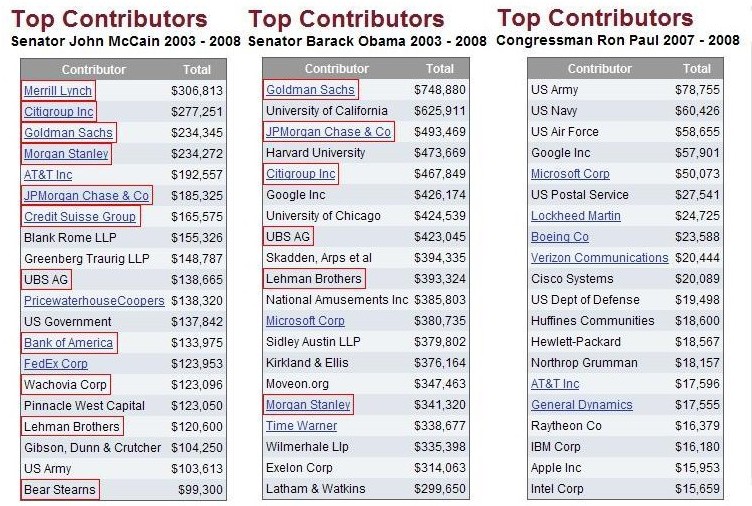

Lobbyists = Legalized Bribery

Goldman was of course most likely told ahead of time that the SEC was going to file charges, and Goldman probably told the SEC (current enforcement chief Robert Khuzami) to wait until they squeezed the last drop of cash from the retail investor, which produced the "Top" on the stock market. The SEC are bought and paid for by the 5-6 largest banks anyway, so of course they are going to do what they are told to do, or risk losing all those "donation's to their favorite charities"... the one's in their wife's' name, that they are the president of.

Yes my dear reader, the SEC will go after Martha Stewart for chump change, but turn a blind eye to the Goldman Gang. I suspect that the SEC has enough evidence to bury Goldman Sachs, JP Morgan, CitiGroup, Merrill Lynch, and Bank of America in grave that's deeper then the grand canyon. But don't count on any of it being released, as you don't rat on the person feeding you!

So why release the evidence now?

Timing, timing, timing... The Obama Administration just got through a crappy health care bill that most American's are still pissed off about. Now don't get me wrong, I'd love to see every American get health coverage. I just think that bill sucks! It forces you too pay a middle man (aka the Insurance company) to get health insurance. Other countries of the world, that have universal health care plans, pay a tax directly to the government, which reduces the cost tremendously because the middle man is gone. Their plan works, Obamacare won't!

Moving on...

Obama spoke several months ago about regulating the banks more. He had a bill that he wanted passed, but after he strong armed many of the senators and congressmen during the passing of the health bill, many of them don't support his bill to regulate the banks more.

So, how to you get that support back? Simple really... instead of attacking the banks publicly, you just expose some of their dirt to the public (which is one thing the government doesn't need to manufacture... LOL). That will of course make the public hate the banks, and then force the senators and congressmen to support your bill, as the public will demand the banks to be punished. What political official would go against what the public wants? Only one that doesn't want re-elected I assume?

Now, congress will be forced to back Obama's bill, even if they don't want too. Great move by Obama this time... I have too give him credit for that one. Of course I'd love to see the banks regulated more, but I suspect that the bill is full of loop holes, and it's designed to get the democrats elected in this years' coming fall elections, more so then regulated the banks more.

Regardless of whether the bill is worth a hoot or not, the timing is picture perfect. Of course you need to call your friends over at Goldman ahead of time, and tell them that you are going to call the SEC and have them bring charges on them, so they can finish up dumping all the shares they can to the naive public at the highest price possible. Plus, you need to get yourself positioned short, so you can make money on the fall of your own stock.

Poor Pete Rose... he got in trouble for gambling by betting against his own baseball team (supposedly... I personally don't believe Pete EVER intentionally tried to lose a game because of a bet he made. I like him, and don't agree with those who say what he did was wrong, and that he shouldn't be allowed in the Hall of Fame. Bullshit! He was a great player!)

Goldman on the other hand, can routinely short their own stock, and it's OK if they do it. Yeah right... one law for the common folk, and another law for the elite.

What Is The Current News Story On Goldman Sachs Really About?

So, now that you know the story behind Goldman and what there are really planning to do, you probably want to understand what the recent news story released is all about. It's not really all that complicated. They simply packaged together a bunch of debt, called CDO's (Collateralized Debt Obligation), and sold them... knowing full and well that they would go down in value, as the housing market collapsed. On top of selling "A Lemon", they also shorted the CDO's so they could profit from them as they fell in value.

It's no different then what they did in 2007, at the peak of the housing bubble. If you read the article by Matt Taibbi, he explains how they bankrupt Lehman Brothers short selling their stock (more phantom stock), and how they sold packages of mortgage backed securities to other large organizations and entities, knowing that the bubble was getting read to bust, and that those packages would fall in value greatly. They even took it one step further and took out insurance policies with AIG, to pay them money if people defaulted on those mortgages.

Also, they collected huge sums of money upfront when they sold those mortgages to the home owner (because many had bad credit), and then made the home owner pay the insurance premium on their own house in case of default, but the home owner wasn't the beneficiary... Goldman was! What a scam! These people don't make money honestly, with values and integrity. They make it by scamming the innocent public. A public hanging of these crooks wouldn't be justice enough to satisfy the evil deeds they've done.

So, To Sum It Up...

I believe that the Obama Gangster Gang (Obama, Geithner, Bernanke, etc..), and the boys at Goldman Sachs, got together and planned out every detail in to how and when they were going to release this news.

- They needed to wait until they had exhausted the market, and sucked in every last retail investor, producing a ridiculous 11,000 plus high on DOW.

- They needed to let enough time go by before causing the coming correction, so it wouldn't be blamed on Obamacare.

- And of course they needed to make sure the banks would profit from it too. After all, the banks paid for Obama's election... you don't really think he's out to get them do you?

Just A Side Note...

Now, as for the volcano erupting in Iceland, I hope that is was just coincidental, and not the government's HARPP machine turned on, causing the eruption... which will cause many stocks to fall as airlines can't fly, and products and services can't get delivered, etc... That will of course cost Billions of dollars in lost revenue for many industries, which is going to cause a sell off in the stock market.

I know that just about all the financial events are planned out and created by the government, so they can steal money from the public. But, I don't think they cause all the natural disasters, but I know some of them aren't "natural". I know they do have the ability to create hurricanes, earthquakes, and even cause volcano's to erupt. However, I'm going caulk this one up as just a coincidence. After all, the volcano could have just erupted when the market peaked, right? Everything in life isn't a planned event, is it?

...

And finally, Part TWO:

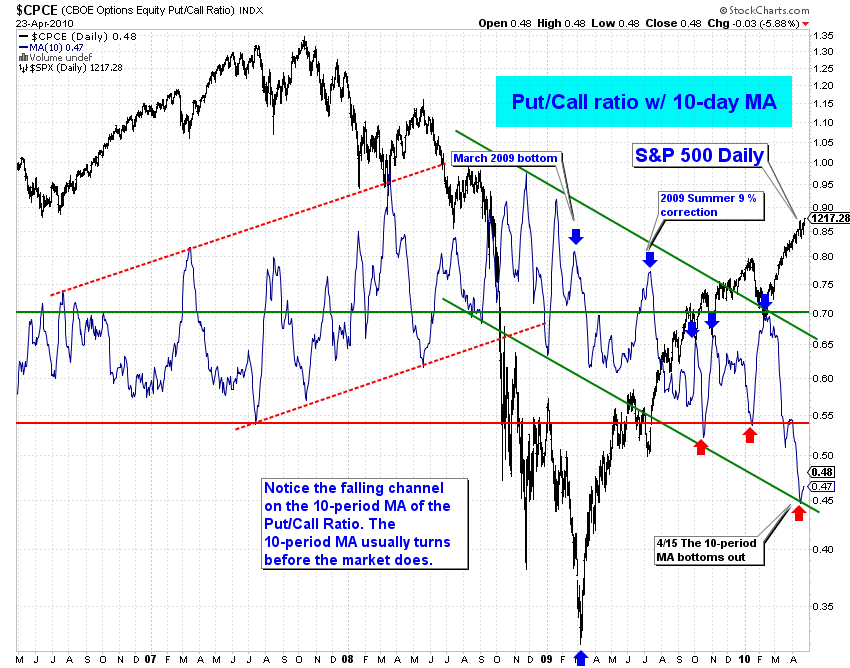

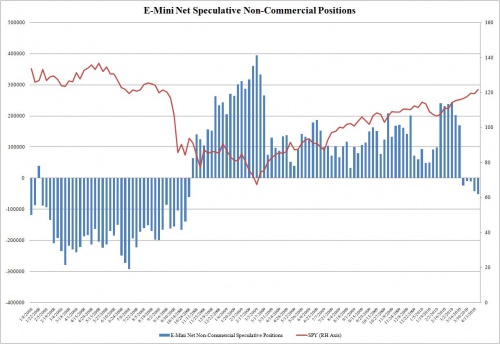

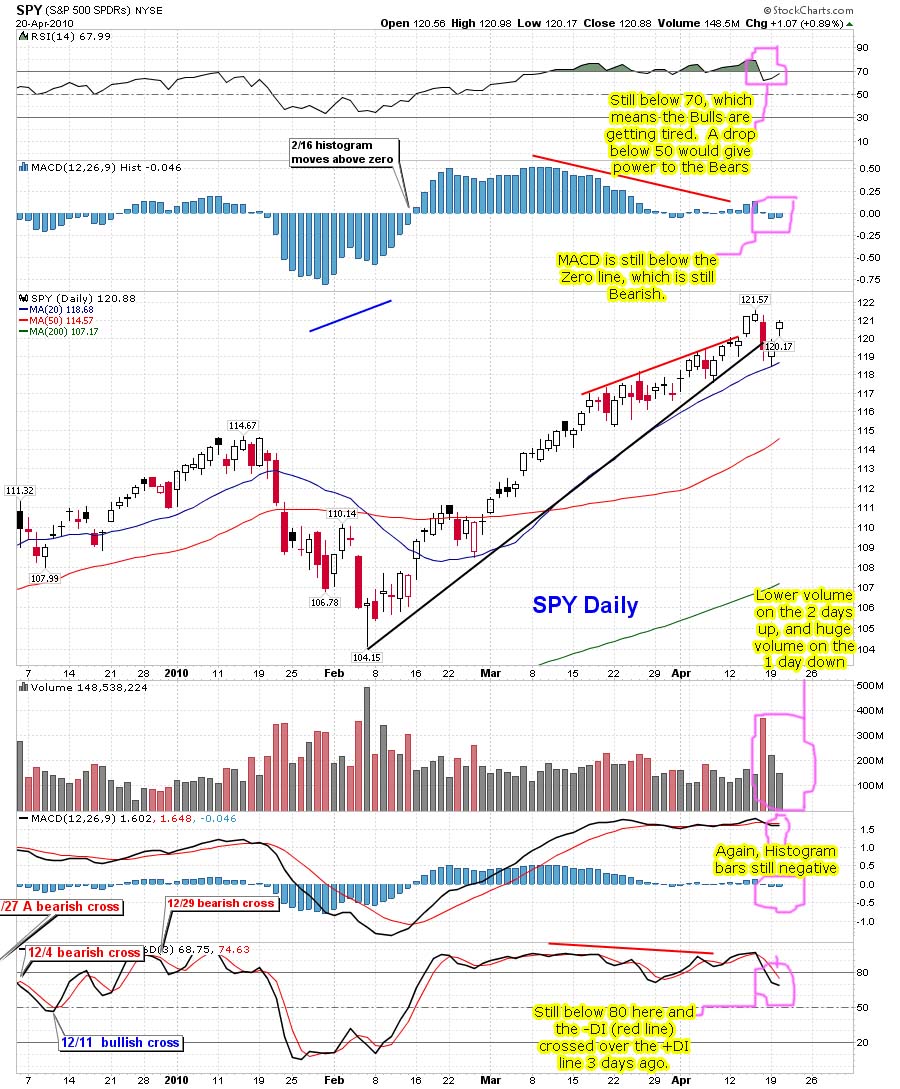

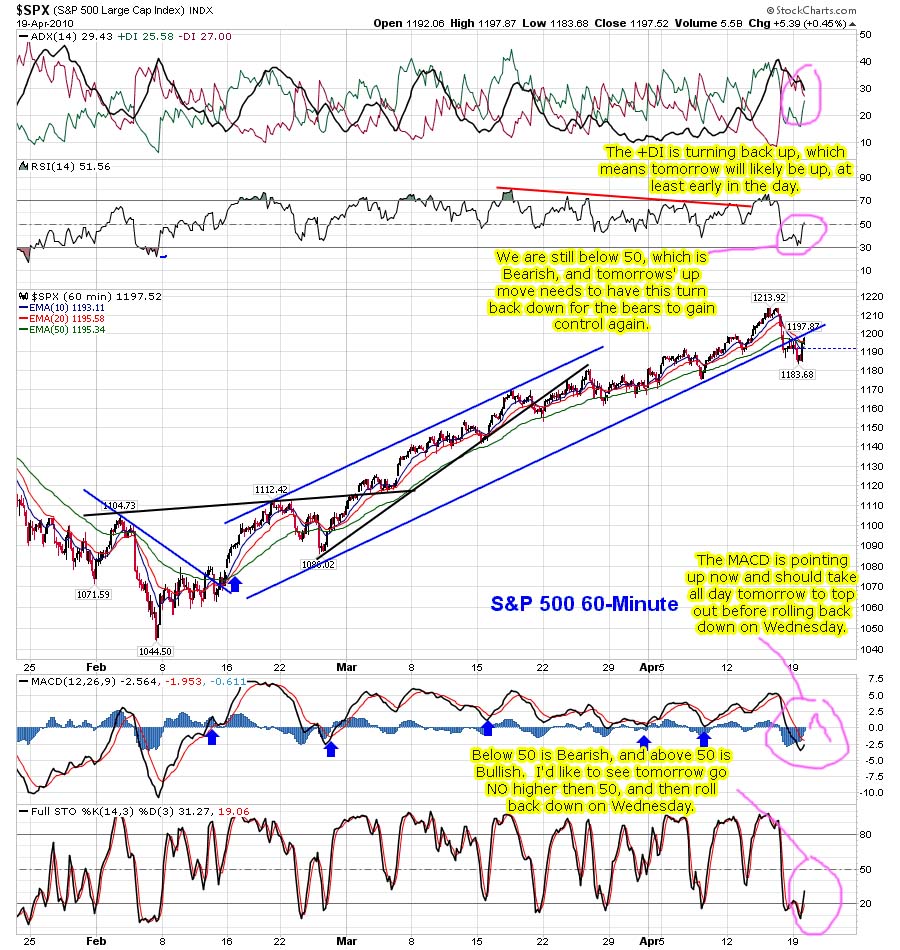

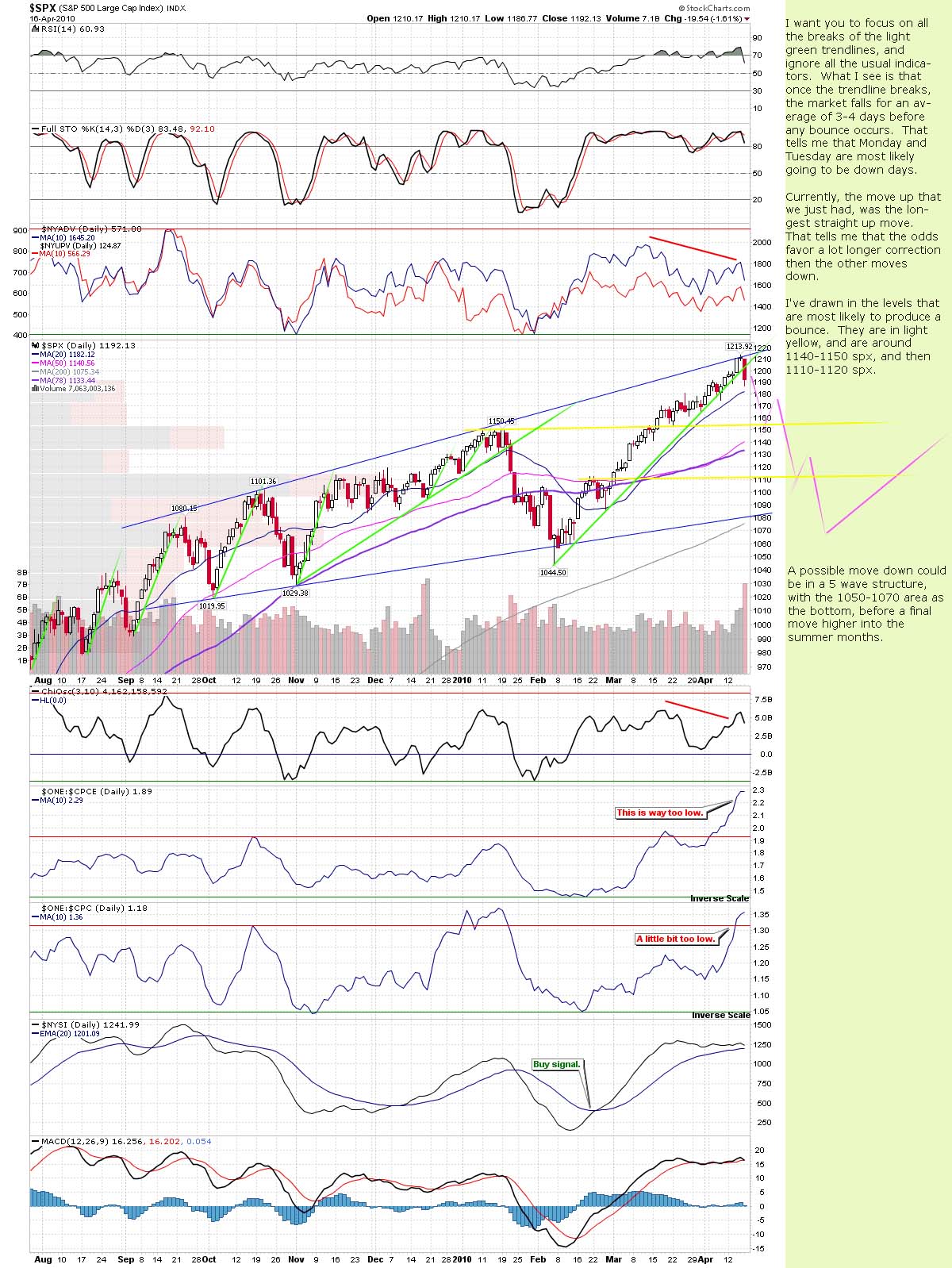

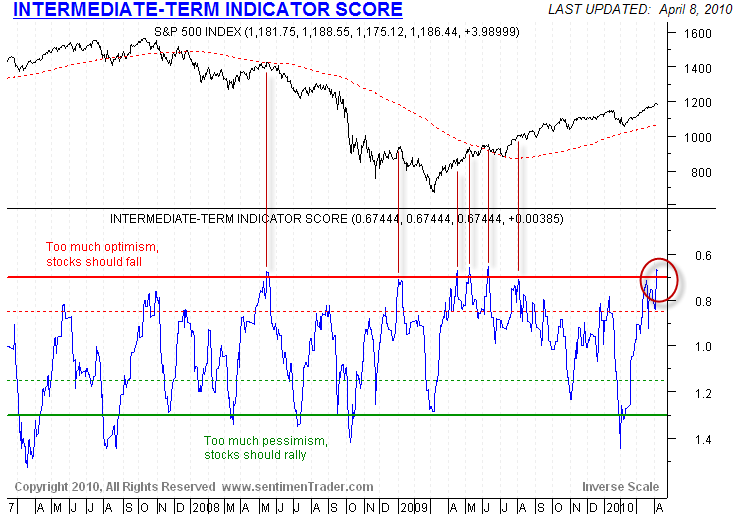

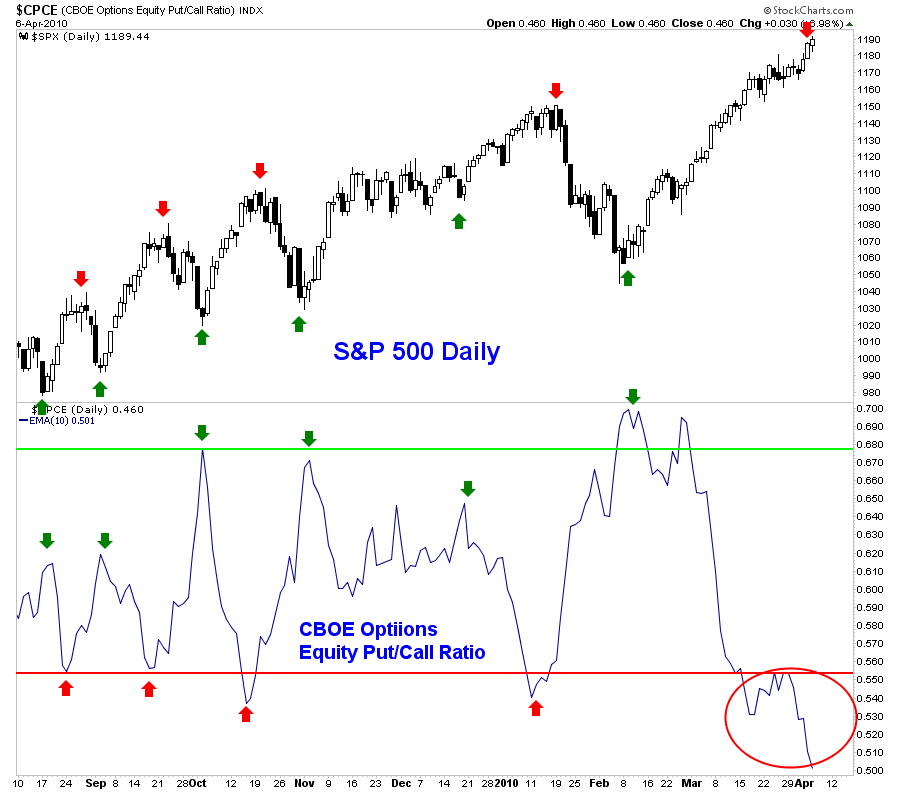

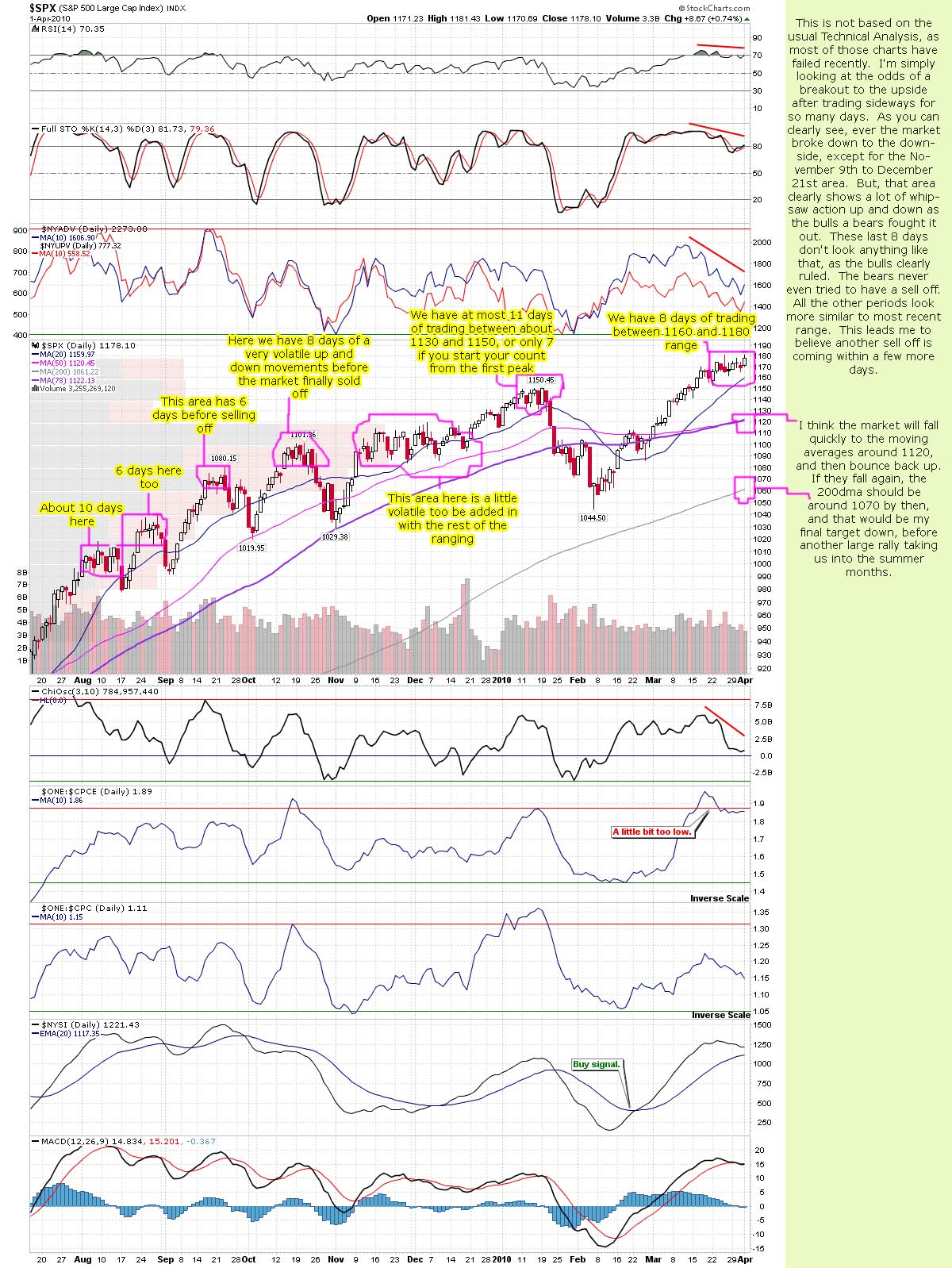

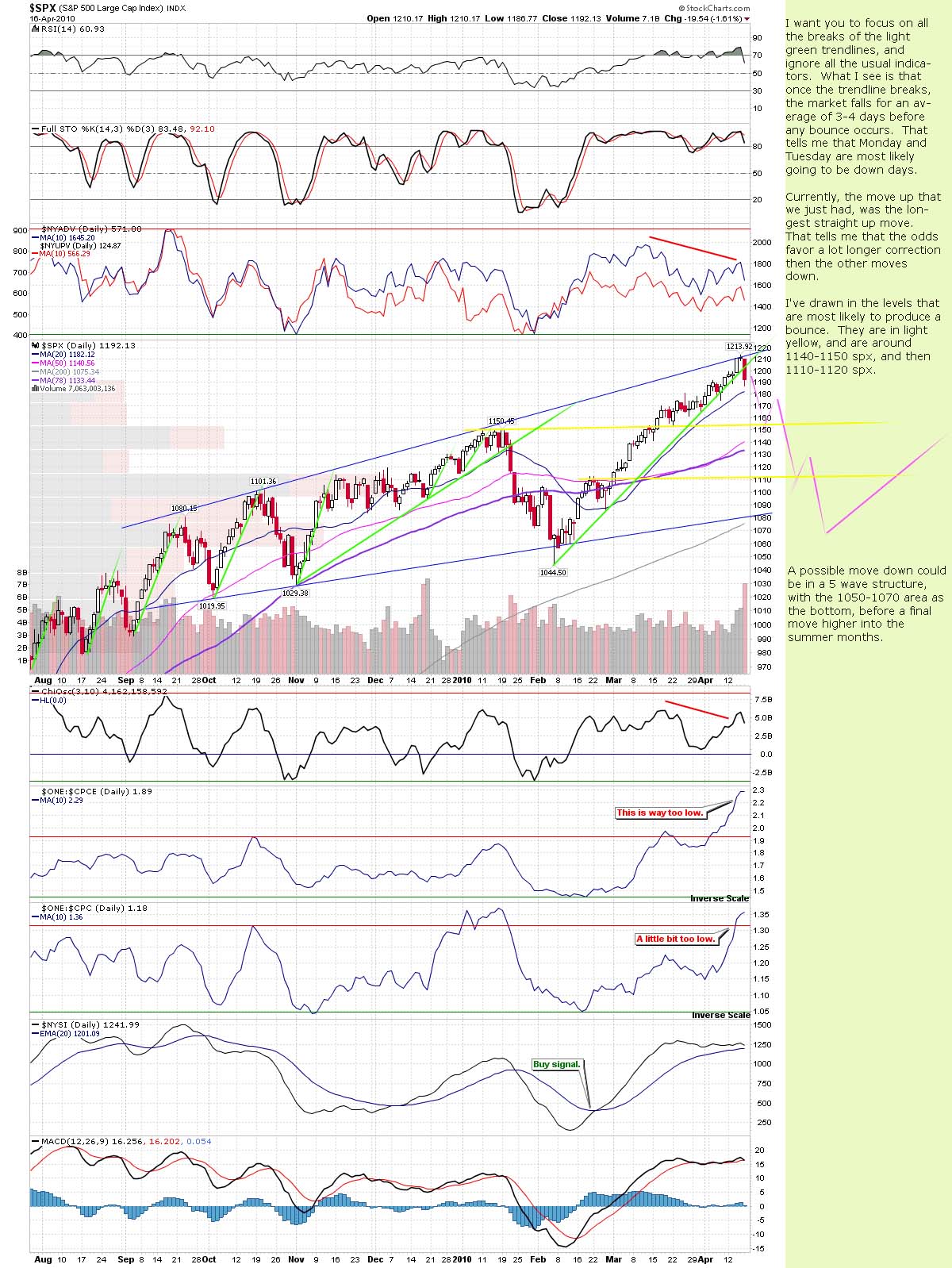

As for the market next week, I do think that the whole week will close down. I think Monday could have a small bounce up, or just a flat open, but end the day down. In fact, I'm leaning more toward a gap down open, but either way, I see the close negative.

Looking back at past history, I see that almost every time the market finally broke rising trendline/channel, it fell for a least 3 days straight before producing any bounce. While a backtest is common when the market is trading with light volume, heavy volume rarely gives the bears a chances to get short with a backtest of the broken trendline.

Here on this chart I've drawn all the trendlines for the past sell offs in light green. Notice how the market fell multiple days in a row, without any backtest of the trendline. Once the line is broken, the bears don't get a chance to get short until the largest part of the down move is over with. That's why I suspect we will fall on Monday and Tuesday, at the bare minimum. We could fall more then 3 days in a row?

(Chart from Cobra's blog, with my notes on it)

I think our first area of support is around the 50 dma, coming in around 1140 spx currently. I do think the bounce will be short lived, and a continued fall down to the 200 dma around 1070 spx is likely the finally bottoming area before the market starts back up in "rally mode" again.

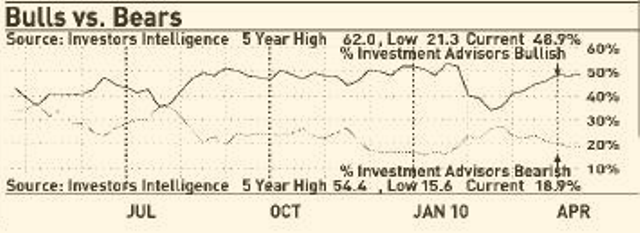

The move is likely to last 3-4 weeks, and then be over. After that, I think the market's will go back to light volume during the summer months, as it slowly grinds higher... waiting for the next staged event to be released, causing yet another sell off. What will it be then? Who knows? But you can bet your last dollar that the market will be at another peak, with record numbers of people bullish. The bear will be non-existent by then.

And of course... Goldman will profit from it too! After all, they've only been manipulating the market since "at least 1929", so what makes you think it's going to stop now? Even if you shut them down, the rats would just leave that burning building and find a new home in another one.

The more things change, the more they stay the same...

Red

P.S. These are of course just my thought's about Goldman and the market, and I could be wrong about any of it? I just try to piece it together with what little facts I find, and re-tell it in a story that makes sense. Your thoughts and opinions are welcome too be heard. After all, we still have "Freedom of Speech" here in America... don't we?