NO Post for Friday, I'll have my weekend post up by Sunday night...

Man that hurt today! I am so ready to bail on my position... that is now largely underwater, but just when I do... this market will tank! So, I really had to bite my tongue and hold my fingers away from the panic button today, as I was very close to bailing out. But, this stopped me...

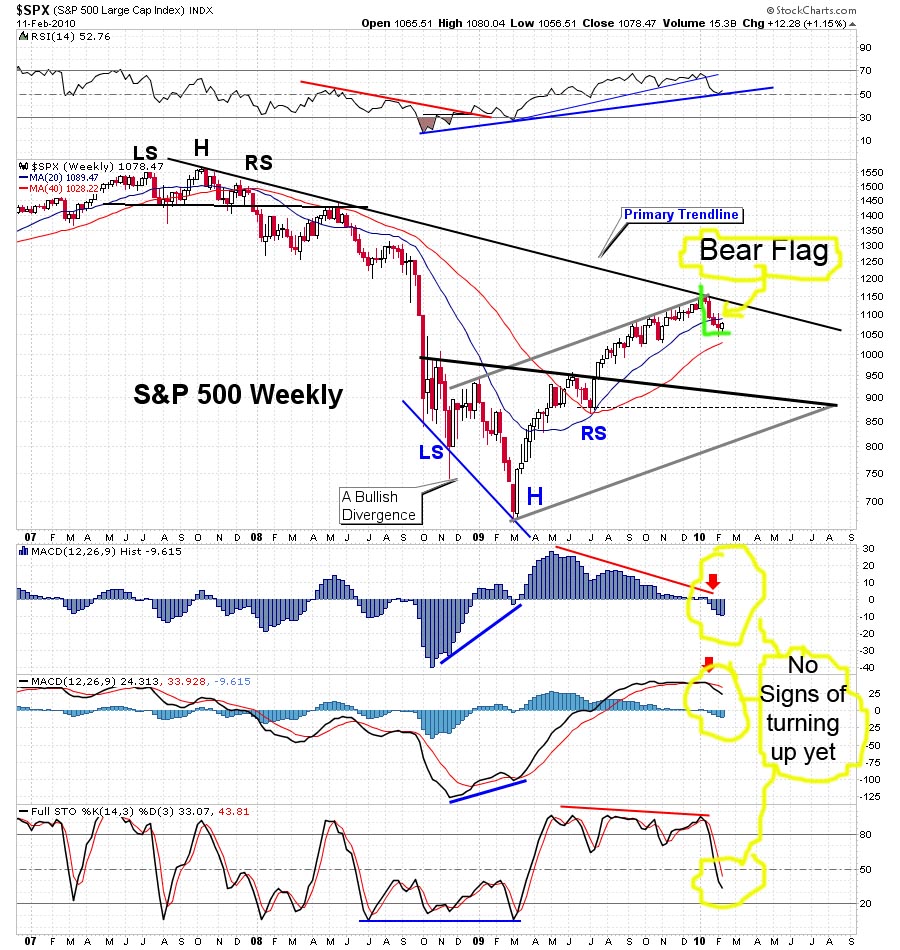

As you can see, the moving averages have rolled over and are still pointing down. This is totally different then the last 10 months or so, as they were pointing up then. This is the real deal! This market has HUGE overhead resistance pointing down on top of it. It's simply can't run up too much further. The question is... will it sell off before this option expiration? I believe it will. How far down? At this point, I think 1044 is definitely likely. The next level at 1020 will be hard to break before opx. It could happen, but I just don't know right now. That means that the 980 level has a low chance of hitting. It's possible, but odds are against it now. Panic would have to set in probably, so I won't rule it out. Remember, the market falls a lot faster going down then up.

I have now changed the Elloittwave count, as to the market still being in Mini Wave 2 up, of larger Intermediate Wave 3 down, inside larger Minor Wave 1 down. This is one of the things I don't like about EW, as you always have to change your count. Just when you think you have it figured out... Bam, it expands out to a longer wave, or changes direction.

That's why I look at the Technical Analysis first, and then try to forecast the waves that we are in. I think EW is pretty good on a larger scale, but the smaller one's are hard too determine. Ignoring EW on this chart, and just focusing in on the TA's, I see a Bear Flag from the sharp sell off on last Thursday to the 5 days of sideways to up consolidation that is currently underway.

You can also see that the UP Volume today was only 221.4 Million. Where are the Big Institutions? They didn't do any buying today... did they? It looks like they did do a Lot of Selling last Thursday... look at that DOWN Volume... HUGE! Notice that every time we had a big down day, there was also big volume. Now I know that the entire rally up from the March, 2009 low was on light volume.... but, the Monthly and Weekly charts were supporting the move, as they were both point UP! Where are they pointing now? You guessed it... DOWN!

That's the BIGGEST reason that I didn't bailout on my short positions today. Yes, I'm underwater badly on them, but the chart still tell me that a big sell off is coming... and before OPX! Notice the downward trend line that Cobra drew on his chart. As you can see, the Bulls could break through it. By the way, Cobra's link is on my blogroll, and you should visit his site, as he is excellent with his TA work.

Next up is the 60 minute chart from the chart pattern trader. Of course I've added my notes on it, (his link is also on my blogroll). You can see that the MACD still hasn't rolled over. It almost did yesterday, but it turned back up and is still going up. The Full STO is above the 80 level and looking like it wants to turn down. These indicators can sometimes remain in overbought or oversold territory for longer then you want them too... eating away at your options.

The downward channels line were broken today and that is also of big concern. Will they fall back into the channel, or is this a real breakout? I have to focus on the volume behind it, and I don't see it going up too much further. There just isn't any good news left to move it up. Low volume up moves worked well when the Monthly and Weekly charts were supporting the move, but they are now pointing down.

It's like the monthly chart is your Dad, and the weekly chart is your older brother. You are the young boy at school, and you can get away with running you mouth a little, as you have your older brother and your Dad backing you up. What happens when your Dad and older Brother are gone? Or worst, they are against you...

That's my primary reason for hanging on in this Bear Squeeze. Good ol' Dad and the older brother aren't around anymore. My only fear right now is the Daily chart below. It looks like the MACD is rolling back up. Now again... it's just like the 60 minute chart, as it too... could turn back down just like the 60 turned back up. Remember, it looked like it was going to rollover, but hooked back up today. The same thing can happen to the Daily chart. It could turn back down just as easy.

The good news is that it hit the lower channel trendline and couldn't get through it. That's called a backtest, and as you can see, this is the second attempt at trendline... with it failing both times. I'll admit that the market could continue a slow grind up... walking the trendline, and not go down until after opx. But, I really think it's running out of time, and energy. Too many resistance levels overhead, and too many trendlines from different sloping channels. This market is dying, and it just hasn't proven to me that it can stay up here very much long.

I'm not just being stubborn here folks, the charts just don't support the up move. If they did, I'd be bullish, and go long. Now yes... I'm a bear at heart, but I will trade the long side if the charts support it. They don't... at least what I'm see doesn't. The daily chart is the only chart that is still neutral, and looking bullish. But, until those MACD lines cross, I'm unconvinced. The larger weekly and monthly charts tell me that the MACD line will roll back down and allow the chart to put in 3-4 lower histogram hills, with each hill getting smaller until they crossover into positive territory.

Best of luck to all of us...

Red

I know how you feel,bailed on 50% mine around up a little from up alot

What scared me is 3 day weekend coming and option week,They will try to squeeze the shorts Friday and Tuesday,and have them go long,looking at FAS 100+dow up day and its up 50 cents,you know something is going on,

If I see anything a will let you know

Yeah, I seen that the banks didn't rally on today's move. It was all retail traders going long over the Greece bailout news. The big boys are waiting in the shadows somewhere… ready to dump, but at what level is the question?

RDL,

First time I've checked your blog. It's terrific. I will add it to my regular blog perusal. Thanks for your research and time.

Cheers,

Richard

Thanks Crowe… I try to entertain people by letting them know my trading account is now smaller then their's… LOL

If that's your idea of entertainment, I'm the Rodney Dangerfield of trading. We have a long way to go to get down to that 1000 level. I'm sitting on a 106/100/95 Feb put butterfly. I hope you're right! We're running out of time!

Well, I got a 106/101 vertical put spread, and it's at least half water underwater right now. I'm a fairly good swimmer, but treading water for this long is wearing me out.

Awesome work as usual Red. Appreciate you doing so much work for us.

Thanks Monica…

I visited Serge's site and posted a comment. He remembered me, and said that I had been there before (although I forgot). Nice short video he did… I hope he's right about 102-103 next week.

I hear ya'!

I have found that you can't really trade on EW and it was a very expensive lesson. It was Elliot Wave my money goodbye. I think it does work on big picture time frames but you can't make money with it to trade.

With that said I think we crap out before 1090 SPX and anything above that would surprise me and make me somewhat bullish.

Good Luck!

I sure hope so K… I'm really tired of all this BS! Some other have us going to 1092 and then back down. I don't know at this point. That Daily chart is looking more and more bullish as it starts to roll back up.

But, it could also turn back down just as quickly. The monthly and weekly are still point down, but that's not a whole lot of help on the short term.

We need another big default to be announced. How about California?

Fear not o red one! This thing doesn't have the volume to get there.

If I'm wrong then I'm REALLY wrong and we get a volume push higher and make our way to 1200. But I don't think so. I say we head down to 1040ish and the we will see.

I'm really looking for some bad news to come out and cause a really big sell off. When is the question? Tomorrow? Or during the 3 day weekend? Greece isn't the only place in trouble you know…

Don't think it's news (though it could be) as much as it is volume.

Still have a high volume low out there at 1044 that want's to say hello again.

Red, Nice charts and explanation. From a TA standpoint you have built a strong case. Thanks for your efforts and letting me jab at you on OBB.

No problem G… I'm really easy going. Don't let Anna fool you about all the conspiracy stuff. I just put it out. It up to everyone who reads it to decide on whether or not to believe it.

Of course I do, but I try to look a little deeper then most people, and from what I see, and find… it's all true.

Anyway… rib on! I can take it, and I'll just rib you back a little too! LOL!

You are the reason I'm long Alcoa.

nyuk nyuk nyuk.

We'll I must admit… I've had bad timing, that is true. But, there is still some time left before I drown in these shark infested waters. I will continue to tread water for awhile longer.

I'm with ya. I've been expecting this up move Tho I didn't hedge with enough longs and my puts are fu uh uh uh cked today. However, we're still in a corrective wave here, and should resume down. Soon enough.

Let's us then all ban together and form a tight circle, so that we might fight off the fatigue and not fall asleep and drown… for if we don't we surely will sink into to belly of beast known only by the name of Illuminati…

Here's the soundtrack for that: http://www.youtube.com/watch?v=-qCn4_fgKNs

Flags and pennants: http://www.chartpatterns.com/flagsandpennants.htm

Thank you for that link… it looks to me like one of the 2 on the right… Pennant or Bear Flag… in a downtrend

The whole move up from Feb. 5 looks like a flag – bearish.

Today's volume after the pop was anemic.

Agreed… that what I seen too. Nothing but retail traders buy up the Greece news. The Institutions are sitting on their hand right now, waiting to sell… but when?

Futures looking good so far this morning

Nice charts RDL, I am with you in Bear Camp….

And I bought a Black Swan Calling Whistle

http://oahutrading.blogspot.com/2010/02/black-s…

That is cool Steveo… Buy that Whistle and blow it hard! I ready for this swan too dive…

Updated post….there is an ugly swan in this weeks SPX

Posted at your site, thanks

my educated guess for tomorrow, assuming a bad retail sales report. the s&p bolts down to the lower bollinger band, also where Coldero's support pivot is at 1041. Then rally some into the close. big rally on tues

Hi Red, thanks for the extensive analysis – aside from OBB, I always pop by here to read the detailed explanation of your view…. As said, I am with you on this, also badly under water, so treating water beside you! Keep up the good work n see u over at OBB

we're getting our 6-9 point gap that i alluded to after the close yesterday

a lot of people will open bearish positions @ the open because they see a carbon copy of 2/4/2010 repeating, lightning never strikes twice in a market

here's the setup: two SPX 3 min gaps they left behind yesterday

1070.6

1073.1

the high P/C ratio that i spoke of two days ago confirms the low is in for a minimum of 9 trading days starting yesterday, we're in the 99 percentile if you want hard numbers

many people here holding bearish positions this week are in some pain, i posted a statistic that too many people overlooked, the $DJI hasn't had 5 straight down weeks in over 4 years, we are currently @ 4 straight down weeks as of last friday,

given these numbers what many of you were doing was betting on the sun not rising, little did you know that when you opened those positions

whatever method one uses in the market to form positions, without using statistical analysis to complement your other methods you are bound to get trapped into positions

You have been right so far on this call Sundancer… I'm not sure myself at this time? But, I do know that the trend has changed, and it is possible to break that 4 week series.

The reason I believe this time is different… the monthly and weekly charts. Those other time appear to be during the uptrend… when the monthly charts were pointing up.

We'll see today I guess. Thanks for you analysis, and thanks for posting it. We can all learn better as a team, and I certainly can't catch it all. Too much information out there.

Anyway, thanks again…

the time is coming for the long road to hell, (SPX 365.85) but it may take 3-7 more months

it took 12 months to form a top during 06-07'

it took 8 months to form a bottom from 08-09'

we're 5 months into sideways action originating back in september 2009

i pay close attention to ian over @ raj time & cycles for major turns

this chart may be of interest to you, keep an open mind

http://1.bp.blogspot.com/_OSfvk1xrysQ/S3LG1_CRO…

Red, Looks like you will get what you are looking for today. Good patience and confidence you have…..

I hope this sell off is real this time, but I'm only seeing a slight pullback so far… We'll see as the day unfolds today.

accordiing to “breakpoint trades” all wave 3 declines between oct 07 and oct 09 did NOT start untill the Maclellen Osc returned to the “0” zero area. that was fullfilled yest.

I didn't know that ben… do you have a link about this?

Daneric wrote about it yesterday in his blog.

its on the breakpointtrades.com site which I subscribe to. it came from Steve Nelson they have a recording everday lasting 20min or so. you have to subscribe. or can get a two week free trial as I did last fall

Yes, but wasn't it really close, like -1.3 or something?

yes it was still a bit neg. I think he ment the zero “area”

Carl Futio this morning:

March S&P E-mini Futures: The ES didn't spend much time yesterday above its last top at 1077 and then broke to 1066 this morning. This kind of action is generally short term bearish. Because I think 1041 will hold I am going to give the market the benefit of the doubt and estimate today's day session range as 1065-1080. Weakness below 1065 will mean a drop to 1045 is likely.

My comment: so the range is really more like 1045-1080.

Thanks for the update earl…

Out of TZA at roughly break even. Need to be away from the keyboard this morning, so going to be cash while away.

Sold 1/2 my TZA calls at .45. +66%

Nice trade, dreadwin. Good timing, buy & sell.

Thanks Earl! It was a very thoroughly planned out trade. I guess this is what one is supposed to do with options 🙂

Sweet, A true viagra moment!!!!LOL

Remember, I called for a maximum TZA price of 10.77. It has hit 10.76 so far. I'd love to be wrong 🙂

I put a line at 10.77. I have this position in an IRA account and I am okay holding it for a while. Nice call and I to hope you are wrong. I think the China news helps things go down today.

Haven't even looked at the news, yet. What's up?

AH China raised the reserve requirement on banks.

Gangs… the wave 3's have started. There's not going to be many spots to go short. Small bounces, and then more down moves.

I'm not going to get excited until we break yesterday's low.

how about a big bounce on tues?

Lower BB at 1037. will we hit it today? I'm selling my puts today

Ben,

Look at this chart… http://stockcharts.com/def/servlet/Favorites.CS…

It clearly shows that the MACD has topped and is now rolling down. It should continue down for 4-5 days. You can sell you're puts if you want, but I'd wait until the end of the day, as there will probably be a sell off into the close.

No traders are going to want to hold over the weekend. Be patience.

Sorry Red – just saw this. Ignore my email. It is making me very nervous though 🙂

Monica, How are you today.

And you?

Hi gocks. Just came home. My option is still heavily underwater. Trying to decide whether to sell some of it.

for those with bearish positions

this chart may be of interest to you

http://www.flickr.com/photos/47091634@N04/43515…

such a big gap down must tell you something. Normally I would think that would break the down trend retest.

Economic figure today are better than expected which support your retest. market is now recovering some…..

it's was the most profitable way to do a backtest as the operators got 1% return overnight plus they sold a ton more puts that they'll get a 100% return on in a week

Update… I'm still short.

The 60 minute chart looks like it is in the early stages of forming a Bear Flag. We need 4-5 more bars (each bar is 60 minutes on the chart) before the pattern would play out. If we continue to trade sideways for 4-5 hours, then a sell off into the close is likely.

If it doesn't happen into the close, then Tuesday morning could be a “Gap Down” day? The pattern must form first, but a continued move sideways from here would form that pattern. I'll definitely be waiting until the close today, to see what happens.

Gracias.

Monica, Still holding all my puts and position in TZa. Dreadwin nailed that 10.77 this morning.

He sure did!

Mark this moment in time, because I probably won't be accurate to $0.01 for a long while!

You never know Dreadwin.

for those wandering why the market won't die, this chart is a daily chart showing you the controlling trendline of the market

http://www.flickr.com/photos/47091634@N04/43517…

has wave 3 to the downside started yet?

Dow is over 100 pts OFF the lows.

This EW & TA has a lot to be desired

No… we are still in Mini wave 2 up, inside Intermediate wave 3 down. (see old charts)

we're back at the max. containment point for the market again

http://www.flickr.com/photos/47091634@N04/43518…

That 1080 level seems to be the key Sun. If it holds, I see lots of selling next week.

what do you mean “max containment point”

spyma what moving average

80 ma on the 60 min

very very large buy/sell programs are based on this ma

once this breaks programs will cover their short positions and then add another bid on the long side

and what do you see if 1080 holds the bulls back?

another trip down to 1070 will be in order then

Do you still see us going up next week?

up or sideways next week

all this back and forth is all manipulation for OPX next week

they've crushed a lot calls this week with time decay

the big volume spike on the 3 min @ 12:15 chart is because of the backtest of the uptrend line from last friday

Update…

The Bulls are fighting this will everything they have. If they break the 1080 level and close, then the Bears are probably done for next week.

If they get rejected again at 1080 (third time), then we should fall hard all next week, into multiple wave 3's. This up and down movement is clearly done to shake out all the bears, and bring in the bulls.

Bears Flags are still on the Daily, and now forming on the 60 minute chart (although it's not completed yet), and I won't know until the end of the day.

It's not easy right now, as these bulls have drawn this thing out way too long. Of course it's planned that way. They have to shake out all the bears. This is still just a wave 2 up, that will end soon.

Over half of the stocks in the NDX, DJ, and OEX have turned the corner in momemtum. The very short term tide is turning. The OTM Feb puts are out of time. I am long the techs and foreign stocks. Data shows that they are leading this mini rally. Based on data available for the last 25 yrs, the current setup has a better than 90% of seeing the market retests the Jan high.

The odds are against the OTM Feb Puts now. But people do win lottery, so who am I to stand in their way to untold riches? 😀

If that is true, then I must be reading the charts wrong.

Not necessary. It is the time frame you are referring to. The Jan top may very well be the P3 top as I do not expect the retest to break any meaningful new ground.

A strong rally like we had, does not die over night. The topping process may last longer than the time you have on your positions. Thus, it may be necessary to buy yourself extra time, for your thesis to work. You may be totally correct in your analysis, but it may take longer for the market to unfold. 🙂

Thanks for you input…

you're reading the charts right, just a little anxious for the big move

as SC said big moves don't die overnight

it took the 06-07' top 12 months and 8 months for the 08-09' bottom, we're currently 5 months into this top

this is so funny watching this circus

we've got a double back test now

http://www.flickr.com/photos/47091634@N04/43511…

What do you see? I see a big bear flag from last Thursdays' sell off. I see a downward trendline that is still holding back the advance. I still an upward channel trendline that holding back the selling. I see low volume. I see Full STO that are rolling over and heading down. I see the dark blue 20ma pointing down into 109. I see a triple top. I see the 61.8% fib almost being reached at 108.25. What do you guys see?

http://stockcharts.com/def/servlet/Favorites.CS…

This is so tiring. When is it going end?!

Yes, I'm so tired of this BS…

it will be interesting to see where they close the market at

we currently have 3 consecutive gap downs on the SPY which gives us 96% chance of either a flat open or a gap up on tuesday

I really hope you're wrong on that Sun, as that has me worried. Are those stats from a long term view… meaning both bull and bear markets? Or, just from the last year… during this huge rally?

9 years of data

it looks like they'll close the market between SPY 107.93 and SPY 107.15

they'll leave everyone guessing over the 3 day weekend

Well that sucks… no up or down next week, just sideway trading…

I guess I'll just have to take the 4% chance that that doesn't happen.

I agree with serge Monica… Rising wedge don't break UP! I'm staying short over the weekend. I think California will be the bad news over the weekend. I see Black Tuesday coming…

this is from jaywiz (straus) blog on Red's blog list. someone names Riza or something sent this in:

Stock Trader's Almanac 2010: Has Wed & Thurs marked bullish , but bearish Friday.

Friday, the day before President's day weekend, S&P down 15 of last 18.

Monday: CLOSED for President's Day

Next week: bullish Tuesday,

However the Monday before Feb. Expiration the Dow has been down 4 of the last 5.

Wed, Thurs Friday: down into Expiration.

Dow has been down 7 of last 10 Fridays of Feb. Expiration.

slight violation of max containment @ the close

big blocks came across the last 15 seconds

odd close for a holiday weekend, a lot of it was algos co-relational to the 3 consecutive gap situation

13-17 pt SPX gap is possible for Tuesday

http://www.flickr.com/photos/47091634@N04/43522…

SPY closed 108.38 @ 4:15 est futures closing

Hello sundancer390

Is the 390 for 390 million?

how to you come to such conclusions

numbers are derived from data mining

last night i was looking for a 6-9 pt gap based on 3 inputs and we got a 11 pt gap

the same 3 inputs gives me a 13-17 pt gap potential given the closing setup, the way to read this output is the closing conditions of the market are fertile for above average volatility of the following open

Are saying a gap up 13-17 points next Tuesday?

if there is a gap up, it will be a big one

remember the gap window from 2/4/2010 is @ 109.03

once the futures start to penetrate that area it will be an avalanche of people trying to unwind short positons

there's a 4% chance of a gap down, but it would take a monster gap down to get below the controlling tendline on the daily, http://www.flickr.com/photos/47091634@N04/43517…

until there is a gap below that trendline no selling will stick

Sun, What do you think if we gap up and fill. Then what?

if the SPY gap is above 109.03, it'll be a squeeze until 110.34 (crash gap 9/29/2008) some dancing around there for a while, maybe a days worth of dancing but that level will fall also

Sun, I concur with Dread in saying that I too have enjoyed your post this week. Thanks and have a nice long weekend.

In TZA at 10.08 after hours, starter

Holding over the long weekend

TNA closed up 2.2% today.

Volume today for TNA was normal.

The close of the market today ended this Full Moon Trade.

[ After eleven days, this trade is UP 0.8% ]

The New Moon Trade, generally a positive for TZA, has started.

RVX (VIX for RUT) spiked up at the open, then fell all day, closing 1.2% lower.

TZA has been down four days in a row, the last two days with large red candles. Overall, it looks like TZA should fall again on Tuesday.

However, the switch from one moon trade to the other has in the past shifted the momentum of TNA & TZA, so the expectation is instead for an up day for TZA.

Thanks Earl

a lot can be learned by observing by general of the bull army AAPL

while the market made new lows on 2/5/2010 AAPL didn't break it's 1/29/2010 lows, that was the first of many clues indicating the 2/5/2010 lows were manufactured

now on the weekly AAPL is at a critical juncture, it closed the week right under a dominant trendline from 9/22/2008, the weekly open on tuesday will give clues as to where the general of the bull army is leading everybody else

http://www.flickr.com/photos/47091634@N04/43525…

I clearly have not seen the big picture here, as I must be reading the charts wrong. I do appreciate your posts. You have been right on this move higher, as I wasn't.

It seems the bulls can keep pushing this until all the bears are gone. What did you think of the closing action? Lots of buyers came in and pushed the tape higher afterhours.

Does that usually mean a follow through the next week, or a fakeout?

The $VIX set a new low for the week, while the indexes did not set new highs (exception: $RUT). SPY is holding pretty solidly at these higher levels after hours. It is a puzzling divergence. I think we have a big gap on Tuesday, up or down, don't know which. I kept a small amount of TZA calls, hedged with a small amount of SPY calls.

I think you see the big picture very clear, but the big picture is on a very different time frame from which the day to day gyrations taking place.

As you continue to observe the rhythm of the market you will become more in tune with the harmony of the market, which will enable you to perform a flawless dance with the market.

The market will lead in the dance and you will follow, individuals get into trouble when they try to lead the market in the dance.

Remember the intra-day gaps I keep talking about

SPX: 1085.89, 1127.38

Those are intentionally left by the operators, so any short positions taken lower than those numbers will eventually become underwater. This all goes back to letting the market lead in the dance and you follow.

I see you use a lot of traditional TA and EW, that's not bad, but whatever method (s) you choose to use they must connect you to the rhythm of the market.

As for the bull rush into the close on Friday, it had to do with the setup on the weekly chart, closing above the controlling trendline from 10/08/07.

http://www.flickr.com/photos/47091634@N04/43530…

What just happened on the weekly is what happened this morning with the gap down, people put on bearish positions little did they know it was just a back test of the controlling trendline (dance partner).

I posted this chart right as we were ending our dancing with this trendline.

http://www.flickr.com/photos/47091634@N04/43515…

Hang in there, let the market lead the dance and good things will happen.

Sundancer, just wanted to chime in and say that I enjoy your comments.

I agree that we will have a big gap on Tuesday, and concur that it seems likely to be up. My analysis of the $VIX fractal suggests that there is a possibility that we could gap down, with the $VIX opening near the 200 day MA. This gap would be fiercely bought and probably closed by the end of the day. The next day would likely be very bullish. I think there's a good chance we see SPY 110 next week.

Some of my members had a great $$ week, including myself

My daily guidance graph has proved itself valuable

others at my yahoo group agree on FEb 16-17 high with a deep cut right after into the 25th.

March will be a month to remember, especially for Red and all other bears, me too,gg, but do watch out for those 1 & 2 day miracle rebounds which always occur in strong downtrends.

Jay

I'm glad you had a good week Jay. Mine is horrible.

Always a fun read:

http://kunstler.com/blog/2010/02/were-weimar.ht…

bear cuddle for some warmth..

GLD/SLV ratio goes up today..

have a good weekend.

I should have remember my own post from awhile back…

http://reddragonleo.com/2010/01/11/97-point-drop/

I would have bailed out when the market hit that level on last Friday. Sheesh… I need a bigger memory chip in my head. (LOL)

Exposing The Story Behind Goldman's Record Profits – Link provided below …

This is a rigged market. Leave this market to Goldman and stay on the sidelines. Goldman is sucking every speculative dollar out of the market killing both bulls and bears alike with their proprietary trading. Understand that in this monopolized game only one firm will make Money, all the remaining players go bankrupt, eventually.

I am posting this message as a community service. Stock market is not going down as Elliott Wavers claim, it is going up.

Goldman will destroy credibility of Elliott wave theory in just a few weeks by taking DOW to new high.

Please read an article titled “Exposing The Story Behind Goldman's Record Profits”

http://www.zerohedge.com/article/exposing-story…

http://www.zerohedge.com/article/exposing-story…

The market needs to go up, generally. I mean this country needs the market to go up. It's a national security issue. The market goes up, or this country goes under.

And, the government, being responsible for national security, has arranged for the market to go up, generally.

No need to stay on the sidelines. Just be aware that there will be times when the market will go up when it seems that it should go down.

There will also be times when the market will go up a lot when it seems that it should go down a lot.

It really doesn't matter why this is happening, or who is doing it. It's happening. Be on the right side of it and make some money.

Good luck in “Casino USA operated by GS”

The problem is as soon as public jump on long-side, Goldman takes opposite trade and crash market. This is how this game is being played, only one player wins.

Imagine how crooks on Wall Street collecting 150 billion dollar bonus in one year. Someone paid that money, and that amount is just employee bonus only, not total profits.

I can see from the charts that the markets are going up and down. That's all a trader needs to make money.

Everything else is noise.

your probably right. Al Capone said of the Stock Market “It's rigged”

I'm not going to tout religion, but we are in the end times, get used to it. The world is going to fall apart at the seams and after paying hell there won't be money, police, doctors and lawyers. I would estimate (guess) its about 7 years off and it will be all over. I'm not kidding.

The solution to most really bad situations is to be some where else.

Red

On shanky's charts is appears he expects a bottom to be put in Mid March

see purple and black boxes on the chart

$$ 1 SPX – Daily opex bars

there are so many lines etc on these tech charts- it's not a sign of clarity! Does it really need to be this complicated.

Red

On shanky's charts is appears he expects a bottom to be put in Mid March

see purple and black boxes on the chart

$$ 1 SPX – Daily opex bars

there are so many lines etc on these tech charts- it's not a sign of clarity! Does it really need to be this complicated.

your probably right. Al Capone said of the Stock Market “It's rigged”

I'm not going to tout religion, but we are in the end times, get used to it. The world is going to fall apart at the seams and after paying hell there won't be money, police, doctors and lawyers. I would estimate (guess) its about 7 years off and it will be all over. I'm not kidding.

The solution to most really bad situations is to be some where else.