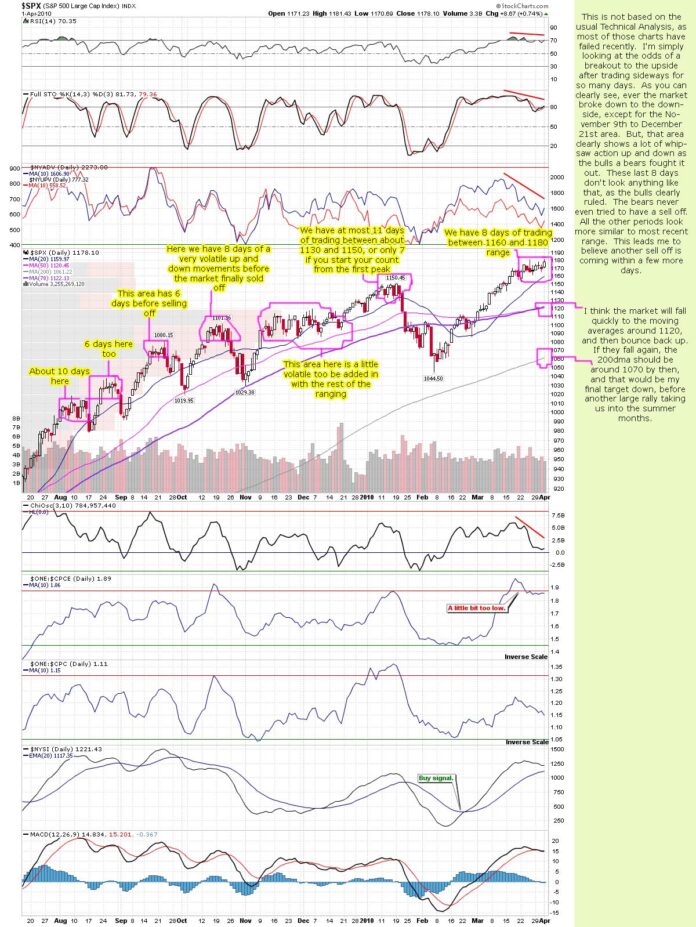

All signs point to a correction to start next week... but will the government allow it? Just looking at the chart below (found on Cobra's blog), and counting the days that we have been in a sideways channel, you will notice that the number of days are about the same as all the previous sell offs.

This is not based on the usual Technical Analysis, as most of those charts have failed recently. I'm simply looking at the odds of a breakout to the upside after trading sideways for so many days. As you can clearly see, every time the market broke down, except for the November 9th to December 21st area. But, that area clearly shows a lot of whipsaw action up and down as the bulls and bears fought it out. These last 8 days don't look anything like that, as the bulls clearly ruled. The bears never even tried to have a sell off. All the other periods look more similar to most recent range. This leads me to believe another sell off is coming within a few more days.

I think the market will fall quickly to the moving averages around 1120, and then bounce back up. If they fall again, the 200 dma should be around 1070 by then, and that would be my final target down, before another large rally taking us into the summer months.

Now, does that mean it will sell off on Monday? Not necessarily... but it could? I really doubt it though, as the jobs' number's were bad, but not bad enough to cause huge selling on Monday. Remember, most Mondays' are bullish, and without some global political event happening, I do expect another low volume day on Monday.

I think the event we are looking for is the Fed Meeting. A surprise raise in the discount rates for the banks is what I expect to be blamed for the sell off. Of course this could be the one exception, and we could have a break out to the upside. The odds are that the next move will down, and playing the odds is about all we can do in this crazy market.

I'm not going to go over all the other TA's, as they haven't be accurate lately. We all know by now that the markets can stay in overbought or oversold conditions for a lot longer then what they appear too be by using the MACD's, Stochastic, and various other charts.

Instead, this weekend update is simply about the number of days the market has trading in a range before making a move out of the range. I could see another couple days of sideways movement before any move down starts (at most).

Looking a little deeper into the past moves downs, we see...

- A rally up to squeeze out the last bear on January 19th, and then the sell off on Wednesday the 20th.

- A rally up to squeeze out the last bear on October 22nd, and then the sell off on Friday the 23rd.

- A rally up to squeeze out the last bear intraday on September 23rd, and then a sell off the rest of the day (which was a Wednesday, with 1080.15 as the high).

- A rally up to squeeze out the last bear on Friday, August 28th, and then the sell off on Monday the 31st.

- A rally up to squeeze out the last bear on Thursday, August 13th, and then the sell off on Friday the 14th.

Notice that every time we had a "rally up to squeeze out the last bear"... just before the down move started. Did we have that "rally up" on Friday? Possibly, as we did squeak out a new high... which was also done on just about all the previous times too.

Also, notice that most of the sell offs were started later in the week, with 2 on Wednesday and 2 on Friday... and only one on Monday. So, it could start on Monday... but I expect it to happen later in the week with some news that the market doesn't like.

What is the news? Who knows? I suspect the government will be at the root of the news though... not just bad earnings on a few companies. So, I'm playing the odds, and that tells me that a sell off is the most likely path next week.

Best of luck to all of us... in this Casino we call the Stock Market!

Red

When does the 10 year T-bill hit 4% Monday? fed can't have that

You will wake up Future will be down T-bills ralling,

What Int.Rate will the fed be happy with?

SPY daily containment update

friday's bullish bias was initiated with a gap over red containment

Should monday have a downward bias, it should be initiated with a gap below daily containment (117.62)

http://www.flickr.com/photos/47091634@N04/44900…

From the looks of futures, doesn't look like we are going to gap down in the morning.

for those trading the IWM

Daily containment update

http://www.flickr.com/photos/47091634@N04/44893…

for the downward thrust to accelerate IWM will need to take out the green & gray containment pts. (66.80-66.40)

here's some steak for all you bears…

$DJI de-lever tick of 10k, which should correlate to the $SPX 1078 de-leverage area

http://www.flickr.com/photos/47091634@N04/44900…

I like it! Let's get the party started! LOL!

DIA weekly contianments pts.

http://www.flickr.com/photos/47091634@N04/44905…

purple line = 109.51

High of DIA= 109.58

juicy juicy setups…

Are you saying that “if” we start falling, the lower trendline currently at 95.20 (which will rise by the time we get there) is the lower target?

What about the 10K print? Granted we could pierce through it, but even still… DOW 10k would still be around DIA 100 wouldn't it? I guess the trendline could be up around that area by then… which would make the most sense.

If 10k breaks, I don't think the market will go back up. I do think it will hold though, as those prints are quite accurate. Then we should expect a slow grind back up to DIA 118.16, throughout the summer months.

I'm just wondering if the Lega**s event will be a bottom (like it was when we hit 1045 in Feb), or a top? I think it will be a bottom. It scheduled for the week of September 10th… I believe.

Putting the pieces together… that's the tough part…

You're starting to get it Red…the market is a beautifully choreographed dance

the DOW 10k print is the indication of the on coming back test of the gold weekly containment pt. which will be in that area by the end of April

I'll be the lone bull, once we reach the de-leverage pt. The operators used the Greek BS to sucker all the bears last time. Who knows what Armageddon story they'll use this time, but mind controlled fools never learn.

The TA enthusiasts will proclaim massive H&S, EWavers will say 100% P3 this time, cycle gurus will be waiting for their infinite cycles to work. All of them will be wrong again, for the Nth time.

Trade with the regulators and you'll be around this rodeo for a while…

A quick move down to the first set of moving averages around 1115, and then a bounce back up to close April opx somewhere above that level (which wipes out the longs on the move down, and the shorts on the move back up), is what makes the most sense.

Maybe back to 1140-1150 area by the 16th? Then another fall down to 1078 within the next 2 weeks, which would definitely have lots of bears jumping on the short side.

Perfect way to clean house on both sides, and take everyone's money. I got fooled that last time, even though I caught the print (http://reddragonleo.com/2010/01/11/97-point-drop/) over a month in advance of the fall.

I didn't listen to it, and fell into the trap. That time it was their fault (as I didn't know it was real), but if I do it again… it's my fault!

I'll be going long with you, once we hit the 1078 area. However, I do expect an intraday pierce though, as the other one went to 1044.50… a little past the 1047 print.

I'll still be a bear at heart, but in a bull suit for awhile. Bears don't get fed too often you know, and I'm tired of hunting for fish in a still pond.

Thank you for the info and Red for your thoughts as well. I will be studying closely. Hope you all had a great weekend!

Carl’s morning call:

June S&P E-mini Futures: Today's range estimate is 1169 – 1182. The ES should reach 1200 in April on its way to 1225 or so.

1166.25 -1177.50 actual last Thursday (11.50 points)

1180.50 high last night

1169-1182 estimate for today (13 points)

1177 currently, so estimate is -8 to +4 from here (bearish)

Of course I would like to see Carl wrong on this call… Save that 1200-1225 for the summer months please.

All things are possible )

Here's a view of $SPX weekly contianment pts.

http://www.flickr.com/photos/47091634@N04/44927…

similar setup to the $DJI/DIA weekly containment chart i posted yesterday, unlike the $DJI, $SPX has not reached it's purple containment yet that will be in the 1191 area this week.

you'll notice on the chart $SPX back-tested max contain (teal line) in it's november low so the only back test it needs is of the gold line that will be in it's previous low area by the end of April

Sounds like a little more upside to go. Thrilling! Thanks.

So it looks like I should have waited a few more days before going short… Arrggh! I assuming here that the odds of it falling without reaching the 1191 target are slim.

Well, maybe I can get out on a dip, and re-enter once we hit the target area. It would really suck if I get out and it keeps falling without reaching the 1191 level…

on weekly containment pts. I generally allow 5 pts. slippage, so the $SPX high is a little out of the range but if things are going to fall it will start tomorrow, time wise things are really close

Thanks Sun. Feel like I have been climbing on a straight uphill incline for months.

Don't feel bad – I have been riding it short forever!

here's some really nice steak for all you bears…

$VIX gapped up while indexes gapped up…

Why was that? Hopefully you didin't forget about this chart

http://www.flickr.com/photos/47091634@N04/44935…

it gapped above it's weekly TL

Maybe the Fed meeting tomorrow will be the reason to sell? Don't know now if I want to get out on a dip and wait for 1191, or ride it out if it gets that high?

If the move likely to come tomorrow then I will probably hold on to the put spread. Is there a level that we need the market to close below today to favor the down move starting tomorrow?

I think the opportunity to get out has come and passed but I prefer that we having a raging bull day so this strength can end for a while. Hopefully Carl is wrong on the day.

You're right on that… one red 10 minute candle, and back to green we go! You snooze… you lose! I'm still short, and will have too ride it through the move up to 1191… if it gets there?

The $DJI has found it's old dance partner from Nov. – Jan.

http://www.flickr.com/photos/47091634@N04/44936…

HOD so far is right at the TL

So what are your thoughts on reaching 11,000? Nothing concrete… just feelings. I guess I mean… that based on your knowledge and indicators, do you see the market correcting from about here, or pushing on up to the next level?

Just tell me what your gut tells you about the rest of the week or month…

Thanks

price levels don't mean anything to me, containment pts. provide the structure, $DJI is @ purple containment on the weekly now so it's spinning it's tires now

$SPX high is within the 5 pt. slippage of the purple weekly contianment

I'll put it this way, I'll be surprised if the downward thrust is not initiated this week. The operators are going to bait the perma-bears good and scare the perma-bulls out.

$DJI currently has 5 consecutive higher weekly closes than opens.

The last time $DJI terminated it's weekly consecutive close sequence @ 5 was the 10/8/07 (07' high) week.

Uni-directional moves like we had in March will likely get retraced in a uni-directional manner. Then the TA enthusiasts will see H&S and what ever else their mind controlled eyes are trained to see.

The operators don't do this for free…bills need to get paid

I guess I should have known they wouldn't stop until they hit 11,000… Art Cashin needs a new hat now! LOL

The frustrating part is that once they reach that level, I don't believe they will start selling off immediately. They held 10,000, and fought the bears until they rose above it.

Just seems like they will keep going if they secure 11,000… what's next, 12,000? Or should we just go on up to 20,000? Man! The disconnect between the stock market and reality is larger then the Grand Canyon!

We haven't hit 11000 yet and I don't think we will!

At least for a few months 🙂

When the market moves against you, you need to make an educated guess if this is just part of the normal process or you are missing/overlooking something.

Situation: No material change detected. No improvement in the indicators.

If the market moves higher, than depending on the status of my indicators, if they improve, then I would have to take my losses and retreat, if they continue to show weakness and deterrioration, I will add naked May Puts.

With expressed permission from http://www.hussmanfunds.com :

“..The first crucial observation is that high risk market conditions like we observe at present come with an “unpleasant skew.” If you look at overvalued, overbought, overbullish, hostile yield conditions of the past, you'll find that the most likely market outcome, in terms of raw probability, is a continued tendency for the market to achieve successive but slight marginal new highs. While this movement tends to be fairly muted in terms of overall progress, it can be somewhat excruciating for investors in a defensive position, because the market tends to pull back by a only a few percent, followed by bursts that recover that lost ground and achieve minor but widely celebrated new highs. That is the “unpleasant” part.

The “skew” part is that although the raw probability tends to favor slight successive new highs, the remaining probability tends to feature nearly vertical drops, typically well over 10% over a period of weeks. Frankly, I thought we had begun that process in the decline from the January highs, but much like we observed in early 2007, that initial decline was quickly recovered and followed by a restoration of overvalued, overbought, overbullish, hostile yield conditions. Eventually, of course, the outcome for investors was very bad, but that in no way rescued us from discomfort as the market approached its final peak in 2007. I suspect something similar is at work at present, but we will take our evidence as it comes…”

Whenever a trade goes against me, I re-examine the indicators. I am still short oil via DTO, and here's the main reason I am still in the trade:

http://www.screencast.com/users/dreadwin/folder…

AAPL almost reaching new highs.

My new shift at McDick does not pay enough to afford the new Ipad… But I can load up on vaseline, thanks to higher minimum wage.

Well that's a good thing because you made need that vaseline to run your car!

No need to buy vaseline SC… you can borrow mine! LOL

The low today (and all-time low) for TZA was $6.66 for a couple of hours, but now the new low is 6.65.

I guess sometimes a number is just a number.

Ha ha! I guess they can't watch every index! Don't forget that news from the Fed meeting could come out today.

The day isn't over yet… it could close at $6.66?

Red,

That's probably it. Close at $6.66 and rally tomorrow.

today's higher close than open on the IYR terminated it's daily consecutive close sequence @ 6.

AAPL got it's higher close than open terminating it's consecutive close sequence @ 4

if the debasement is going to be a process rather than an event, the process should start this week with the initiation tomorrow

Anything thoughts about XLF

Thanks

didn't make new highs while everything else did today

it's got a daily containment declining and it will be in the low 16.40's tomorrow so if there is any new highs it will be limited

it needs to backtest a daily containment pt. that it broke through on 3.5.2010 it's currently @ 14.79 and declining daily

GS tested the high 169's again this morning, 1 or 2 more hits & the dam will break

If GS breaks the dam, and heads up more… the market will too. I can't see us falling without GS?

Today's move to 1187.73 spx looks very similar to moves made the last day before a fall, when comparing it to the chart above of previous actions. Each time there was a pop higher, and then a drop.

I'm sure everyone is now expecting us to get to 11k DOW… just wonder if that isn't the plan to lure in the last bull, and squeeze out the last bear?

Since it seems so obvious, maybe it doesn't happen?

the dam breaking on GS would be to the downside, i referenced the high 169's because it's where GS 2 most important daily containment pts. are at.

this mornings dance with the high 169's is hit #3

i posted this chart last week

http://www.flickr.com/photos/47091634@N04/44793…

LOL… Of course it would be! Duh! I was thinking of a different chart when I typed that, and didn't go pull up the GS chart.

I forgot that they have been selling off the last couple of weeks. I'm so used too them rising every day (like Bidu and Google has been) that it never occurred too me that you were talking about the support below, versus overhead resistance.

(Screwing my head back on now, and inserting brain… might need some batteries though?)

Let's have a vote here gang… How many of you want the debasement to be an “event” versus a “process”?

I vote for “event”!

The debasement of my account has been a “process” called margin calls, culminating in an “event” called liquidation. LOL

Mine too SC…

So, I'll see you later at Mickey D's for the 3rd shift? I might be a little late as I don't have enough gas in my moped. I'll be walking.

lol..

From the tips of your fingers to g-d's ears! Otherwise, I too will be joining Red and SC at Mickey D's! Thanks for your thoughts Sundancer.

Carl at day’s end:

1169-1182 estimate for today (13 points)

1174.50 -1183.75 actual today (9.25 points)

Carl was a bit low today

Trades: no trades today

Grade: C didn’t lose any money

Grade: C —- LOL! Hell, I'll give him an A+ for not losing in money!

Red,

Can't be grading on a curve here. No money, no kudos 🙂

TNA opened up 1.0%. Gap from $55.95 to $56.03 was not filled. TNA was up 5.7% at the high, and closed up 5.7%.

We are now in a Full Moon Trade, which tends to favor TNA.

AmericanBulls had TNA with a BUY-IF signal last Thursday, and TNA gapped up this morning, so this trade bought TNA at the opening price $56.50, and was up 4.7% at the close.

Volume for TNA today was the lowest of the last 19 days.

$RVX (VIX for $RUT) was down 5.0 % today with TNA up 5.7%. No divergence.

TNA has now been up 4 of the last 8 days. Chop generally, but today was a breakout. Good for TNA.

The high for TNA today was $59.16, the highest TNA price since November of 2008.

Ultimate Oscillator for TNA rose from 37 to 47 today. UO has been below 50 five of the last seven days. Indicates weakness for TNA. Bad for TNA.

MACD on the monthly chart crossed over downwards six days ago, but has started moving back up. Good for TNA.

Bollinger Bands for $RVX (VIX for $RUT): today’s long black candle touched the top Bollinger Band at the open, and closed below the mid line, back in an area of congestion. MACD is rising, but might be topping. Looks like $RVX might be falling. Good for TNA.

Bollinger Bands for $RUT: The large white candle for $RUT closed above the top Bollinger Band. Looks like $RUT may have topped, but need to watch tomorrow for confirmation. MACD has crossed down, but may be working back up. Unclear.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s white candle is at the top near the upper Bollinger Band. The upper Bollinger Band is flat. Looks like the topping process has paused. Good for TNA.

TNA had a much higher high, much higher low and much higher close – Good for TNA.

Money flow for the Total Stock Market was $777 million flowing into the market. Bullish – good for TNA.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, it looks ok for TNA for tomorrow, but bad generally. (Big move on low volume, general Ultimate Oscillator divergence)

The BB for $RUT:$RVX flattening out could be a bearish signal. It is actually falling — which means that if prices and volatility stay at current levels, we will get a sell signal.

Makes sense.

Alternative view:

http://www.screencast.com/users/dreadwin/folder…

In mid August we had a similar fractal. It looked like a sell signal was coming, but we had a sharp 2 day (?) drop when resulted in a $RUT:$RVX buy signal because the BBs had become so constricted. Frankly, I'd love the return of a range bound trading pattern like we had late last summer/fall.

Thanks Earl of – looks like nobody can get it right at the moment.

The Daily view from Americanbulls

TNA had been a highly reliable BUY-IF signal, was up today, and is now a confirmed BUY. TNA opened (gapped up) today at $56.50, and the buy is at that price. TNA closed at $59.16, up 4.7% since the buy.

The candlestick today Long White Candlestick (strong buying pressure).

TZA remains a Hold. **cough** The buy price was $7.04. TZA closed today at $6.57, down 7.1% since the buy. The candlestick today was a Black Candlestick (normal selling pressure).

Three recent TZA Buy signals have failed and may perhaps serve as a warning:

Buy at $7.33, sell at $7.14

Buy at $7.11, sell at $7.05

Buy at $7.04, now down 7.1%

For that matter, recent TNA Buy signals (until this last one) have also been uninspiring:

Buy at $55.36, sell at $55.43

Buy at $55.69, sell at $55.63

Buy at $56.50, up 4.7%

Summary of $RUT based ETFs & a few popular ETFs (Market positive):

Wait: DRV(-3x), SRS(-2x)

Hold: DRN(3x, up 5.6%), DIA(up 0.6%), QQQQ(up 0.5%), IWM(1x, up 1.9%), UWM(2x, up 4.1%)

New Confirmed Sell RWM(-1x), TWM(-2x)

New Confirmed Buy TNA(3x)

Market Transition:

Highly Reliable BUY-IF: URE(2x), IYR(1x)

Market Negative:

Wait: SPY

Hold: DTO(-2x oil, down 15.43%), TZA (-3x, down 6.6% )

Comment: simply astounding that DTO is a hold here, down 15%.

Comment: TZA is a hold, down 6.6%. It’s inverse buddies (RWM(-1x) and TWM(-2x) are sells. The 3 positive ETFs in the $RUT family are hold, hold & new buy. That leaves TZA hanging, looking foolish.

Comment: market more positive than yesterday, 2nd day in a row

Action for tomorrow: none

a Black Swan is coming any day now, I can just feel it.

we're going to need a trigger to get it going.

the volume today looks as low as it did at the peak in January.

I say we go side ways this week if nothing bad happens, actually something bad that isn't ignored! then next week we kick off with

AA on the 12th

INTC 13th

JPM 14th

YUM 14th

AMD 15th

BAC 16TH

GE 16TH

I may have missed some companies but my thinking is that if most of these don't move up after they report it could give the big boys the power to move the market down. Considering how overbought we are it would be the path of least resistance.

I swear though, the dumber you are the more money you can make in this marker.

“the dumber you are the more money you can make”… ain't that the truth!

I'm just smart enough to know how to lose, and not dumb enough to win… I sometimes wish I would have taken the blue pill.

Red Dragon has been calling for the market to go down every week for 6 months. Chronically WRONG

Red Dragon has been calling for the market to go down every week for 6 months. Chronically WRONG