No Post For Friday Again Gang. I'll have the weekend post up by late Sunday Night, and I'll do a video again as well. Great Day to be a Bear, and I hope you Bulls survived it and got out OK. Go Enjoy The Weekend.

A doji means indecision...

Basically, we are waiting on the job's report tomorrow. We could rally higher if they are really, really great numbers. However, I believe the numbers are already factored into the market. I think the resistance we hit above at the 200ma, will hold the market back, and another leg down will start.

But, I'll present both sides here, as there are as many bulls reading this post as there are bears, but make no mistake about it... I'm still very bearish. On the 15 minute chart we can see that there seems to be no clear reading either way? The move up from 1069 to 1105, and then back to 1100 could be a large bull flag, while the move from 1105 down to about 1092, and back up to 1100 area, could be a small bear flag. It could go either way tomorrow?

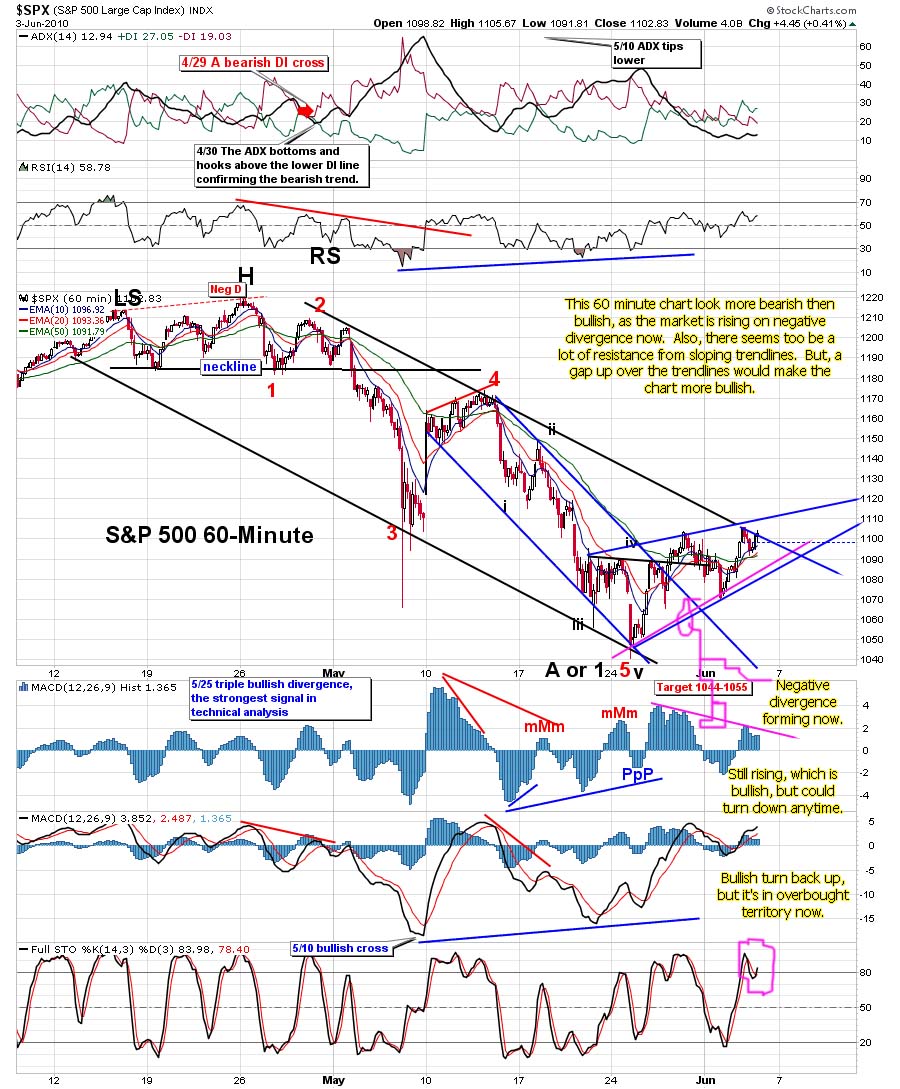

The 60 minute chart looks like it's running out of room in the downward sloping channel, but could go up a little bit more before rolling back down. The histogram bars are overbought now, but could still go higher. The STO's have turned back up, but are already at a high level above 80, which means they don't have much room left before they roll back down.

The fact that the volume was very low today, and they didn't push the market higher then the 1106 area that Mr. TopStep mentioned, tells me that they don't want to go higher. Believe me, if the big institutions wanted to take out last Thursdays' high, when we were at 1105 today, they could have done it very easily. This was all retail buyers pushing the market up today. The big boys were just sitting on their hands waiting.

Intentionally holding this market under the high from last Thursday is a key sign that they don't want to go higher yet. They tagged the 200ma on the DOW daily chart and backed off too. The 20ma is barreling down fast toward the 200ma, and will form a powerful necktie of resistance tomorrow, when I expect it to hit it.

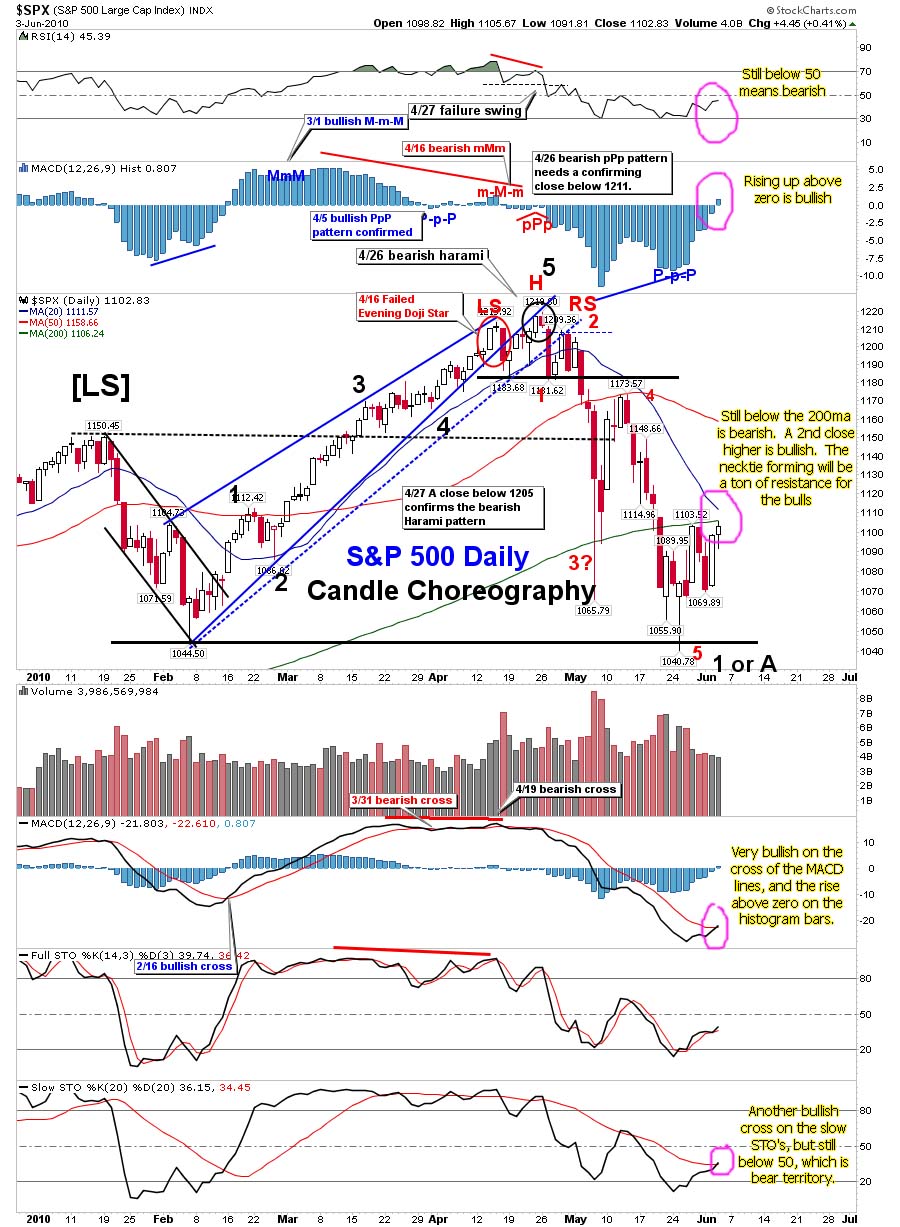

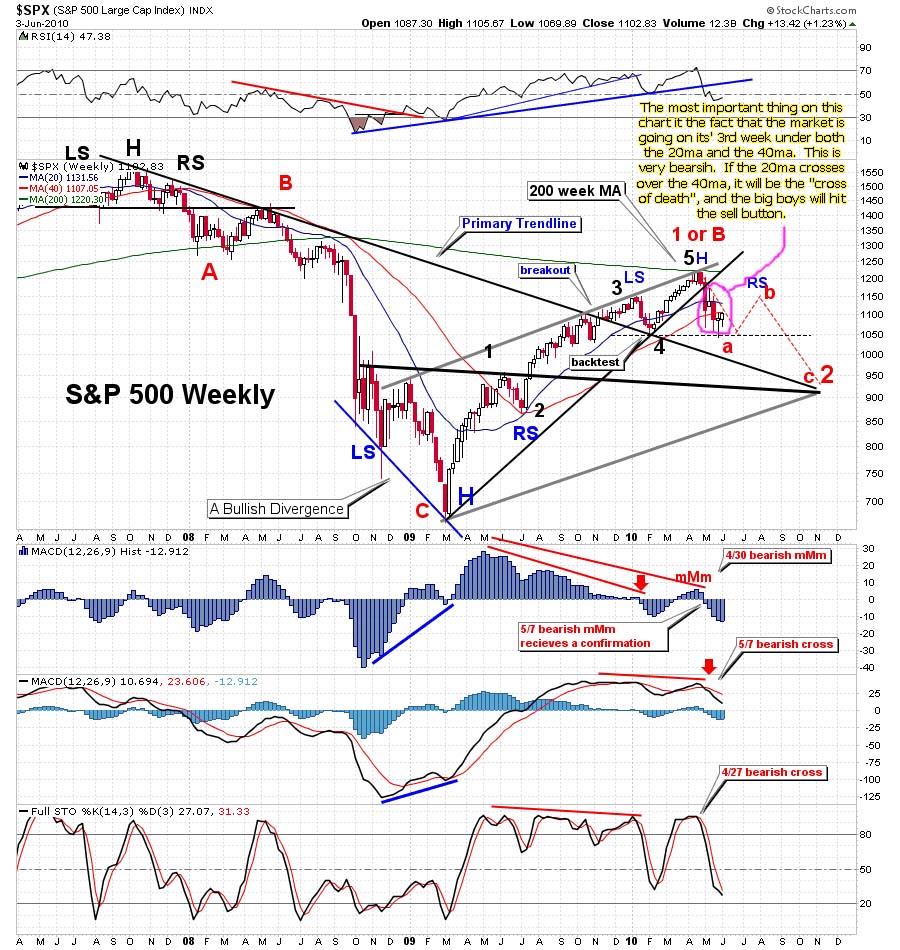

On the bullish side, the daily chart is now above the zero line with the MACD lines now touching and ready to cross over and push the market higher. But, the larger weekly chart is forming a bear flag now, if the market closes out flat this week, then next week should produce a large drop on that time frame. Remember the weekly has now spent the last 2 weeks under the 40ma at 1107.05 spx, this week could be the 3rd time under it. It hasn't been under the 40ma since the March 2009 lows. If the 20ma crosses over the 40ma... you can kiss the market goodbye, as the Bears will be eating steak for dinner.

Everyone and their brother seems to be waiting for 1120 spx from the falling channel or 1140-1150 for the right shoulder to form. Do you really think they will just let all the bulls cash in their longs at those levels, and allow the bears to get short? I don't think so. If you listen to what Mr. TopStep said... he stated that the shorts have been basically squeezed out these last 9 days. Without shorts to keep the market up, and without the big institutions buying... who's going to push it up through all the overhead resistance to make that right shoulder? The retail trader? Please.... you know better then that!

This market is heading down again... if not tomorrow, then next week will be another large down week. Rallying when you are above the 20ma and 40ma on the weekly chart is easy, as they provide the support needed to bounce off from, but rallying when you are under them is another story. This market isn't done selling yet... I wouldn't be buying into the bulls' propaganda if I were any of you reading this.

There is more bad news hiding in the closet right now, it's beating on the door to get out. Just when every bear has bailed out, and every bull is on the long train... the door will open, and train tracks will be gone as the next bridge is suddenly blown up... courtesy of Clint Eastwood and Sister Sara.

The bears are waiting patiently at the bottom of the bridge now, as the train is speeding up to its' finally destination. Last stop for the bulls to get off was today, as tomorrow they might have too jump off the train before it reaches the bridge...

Good luck to both bulls and bears tomorrow...

Red

Great post red, looks like we really have to wait and see where ms. market wants to go tomorrow.

Thanks NewBear…

First the first time, I feel like I'm the only blogger left that's still bearish. It seems everyone else is looking for 1120, or 1140-1150 for the right shoulder.

Maybe that's a good thing that I'm one of the few still bearish, as the market tries to hurt the most about of people it can…. and this time I'm in the minority camp.

LOL

Red. Let's ride it down to 980. Tomorrow's job number is gona be phony anyway.

Here's a nice chart of the Euro, showing how it's resting on the edge of a cliff (sent to me by my friend Keirsten).

http://reddragonleo.com/wp-content/uploads/2010…

Once that lower support line breaks, that's it's current resting on, it should fall hard. The 120 area is a likely target.

Exactly what I am seeing, the correlation could stop, but not likely. The only way to save Euro land is to totally tank the Euro—to .8

Daniel Estulin Speaks To The EU Parliament About The Bilderbergers…

http://vodpod.com/watch/3760835-daniel-estulin-…

The Bilderbergers are currently starting a meeting on Friday. They control the market and the economic. They create the bubbles and the crashes. You need to watch this, as your trading account depends on what they plan too do.

In this 30 minute video (the first 2:45 you have to read the text on the screen, but then Daniel Estulin speaks in English), you will learn about the Bilderberger group, and some of the things they have done in the past, with some thoughts on what the plan on doing in the future.

The most important thing you need to focus on, is that they are have a meeting on Friday. That means a big change is happening in the market within a days of the meeting concluding.

They planned the rise of the price of oil to $150.00 per barrel, and the crash of it's price to $30 per barrel, as stated in the end of the video. It happened right after a meeting concluded.

Will this time be different? You decide? My guess is that they tank the market instead of rallying to new highs. But you don't have too believe me… you can order Daniel Estulins' book and read the history of the Bilderbergers.

He states that he's hasn't ever been wrong, as everything the Bilderbergers decided to do… happened. The last 5-10 minutes are when questions are asked from the audience. It's pretty interesting, and should be watched.

The last 30 seconds shows the date of the meeting (June 3rd-6th), and some other interesting agenda's they are working on discussing in their meeting over the weekend.

EUR VS USD is forming a triangle pattern in 10 minutes chart

http://niftychartsandpatterns.blogspot.com/2010…

Red, there was the largest buying of block trades long the SPY that I have ever seen in 200 inspections. Today. Ramp to screw the bears methinks.

check out buying weakness and selling strength link on the right side of my defunct blog which shall remain open for historical purposes.

Thank's for the update Steveo…

Looks like the buying is over now, and it's time to start the selling.

turned my accounts into short futures last night…..sweet!

That's great Steveo….

Smart move.

from forexlive.com

incase you were wondering what caused the 10 s&P pt drop

(I assume this is the cause)

Comments from the Hungarian Prime Ministers spokesman (over Bloomberg) that default talk is not an exaggeration has sent EUR/CHF down 150 pips. EUR/USD has just broken below 1.21 (1.2090 the low) thus extinguisng the 1.21 barrier.

Thanks Ben, I got up this morning and looked at that and said WTF? I knew there were more skeletons in the closet, just waiting to get out.

Agree, i think the EUR issue is the key piece here

June 04, 2010

Total nonfarm payroll employment grew by 431,000 in May, reflecting the hiring of 411,000 temporary employees to work on Census 2010. Private-sector employment changed little (+41,000). The unemployment rate edged down to 9.7 percent.

LOL…

Yeah, that's the wonderful job growth Obama was talking about! Futures are loving it too… ROFLMAO!

So, what's the target today? 1068? 1075?

Hey, Red, I was thinking that the only thing that would save us on the MACD buy signal would be a gap down, and looky here.

Don't know the target for today, but I'm sure 1068 will be tested…. and possibly the 1040 area again? Regardless, we should be on our way to at least 988, maybe 944 by Tuesday. I'm just staying short, and watching patiently.

Should have added more yesterday. Now it will be a chase down.

the jobs numbers are a disaster.

Well Jim,

At least you have some shorts. Add to them on a bounce today, if you can. Monday is going to be bloody I believe.

The spiral chart gizmo seems to indicate an uncomfortable rally Monday. It didn't grade the last couple days as significant though I was sweating bullets.

Trying to make up my mind here. I am not crazy about sweating a rally to 1120-1150.

I'll probably cash some puts, but otherwise will stick.

That's fine Rip,

But I'm staying put until we hit 988 at least. I really don't think they are going to rally on Monday. Why would they? What kind of great news is going to be released to rally the market after these horrible jobs numbers?

There is a strong possibility of another huge day down on Monday. Then, if we hit our downside targets, we rally on Tuesday. That could be the turn date you are looking for.

The irrepressible dip buyers may jump in this afternoon. Well, I'll probably weather them out, seeing as I have so far.

I suspect that some dip buyers have been pension plans and the like, but also the Fed and PPT all along. They are the bagholders at this point.

When the institutions capitulate and the market lays like a dead dog with no eager dip buyers, that will be the end. I am looking forward to picking up AAPL for $199 per share and F for $9.

Obama is coming on TV again to try and save the market. This will probably be the only bounce today, so bulls should jump off the train at this time.

On Monday I expect Clint to hit the dynamite, as a gap down and continued selling is highly likely.

Are you sure about Monday? If today a down day then the June 6th spiral signal says the trend reverses.

If they hit 944 today, or at least 988, I'll bail out. Otherwise, I'm waiting for Monday. More bad news is likely scheduled to be released over the weekend, causing one very ugly Monday.

Of course, all bullish divergences on the 60min charts are secondary to global debt implosion

You're not long are you Pez?

Carl’s morning call:

June S&P E-mini Futures: Today's range estimate is 1070-1090. I think the low at 1036.75 ended the drop from 1216. I had thought that the base building process was complete but the employment number this morning knocked the market back to the low end of its recent 1068-1105 trading range. A move to 1300 is underway

1076.50 – 1107.75 range last night (31.25 points)

For the past 10 days, the over night range has averaged 21.3 points.

1070-1090 estimate for today (20 points)

1079 currently, so estimate is -9 to +11 from here (neutral)

Where is Monica today?

I bet she's swinging from the chandelier about now. LOL.

Sorry – had to come down from the chandelier! Busy with the kids. Finally, the patience pays off. Holding until Monday.

LOL… I knew you were swinging on it. Glad to see you smiling today.

YOU TOO!

Red – I don't know about 944 on Monday – but I'll take it! I am thinking that it is more likely we reach that number at the end of June.

Yes Monica,

I agree. I don't know what we will hit, but I look for a capitulation day on Monday. I'll get out probably at the end of the day.

You are going to get out of shorts???? On Monday??

Probably Jim… it depends on where we are at that time. I may wait until Tuesday morning, as it could carry over until then. But a nice rally back up should start sometime Tuesday I believe. I need to see the capitulation occur.

It could happen at the end of the day on Monday, or early Tuesday morning and then a big reversal like February the 5th was. Just have too wait and see.

my thoughts exactly.

I'm thinking it will take about a week to work down there, like it did from 1180ish to 1040.

They are trying to save the day already

Don't worry Jim, there's more selling coming. Hang tight.

Why does my account make less on down days then it loses on up days! argh.

Bulls trying hard to defend 10100

http://niftychartsandpatterns.blogspot.com/2010…

The vixes are not supporting this as a sell off. No selling conviction.

What do you mean Jim? The vix was 29.46 yesterday, and now it's up 3.10 to 32.56. That's about typical. It's not capitulation yet, as I don't expect that until next week, but it's normal.

On the vixes. I have learned that the daily has to be above 12% change either way to support a significant movement either way.

The % seems to indicate the daily intensity rather than the actual number as you point out.

VIX broke out today as far as I can tell.

I have a theory about VIX, that recent activity is not a breakdown of trend, but a consolidation into a broader and more long-term trend.

I suppose the Obama speech the other day about “good” job numbers did not work out today ………….. or did it? He knew then, what he was doing, its all a game ….. good trading to all

Talking Heads are telling the sheep to buy this low … classic

Exactly Jeff…

This is a time to sell the bounce, not buy the dip.

Once this line breaks, we should see a lot more selling….

http://4.bp.blogspot.com/_mNgsiAj3Xko/TAkDshS64…

The market is pretty oversold right now, and this bounce could go up to as high as 1092, but 1088-1089 is more likely. I expect take a few hours before it rolls back down again. I think it will sell off into the close. We need to close below 1067-1068 today, as that would likely produce a gap down on Monday.

Why 1092 Red ?

That was early today, it's not going there now. It only made it to 1089 area. Now I'm looking for 1067-1068 before the EOD.

What are the nubers based on ?

That was the 50% fib. level from the low this morning. But, it's gone now, as we are putting in a new low.

SP 500 hourly chart Bulls are getting some support from the hourly chart

http://niftychartsandpatterns.blogspot.com/2010…

San, I'd like to put in triggers to cover when that move is fulfilled.

What do you suggest, 9800? 9820?

Van Break of 10000 could lead to 9950 and 9900. I would suggest you to cover half your position when it breaks 9950 and 10000. And wait for the next. But before all that 10000 would act as good support.

Thanks, San!

We need to break this lower support line of the rising channel, and we should fall fast and hard. Should break before the end of the day.

http://4.bp.blogspot.com/_-p17nqJfPI8/TAkPralrs…

Here we come S&P 1300

mentioned that because of HFT scanning

I will not happen until the lows are retested

It's looking like we will go down to 107.50 spy, and bounce up into the close. I will probably close my shorts there and reload on a bounce.

We have MACD divergence on that last leg. Bullish?

Yes Rip,

We are very oversold, and should bounce up soon. I think one more move down to 107.50, and then a rebound into the close.

Red,

Notice how now the vixes are over the 12% range.

Even though we are oversold the in and the MACD has some positive divergence the intensity and there for the index changed quickly.

if they move above 15% you will see further escalating pressure.

You mean more selling or buying? It's looking like it's about to turn up now, and rally into the close. But, I'm looking for one more low first, around 107.50… gap fill from Tuesday.

If the vixes are negative it will be selling

just hit 15%…what are you expecting?

Matt at Breakpoint trades has this to say about MACD but an hour ago or so………..

The 5 min bear flag played out that I posted …

Posted by: matt on the 4th of Jun 2010 at 11:56 am

The 5 min bear flag played out that I posted earlier, there is now some positive divergence via the 5 min SPX chart and MACD, although it is a small divergence and it is still early in the day, plus the MAs are far apart from one another, so at best I think it will chop around today, and probably needs another intra day low and some sideways action. Also the MACD is so far below zero which is not good

Matt and Steve are the founders of Breakpoint

all I can say is what they say below

” so at best I think it will chop around today, and probably needs another intra day low and some sideways action. Also the MACD is so far below zero which is not good”

I have my feeble put. I was about to shoot Presevento and Bam but maybe they are correct. I do remember Pres…. saying that things would start (Might get started June 2 but probably June 4 and ???get going 7&8. So I'm hoping for big downside monday tues

Maybe china tanks, it's near 9500, It's been a while since we've had bad Euro news (execpt Hungary) Euro is in a precarious state, could be forboading bad news soon out of Euroland.

I'm just thinking out loud.

I got what I want, so I'm going to stick with my put which expires in two weeks.

HUGE sale of SPY, 3 million shares at $107.88. Think that's about it?

We need to hit that gap fill at 107.53 spy today, before a big bounce into the close

Mr. Topstep…

http://www.youtube.com/watch?v=z7XHiag6Q-Y

what's topstep got to say? can't get it from here

Just what I just posted, that there isn't any buyers stepping up to buy over the weekend.

No buyers stepping up in front of the weekend, so I suspect we will find a bottom and trade sideways into the close. Monday could rally up to work off the oversold conditions, but that's assuming no more negative news comes out and gaps down the market.

We have a new low and vix is almost 16%.

Unless the vix changes soon we sell into close heavey. If vix starts turning we will flatten out the day.

18%!

It's looking more and more like we will sell off into close. A 100% trend day we have now. Who's going to step up and buy going into this weekend?

Vix broke 16% .now think we have a 60/40 shot at going to -20%.

if it does s&p will see 1068 or below

Thanks Jim,

I think you are right and there will be some panic selling into the close.

There is no possible good news over the weekend. Monday will continue this after a short possible reprieve.

Tuesday i just do not know. The charts are going to look very bad.

Agreed Jim…

I wasn't looking for good news either, just didn't know if they were going to release anymore bad news and cause a gap down in the morning.

I've been running in circles in the room with my hair on fire, hoping my put will increase in value

Concidering the “prophecies” of Persevento & Bam, who think that next week (esp. Mon & Tues for Pers.) we get heavy bearish action- I bet some banking flatulance eminates from Euro land

We've done Euro to petrodollar and Chinese newspaper swaps… nothing to be concerned about.

Dow 9800 here we come. I'll finish covering there.

Bought some TZA at a pretty high price before this last drop, hope it works out.

I have a lot of tza typ drv and spxu and vxx. in my core. Things are looking good.

Its a good day.

Had SDS which was a bit poky. Going heavy on SPXU for next leg, and some AAPL puts if I can get a good price.

VXX could be great, I think it could go to 90.

I've heard Toni Hansen and Cramer talk of “they better get a rally going by 3pm or this is going much lower”

at 3:03 we got a 4pt pop on the s&P but nothing to write home about.

I hope steady drop today and panic on Monday/tues?

I'll hold on to my put and wait till Monday and see what happens.

Vix just broke 20% this ain't over yet.

I do not see how they can rally this but it sure looks like they are going to try the last 30 minutes

I don't thinks it's going to rally much Jim… more like “hold” the current support level.

Maybe Iam wrong. That pause made me wonder if bulls found balls. But it may have been a steer. Please forgive Wyoming humor.

Last half hour should rock. I think Dow 9800.

Could finish first thing Monday.

I will close out some of my shorts before the close today, and let the rest ride into Monday. I'm not sure what will happen, as we could gap down first and then rally up to work off the oversold conditions.

Or, we could gap up and then sell off again? I'm leaning more toward a gap down, and then a squeeze… with more selling into the rest of the day. That's why I'm going to keep about 80% of my shorts over the weekend.

Monday should be a big rally, sort of makes sense if we hit old lows.

I rising wedge on Dow says 9800, so I am cleaning house there.

Bull flags on ETFs say we are close to top.

That's exactly what all the charts say Rip, but I don't trust the charts right now.

It needs to hit 1044 before any rally.

This will not rally on Monday IMO. Too much fear building now.

Red, maybe you should put up the crash sign again sunday…Monday will be fun to rideit…

Maybe Al… but I might jinx's it if I do. LOL

Gang,

Many retail bulls are going to go long here expecting a big rally up on Monday. What if they are wrong? There is a reason the Bilderberger group is having a 3 day meeting over this weekend.

It's because they want the bulls money. I wouldn't trust the technical's right now… even though we are extremely oversold. We can be even more oversold, just like how we were extremely overbought on the rally up. The same applies on the downside too.

People may be looking for 1040 for a bottom, but I would bet that it starts around 1050. Spiral charts is projecting a big rally Monday, and after that no rallies until the market is toast. Sounds reasonable to me.

I am covering at Dow 9800 and will not go long, but will build inventory through Monday. Will make sure I am fully loaded by 3:00.

Betcha by the time next week's over the term 'dip buyer' will have vanished from Investopedia.

Yeah Rip,

I'm not ruling out the possibility that Monday could rally up at some point, I just think it will gap down first. To what level… I don't know yet?

But I suspect that a lot of people are looking for a rally… hence that's why it will gap down first. Fool the bears by not letting them in on a bounce, and fool the bulls that went long expecting a rally.

We are oversold on the intra day but we are far from oversold in the daily and especially the weekly.

Exactly Jim…

That's why I'm leaning toward a gap down first, and some type of rebound back to work off the intraday (15 and 60 minute charts) oversold conditions.

It may only bounce back to a 50% fib. level from the open to gap down low, or it could just trade sideways for awhile to work it off? That's why I stayed 80% short.

Buy algs just kicked in

Still short. Probably crazy and stupid.

I stayed 80% short Monica, so have faith.

a few of us are crazy yes, going long would be stupid

Carl at day’s end:

1070-1090 estimate for today (20 points)

1059.25–1088 actual range today (28.75 points )

Carl missed the low by 10 points, but was within 2 of the high.

For the past 10 days, average actual range has been 25.75 points

Trades: No Trades today (not a bad day for a Bull to stand aside)

Grade: C (lost no money)

In the past 10 trading days, Carl has taken just one trade, a loss of 4.75 points.

You know Earl, Carl is pretty smart to not take any trades right now. The market lots pretty ugly.

Red,

Carl sure doesn't feel compelled to trade every day, or even every week. There is something to be said for waiting for a good pitch.

On the other hand, Carl just barely trades more often than my dog Abby. And, in the past month, Abby (no trades, no losses) has done better than Carl. Makes you think 🙂

LOL… Cash is still a position, and a safe position at that. Good luck to him, as this market takes no prisoners.

LOL, before I asked you about the identity of Carl a little while back, I thought he might have been a pet or a child.

The market is a cruel beast. The only reason I'm in it is gambling my father's life savings in order to pay his nursing home bills. Gamble or watch the money drain away, that's the choice. He is pleased at how I'm doing.

I'm glad you're winning 🙂

Now I need to go back though your posts to see what kinds of trades you get into. Homework.

My most lucrative have been AAPL put options, of which I haven't any right now, due to the premiums. I also made some good money on SDS call options.

When I was a bull (before April) I liked undervalued midcaps with good earnings. That's my usual thing, not the 'name' stocks.

I like these 3X ETFs, may never buy another stock again unless it's something I really like.

for you RDL, since you turned me on to these

today: http://www.screencast.com/users/alphahorn/folde…

5/27: http://www.screencast.com/users/alphahorn/folde…

LOL…

Thanks Alpha… I forgot about that print. It's seems like it worked out like a charm. Let's keep our eyes out for more.

The one most basic point the experts and bulls are missing while evaluating these markets is related to future earnings and PE ratios in valuating the price of a stock.

What they all forget is the historic valuations are not applicable when hyper inflation kicks in.

If a PE ratio of 15 is moderate in normal times what price and PE is acceptable in periods of high inflation? I would maintain that ratios in the 6-10 range may be the norm as acceptable in such an environment. Therefor where will the market go to achieve those new norms? Well i believe prices will have to drop close to 50% and possibly more.

The definition of inflation is the increase in money supply. Price increases that we deal with on a daily , monthly basis are merely a consequence of inflation and those consequences may not have shown their ugliness as of yet.

Intel may be a great company and at a price of 21 and a PE ratio of 19 under old rules it may be fairly priced against future earnings. But not if you are in an environment of 18% inflation such as the Carter years oif the late 70's. many of you may be too young to remember of know what interest rates were during that period.

Just food for thought.

We are now in a Full Moon Trade, which tends to favor TNA.

This trade owned TZA today. AmericanBulls had TZA with a Hold today, which means no buying & no selling. TZA opened up 7.9%, and the opening gap was not filled. TZA was up 15.8% at it’s high, and closed up 14.9%. TZA closed at $7.55, with this trade now up 6.6%. AmericanBulls has TZA as a Hold again for tomorrow.

This trade also owned TNA today with a Hold, which means no buying & no selling. TNA opened down 7.8%, and the opening gap was not filled. TNA was down 5.2% at it’s high, and closed down 14.7%. TNA closed at $41.90, with this trade now down 12.2%. AmericanBulls has TNA as a quite likely Sell tomorrow.

Since this trade owned both TNA & TZA today, today was roughly a wash.

TZA gap from today ($6.57 to $6.92) remains unfilled.

TNA gap from today ($49.17 to $46.60) remains unfilled.

Volume for TNA today was 23% above it’s 1 month average.

Volume for TZA today was 5% below it’s 1 month average.

$RVX (VIX for $RUT) closed up 18.3% with TZA up 14.9%. No divergence.

TNA closed today as the lowest close in over 3 months (Feb 12th). Bad for TNA.

TZA closed today as the highest close in the past 6 days. Good for TZA.

Ultimate Oscillator for TZA rose from 39.7 to 51.6 (+11.9) while TZA was up 14.9%. No divergence.

Ultimate Oscillator for TNA fell from 56.6 to 44.4 (-12.2) while TNA was down 14.7%. No divergence.

TZA MACD both lines are > 0 and rising. Good for TZA.

TNA MACD both lines are < 0 and falling. Bad for TNA.

Bollinger Bands for $RVX (VIX for $RUT): Today, $RVX was entirely above the Bollinger mid line (20 day MA). The fast & slow MACD lines are generally falling. Neutral.

Bollinger Bands for $RUT: Today, $RUT had a long red candle that closed near (but still above) the 200 day MA. $RUT has not closed below the 200 day moving average for about a year. MACD fast line is falling again & the slow line is flat. Good for TZA.

Three days ago, NYSE Down volume was 12.3 times the up volume.

Two days ago, NYSE Up volume was 20 times the down volume.

Yesterday, NYSE Up volume was 1.7 times the down volume.

Today, NYSE Down volume was a zillion times the up volume. Actually only 119, but that’s like a zillion. Pretty much.

Good for TZA.

Money flow for the Total Stock Market:

$ 668 million flowing into the market 2 days ago.

$ 887 million flowing into the market yesterday.

$ 2,643 million flowing out the market today.

Good for TZA.

Overall, Good for TNA for tomorrow. TZA was overdone today – Monday goes to TNA.

The Daily view from Americanbulls

TNA was a Hold today, was down 14.7%, and is a likely sell for Monday morning. TNA bought at $47.73 and closed today at $41.89, down 12.2% since the buy.

TZA was a Hold today, was up 14.6% today, and closed today at $7.54, up 6.6% since the buy. TZA is a Hold again for Monday.

Of the ETFs I *really* follow, these are to hold on to:

RWM (-1x $RUT), TWM (-2x $RUT), TZA (-3x $RUT)

SRS (-2x RE), DRV (-3x RE)

The list to avoid:

IYR(1x RE), URE(2x RE), DRN(3x RE)

The following are quite likely buys tomorrow:

IWM (1x $RUT), UWM (2x $RUT)

The following are quite likely sells tomorrow: TNA (3x $RUT)

Comment: One reason I look at the 1x, 2x and the 3x of an ETF is to see if AmericanBulls is treating them all the same. Today is a headscratcher: TNA (3x) is a likely Sell, but IWM(1x) & UWM(2x) are likely Buys. I conclude that the candlesticks are out of the norm, and less trustworthy here. Or the market is out of the norm.

Summary: Very Bearish

No new Buys or Sells today.

Action for TNA or TZA for tomorrow: Hold TZA & likely sell TNA

DOW JONES Analysis after closing bell 04-06-2010

http://niftychartsandpatterns.blogspot.com/2010…

Bad week to quit crack if you were trying to play the inverse H&S

LOL Pez…

I'm sure the Bulls will find some more crack some time next week… after we take out the current lows first of course.

DOW JONES Falling wedge in line chart

http://niftychartsandpatterns.blogspot.com/2010…

Dow jones weekly chart with fibonacci support and resistance

http://niftychartsandpatterns.blogspot.com/2010…