The bulls wiped out a lot of bears today...

The rally up today was one big short squeeze on no news. However when Obama leaked out that the Friday job's report is really going to be good, the market rallied. Great timing Obama. I wonder if they have ever released good news when the market is topped? Or how about releasing bad news when the market has bottomed?

No, of course not... they play the game of tricking both bulls and bears, by carefully releasing news at pre-planned time points. Today they wanted to rally the market, and that's exactly what they did. All the retail buyers went long today, and more will jump on board tomorrow too.

We could now go up to the downward sloping trendline at 1120 spx, into Friday's wonderful jobs' data. Wonder how good it's going to be? I'm excited, as I need a job... especially since my current job is about gone now. I want too sign up to be a census worker too. I know they must be high paying jobs... after all, the last statistic I heard was that it cost $150,000 for every new job created. It's got too pay well... right?

But who needs a job anyway? I'll just go long when the wonderful jobs data is released, as I'm sure that will cause a huge rally up to new highs... right? Just paint "I'm a sucker" on my forehead, and I'll even borrow money from my mortgage and credit cards to invest in this new bull market.

Ok, so enough ranting and raving...

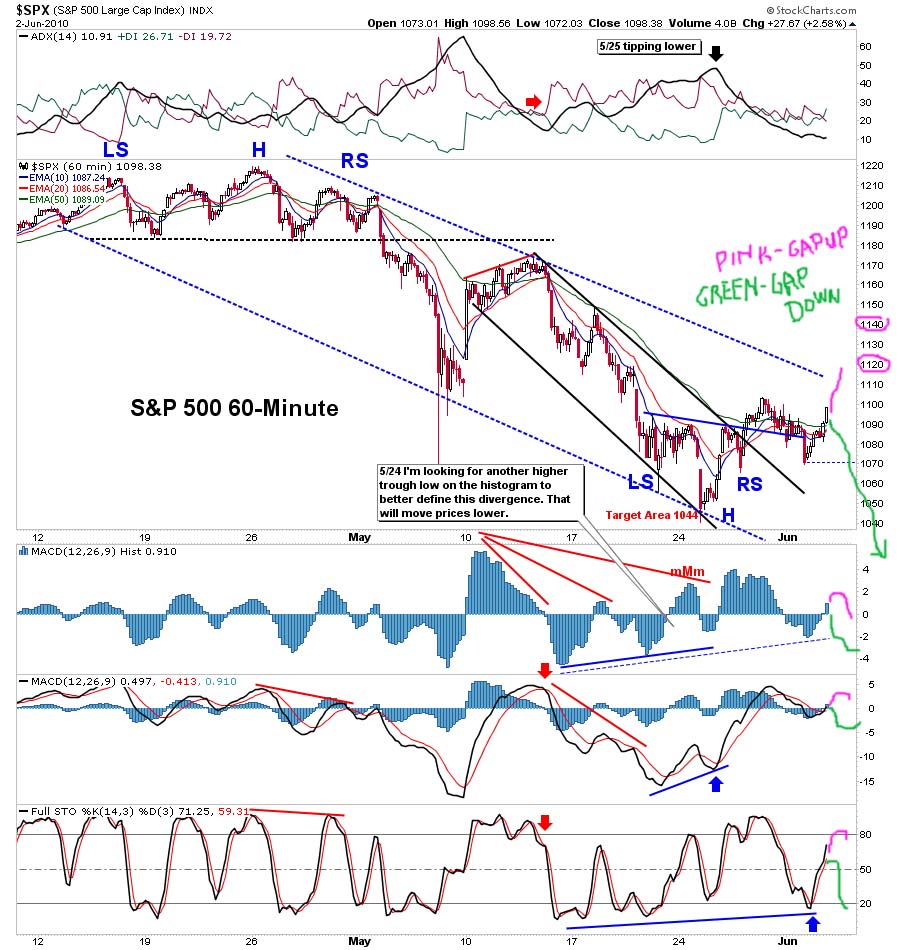

Here's the chart of the spx on the 60 minute time frame. As you can see, we are still heading up on the MACD's and the histogram bars are rising into positive territory now. It could continue higher or roll back down. If it continues higher, then you can expect 1120 spx to be the first target, and then possibly 1140 spx. If it rolls back down, the market should fall hard and fast, into a wave 3 of 3.

So at this point, it's up to them as to what they want to do? Do they want to rally for the rest of the week and into next week, and then take the market down. Or, do they want to take the market down starting tomorrow? Either way, the market is still in a confirmed downtrend, and will likely continue lower for at least this month, if not the next month or two?

Pretty simple then... a gap up and we go higher to 1120 - 1140, or a gap down and we start the next leg down in the bear market.

Red

In addition to an excellent Bloglist on Red's site, here is another one

breakpointtrades.com/

They have a two week free trial and a lot of mechanical systems that work very well. (I wish I had some money)

I would not ignore these guys

the main thing to listen/watch is their daily videos which usually are posted late at night for the next day

Let's put Persevento and BAMinvestors to the test.

Persevento saw the bear coming perhpas June 2nd but things get ugly June 4,7&8 to June 26

Bam investors see June 4th (friday) and on as a really BAD period ie bears rejoice.

Maybe both of these sources are wrong. I'm going to find out.

Also on Danerics latest post, Comments section. The e mini did not have a divergence on its recent low (MACD) and now the stochastic is nearly over bought and crossing over. Very bearish they say.

The market still needs to put in another lower low, in order to have a positive divergence occur. It still hasn't do that yet… which means that it will fall again.

The question is “When”? This week, or next week? I can't answer that, but something tells me the selling will start this week. Maybe tomorrow, or maybe on Friday after the wonderful jobs report? But another low is coming. This isn't over, and the bull market is back… that's one thing I'm pretty sure of.

SP 500 Analysis after closing bell

http://niftychartsandpatterns.blogspot.com/2010…

Simple. elegant. yet robust. It is the AK47 of trading system.

If you look at the 60min charts, the bullish divergence was glaring:

MACD Hist, Force Index, even a 130period money flow.

http://crashthemachine.files.wordpress.com/2010…

Green shoots!!

good post. A different perspective that I've havn't seen yet. How do I get set up to get that info?

I found stockcharts. I can't find the symbol of the emini s&P

The Obama administration is as breathless as schoolgirls over the upcoming Friday jobs report. 500-600k new jobs, 75-80% of which are census workers. My only question is, will this news be received by smart Wall Street or dumb Wall Street (which is in fact also smart Wall Street)? Sometimes I get so lost in doublethink that I lose track.

Boy, do I wish I'd cashed in my puts yesterday morning as instinct prompted me. Now that we've pushed slightly beyond the teal line, will the next correction be just a correction followed by more sigmoidoscopy, or The Big One? That's the last time I ever listen to you a-holes. 😉 (j/k)

Spent a few minutes this morning looking at May and June charts and http://spiraldates.com. As far as I can tell, between now and Monday, the market will be up or down a little or a lot, after which it will be down or up a little or a lot. The turning point will be Friday or Monday, or possibly yesterday or today. Hope this helps. 🙂

I feel your pain rip. I plan to cover my shorts at the close today and maybe reshort at the close tomorrow. I think we will get a down day today but then will bounce.

FTSE is testing resistance this morning, and it's not going well. We will probably plunge with them this morning. Could be a one-day field trip to 1073-ish and back, or the Big One, so you'll probably want to hang onto something.

Thanks Rip – I was planning on hanging on to at least the close but my options are becoming worth less and less as the days pass on. . .

For now, my target is the 40ema on SSO and FAS (40ema SPY).

It is more then the 20 and less then the 50 (which most people watch).

Also see chartpatterntrader:

http://stockcharts.com/def/servlet/Favorites.CS…

As he said, the next hurdle is to get the 10 and 20 over the 50 on the daily..

Carl’s morning call:

June S&P E-mini Futures: Today's range estimate is 1090-1110. I think the low at 1036.75 ended the drop from 1216. The base building process is pretty much complete. Reactions should now be about 10-20 points instead of the 30-40 points we saw during base building. Initial upside target is 1125. A move to 1300 is underway

1095.25 – 1104.75 range last night (9.50 points)

For the past 10 days, the over night range has averaged 21.3 points.

1090-1110 estimate for today (20 points)

1101 currently, so estimate is -11 to +9 from here (neutral)

Carl is the ultimate bull and I am the ultimate bear.

Well, the ultimate bull is all cash at the moment, so he's not feeling it right now 🙂

Helpful reading: Dr Elder

http://www.scribd.com/doc/9850865/Elder-Alexand…

From a macro standpoint – this is a daily read:

http://pragcap.com/

The Bull-Bear spread is below 10%. Not quite at the levels we had during the lows in February, but very close.

http://aaii.com/sentimentsurvey/

Good Morning Gang…

If I'm not around later today, it's because I've went downtown to get one of these new wonderful jobs Obama is touting. Their is a “job's fair” in town today, and I'm sure that I can find a great job, that pays 100k or more… as Obama says that everyone is great again now.

Well, tell them that you want a job in which you can use your head AND your hands. They'll put a cap on your head and a broom in your hands. (courtesy Fred Sanford)

LOL…

I think I'll just ask for the $150,000 it took to create the new position instead.

So who is going to win this battle? Will it be the MACD lines crossing and point up, with the histogram bars almost above the zero line… or will it be the 200ma that the DOW is bumping it's head on, while the 20ma is barreling down fast to provide backup for the 200ma?

http://stockcharts.com/def/servlet/Favorites.CS…

My bet is that we'll climb over the 200 today, hop the 20 tomorrow, and Israeli commandos will attack a Palestinian daycare over the weekend.

LOL….

Some how I don't think we will make it over the 200ma today. But who knows about the attack?

uh oh… Wat cha gonna do, dude?

See the divergence that you said has to be there? Well, you got that in the DOW, but not in the QQQQ. So what now? To be or not to be…… lol

I'm probably going to go back to work with you on 3rd shift at McD's… unless my position has been replaced by a Harvard graduate with a masters degree?

Mcd is a bit too much for us. There are more qualified people than us. Stop dreaming about Mcd. Why not apply for day laboring jobs, if you qualify on a call by call basis. Benefits are excellent as they have free fountain drinks.

LOL…

I like it. I'll get a job digging ditches for the state road, while 10 supervisors standby and watch me do it right.

Nowdays even Mcd looks for credit history. At least day laborers dont

I got fired from mcdick. They said my ID card no good. Wtf? I paid good moolah for it.

http://www.grouchyoldcripple.com/archives/NewDr…

LOL – I think they made a mistake on the state, it should have been Hispanfornia, as it becomes only Mexis not the rest

Hey, look at this FTSE chart. Anyone ever seen this chart pattern before?

http://finance.yahoo.com/echarts?s=^FTSE+Intera…

Strange pattern Rip? Straight up, then straight down… that's really odd?

I was referring to the double inverse humps that resemble a variety of naughty bits, lol. I wonder what you get when that breaks out, hopefully a 20% drop.

Well, I was trying to NOT have a dirty mind… but yes I noticed the resemblance. LOL. I'm OK with a 20% drop… wouldn't bother me a bit.

SPY potential options & fxi correlation:

http://www.etf-corner.com/markets/2010/06/spyfx…

Anna caught this and screen captured it. I noticed it too yesterday, as it showed up on the Nasdaq.com site. Not sure if it's just a late fill or fake print? Hard to say, as when I see large volume it tells me that it was a big institution getting filled in the afterhours instead of a false print. But, here it is anyway…

http://content.screencast.com/users/Annamall2/f…

Again though… the print I see had about 1.5 million shares on it, and it was around the same target level. Maybe it's real, maybe it's not? If we fall, we need to take out 107 spy anyway before any real selling can happen.

DOW JONES Resistance line in daily chart

http://niftychartsandpatterns.blogspot.com/2010…

For you bears out there, SpringHeelJack made a nice post on Anna's site, pointing out several reasons why this bull rally is likely to fail. Go check it out, and post a comment if you like it… or post your thoughts if you don't like (only those bullish will likely disagree).

http://hotoptionbabe.com/blog/13-muddy-waters.html

DOW JONES might do a classic retest of the Triangles t trend line or 10200 before moving up again.

http://niftychartsandpatterns.blogspot.com/2010…

San, what do you think of our present situation being the third hit on a rising wedge?

in which time frame you spotted the rising wedge

That would be the 23rd through today, same chart that you reference above.

I Saw it but the pattern it is not rising it is kind of making a side ways move so that reduces the bearishness of the pattern. So if you are short i would suggest you to look at the triangle for you to give a false break out which might save the bears. But 10200 should be breached first.

OK, San, thanks!

Rip Van Trader mentioned the rising wedge here it is with the triangle.

http://niftychartsandpatterns.blogspot.com/2010…

That's cool. San. I need to practice with drawing charts.

Not sure how valid the wedge is as it applies to the Dow only, but it's fun for a bear to dream.

Looks like the magic number is about 10,100.

The break down number for today is around 10100

any news out of persevento or BAM investors??? today and next week this market is supposed to get toasted.

We need several Nasty news events

The only news so far is that Bp oil spill will travel all around Florida. I'm waiting for the news that they will nuke the hole.

The latest news is they have a new recommended reading.

http://www.amazon.com/exec/obidos/asin/03853365…

When I get the cash $5,000+ I'm going to trade a 5 min Renko chart, recommended by breakpoint trades. I'm under the impression that I'm going to make a mint.

Any advise out there.

My problem is that I never really had the cash to buy the tools and info to play the game. but that will change.

One scenario pointing to 1110

http://screencast.com/t/ZDAwZTBjY

Iam itching to add to some shorts. Did not expect this retrace today. Figured they would try to run through Friday.

Anemic volume on yesterdays rise and even weaker today.

Chart trader may have called it correctly as sideways action until up breakout.

Do we have a bull flag developing on 15 minute charts? spy

isn't that a bear flag……I'll defer to the experts

When the flag is dropping downward from a vertical pole its considered a bull flag.

But the pole is not really a decisive stick.

I wonder how many bulls will go long into the jobs report tomorrow? Obama says it's great, so it must be a good time to go long… right?

You still short? I am but rather miserable at the moment. I'm going to hang on for the ride.

Yes, I'm still short… painfully, but I'm staying put until I see what tomorrow brings.

i am short but not at an intended full position. I will add at some opportunities but have to admit to being cautious, possible overly.

i am leery about the possible calls to 1140

sp 500 forming a bullish pennant pattern

http://niftychartsandpatterns.blogspot.com/2010…

NASDAQ Is busting out.

They are going to run it again today. I will be picking some shorts up in abit

For those wondering why we aren't going anywhere but sideways, it's because the 60 minute chart is pushing the market down, while the 15 minute chart is pushing it up.

In this chart of the 60 min, you can see it has rolled over and it is now getting ready to cross the zero line.

http://stockcharts.com/def/servlet/Favorites.CS…

But, the 15 minute is crossing back over the zero line and heading up… which is why we are stuck right now.

http://stockcharts.com/def/servlet/Favorites.CS…

The daily is pointing up too, which is giving the 15 minute chart a little more power. I believe the 15 minute chart will peak out by the end of day, and be ready to roll back down into tomorrow.

http://stockcharts.com/def/servlet/Favorites.CS…

As for the 60, it should be below the zero line and still pointing down. The daily will be pushing up, and could rally the market higher tomorrow? Or, we could “sell the news” on the job's report, as I believe most trader's know it's all made up anyway.

If the bears have any hope, it's this 20ma coming down hard to push the market back down and form a necktie of resistance at the 200ma line. (Plus on the 60, we are still inside the downward sloping channel).

http://stockcharts.com/def/servlet/Favorites.CS…

Just curious there. Did you notice this?

[Begin quote]

“….5/26

The inverse H & S pattern on the 15 min chart completed and broke out today. We now have a tradable bottom. I fully expect prices to rally over the next week and half to two weeks to set up a massive right shoulder on the daily chart of the S&P 500. Then I'll be watching for a pivot reversal to buy my short positions back. I went long today on SSO to ride up the right shoulder. After the RS is complete, I believe that the market will collapes and that the H & S minimum objective will allow the S&P 500 to test the 875 level. If that cracks we will test the March 2009 lows. I believe we will test the March lows and move much lower. The world debt crisis is not going to go away.

5/21 Sold shares of SPXU, TZA, TYP and QID

5/25 Sold Shares of SPXU, TZA, TYP and QID

5/26 Closed balance of position of SPXU, TZA, TYP AND QID

5/27 New long on SSO at the gap

I'm now short term bullish. I am long with a target of 1150-1170 on the S&P 500.

thechartpatterntrader.com …….

[end quote]

Yes SC,

I know the CPT is bullish, but I'm not. I don't always agree with him, even though I like his charts. We all have different opinions.

Like for example, the Mr. TopStep guys now think that we are going back down to 1068 area, because we didn't that out the 1106 high from last week. He stated that they stopped the rise at 1105, and that tells him we are going lower.

http://www.youtube.com/watch?v=Ivt6Av4FTP8

Everyone has different opinions… that's why it's a zero sum game. Someone wins, and someone else loses. I hope we both make money in it, but I'm still bearish right now.

Don't forget to check your Big teal lines and little teal lines.

Good luck to all.

Kinda sucks today. I am staying pat

Gang,

According to Mr. Topstep, we need to take out 109.80 spx today, and then we will be heading back down to 1068.

Sorry, that was 1090.80 spx, not 109.80. Sheesh that would be about Dow 1000. LOL

Chartpattern trader is probably right. Pesevento (?sp) and BAM investor are probably wrong. I have too little cash in my account to do anything with either…..ie $170!!

But I did buy a 990 e mini put at 3.00 expires in two fridays. If the two above bears are right I may have enough $ to float my little row boat

When I get over 6K watch out (I do it every 3rd year or so- so I can do it again.) “move over rover and let Jimmy take over” (Hendrix)

Is “Diablos” scernerio working out here that was posted 2 hrs ago? need to tank asap

http://screencast.com/t/ZDAwZTBjY

Its not going to tank. they are going to run this through tomorrow.

probably right

Scenario still alive.. actually doing exactly what the chart showed.

Original: http://screencast.com/t/ZDAwZTBjY

Current: http://screencast.com/t/MjkyOTkzZT

Sounds good too me Diablos… let's make sure that's how it works out tomorrow, as I'm about over all this bullishness now.

Diablos – can you share how you came up with this projection …

Also, if you could share the MA chart that you had shared once before ….

Basically, its an elliott wave chart. Other 'research' points to resistance at the 1115-1110 level, so I tried to see if an elliott wave scenario would support it. There are many blogs on ew, many different variations of the chart, one good one would be http://marketthoughtsandanalysis.blogspot.com/

Regarding the MA chart, not to be dramatic, but i've been asked not to repost that chart and I want to respect that person's wishes. Sorry.

Best wishes.

sp 500 Hourly channel

http://niftychartsandpatterns.blogspot.com/2010…

I will venture to say that anyone left short has bailed out by now… leaving only the bulls, into a wonderful jobs report tomorrow.

I expect to see them charging higher tomorrow, with a big gap up! Or will they just be trapped, when the big boys sell the news instead? Tomorrow will be interesting… to say the least.

I still have shorts.

After today's indecision I am not in longs. Mostly cash.

Well Jim, I'm rooting for us both… and Monica too.

Thanks – went to take a nap so I wouldn't be tempted to cover. Still short – my account looks ugly.

Yeah, me too Monica…

I'm still waiting though, as I want to see what tomorrow brings. The 60 and 15 minute charts are overbought now, but that doesn't mean they can't be more overbought…. only that they could easily rollover if the jobs report doesn't blow out expectations tomorrow.

NASDAQ Is The Fire. Otherwise this market could not move forward like it is.

this is a bloody week for the bears for sure

FAZ the 3x financial, and skf has eked out a green day. Not all blood for me

Jim,

It sure makes you wonder how the market rose and the bear eft for the financial's rose too. Something doesn't smell right. The euro fell, the dollar rose, gold fell… all very out of character?

There are a lot of conflicting signals.

For example, check out the weekly S&P Charts. They are not what I would call bullish.

My gut is when volume is low different forces pull different directions and a clear path is not showing the way.

it looks like we may still see a right shoulder develop but perhaps with a weak volume and possibly not as strong as some think.

ADP data today was not good. tomorrow will be gov't numbers which nobody trusts anymore and in the least will include a tremendous number of census workers.

The Nenner cycles still call for another low in June???

The Bam people have a few days yet to see if they are on or not.

I can feel your confusion…I have always gone with…if the vol is weak and there are more down vol than up…we go down…but from the feb low this thinking didnt work till it did…low vol and high low days…it still rose till may then tanked…I got to get back in for a short …I am cash right now…

Yes Jim,

There are a lot of confusing signals, but the weekly chart tells me we are going down next week. If it doesn't start selling off tomorrow (as I expect it too), then Monday should start it.

Bulls seem to forget that we ain't above the moving averages on weekly chart anymore… we are below them. That hasn't happened since the March, 2009 low, and believe me… it makes a big difference now, as compared to the ride up from last year.

Do you know WHEN in June is the Nenner low?

I've heard that Nenner is very good. I suppose there is enough time to pop for a right shoulder and then down hard?

I do not know He just states the low is in June. His cycles can be pretty wide. His trend seem to be fairly accurate but his short to midterm timing can be off by weeks IMO

If this is any help

Spiral Calendar dates see blog list under Astrology/moon dates (This is not astrology but only refers to cylces consistant with the moon.

there is a peak at June 6th- this means could be a peak OR trough depending on the previous trend. Now the trend is up so friday or Monday may be a peak.

don't forget China, still very close to the “critical” 9500 area

Carl at day’s end:

1090-1110 estimate for today (20 points)

1090.75–1005.25 actual range today (14.5 points )

Carl nailed the low, 4 points above the high.

For the past 10 days, average actual range is 25.3 points

Trades: No Trades today

Grade: C (lost no money)

In the past 10 trading days, Carl has taken just one trade, a loss of 4.75 points.

DOW JONES Analysis after closing bell

http://niftychartsandpatterns.blogspot.com/2010…

We are now in a Full Moon Trade, which tends to favor TNA.

This trade owned TZA today, and AmericanBulls had TZA with a Hold today, which means no buying & no selling. TZA opened down 0.4%, and the opening gap was filled. TZA was up 0.8% at it’s high, and closed down 3.8%. TZA closed at $6.57, with this trade down 6.9%. AmericanBulls has TZA as a Hold again for tomorrow, which seems insane.

On the other hand, AmericanBulls has TNA as a Buy today, with a buy price of $47.73, the opening price. So, while it makes no particular sense, this Trade will buy TNA at $47.73 and own both TNA and TZA until one (or both, I guess) gets a sell signal.

Volume for TNA today was 2% below it’s 1 month average.

Volume for TZA today was 24% below it’s 1 month average. Not good for TZA.

$RVX (VIX for $RUT) closed down 3.9% with TZA down 3.8%. No divergence.

TZA closed today as the lowest close in the past 10 days. Bad for TZA.

TNA closed today as the highest close in the past 4 days. Good for TNA.

Ultimate Oscillator for TZA fell from 44.2 to 39.7 (-4.5) while TZA was down 3.8%. No divergence.

Ultimate Oscillator for TNA rose from 51.8 to 56.6 (+4.8) while TNA was up 3.8%. No divergence.

TZA MACD both lines are > 0. The slow line is still rising, but the fast line fell today to touch the slow line. Bad for TZA.

TNA MACD both lines are < 0. The slow line is flat, but the fast line rose today to touch the slow line. Good for TNA.

Bollinger Bands for $RVX (VIX for $RUT): Today, $RVX fell further below the Bollinger mid line (20 day MA). The fast & slow MACD lines are falling. Good for TNA.

Bollinger Bands for $RUT: Today, $RUT had a white candle that closed near the Bollinger mid line (20 day MA). The last time that happened, $RUT was at it’s peak and fell from there. MACD fast line is rising to touch the fast line & the slow line is flat. Complete mixed signals. Neutral.

Two days ago, NYSE Down volume was 12.3 times the up volume.

Yesterday, NYSE Up volume was 20 times the down volume.

Today, NYSE Up volume was 1.7 times the down volume.

Good for TNA.

Money flow for the Total Stock Market:

$ 961 million flowing out of the market 2 days ago.

$ 668 million flowing into the market yesterday.

$ 887 million flowing into the market today.

Good for TNA.

Overall, Good for TNA for tomorrow.

The Daily view from Americanbulls

TNA was a possible buy today, and closed up, so was bought at the opening price – $47.73. (Yes, time travel was required).

TZA was a hold today, no sells, no buys. TZA was down 3.8% today, and this trade is now down 6.9%. In spite of being down over 8% yesterday & down 3.8% today, TZA is a Hold for tomorrow. (Sounds pretty stupid).

Of the ETFs I *really* follow, these are to hold on to:

TNA (3x $RUT) , TZA (-3x $RUT)

DRV (-3x RE)

The list to avoid:

URE(2x RE), DRN(3x RE)

The following are quite likely buys tomorrow:

IWM (1x $RUT), UWM (2x $RUT)

IYR(1x RE)

The following are quite likely sells tomorrow:

RWM (-1x $RUT), TWM (-2x $RUT)

SRS (-2x RE)

Summary: Transitioning from Bearish to Bullish

New Buys today on: TNA (3x $RUT)

Action for TNA or TZA for tomorrow: Hold TZA & Hold TNA

Note: While the positions here on TNA & TZA make no sense (to me), AmericanBulls is consistent on the 1x and 2x versions (which is why I look at them all the time). Possible sell on the inverse, possible buy on the positive.