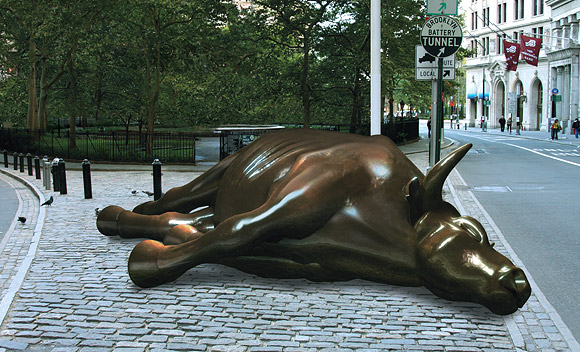

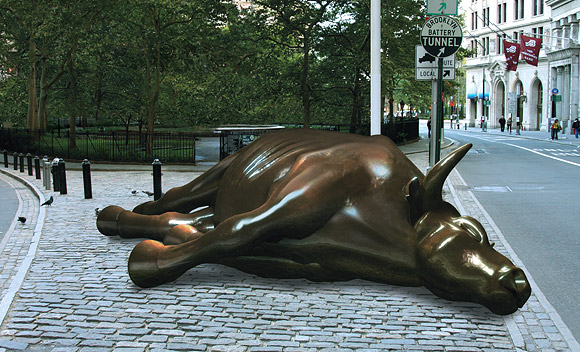

The bulls failed again today, as the bears took her down into the close...

We are getting pretty close to a temporary bottom now. I still think we will see at least the 100.72 spy fake print level, and even the low 990 spx area could come tomorrow... who knows? At that point I would expect a multi-day rally.

The charts are getting into oversold conditions now, but can continue lower. We still didn't get a capitulation day today, and that tells me we still have more selling... before a brief rally. Tomorrow could be the day, since everyone is now extremely bearish, and negative... meaning they are expecting horrible job's data on Friday.

Of course a prelude to that data will be released tomorrow morning... the Continuing Claims, and Initial Claims, but Friday will have the big kahuna... the Nonfarm Payrolls and the Unemployment Rate. I think we will bottom either tomorrow at the close or Friday... it depends on the numbers?

Will the government spin them to look "not so bad", or will they just tell the truth... which is horrible of course. I think that they will already be factored in, especially if we tank again tomorrow. The old "sell the rumor, buy the news" dance (normally, "buy the rumor, sell the news"... but reversed when bearish).

So, put the technicals with the news, tomorrow looks like the best candidate for a "capitulation day". Not saying for sure that it will happen, as we still haven't got a one day relief rally bounce, squeezing out the bears. But, there's no guarantee as to "when" that day will occur.

We now have 8 down days in a row on the NDX, while the SPX would also be the same, except for a small up day on last Friday. Not exactly what I'm looking for... to squeeze out the bears, before falling again. But then again, they did the same thing on the way up, closing higher every day with only a few small down days... trapping the bears for several months of pain.

Maybe it's the same thing going down? Trap all the bulls long, and not let them out on any rally. That should indicate that once a rally starts back up, the bears will be trapped short... with very small down days to allow them an escape.

Ok, with that said, I don't know what will happen tomorrow morning. Sorry, I wish I did. If the Continuing Claims, and Initial Claims are really bad, then we could gap down and trend down all day. If they aren't too bad, then we could rally up slightly to backtest the breakdown area from today. But, I would expect the selling to resume later, as the fear from Friday's data should cause continued downward pressure.

If we get to 990-995 area, that's a great spot to go long for several days. If we rally tomorrow (to squeeze out some bears), then the move down to that area might not happen until Friday. My gut tells me that they want a relief rally going into the 4th of July weekend... to make people feel better of course.

But, my gut isn't that accurate, so the only thing I can say, is that I expect the 990-995 area (at minimum the fake print of 100.72 spy) to be hit by Friday at the latest. Then a multi-day rally... allowing everyone another chance to get short again.

Best of luck to everyone...

Red

Communication and math are essential trading skills, refer to the funny post below that guides in improvement of these skills.

http://oahutrading.blogspot.com/2010/06/communi…

LOL, now that's funny. Thanks for posting it.

A little comic relief before a wave 3….better than a burrito with cheese.

Well, that one is over my head. It's been too long since I took all those math classes in school (but I took all tough ones).

I'll just pay my bills in cash…

http://reddragonleo.com/wp-content/uploads/2010…

You would not be paying much! For e^(i*pi) when using imaginary numbers in such a notation you can convert it to rectangular form by taking the cosine of the real term and the sine of imaginary coefficient. The sine of pi is 0, so it's just a fancy way of writing 0.

As for the .002, because the limit as n approaches infinity of the summation on the check is technically 0.9999999… …9, I think he threw that in to round up to a dollar.

Basically 0 or .002c!

BAM Investors audio important interview…

http://thewallstreetshuffle.com/podcasts/062810…

Wow…pretty much everyone everywhere (forums or blogs) is ready to bottom pick tomorrow…that make me think …what if…

The low 990's has a weekly moving average support, that is highly likely to be hit before bouncing…

http://lh6.ggpht.com/_APmrYvpA45s/TCvvwV3x9MI/A…

The same level is on the monthly chart too (991.82 – 20ma)…

http://stockcharts.com/def/servlet/Favorites.CS…

If we hit that buy Friday, it should be a good long for next week… if you like being a bull?

Thanks Red…Still holding half of SDS positon…will close them tomorrow and maybe go long Friday.

Just look for the 991 area to be hit first… before going long. Remember, hitting a moving average on the first hit has about an 80% success rate of a bounce.

The 2nd and 3rd (etc…) times get weaker, and will break. Look at the link for the weekly chart, and you will see in the past that it bounced for 2 weeks back in late November of 2008… and then fell back down again going through it on the 2nd hit.

We could have the same thing over the next 2 weeks, as OPX is 2 weeks from this Friday… meaning that every one short will likely be squeeze into opx.

Not a guarantee of course, but I've seen it too many times now. Get everyone buying puts at the bottom (short term) and rally up into opx making them expire worthless.

I don't know how high of course, and yes I expect more selling in the month of July and August. But, there will always be rallies along the way. Just close out all your shorts by Friday at the latest, or 991 area… whichever comes first.

Great analysis! love your charts too. Thanks Red!

Well, the charts aren't mine. The weekly chart is on Cobra's blog, and the monthly is on The Chart Pattern Trader… so I'll give credit to them for the notes on each one.

But, I do come up with my own analysis. I look at other peoples' charts, throw in the fake prints and add the “manipulation” factor in the mix… and Bam! … I have a forecast. LOL (wrong most of time anyway, but is anyone always right?)

GS

You mean… look at Goldman Sachs? They are tanking this morning and almost ready to fall through an important downward sloping trendline. Good for the bears… LOL

Hi there, took a position in TNA for the day to hedge the short positions I have left. Will reload shorts on a bounce in the next few days (probably after the holiday)

I don't if we are done sell yet Monica? If we rally today, I'd close them out… just to be safe. You never know what Friday will bring?

However, starting next week, and until opx (this is after we hit the low 990 level), I expect a move up to 1070.50 spx.

I just remember the big pops on Cobra's charts on the 9th and 10th day. Jesterx also mentioned that if we go into a holiday weekend bullish, we tend to resume bearish the following week and vice versa. But, maybe we go straight down and reverse at 990.

Hard to say which way they will flip it? But, you and I both know that opx week will most likely be bullish… to squeeze out all the shorts. So, if we go down to 990's first (by the end of this week), then go long until 1070.50 is hit.

If we rally first to 1070.50, then go short, as a sell off to 990 is coming. I think it will happen tomorrow though, but that assumes we rally today, and tomorrows' job data is horrible.

ok – I was wrong. Got rid of my long hedge.

Eur/Usd bull flag breaks out. If it is not a false one will take the pair above 1.24 region

http://niftychartsandpatterns.blogspot.com/2010…

S&P 500 Week chart with broken support levels and the next target

http://niftychartsandpatterns.blogspot.com/2010…

1120 broke fairly easily this am. It looks to me like the next pause is around 990. After that its 900.

990 may come. 900 should wait

U.S. Markets and Eur/Usd moves in Opposite direction

http://niftychartsandpatterns.blogspot.com/2010…

Looks like we will see 990 today gang… wow.

Vixes are over 6% now. If we hit 12 % today 990 will be sliced through tomorrow like it isn't even a factor.

Yes, I agree Jim. 990 is coming up fast. It lunchtime now, so we could find a temporary bottom here, and finish selling off into the close today… ahead of the jobs data?

We are not getting 990. Mark my word. NYMO is finally giving positive divergence, and we will have a relief rally. There is way too much support between here and 1000.

I disagree IlliniKap. They will break the 1000, and then do a hard reversal to squeeze out the bears that go short below 1000… it's just how they play the game.

We Shall see, but the level the VIX was at was implying about the size of a move we already had today. 990 for today is wishful thinking. I'm not saying we aren't heading much lower, but it just sounds like the bears are getting greedy, and will only end up handing money back as we have a relief rally.

It might come into the close today, or tomorrow morning on the jobs data?

So far, we hit a low of 101.13 spy, just shy of the 100.72 fake print I got. I still think we will see that print hit. Possibly into the close today, or on the jobs data tomorrow morning, but I still see a panic flush below 1000 coming.

we'll hit it after we bounce back to 1040 first.

I did go long with a could of SSO calls

I think we will see 1070 by opx, so you should be fine.

Looks like some folls want to bounce it again so they can unload.

gonna get interesting.

Isn't that amazing how we with down to within pennies of that fake print, and then reversed… LOL

Should have bought deeper in the money calls. The volatility drop is offsetting any of price gains.

Or do a call spread, so the vix doesn't matter. That's the only way I will go long.

I hate sogotrade. Always says i don't have enough margin

Well, I'm not in love with Ameritrade either, but at least Think or Swim is with them now… that's a bonus.

hard to make money with calls after a drop.

I don't know if we get to 1040 or not, but we might fill the gap today (1027.50 spx), and sell off into the close today, and early tomorrow. We just need to wait patiently until around 3pm to let the charts work off the oversold conditions. Volume will return into the close, as people panic ahead of the jobs data.

Usually I'm very bearish going in to jobs report, but for some reason, given all the selling last 2 weeks, I have a feeling the government is going to skew the data for positive reaction. Everyone is already expecting the worse because of the ADP report yesterday. Who knows.

Well, that would make some sense, as they've done that many times in the past. However, I think tomorrow is the best time to give the worst report possible, as we are already oversold… meaning it shouldn't go down too much further.

Then, the next jobs reports, you can manipulate those numbers more easily, when you only have to beat tomorrows numbers. Kind of like telling your deepest dirtiest secret when everyone is drunk and spilling their guts too. It will get lost with all the other stuff, and won't be a bad… as you telling it sober on your wedding day.

Well, that would make some sense, as they've done that many times in the past. However, I think tomorrow is the best time to give the worst report possible, as we are already oversold… meaning it shouldn't go down too much further.

Then, the next jobs reports, you can manipulate those numbers more easily, when you only have to beat tomorrows numbers. Kind of like telling your deepest dirtiest secret when everyone is drunk and spilling their guts too. It will get lost with all the other stuff, and won't be a bad… as you telling it sober on your wedding day.

Taking the vix down again. Everyone be aware that there is a giant gap on the VIX at 29 and it will probably get there sometime soon.

Instead of going long next time, I should just sell the Vix

Well, once we hit the low 990's today or tomorrow, I'll probably do a put credit spread on the spy. Then the vix and time decay will work in your favor.

Red, I think we'll hit it next week. I am going to reshort when the vix hits 29.

I think we will go up to 1070 by opx Monica, so you might just want to wait until then.

Yup, I'd go short when the VIX hits its 200 again.

We're getting capitulation today. Could be start of a multi-day rally.

Could be? But the volume isn't as high as I'd like to have seen it. It's high, but I'm not sure yet? We didn't hit my print of 100.72 spy, and the jobs data is still ahead tomorrow morning. If all the news was out, then I'd feel a little better agreeing with you, that we may have had capitulation today. Let's see what the last hour brings first…

S&P 500 Trading near resistance levels

http://niftychartsandpatterns.blogspot.com/2010…

Looks like 1035 is the 50ema, and should also act as resistance.

Red, my GUESS is that the shorts gets squeezed after tomorrow's job reports and we get back to the 1040 zone for a backtest (at which point the vix will probably be at 29). From there (maybe Tuesday morning), we start heading back down to your casper. After that, I believe we bounce to 1070.

Possibly? Hard to tell right now? I'm in cash and will wait for 990 to go long, or 1070 to go short.

cash aint bad. Go out and enjoy the beach while you still can!

Damn the volatility bleed. S&P is up 10 points since i bought my SSO calls, and they are barely above even.

Dow Jones resisted at yesterday's break down point

http://niftychartsandpatterns.blogspot.com/2010…

That might have been all the downside we get for today and tomorrow? The jobs data could go either way… causing a morning sell off, or a morning rally?

Well, we certainly filled the 1027 gap, now I'd expect us to try for the 1040 level today or tomorrow. That would match up with filling the VIX gap at 29, that Monica pointed out earlier.

ok heres my genius take on this…I would like to see us get a little closer to 103 and close there….then it looks like a strong kangaroo tail according to Dr. elder and tomorrow should not go down much more than 102 then up…I am in @ 102.28 and if this doesnt pan out then stop at 102…

I want to see the 60 minute chart get overbought and start to roll over before I go short. The 15 is already there, but the 60 is holding it up now. It looks like it might be tomorrow before we roll again.

im long 102.28 thinking the turn is in…drop back a little tomorrow then up…I dont think we get below 102 tomorrow…

did I tell ya I am hardly ever right…but once in a while I get there…

LOL… I not right very much either! But who is?

Someone's trying to aggressively sell this market.

I'm sorry about that. Should I stop? 😉

LOL… too funny.

No ! Pick it uo get scared! sell.

The vixes do not support that statement at the moment.

iam a bit surprised at the complacency or the lack of selling momentum today given the support levels that have broken.

I agree Jim. The down move is over for today I believe. Now we wait until the jobs report tomorrow morning.

If we close s$P below 1020 I think selling picks up serious tomorrow.

I agree…my stop 102…

I'm looking for something like 2/5/10 on the spy daily to happen tomorrow…will see..

We've been rejected by the Hourly 10 SMA and 8 EMA all day since the lows. If bulls can close above, it bodes well.

Bulls are on move.

what time is it…they always get a move on @ 3:30

If we sell off in the morning tomorrow, I believe it will be a good buying opportunity… short term of course. Looking at the charts right now, I see a positive close tomorrow, with the rally to start between 10:30-11:30am.

looks like I might get my 103

Just remember, according to what I'm seeing in the charts, any sell off tomorrow morning will be bought up. Get out early, if you go short.

not going short…I am long till 110…I think corner is turned…tomorrow will tell…

I don't think 110 is the correct target Wolf… I have a fake print of 1070.50 spx (about 107.50 spy), and another one at 112.41 spy. It should be either of those 2 targets… probably by opx.

Thx…I'll write it down and keep it for front…

Dow Jones Triangle in fifteen minutes chart

http://niftychartsandpatterns.blogspot.com/2010…

What's the upside target for a breakout? (Dow and SPX)

I have shown it in Dow Futures. If it gives a valid break out it should give at least 9865 in dow futures

I see about 1050 on SPX cash index it breaks to the upside before close.

This last 10 minutes could be quite a trip.

Here comes the dump. Bears are fully in control now. Before it would be runups into the close, now its just dumps.

Sell the rumor buy then news?

IlliniKap and Jim, I'm just sitting on my hands right now, as the direction is unclear. I won't go short or long into tomorrow at this level.

question is do you hold shorts.

imay unload a little

No, I'm in cash. But if you hold shorts, then I'd sell early on the bad jobs data (which it is still likely too be). Look for the 10:30-11:30 time frame for a bottom, and then get out.

Cup and Handle Break out or is it a bull flag?

http://niftychartsandpatterns.blogspot.com/2010…

Yes, I agree… the direction is up on either pattern.

Red, Do you like horror stories? I had GOLD shorts at 98.5, got out yesterday…Today GOLD down $4. ):

LOL… yes, I got of my spy shorts yesterday too… before the fall to 1010 today. So yeah, I feel your pain.

Retail stocks, falling knives, finally some of them are having a first up day….That sector became way oversold.

Today's low came within 41 cents of hitting the 100.72 spy fake print I have from a month ago, tagging 101.13 as an intraday low. Will that be close enough, or will we spike down tomorrow morning and retest, before going back higher into the close?

Worse yet we rally and just as bulls think they are in the clear we hit those lows next week sometime.

I did a video on the new post I just put up, but yeah… we could rally to 1040 tomorrow, and fall back down to 990 the first of next week… and then move up to 1070.