Thursday Update...

(to watch on youtube: http://www.youtube.com/watch?v=3x0lhKrVKno)

I'm looking for a small red day tomorrow. I think the rising wedge will breakdown and we will form a channel. I don't think we will go past the 1340-1345 spx area, as that's strong support now. I also expect the POMO money, (and the light volume on a Friday) to keep the market from closing too far down. By the end of the day I expect it to rally back up to about flat, or slightly down. If by some miracle we go up the the spy FP of 138.86, then I'll go short... but otherwise I'm sitting out until next week.

Red

_____________________________________________________

Wednesday Update...

(to watch on youtube: http://www.youtube.com/watch?v=Pdz9myge4_o)

Looks like we are now on our way up to the SPY FP of 138.86... but will we hit it this Friday? Who knows? Anything is possible with Bernanke at the helm (of the Titanic of course). As for tomorrow, my best guess would be a spinning top doji day. It could be a little up or down, but if all goes as planned... Friday will go up to the FP. If not, then it might get pushed out until "Bullish Monday". However, the gangsters are having another meeting at the Legatus conference over the weekend. This could be a big turning point in the market? Hard too say right now, but we'll know more by this Friday.

Red

____________________________________________________

Tuesday Update...

(to watch on youtube: http://www.youtube.com/watch?v=nvo9MHpdW4g)

Expecting a wild day tomorrow. Something will be announced by the Fed's at 12:30 pm, which could produce a sell off. But the 2:15 FOMC minutes will likely rally the market back up into the close. All in all... expect the unexpected!

Red

_____________________________________________________

With the strong moves up last week, it certainly looks like they plan on hitting the spy fp... but will they do it by April 29th? Or, did I interpret the FP wrong and the volume of 4,290 shares simply meaning nothing? Only time will tell I guess...

(to watch on youtube: http://www.youtube.com/watch?v=Hfd5kcaAqWo)

While they fooled me on Monday, with the bogus timed release of the news that they "may?" downgrade the S&P500, the rest of the week was Bullish as expected. In fact, it was too bullish in my book! Gapping up huge 2 days in a row spells trouble for the bulls I believe. It's just not sustainable at that kind of accelerated rate. Burning a flame that hot will only make it burn out much faster! Those moves up looked like one big bear squeeze too me... so what's next, more of the same?

Well, since the fake out on Monday caught many bears off guard, it's not likely to have filled the boat with them going into Tuesday of last week. Just guessing of course, but I'd say that all the bears that got short Monday are now squeezed out. The relentless b.s. move up the rest of the week threw those bears overboard I'd bet. Meaning, I'm not expecting much more upside immediately, without more bears to squeeze.

And since they will be a ton of bears waiting to get short around the 1340-1345 area, I don't think the gangsters can get through it that easily next week. That means they must sneak around behind the bears in the afterhours and premarket sessions by gapping over that area. But what news could justify such a gap? Nothing! But that doesn't stop the gangsters, as they can make something up later... after the gap.

April 24th, 2010... What Happened Afterwards?

However, with the short term charts all overbought and pointing down, I suspect this gap won't happen on Monday. They need to reset the charts, which means it will likely be pushed out until later in the week... if they still plan on going up to the FP? There's no way of knowing if the date is 04-29-2011 as I guessed? It could be later in the year, and the volume could mean nothing. This would leave the door open for a pull back next week, and then another lunge higher in May or June. Remember, the POMO doesn't end until late June.

Ok, so if I were a gangster and I wanted to steal the sheeps' money, I wouldn't let them get short by gapping up into a wall of bears Monday morning. And since the short term charts can't sustain a "gap and go" move, any gap over the resistance zone has a very high chance of failing. This means that the bears would jump on board fiercely at that level and profit nicely from the drop that will follow. Since the gangsters don't want the bears to make an money (as that would be stealing it from them... the professional thieves), that should lead them to Plan B... a Monday sell off without letting bears get short!

Yes, if I were a thief like the wallstreet thugs, I'd do another gap down on Monday to reset the charts for another move higher later in the week... just like they did last Monday! It's perfect actually, as then they could put in another right shoulder, break the rising wedge, get more bears on board at the bottom, and use them to fuel another short squeeze past the overhead resistance zone. Bingo! The perfect evil plan...

Let's not forget that the daily charts are still pointing up, and a one day sell off isn't likely to do much harm to them. Yes, yes, they could roll over at anytime... but that doesn't mean they will. They will support a move up to the FP on SPY, and I'd really like to see them get this final top out of the way as soon as possible. I don't want this thing dragging out until June or July. Let's get it over with now, so the fun can begin!

For once, I'd like to see the "sell in May, and go away" saying actually work! Let it be a bullish April and very bearish May... don't you agree? After all, April is almost done... so give us bears the entire month of May to take this beast down. Or, just sell off on Monday and don't look back... meaning, let's go ahead and start wave 3 down! I don't think that's going to happen of course, but it is possible (wishful thinking here).

April 25th, 2011... Will This Time Be Different?

Since gangsters are still in control of this manipulated market, and since they told us the upside target with the spy fp, I have too lean bullish... but only after a sell off on Monday. I'm thinking they will go down Monday to put in another right shoulder, but a higher low then the previous one. This should give them another chance to push up again later this week. The other possibility is that they sell off on Monday and continue down, allowing the daily chart to roll over, and wave 3 down starts. I just don't think they will do it yet, but I've been fooled before so I wouldn't put it past them!

Also, there is one more possible move on Monday. While both of the above scenarios involve a gap down on Monday (or a flat open and selling most of the day), there is still the chance that they'll be nice and gap it up... allowing the bears to get short at the resistance zone of 1340-1345. Wouldn't that be nice of the gangsters? Of course I'd still expect it to sell off and end the day in the red. How far red is another story!

The short term charts do support a gap up, as they ended the day on Friday putting in a bull flag. And I'm sure every trader seen it and many went long into Monday I'd guess. But to me, it seems too obvious. A gap up would allow the bulls that went long Friday to close out their positions at the resistance zone for a nice profit, and allow the bears to get short at the same area for a nice move back down. What a perfect trade that is! Both bulls and bears would make money from the gangsters.

Now you tell me, do the gangsters usually make it that easy to spot? I've never seen it so obvious, as everyone will make a profit if it gaps up into resistance and gets slapped back down. I'm not 100% sure that it can't gap up and go, but the odds are clearly against it. All the short term charts are overbought and rolling over, making it very unlikely that any gap up will hold. And since I'm not the only trader that can see this in the charts, I'd say that there will be a ton of bears waiting in the resistance zone for a chance to get short at the top of a move... with high odds that it will be pushed down 10-20 points easily.

The Bull Train... Need I Say More?

I think back to other times in the past when I've seen them fall short of an area that all the bears are waiting at, not allowing them on board. The bears then chase the move back down and get short heavily at the bottom of it. Time and time again, I've seen this happen... it's what gives them the ability to have a big short squeeze. Other times I've seen them gap over a resistance zone to do a stop sweep and then reverse back down without any bears still in short positions... once again, stealing the little guys money.

This game has been played since the market first opened I'd imagine. While they still could do the later and gap it above the resistance zone and then sell off, I really doubt that will happen. Again, the short term charts just don't support that happening for Monday. That leaves me to one conclusion... Monday is very likely to close down. Whether it gaps up and falls back down, open flat and sells off all day, or gaps down and closes red... the end result is the same, "A Red Monday".

The "how much" part is the tough one. I'd like to see a move down to gap window from Tuesdays move, (around 1320 spx), as that would make a higher low and a second right shoulder... still allowing the rest of the week to rally back up. Now I'm not a bull, as you all know that, but I'd just like to see them get the spy fp out of the way as soon as possible. Since the daily chart can still go up more this week, I'd like to see it happen while it's still pointing up. Once the daily rolls back down we should see a bear feast I believe.

Basically, I'd like to see a repeat of last week... a nice fake out move down on Monday, and a rally up the rest of the week, hitting the spy fp by Friday. Will it happen like that? I doubt it, but it's possible... even if only a little bit possible. A much shallower move down on Monday would certainly support a move up to the FP by Friday. Maybe it will only drop 5-10 points on Monday, and the rest of the week is more of the same Bullish@t from last week... gap up after gap up, on fake news and made up earnings. Anything is possible in the matrix we live in!

Good luck everyone...

Red

P.S. I'm long the vix (vxn) from Friday... wish me luck too!

QQQ Weekend update: http://niftychartsandpatterns.blogspot.com/2011/04/qqq-weekend-update.html

Nice update San…

Personally, I think the bulls don’t have too much longer to ride this train, as bear territory is up ahead soon.

Thanks Leo

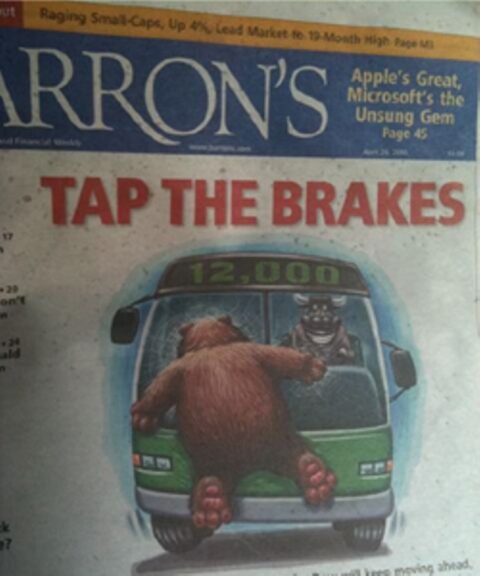

Red, saw this posted on another site. FYI

“Note that this weeks Barron’s cover is a warning (from the Gordon Gekko’s of Wall Street) to Corporate Insiders that the markets will be moving lower.”

http://www.businessinsider.com/uh-oh-remember-what-happened-the-last-time-barrons-had-a-bull-crushing-a-bear-on-a-cover-2011-4

Thanks…

Good catch! Looks like we are very close to top from the looks of things.

sa-WEET!

you should get 3 or 4 likes for this gem.

Red, I lost you around the 5th paragraph.

I do agree there could be a lot of gaps both ways, (meth teeth pattern)

so, I fall back to bigger charts.

A 54 year T run.

http://ttheory.typepad.com/files/eliades-3-megatspdf.pdf

April 27th to ~ June 13th.

🙂

LOL… yes, I should have broke it up with some pictures to make it easier to read. I’ll add one for you.

doh!

http://us.123rf.com/400wm/400/400/Cole123RF/Cole123RF0803/Cole123RF080300040/2645270-red-crayon-drawing-line-graph-on-grid–vector.jpg

I like the Barron’s post by Robert… refresh the page now.

Ok, I added one more for you… “the bull train”. LOL!

Fear Factor

Fear Factor, the 25% channel line is a pretty good “interior channel” all by itself. I can’t do the PRS on Prophet charts, so we have to live with this standard 0/25/50/75/100 channel.

The kiss on the 25%and the Bollinger Band AND nearly a FF Gap Fill, well what can I say. Sure our central planners can throw our tax money at a useless endeavor like levitating an overstuffed pig. At some point fundamentals do matter, just don’t go broke before that happens.

Cable with a “blow off top” pressing the old channel line, popping it really.

http://oahutrading.blogspot.com/2011/04/fear-factor_24.html

ES Chart: http://niftychartsandpatterns.blogspot.com/2011/04/es-support-and-resistance-levels.html

I don’t count the kind of FPs you see like the one at 138 because it’s not on the charts. It seems strange that they would put any communication out in such a strange and esoteric way. However, if that print is some kind of top or it is hit on 4/29 like you say, then I will have to take it seriously!

Need the spy to come down and hit FP 133.11, then ill go long and strong!

Crude Oil Chart: http://niftychartsandpatterns.blogspot.com/2011/04/crude-oil-near-resistance-level.html

red,

i am unsure, but i see 000’s across the board in european futures…..is european markets closed today???

Hmmm… I don’t know Richie?

Hmmm… I don’t know Richie?

I think they are closed Richie…

red,

i HOPE they are, otherwise all of europe went offline all at once ~ which would mean only one thing ~ BBQ!!! AND WE WEREN’T INVITED!!!

Bank Holiday, I thought. FYI

The Goldman boys needed a day to hang out on their 200 foot yacht with $1,000 dollar hookers and bags of cocaine.

200 foot??? I think that’s what the butler owns. You don’t think they’re doing all that hard work flipping bonds back to the Fed for chump change, do you?

LOL… mistyped that one I guess. How about a 2000 foot ship for the gangsters and the 200 foot on is for the mistress (the butler is a sheep like us, so he’s not likely to get as much as the hot looking tramp on the side).

Maybe we go down to the 132.26 spy fp from last Thursday?

Mr. Topstep…

http://www.youtube.com/watch?v=nN2hZ6ujaTk

SLV Chart: http://niftychartsandpatterns.blogspot.com/2011/04/slv-hour-stays-above-trend-line.html

Looks like this is all we are going to get on the downside folks! Sad… truly sad. We didn’t even fill the first gap dow around 1330, let alone go for gap window at 1320. This is very bullish for bulltards I’m afraid. They have just about reset all of the short term “overbought” conditions now. Maybe one more day of this garbage and then it’s off to moon we go!

possible 31 FP VIX

http://2.bp.blogspot.com/-AoMthfKtk8Q/TbXqTulYKZI/AAAAAAAAAgY/mgRS-H6UZmw/s1600/spxvix.jpg

I think you’re right about FFIV being a buy. There was an AH price near $105, at gap support. I’m long.

No video tonight gang… I’m too tired, and I’m not really expecting much until after the FOMC meeting this Wednesday. Tomorrow should be another light volume day and just chop around. I’ll do one tomorrow…

Watch out for a 211 at 938 Temple tomorrow…………….Silver getting manhandled in after hours activity.

Wouldn’t be surprised to see a pop & drop.

This is a problem, for the bulls, that is:

http://www.bloomberg.com/apps/quote?ticker=GGGB2YR:IND

hi

I’m new to this page, I have been learning the forex for the past 2 years and this blog rings very true to my observation and gut feel to what’s going on.

Bearing in mind (no pun intended) the immanent big short what should I be doing to safeguard the meagre funds I have available to me?

Just how do you plan on shorting this pig? Every time I short it, I get taken to the woodshed. I shorted the market Friday by going long the vxx, thinking that the vix would pop for sure, even if the market didn’t sell off that much. Well, the vix popped 1.50 yesterday, but the vxx tanked! WTF? How can you win in this rigged game? I got the call correctly, but the only instrument I knew of to play the vix with was the vxx… and I still got creamed!

Hey Red, I wouldn’t be surprised to see the gangster market powers that be, find a way to get rid of the market shorting ETF’s before the big plunge. They love to keep retail from making any money.

Don’t I know it! The only way to make money is to become a gangster and steal it from the sheep… to bad I’m still a sheep!

Have some solice in this,.. IF there is still a market in the future, TA will actually work again. This inverse head and shoulders pattern seems just too textbook for these gangsters. I am like you, I gotta wait and see. I’ve been headfaked too many times, LOL!

The inverse H&S put it much higher then the 1388 FP area, so that could be the fake out that the gangsters are planning. I suspect that all the bears will be dead (or become bulls) when that target is hit… and the bulls will be looking for 1420-1440 (or more?).

Many will go long over the weekend, should we hit 138.86 this Friday. However, guess who’s having an “event” this weekend?

http://www.legatusmagazine.org/?page_id=117

Yes, the gangsters are gathering to plan the next crash in the market. They have too pay some debt I’d assume, and you know they don’t pay for it with their money… they steal it from the sheep! How about a nice gap down and tank on Monday, by some staged event or news released to get the ball rolling back down hill…

I hear ya Red. I’m still trying to figure out how Obammy figures into this. He’s going to have difficulty getting re-elected into high gas prices or falling market headwinds. He can’t really blame it on Bush too much now I don’t think. Maybe the Illuminati just needed to use him as President for one term. LOL!

I think Obummer isn’t doing what they want him to do… hence all the talk of him not being born in America now. They suppressed that info when they supported him in 2008, but now they seem unhappy with him. They probably have Palin in mind for the 2012 election. She’s pretty naive and easy to manipulate. I’m sure she’s never even heard of the Illuminati, so they will pull her string easily.

ES Chart: http://niftychartsandpatterns.blogspot.com/2011/04/es-near-resistance-level.html

That’s a FAT divergence.

REAL FAT!

Anybody like what they are seeing or are you all too busy selling and shorting. LOL!

The vix sure isn’t buying this move. I would expect some serious volatility heading into Berscumbag’s question and answer session.

Up, up and away… to 138.86 we go! (Total BS of course, but what’s new!).

Fat Divergence or not, you guys both know where this pig is going to… and I’m not shorting it until it gets there!

Wow,..they really got you gun-shy. Either this is the base for a huge move up (like Red thinks) OR it’s the nail in the coffin. Berscumag will let us know tomorrow. Or maybe he will just say a bunch of neutral crap… Ugh.

If they close this pig over 1344.07 SPX that inverse head and shoulder pattern will send it parabolic. They must already know what gangster Bernake is gonna say… Pays to be an insider thief. I’m sure the SEC will be looking into all that.

I can’t buy into tomorrow at this point… I might as well shut ‘er down. Sickening.

Bought yesterday when we came down close to the 133.11 FP. as luck would have it, been up ever since :). i agree that we are eyeballing 136 this week and heading higher into may 5th. after that..i would expect a 4th wave down on the daily SPY…maybe lasting a week..then a final push higher going into early june..after that…LOOK OUT! Also…a low risk trade where u can buy stock and not options is the VIX at 13 and once the crash or stock correction hits in early summer, vix going to at least 30…easy way to double $$$.

Why stop at 136? I wouldn’t be surprised if we hit 138.86 by this Friday.

“I’m sure the SEC will be looking into all that”

Yeah, the SEC wolves will be investigating the WallStreet wolves to see if any sheep were hurt in this wolf attack!

136 is the weekly upper BB. Based on last years weekly 5th wave up, once we started inverse HnS, we rushed up to the upper BB, very temporary resistance, and from a weekly standpoint, rode the upper BB until the 5th wave ended May 5th. So yea, minimum 136 this week but i do see it facing some resistance and perhaps hitting 138 next week. SPY 30, 60, 4 hour and maybe even daily SPY will be overbought at 136 …gotta do some recycling anyways maybe this thursday or friday before heading to that FP at 138.86. I measured the inverse HnS right shoulder and should extend to 1377 SPX before the 4th wave down begins on daily chart. after that..we all know SPX will try its damnest to reach 1400..will probably correct right before we get there or shortly after… this summer, looking at least 10 percent correction..probably more to get the monthly RSI down within the channel.

“overbought” what’s that? I’ve never heard of it!

well u have a valid point there lol, back in the day before 1971 especially…, it used to be legit! but like u said, technicals only work for the bulls! so there is only such thing as oversold!

Unfortunately during this time of the year, the daily bollinger bands get tighter and narrower meaning for a substantial move up, we must keep pushing on the bands. Vix looks like it might head lower now and from a 15min chart perspective, should start 3rd wave up soon. at least i hope?

Looking down the road… lots of people calling for a major crash this fall. i dont see it. i think bernanke will continue to do the same thing he has done all along… print, print, print, print. now its true he was printing during the 2008 crash but i dont know, just see “asset” prices moving higher and the dollar sliding. HOWEVER, if he doesnt do QE3 or a version of it, yes, i believe the market will tumble but again, hes so pollitical, why would he let the market tumble when he was put in by the prez himself… i believe the true crash in equities after the dollar crash and all that crap..will be in 2016, if we make it that long. I think it depends on interest rates, our credit rating, debt crisis, etc. Interest rates should hike, but wont. Credit rating should have already been downgraded, but hasnt. Debt crisis the worst here than anywhere else but still accumulating more. Hate to say it but the worst case scenario is looking to be the most likely.. 200 dollar oil, dollar crash, 300 dollar silver, 3000+ dollar gold. Cause govt has two options…default..it wont. or inflate the hell out of the currency…so far, Benny has chosen the latter.

Dont wanna be a bloghog but did some open interest research for May SPY.

The Upper Limit is a bit hard to call right now but SPY’s upper limit on expiration friday will be 135 to 138 and lower limit 135. Will do the research once a week until expiration week. Thanks!

Do you mean for this Friday or the third Friday in May?

3rd friday in may. did u just see that SPY FP? is that a Fake print or did some news just come out..daggone!

No, I don’t see any FP? Post it or email it too me…

I see it now… looks like a late fill, that’s all.

It looks like the 211 at 938,938 Temple has been delayed possibly to its natural date when the squares of 28, and 36 hit. But there is a 191 hit tomorrow from Bradley’s date. It will also be xx37days later. Somehow the insiders love the 4-26 number after making starring appearances in 127 Hours, Bradley’s ode to the boiling point, the pre-flash crash high, 426 days from 3-6-9 to 5-6-10.

Roger 10-4, send a car over to 1334 Anaheim St to check out the ONS liquor store. ONS liquor store. That’s where Bradley went to get all the liqour he couldn’t afford.

10-4 Unit 1-5.

Mr. Topstep sees 1383.50 ES as the highest high expected, which is probably right in line with the 138.86 spy FP…

http://www.youtube.com/watch?v=_Nx5I19IDr4

(also, I’ll have a new video up in about 30 minutes or less)

Refresh page for new update…

MSFT Chart: http://niftychartsandpatterns.blogspot.com/2011/04/msft-closes-above-200-dma.html

ES Rising Wedge: http://niftychartsandpatterns.blogspot.com/2011/04/rising-wedge-of-es.html

Red,

Maybe it’s just me, but it appears that around this point last year we were seeing all kinds of very low downside FP’s (GS @ 13, SPY ~20, Dow 8100, VIX 349, etc). Now it appears the ones that are seen are close ones up or down (maybe +/- 60 SPX max?)

Do you think it’s possible something has changed and TPTB is altering their plans? Or are they just fine tuning their timeline and waiting for the right opportunity to tank this sucker?

I just find it strange the type of FP/casper that seems to be showing up recently – while provides direction – doesn’t have the “wow” factor TPTB would need to implement their NWO plans w/ a new currency. Thoughts?

Red,

Maybe it’s just me, but it appears that around this point last year we were seeing all kinds of very low downside FP’s (GS @ 13, SPY ~20, Dow 8100, VIX 349, etc). Now it appears the ones that are seen are close ones up or down (maybe +/- 60 SPX max?)

Do you think it’s possible something has changed and TPTB is altering their plans? Or are they just fine tuning their timeline and waiting for the right opportunity to tank this sucker?

I just find it strange the type of FP/casper that seems to be showing up recently – while provides direction – doesn’t have the “wow” factor TPTB would need to implement their NWO plans w/ a new currency. Thoughts?

Hard too say? But it does seem like they put out all the really good FP’s last year. I’d say that the volume, date and time of those prints told the insiders when they would be hit. But of course us sheep don’t know the code.

Once this market does finally roll over, I’ll be looking for all those prints to be hit on the move down. For now though, we have too wait until this pig finally dies.

On a side note, what if the Simpson’s clock reads May 6th… as in “5 minutes until 6 o’clock”? Maybe that’s when one of the reactors blows in Japan (or some where else in the world)?

Thanks Red! Of course the Simpsons clock really is May 6th, they’d wait until after hours to trigger the false flag so everyone would be trapped over the weekend!

That small gap up in the morning tells me they will likely hold the market in the rising wedge until the 12:30 announcement by the Fed’s. After that… who knows? I personally think it will sell off and break the wedge… at least until the FOMC minutes are released at 2:15.

Notice how they decided to do this in the middle of the week and the middle of the day… as well as during earnings season. Whatever they say I suspect it will be negative for the market, and they are hoping that the good earnings reports will keep the market from selling off too much. And, I’m sure they’ll say something positive at 2:15 to rally back up whatever it sells off to.

It’s a damn casino. Headfake here, headfake there… Get the shorts on and then rocket up until retail longs get on then drop her down to shake ’em off…

Yes, it’s going to go crazy at 12:30 pm and 2:15 pm! I don’t know which way it goes, but I do expect a positive close by the end of the day.

Still think they will take ‘er to the spy 138 area? I think a second confirming close above 1344 will open the bulls flood gates. They are a little aprehensive today obviously, but like you say, bullish TA is the only TA that works and an inverse head and shoulders is a pretty powerful pattern.

I’ve been told that the FOMC decision is at 12:30 and then later Bernanke talks at 2:15… so be ready for some volatility!

Well, nothing changed… why aren’t I surprised? LOL

Sounded like QE goes on… According to them, inflation is not much of an issue and the market needs further easing.That’s what I heard. LOL!

Well, I’d say we’ll hit that upside FP on the SPY for sure now.

What is your interpretation of the Fed statement? Different news outlets are acting like the statement meant QE2 will end and further easing is being taken off the table. I totally didn’t hear that at all, if anything I heard further easing… I’m puzzled now… I need to get back to my charts. LOL!

The bottom line on what they said… “they will continue to manipulate the market (errr… I mean “buy the debt”). You can only eat 10 fingers and toes, and at some point they will run out of body parts too eat.

What is your interpretation of the Fed statement? Different news outlets are acting like the statement meant QE2 will end and further easing is being taken off the table. I totally didn’t hear that at all, if anything I heard further easing… I’m puzzled now… I need to get back to my charts. LOL!

SLV Chart: http://niftychartsandpatterns.blogspot.com/2011/04/slv-slows-down.html

Thanks San… looks bullish too me. Off to 138.86 spy I believe, and slv will go up too!

I’d really be shocked if we don’t bust through this resistance and put in a new high today. I’m going to be even more shocked if we hit the FP on Friday!

With uncertainty removed (Benny’s Press Conf), market should go uppy…

Ben Bernanke for King of the Stock Market! He can save us all… LOL!

So,…reinvestment of maturing securities essentially keeps the current liquidity on the table, but not reigning in any dollars to destroy and lower the supply of them on the market. Hmmm

Kind of like a snake eating its’ tail… eventually it will end badly! LOL

GOLD: http://niftychartsandpatterns.blogspot.com/2011/04/new-high-for-gold.html

WOW.. you guys see AMZN ? those shorties all got their asses kicked…inside out.

Yeah! New highs I believe! Crazy stuff here… can you believe it? I never thought it was possible to get to the spy fp by this Friday, but it’s looking more and more likely now.

hey..red can you check out AMZN charts.. i mean… from a technical point of view… it looks like…todays move up…wiped out all those previous shorties…who had stops set…which fired the move up super high today ..correct ?

Overbought! …but the market doesn’t seem to care.

Do you still think it crashes afterwards (hitting FP) or can this accomodative policy keep the rocket fueled up?

Hard too say, but the timing of the FP for this Friday (if it hit’s?) and the Legatus meeting over the weekend, sure makes you wonder if Monday is going to be ugly or not?

still holding FFIV long overnight. RDWR reports before the open tomorrow, according to Google. RDWR and FFIV are in the same “space” and good news for one usually bumps the other’s stock.

Looking to sell at the 200 dma (108.9) and then re-evaluate

Anna made a great call on Silver today Dread, and made a ton off it! It’s still going up afterhours it looks like. What’s your overall upside target on the market? (spy, spx, dow, etc..).

I like this chart on Carl Futia’s site:

http://3.bp.blogspot.com/-vIDLGs77mZk/TbbhpLGCP0I/AAAAAAAACjY/L56_QJ9omsw/s1600/110426%2B1115%2Bam.jpg

that’s /ES, not $SPX

Well, Carl’s target is in line with everyone else it seems. Mr TopStep was calling for 1383.90 es and I have the 138.86 spy fp, and Carl’s target is in that area too it seems. I guess the bottom line is… we are going up!

Things going very well. 1400 will be here shortly…..:)

You never know Robert, but one thing seems certain… the SPY FP is going to be hit. Whether or not we stop there and turn back down, or continue higher to 1400+ is unknown?

Sure looks like you will see your FP soon. Bought a little MSI before earnings….

Print from http://www.fxstreet.com/rates-charts/usdollar-index/ on the USD has a candlestick high for 4/28/11 for 86.55.

I don’t see it? If it was there, it seems to be gone now. Did you get a screen shot of it? If so, email it to me please or just post it.

Candlestick is gone very weird because date was wrong as well. I don’t know how to take a screen shot, but there was an obvious abnormal candlestick with a high at 86.55 and a date of 4/28

If you hold down the “shift” and “print screen/sys rq” button at the same time you will copy your screen to your computers temporary memory. Then open up MS Word (or any other program) and “paste” it. Hold down the “ctrl” and then press “V” to paste. Then save the file and email it to me… next time I guess.

very cool indeed thank you

HI guys vid is up.

Es is giving me a BULL Woodie!

Bonds are giving me a Bear Woodie! LOL

Live Video Analysis here ==> http://bit.ly/jHLnQz

Good luck out there as always and HAPPY TRADING!

Thanks Jesterx… I like your video’s. Very simple and to the point (unlike mine… LOL).

Refresh page for Wednesday update…

AMAZON Chart: http://niftychartsandpatterns.blogspot.com/2011/04/amazon-price-volume-breakout.html

Hey gang, looks like that FP on the Dollar is back…

http://www.fxstreet.com/rates-charts/usdollar-index/

If the dollar rockets to 86.47, you can kiss this rally goodbye! I’d expect at least a 1,000 point drop in the Dow if the dollar goes that high. (tell me if you guys don’t see it please).

Well you know Bennie has to justify QE3 somehow, right? If the dollar shoots back up and the market tanks…presto…he has his excuse. We knew the dollar demise wouldn’t be a straight line to the bottom anyway…

I got a screen shot of it in case is disappears…

http://reddragonleo.com/wp-content/uploads/fp-dollar-86-47-on-04-28-2011-date-one-day-in-the-future.png

ES Chart: http://niftychartsandpatterns.blogspot.com/2011/04/es-support-level_28.html

Thanks San… looks like we can go high still.

That’s right Leo. Price breaking above 1356 can extend this. (ES)