This could be our "October Surprise"...

(to watch on youtube: http://www.youtube.com/watch?v=yKVJzAb-jIM)

Why? Because it really doesn't make sense to devalue the dollar when the market is up so high. It would be more logical (and get more "bang for the buck") if they sell off the market some first and then at the bottom they could do the devaluation to spark a "blow off" top rally into the summer of 2013. Kind of like doing "reverse stock splits"... you don't do them when the stock is high, you do them when it's really low. That way it goes back up to a "trade-able level", where as it's hard to trade it when it drops below $5.00... which is the reason why they do them as a 10-1 reverse split would put a $5.00 stock back at $50.00 and be more attractive to trade.

Therefore, if they sell of the market a couple of thousand Dow points and then do the dollar devaluation it would make the market (and gold) go up huge... maybe even to WBS's 30k+ target? Of course it will be with devalued dollars and therefore wouldn't be a real "level" like today, but it would fool the sheep until next summer when they really do let it all collapse for real. So, what am I thinking will happen? This coming October 23rd and 24th they will have another FOMC meeting (http://federalreserve.gov/whatsnext.htm) and I think that something they say will trigger a sell off in the market. Like I said, I think the top will be put in on Tuesday the 23rd as it's a ritual "eleven" day... just like the most recent top of October 5th was also an "eleven" day.

But what will they say? They now have QE3 going forever with no ending date set, so what's left for them to say to spark a rally? I can't think of anything... can you? If fact, in this latest 3 hour video Lindsey Williams says some very interesting things starting at 2 hours and 56 minutes into it.

http://lindseywilliams101.blogspot.com/2012/10/lindsey-williams-america-will-be-over.html

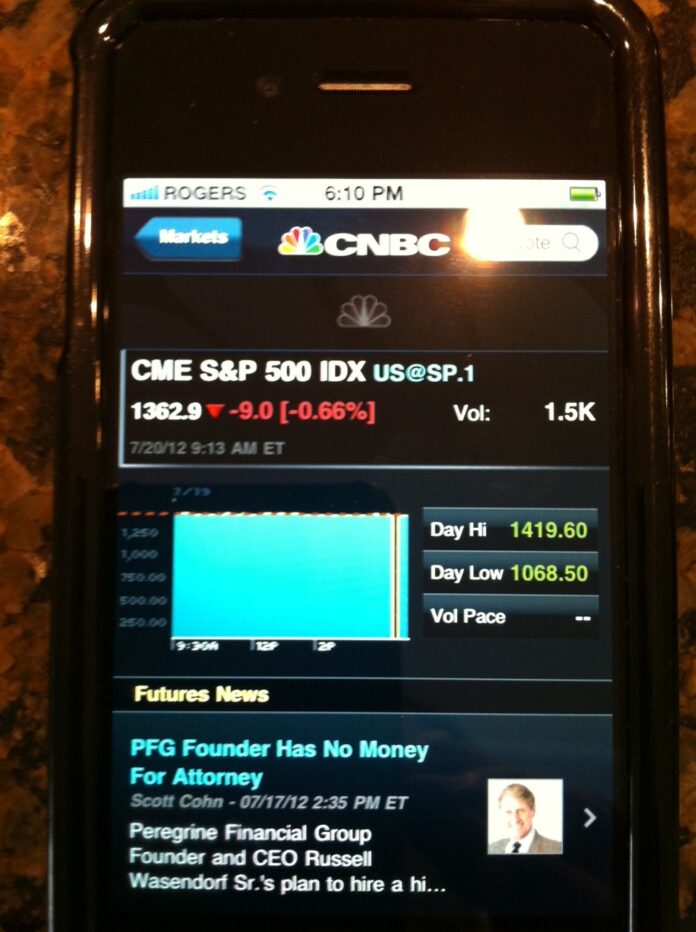

I'm thinking that they "may" actually raise the interest rates at this meeting which would of course tank the market hard. Not a crash but a very large move down... possibly to this FP of 1068 on the SPX. Notice the date in the left hand top corner (not the date the screenshot was taken, which was 7/20/12 9:13am) that shows 7/19... which is 0+7+1+9+2+0+1+2=22, or "11"! These FP's that are put out on "eleven" days seem to be "real" ones, whereas others "may" be just a distraction? So, "if" they actually do sell off the market down to 1068 and then do the dollar devaluation... there going to be a new "all time" high for sure next year! Gold would go up 40% instantly just like they want to happen. Then from whatever level it starts at I would fully expect it to continue up all of next year while the market is on a crazy insane "devalued dollar" Bull Market Rally!

I'm thinking that they "may" actually raise the interest rates at this meeting which would of course tank the market hard. Not a crash but a very large move down... possibly to this FP of 1068 on the SPX. Notice the date in the left hand top corner (not the date the screenshot was taken, which was 7/20/12 9:13am) that shows 7/19... which is 0+7+1+9+2+0+1+2=22, or "11"! These FP's that are put out on "eleven" days seem to be "real" ones, whereas others "may" be just a distraction? So, "if" they actually do sell off the market down to 1068 and then do the dollar devaluation... there going to be a new "all time" high for sure next year! Gold would go up 40% instantly just like they want to happen. Then from whatever level it starts at I would fully expect it to continue up all of next year while the market is on a crazy insane "devalued dollar" Bull Market Rally!

This would qualify for what Lindsey Williams said about there NOT being any crash in the next 3 months (his "crash" is something like from 1929, not a minor 3,000 point drop) and the rise in prices for Gold and Silver... as well as Oil. These things could all come true "if" they sell off first (to scare out all the bulls in Gold right now, as it should dip too) and then devalue the dollar to get the prices of everything up where they want them to be.

But what if I'm totally wrong and the "turn" after Legatus is UP?

This chart of the open interest in Gold has me worried. So one (or several big buyers) purchased 20,000 calls today on Gold for the 190 strike price for the month of November. Gold is selling off today as I'm writing this post and is around 168 currently. A move up to 190 or more would only happen if the "October Surprise" was the 40% dollar devaluation... which means the market won't tank hard as I current think it will. Everything tells me that we are going to sell off hard, but too many others see the same thing... and that has me really worried!

That facts are that the gangsters all met together in these Legatus Pilgrimages and decide the fate for us sheep. Right after almost all (not everyone of them though) a big turn in the market happens. I have just been "assuming" (making an ASS out of U and ME) that because we are so overbought that the "turn" will be down hard. But the reality is that we have been chop it up sideways in a narrow trading range for the last 2 months or more now. Therefore a "turn" could go either way, as trading basically sideways is just "Flat" with no direction really chosen.

I'm also worried about what Lindsey Williams said too. You see I'm sure they use him to spread "timely" information that benefits them when they want us sheep to take the other side of the trade. When they are long they spread fear in the market and all the bears get short. When they are short they everything is fine and it's just a health correction, and that we sheep should be buying the dips while it goes longer. Once the bottom is in they start spreading fear that it' going to collapse and that we sheep should panic, sell out our longs and go short. Then they rip it higher and squeeze us all out.

That's how the game is rigged folks. So right now they seem to be spreading fear of an "October Surprise Stock Market Crash". Now I've repeatedly said I see a big move down, but not a crash. However, if I'm wrong on this and the real "October Surprise" is the dollar devaluation (meaning that Lindsey either lied, was lied to by his elite source, or the elite source was lied to) and they will do it this year... not next year as he was told. Lindsey said that his source stated that they'll be NO collapse of the dollar before January 1st, 2013. I take that to mean that they won't do the 40% dollar devaluation this year... but what if he's wrong?

These gangsters are masters at lying, mis-leading and deceiving us sheep, so the biggest surprise could very well be a rip roaring rally from a dollar devaluation... and not a big correction as I (and many others) have been calling for. The facts are simple, as they refer to what has happened in the past. I'm not referring to the charts as they are too heavily manipulated to work anymore. I'm referring to the ritual numbers like "eleven" that many (not all) significant highs are put in on.

I'm also referring to the past times that there was a turn after an FOMC meeting (which is this coming October 23rd/24th). They will usually run the market up into the meeting and then sell off afterwards when no new "good news" is released from Bernanke. If they rally into the meeting slowly (because they don't know what will come out of it) then sometimes they rally hard after it... especially if Bernanke promises more crack. This past FOMC was a perfect example where they started a small rally into the September 13th, 2012 meeting and then sold off afterwards. It's always a tough call on what will happen after these meetings but they usually produce a turn in the market.

The other indicator that I watch is the Legatus meetings where all the gangsters meet to decide on how to screw the sheep again. The past Legatus meetings have been turns at least 80% of the time going back to 2008 (I never checked back further then that). So I fully expect something big to happen after this one ends this coming Sunday the 21st. Note that they are in Rome during this time period where it's easy for them to funnel their stolen money through the Vatican banks, as they don't answer to anyone or keep records of your name... only a "number" and "key" is used to access your account (great for thieves that need to launder money).

With everything lining up together now a "Big Turn" in the market is nearly certain!

The question is... which way? These gangsters are masters at stealing your money. Remember, they don't work for their money... they steal from you! The "work" that they do (if you can call it that?) is based on how to manipulate the sheep into taking the opposite side of any trade they are in... and then buying off, bullying, or threatening the right people to make the trade go in their favor. They front-men companies like JP Morgan to illegally manipulate silver and thugs like Goldman Sachs to move the stock market up and down where they want it to go. Make NO mistake about it... these people are criminals! They do "insider" trading as often as they eat, and murder the competition... physically!

You didn't really think Japan was hit by accident did you? Of course it wasn't... they had to murder the competition. For what you ask? Cars that run on water of course. That would have killed the oil cartel and destroyed their evil plans to chip us all and mold us into their "New World Order". You see, they will do whatever it takes to control you. While Lindsey Williams may have compassion for his elite friend, I don't! They are all murdering satanists that need to be exposed, arrested and tried for crimes against humanity.

Believe me, they don't care one red cent about you... in fact they call you a "useless eater"! I call them Satanist Pigs! They may be trying to save themselves as they get older and face death (that's what Lindsey says), but "karma" is "karma" and they will have too pay for all the evil they have done throughout their lives. So will you and so will I... so I try my best to keep good karma and not do bad or evil things to anyone else. I just use this blog to wake up the sheep to the evil around them, but not to fall prey to them. Just smile everyday and don't let the gangsters bother you, as they will meet their maker when their time is up. Do good to others and when you meet your maker he (or she for you ladies... LOL) will be happy to see you, and reward you for your good deeds! (assuming you believe in the afterlife?).

Anyway, I rambling now. Let's get back to "thinking like a pig" but not becoming one. What are these gangsters deciding on doing after this latest Legatus meeting? I wish I knew the answer to that question but I don't. So, I'll have to play both sides of this game but lean heavy to the short side. I plan on taking a long position on gold as a hedge in case they surprise us sheep over the weekend and devalue the dollar 40% (closing the banks on Monday of course). This will be a "wildcard" position that I expect to expire worthless if the market tanks as I expect it too (gold should follow the market down... or up). I will take this position before the close on Friday the 19th and hope that I'm totally wrong on the surprise being a bank holiday.

If nothing happens then I'll be looking to get short the market on Monday the 22nd and see if I'm right on this call. A big sell off in the market will mean the long gold position will expire worthless as gold should go down with the market. However, "if" they panic the traders with a big, fast sell off (mini-crash) move down then gold could go up huge from the panic (as traders would flock to safety) and I would win on both positions. I don't see this happening though as it makes more sense to just take it down in a similar fashion to the May 2nd, 2012 sell off. That one dropped about 124 spx points over 13 trading days.

But, if Bernanke instead announces and interest rate hike then the dollar will soar hard (meaning gold should tank, but again... it's a wildcard as "fear" can also cause it to soar higher), and the market will tank hard and fast. Logic (and the evidence) tells me that a "BIG MOVE" is coming this October 23rd, 2012 but which direction is still unknown? Therefore the safest trade is to play both sides. One would be to go long metals in case of the dollar devaluation and the other would be to short the market in case of an interest rate hike. Either way the money made from whichever one plays out should more then make up for the loss on the other one that will expire worthless.

While I'm not giving out trading advice here as you all have too make your own decisions based on what you see in the market I'll personally be looking hard at some wildcard gold calls like "some big player" purchased today at the 190 strike price for the month of November. Now we all know that there is a buyer and a seller for all trades for both "calls" and "puts", so there had to be a seller for those 20,000 calls too, right? Some of you might think that someone is just "hedging" their positions by selling those calls to collect the premium as they expect gold to go down making those calls sold expire worthless in November.... which is a natural thought.

But, what trader in his right mind would sell so many "calls" so far away from the current level to collect only 4-5 cents? If you thought (or knew because you were an "insider") that gold was going down into November expiration wouldn't you want to collect as high a premium as possible? You be more likely to sell "calls" that are much closer to the money like the 170's that are worth $2.08-$2.10 per call. Remember that someone that buys or sells 20,000 calls usually has "inside information"... meaning that you (or that trader) knows that gold is going down and that he will get to keep all the premium he collects for the sale of those calls. So ask yourself this question... would you rather sell 20,000 calls for 3 cents each and keep the premium when gold sells off as expected or sell 20,000 calls for $2.08 each and keep that premium?

But, what trader in his right mind would sell so many "calls" so far away from the current level to collect only 4-5 cents? If you thought (or knew because you were an "insider") that gold was going down into November expiration wouldn't you want to collect as high a premium as possible? You be more likely to sell "calls" that are much closer to the money like the 170's that are worth $2.08-$2.10 per call. Remember that someone that buys or sells 20,000 calls usually has "inside information"... meaning that you (or that trader) knows that gold is going down and that he will get to keep all the premium he collects for the sale of those calls. So ask yourself this question... would you rather sell 20,000 calls for 3 cents each and keep the premium when gold sells off as expected or sell 20,000 calls for $2.08 each and keep that premium?

Logic should tell you that one (or several large traders) did not sell 20,000 calls at the 190 strike price today to collect the premium for them when they expire worthless, but instead bought them because he was expecting a big move up and they were dirt cheap to purchase. A dollar devaluation would cause them to go up 10-20 fold or more... overnight! To me it makes more sense that one (or several) large buyers purchased these calls today from many smaller sellers (that don't think gold is going up). While there has to be an equal amount of buyers and sellers for every call and put at every strike price that doesn't mean that there can't be one big buyer that purchased from many smaller sellers... which is what I think happened today.

Of course this is all just speculation on my part, but I wan't to be covered for the big move coming, so playing both sides just makes the most sense too me right now. Therefore I'll be looking to pick a crazy "out of the money" strike price on some gold calls tomorrow (Friday, October 19th, 2012) to go long on. Again, I fully expect them to expire worthless as I'm only getting them as a hedge against a surprise dollar devaluation over this coming weekend. Then I'll go short the market with some SPY puts on Monday the 22nd (again, this assumes nothing happens over the weekend). From there I'll just wait and see what happens during the FOMC meeting on the 23rd (the most likely "turn date" because it's an "eleven" date). My ratio will be 1/3rd long gold and 2/3rd's short via the SPY.

Please make your own trading decisions here and don't put up more money then you can afford to lose. While I'm doing my best to help everyone make a bunch of money from this big move coming I'm not always right as I'm a sheep like you are and don't have any insider information. This is pure speculation on my part and I'll be putting it to the test with my own money, but you should do your own research and make your own decisions.

Good Luck everyone...

Red

thanks to annamall, i found out u had a new post up red! hehe

i’ll go post the link at my blog…this is a rare happenning!

Thanks… copy and re-post away as we need to get the word out asap!

a very nice post! one of the best ones yet!

Thanks… sometimes “quality” is better then “quantity”. Writing less posts and just updating the current one with comments works better for me. Then when I do write a new post it has really good information in it.

http://zstock7.com/wp-content/uploads/2012/09/google-start-page.jpg

Got to Love Red’s update video’s…Next 2 months are important

Sanchito raisded him QB rating from 66.6 to 70.9 with his 11 for 18 for 82 yards performance last week against the Colts and their heralded #1 pick QB, Andrew Luck #12 for a good old 6-12 QB duel last Sunday. 18 attempts for 82 yards====4.555555555 yds per attempt.

666.79 of course is the infamous 3-6-9 SP low.

Meanwhile, perusing through the Vanderbilt-Florida box score from last Saturday, I did happen to notice that the first touchdown of the game was scored by Vanderbilt on a 6play 66yard drive with the time at 9:22 (I assume that a 6 play drive wouldn’t take 9 minutes). Florida’s QB Driscall ??? broke Tim Tebow’s single game rushing record of 166 yards by running for 177yards.

The Legatus Tigers just swept the Yankees out of the playoffs. Maybe they’re just the semi-Legatus Tigers now since the previous owner was the Legatus founder. He sold the team in 1992 but they’re both pizza biz bros from the Detroit area and then throw in Mitt whose Bain Capital bought Dominos from the L.founder back around 1987 and it’s just a small little world with many coincidences.

Driskell’s #==6 to Tebow’s #15(6).

well i lean to the short side at least till the elections ..so its us bears cheer till elections then run bull run (4 a while…) tank hard then the devaluation…man its complicated…

Nothing is ever easy I guess… but we’re getting better I think.

SPX Analysis after close: http://niftychartsandpatterns.blogspot.in/2012/10/s-500-analysis-after-closing-bell_19.html

Red, if you think they’d do the devaluation over the weekend, and sell off after the 23rd, then why don’t you bet heavily for the devaluation tomorrow, and if it doesn’t happen, you close out and open your shorts when your funds clear on Tuesday?

That “IS” the plan Anthony. I will only buy the gold longs as a hedge against a possible dollar devaluation over weekend. If nothing happens then I’ll sell them on Monday and go short the market.

I’ll keep an eye on volune of gold tommorrow… it certaibly isi odd, but I think someone would be blowing a lot more then 100k on it if they knew that was about to happen.

Pastor Williams points to momentous events in monetary geopolitics that slipped with little notice while the political class was holding their dog and pony show.

http://lindseywilliams101.blogspot.com/2012/10/lindsey-williams-on-radio-liberty-10-06.html

http://www.youtube.com/watch?feature=player_embedded&v=EZLqkT-IzzQ

GOOGLE Chart analysis: http://niftychartsandpatterns.blogspot.in/2012/10/google-chart-analysis.html

APPLE Testing the cloud: http://niftychartsandpatterns.blogspot.in/2012/10/apple-chart-analysis.html

I’ve changed my mind about going long gold. While the possibility still exists that they “could” do the dollar devaluation over the weekend and cause gold to soar up 40% the odds don’t favor it. Nor do the facts I’ve accumulated over from prior history.

Therefore, after much soul searching last night, I’m going to stick to my original plan and do nothing today. I will not take any position at all until Monday or Tuesday, and that position will be a short position on the market.

I can not let myself get distracted from the evidence even if it is accurate information. While many people with the best intentions come forward and share information that they believe is credible I can’t take it as fact. It could be inaccurate, and even if it is correct I don’t know the time frame.

I’m only concerned about the short term (meaning the next couple of weeks) and I must stick with the facts I have at hand. Those facts are: Legatus, FOMC, and ritual “elevens”.

While the market hasn’t always turned during or just after a Legatus meeting it has do it about 80% of the time over the past 4 years. And while all significant tops don’t happen on “eleven” days the past 3 important ones have.

The same holds true for FOMC days as many (not all) are important turn dates. When you combine all three together into the same time frame you have very high odds for a big turn in the market. So while I can’t know which direction that turn will be the extremely overbought conditions say it should be down.

So if all goes as planned we should have one more important top on Tuesday the 23rd and then we should sell off similar to the May 1st, 2012 drop. That was about 13 down days with only 1 positive close in the middle of the sell off. I’m expecting something to happen just like that, and it could be worst.

As for today, I wouldn’t be surprised if they don’t turn this back up by the end of the day and possibly close in the green or even. Then Monday could (and should) be a nice “all up” day… leaving Tuesday to put in the “topping tail” and allow the real sell off to happen.

So, I’m not wasting my money on a gold hedge as I don’t think we are going to have that bank holiday over the weekend causing gold to soar and the dollar to get crushed. I’m staying in cash until I’m ready to short on Monday or Tuesday.

Good thought Red on staying with your gut instincts…there is so much noise out there today it can drive you crazy!

One thought I had is and maybe food for thought…

Assuming proportionality (which it never is exactly in this market, but sometimes close), the 1086 SPX print you show would be roughly 9950 on the DOW. If you had a 40% devaluation on the dollar, that could in theory bring you to just under 14000. Which is real close to the FP of DIA 143, right? The same proportionality applies to the IWM 87.5 FP I thought someone mentioned a while back. (IWM would be roughly 61 at SPX 1068; then multiple that by 1.4 for the 40% devaluation)

The assumption is that 1068 SPX is the target for when the 40% devaluation happens. So maybe that’s how we will reach those prints? Just one theory to consider…

ES Chart update: http://niftychartsandpatterns.blogspot.in/2012/10/es-chart-update_19.html

sitting on the side until next week, but looks like a nice down day- options exp

CRUDE Oil Ascending triangle: http://niftychartsandpatterns.blogspot.in/2012/10/crude-oil-ascending-triangle.html

Kimble: Head & Shoulders topping pattern in the NDX 100 just got some help from Google???

Jeff Cooper: We are 300 months from ’87 crash. 300 ties to 9/14, this year’s high. Oct. ’07 = 55 months from March ’03 low. Next week = 55 weeks from Oct ’11 low.

The crash in both ’87 and ’29 were 55 days from high.

When they run for cover, GOOG could be a harbinger of what the sell-off will look like. Is the NDX commencing a 3 of 3 to the downside?

Don’t know what it means, if anything, but it took 25 years for the market to make a new high after ’29 crash. Now we’re 25 years from ’87 crash.

They say ‘this’ is about earnings, but the news breaks with the cycles and in 1980 the market plunged during the weeks prior to the election.

Isn’t 55 a fibonacci number?

Going to have to put in some pretty solid up days to hit 147 next week

Looks like the move down has started early gang… not sure what to think? It’s right close to the end of the Legatus meeting, which we now know it accurate again. The top being on an “eleven” day will have to go back to October 5th.

So what does this leave for the 23rd? Since “eleven” days aren’t negative or positive, but used by the gangsters for evil of course, there is now a possibility of a “flash crash” on that date. Insiders already know what Bernanke is going to say and do… which is why we are tanking early.

This tells me that we aren’t likely to bounce much and should continue down like the May 1st sell, with yesterday being May 1st. This means I’m wrong about October 23rd being the top but right about Legatus.

Unfortunately one needs to get it completely right to profit from successfully. So here I sit in cash missing the start of the sell off and not wanting to get short until I see a bounce. But past history shows there were very few bounces for the bears to get short at. They intentionally make it this way as they don’t want us sheep to make and profit.

well, can’t get them all right. if we’re heading anywhere near 165, there’s plenty to stoll be made

Very true Anthony… only Legatus was accurate this time. The insiders are selling ahead of the FOMC meeting. So what will Bernanke say? Interest rate rises?

going to wait until monday and hope for a small pop up, or the sell off to start a bit more slowly. That should make the puts at ;east a bit cheaper then the current rate

Yes, at this point you have to wait as the decay over the weekend would eat some of you profits and kill you if it bounces hard.

ES update….

http://screencast.com/t/aWgvRegLQ

GOLD Chart analysis: http://niftychartsandpatterns.blogspot.in/2012/10/gold-chart-analysis.html

ES Support levels: http://niftychartsandpatterns.blogspot.in/2012/10/es-support-levels.html

. how come QQQ 60 isn’t marked off. chart lacks macro judgements!

Not looking good for the market gang. One thing I got right was that the gangsters are masters at tricking the sheep. LOL. So Legatus is accurate it seems, but I’m still not sure why they started today instead of next Tuesday?

Assuming the world doesn’t end over the weekend I’d think we’d see some type of bounce on Monday and/or Tuesday. At this point I’m certainly not getting short and chasing this market down.

I missed out on calling the top yesterday but there’s still more downside to come. Remember that the May 1st sell off lasted 13 days… this is only the first day. So I will angerily sit on my hands today and kick myself Saturday and Sunday for not catching this…

I’m thinking that the bounce will come from the retail sheep that think Bernanke will save us with QE4 after the FOMC meeting this coming 23rd and 24th. The people selling today are obviously the insiders that know the outcome of the meeting.

they got a lot more hurt coming, than everyone is expecting, so they needed to start off early!…see my post on the QQQ, if i have this right, the numbers are frightening!

WashBoardStocks… you out there? What say you?

Long and strong. What else? The table is set.

You get my email?

no, will check now

“long and strong” or mssive sell off…… time will tell

Apple closed at 609.98 -22.66, back at the lower BB……SP was down 1.66%

New York Composite down 118.77 pts…..looks like that Florida QB’s stats from last week.

NewY.Composite advancers==670 issues. At one point, they were at 667 near or after the close. It drops a certain little indicator back into negative territory.

nobody except me is looking for an 18% drop in the QQQ—-

it’s very possible…check out why!

http://zstock7.com/?p=6975

Congratulations RED on the site being a lot more conscientious on making the BIG CORRECT call. And there is nothing wrong with you making a BIG CALL and making sure any newbies remember to put in stops just in case the big call goes wrong.

Hindsight is something we don’t get to use in this game, but your present course of being like a deerhunter instead of a skeet shooter should get this site back to its rocking past and much more. And the dates certainly DO, line up for some exciting drops and rises. All I will say is this. Bull markets, have always been propelled by fooling even the elite.

As we both know the elite have another set of elite above them. And occasionally, the elite are fooled by the superelite. Its what really drives a short covering from hell, literally.

By the way Red. A young man I mentored and watch go out on his own, took a very small amount of money and turned it into a rather large amount of money recently on the forex.

Unfortunately he is tough to get a hold of as he is young, full of youthful expectations and has a full time job, but he checks into this site fairly often and himself noticed the monster SiLVER Fake print of a few years back that indicated silver going to 63,when it was 17 or 18. Interesting that “they” were unable to get it all the way past 50,but still what a monster move that could have been caught. Any more thoughts or discussion that I have missed on that outrageous gold FP? I mean, that is crazy. Anything even close to that level we are probably in the middle of something pretty fugly.

S&P 500 Analysis after close: http://niftychartsandpatterns.blogspot.in/2012/10/s-500-analysis-after-closing-bell_20.html

Dow Jones weekend update: http://niftychartsandpatterns.blogspot.in/2012/10/dow-jones-weekend-update.html

Tell Gary I think I figured it out Red

http://axisoftruth.org/?p=206

APPLE Weekend update: http://niftychartsandpatterns.blogspot.in/2012/10/apple-monthly-pin-bar-update.html

GLD Weekend update: http://niftychartsandpatterns.blogspot.in/2012/10/gld-weekend-update.html

I caught another 8-7 score Thursday night after the fact in the Oregon-Arizona State game.

After Oregon scored its first TD on #24s 71 yard run on 2 and 10 from Oregon’s 29 yard line, they attempted a 2 point conversion and converted it to make it 8-7 on a pass from the Punter #49 to the kicker #93. Oregon then basically had its way for the rest of the first half running the score up to 42-7 before ending the game at 42-24???? but I did notice on the way they got the score to an unusual 29-7..

I also saw Arizona State flash a 1987 in its huddle in garbage time during the fourth quarter on a 4th and goal play but I still need to dig into this. Their TE #87 was everywhere during garbage time hooking up with the backup QB #18 quite frequently.

Check out the USC game and their dynamic receiving duo #2 and #9 and their prolific #7QB to #2-9s connection.

Quite an incredible front page article in today’s WSJ on the current earnings and economic meltdowns. Must read material. I posted a small blurb over at DE’s.

Keep it simple…… As Michael Belkin says recessions===corporate earning meltdowns.

Earnings meltdowns====occultists hitting the algo self destruct buttons=====market crashes.

10-21-2012, take out all the zero’s, and its..

12-12-12. if you don’t write down 12-12-12, 3 times on a piece of paper,

you’re going to die today!

If you have not been watching to many movies, than what have you been smoking? LOL

truth is, I’ve been watching too many movies! rofl!

QQQ Weekend update: http://niftychartsandpatterns.blogspot.in/2012/10/qqq-weekend-update.html

my hope is, QQQ can stay above 60… maybe next week, 60 out of 100, won’t miss earnings / sales report, like they did last week.

More selling in silver tonight..So rigged.

oct 19th sunspots video. #1 in this field

http://www.youtube.com/watch?v=xGzz8mGNI2k&feature=channel&list=UL

now compare this today…oct 19 looks much bigger, by a lot.

http://www.youtube.com/watch?v=6xOo5U8NkAI&feature=channel&list=UL

tsunami or earthquake coming to calif:)

here’s HAARP activity, Calif, is orange alert!

http://www.haarpstatus.com/haarpstatus/haarpmap.html

no dollar devaluation – they want Obama re-elected. Romney would tighten the money supply and finish the keystone, making OPEC jealous and vulnerable to decouple from the USD for oil. The banksters want Obama re-elected for these reasons and a dollar devaluation would get Obama defeated overwhelmingly and Ben bern the banke fired!

If Obama re-elected, buy calls on HCA or THC. If Romney is in, buy puts on HCA or THC.

If Obama is in, market will tank. If Romney is in, my hunch is the market’s reaction will be up, but then will quicky tank on tighter money supply and elimination of QE. If stalled on a re-count, this means less time to solve the fiscal cliff. Market will really tank! My bet is Obama gets re-elected and Republicans keep control of the house and market tanks on this stalemate for the fiscal cliff to be not worked out in time. VIX calls is what you want! The only good news out there would be a Spain requst for bailout – everything else, bad news, buy puts FB weatherbill7

Interesting ideas you have there. I think the gangsters want Romney in but you never know? Who knows who’s going to win at this point?

Lindsey Williams ~ The Elite want Obama ousted

(largely because of his opposition to Keystone Pipeline)

http://www.youtube.com/watch?v=V_00OFp2k_Q&feature=player_embedded

Watching FNRC. Was a decent buy at .40 imo.

You forgot about Sunday…

Got sidetracked right before calling you. Tonight??

That’s fine… between 8pm and 11pm would be ok. (EST)

Getting your wish Red, those puts may get a bit cheaper over the next 2 days

Yes, we could still be right… but have just missed the first wave down. If they top out tomorrow there could still be a very nice sell off start on that “eleven” day.

Should rally today gang… but tomorrow “could” still be the “important” top day as it is an “eleven” day, and many (not all) tops happen on them.

aww shucks! Missed the QQQ to buy puts on the high. I knew aapl was gonna run. No brainer on the hype of their mini coming out tomorrow. AAPL also releasing earnings thurs after the bell…hmmm

You’ll get another chance… tomorrow probably.

Apple trend update: http://niftychartsandpatterns.blogspot.in/2012/10/apple-trend-update_22.html

we might not be going up… still sitting for tomorrow though

There is usually just one decent bounce day before the selling really gets started and that should be tomorrow. I see this last wave of selling as a wave 5 down (inside a larger wave 1 down). That means we should see a larger wave 2 up tomorrow morning and then the start of the larger wave 3 down to follow. It should last all week I’d think.

Thanks- updates always appreciated. Learned a lot since following this blog- made me dwell into numerology as well.

I’m expecting a “pop” tomorrow morning to panic those bears that got short today, but I don’t think it will hold. I’d short that bounce… wherever it goes to in the morning, as the first wave of trapped bulls will sell out at a loss to get out of their longs.

After that we should see more selling. How low we go is still unknown though as I just can’t determine yet if this is a “fakeout” sell off or a real one?

looking forward to it 8)

wait for rut845

CRUDE Oil breaking support levels: http://niftychartsandpatterns.blogspot.in/2012/10/crude-oil-breaking-support-levels.html

I see several FP’s to 143.41 on the SPY… time to squeeze the retail bears!

GOOGLE Chart update: http://niftychartsandpatterns.blogspot.in/2012/10/google-chart-update_23.html