More from Ali...

Time to expand the way you think about how things really work... including the movements in the stock market!

(to watch on youtube: http://www.youtube.com/watch?v=MXE_5806O-0)

In my previous post, I mentioned that everything in nature is based on “The Law of Harmonics” or “Vibration”. All things are universal, actually there is nothing which is not universal. Man and mind, emotions and all creating things are universal, as we are all made of “Aether “ which is the fluid-like energy of life and the force behind the “space and time”. Time is life is energy is motion and according to the law of vibration and harmonics, every motion is cyclic and periodic, of course in a non-linear system.

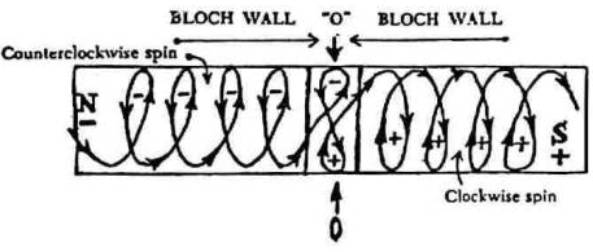

As a matter of fact, there is no straight line in the universe and all directions are curved and non-proportional. All the forces in the universe are “diatonic” and the universe is a “tonal one” which is pulsating round the clock. Man is sure part of the nature and all nature is a series of orderly tonal periodicities of the “One Force” vibrating into the "Octave of Dimensions”. Every form of energy is spiraling, thus, it is progressive and evolutionary and divided into “opposites” (positive and negative), clockwise and counterclockwise, revolving around a nuclear center.

Humans consciousness, thoughts and emotions are truly based on “etheric energy”, as we are made of the same stuff. Therefore, thinking is a process, an orderly, evolutionary and periodic process which is truly constituted in form of “seven tones” and multiple octaves. When these octaves complete, a new cycle will be born and the process will go on to infinity. The fact that matters is that these octaves along with their tones constitute a cycle of evolving states of motion.

All motion is oscillatory and in form of “Electromagnetic Waves” which swing in sequence between two opposing forces, namely “gravitation and repulsion” and are respectively electric and magnetic. This progressive and evolutionary motion is a pulsating and vibratory in-breathing and out-breathing. These two opposite forces are only two forces of mind which are added together, constituting the “One Force”.

Now we may infer that mind is the universe and that's all there is to it. Indeed, all the forces in the universe are diatonic. “Musical scales” or “Harmony ratios” were first documented by Pythagoras a philosopher and mathematician in the 6th century B.C.

In my prevoius post, I mentioned that the "seed sound” of the universe vibrates itself into an octave in order to create a life from itself: Do, Re, Mi, Fa, So, La, Ti.

- Do-has the value 1. (The other vibrations are simply increasing ratios of this vibration - [Ascending]).

- Re- Do by 1/8, or the factor 1.125

- Mi- Do by 1/4 or the factor 1.25

- Fa- Do by 1/3 or the factor 1.333

- So- Do by ½ or the factor 1.5

- La- Do by 2/3 or the factor 1.666

- Ti- Do by 7/8 or the factor 1.875

Do- which is refered to the “descending octave” and completes the octave.

Below, a descending octave (1 to 1/2) is measured by multiplying the descending Do (1) times ½ diatonic ratios.

- Do- 1 (descending Do)

- Ti- 0.9375 or 15/16

- La- 0.8333 or 5/6

- So- 0.75 or 3/4

- Fa- 0.6666 or 2/3

- Mi- 0.625 or 5/8

- Re- 0.5625 or 9/16

- Do- or 0.5 or 1/2

When it comes to the consciousness, there are actually three positive major “tonal forces” and three negative tonal forces and the last one is the combination of both positive and negative forces. Actually, this process completes an octave (Master Tone). I also touched on movement of the stock market and how to link it all to the “Law of Vibration” or Harmonics in the last post. Indeed, the financial markets can be the best example, reflecting and charting out the humans emotions (greed and fear).

The weekly gold chart below is an example of “diatonic forces” but remember that it is not always the same case with all the patterns in the charts, as most of you folks know that patterns are quite interwoven and the bigger cycles can easily overpower the smaller ones. (the info I present here is so limited as this study is very deep).

Weekly Gold chart...

As you see,if you measure from the high of September 2011 to the high of November 2011, the “fundamental tone” is 10 weeks, when you multiply it by the “musical fifth” (Ratio of 3:2) or the factor 1.5, you will get 15 weeks... the high of February 2012. Now if you multiply that by the next octave or 2, you will get 30 weeks. This is the beginning of the spiral with combination of both positive and negative energy. The process will go on until it completes the octave and the “mid-tones” describe the fractals!

Below is another example of the Dow Jones monthly chart...

As you see, we have 16 months between the low of march of 2009 and the low of July of 2010. Now lets take it as a "fundamental vibration", or 11*1.5 (musical fifth)=16.5. As I stated earlier, every movement of energy generates opposing movement of energy or "polar opposite", so now the reverse of 11*1.5=16.5 is 11 months (the move between the low of July 2010 and the high of May 2011). It's a "counterclockwise" move!

You see... 11*1.5=16.5, or the move between the high of May 2011 and the beginning of the down move in October 2012. Therefore the octave will have to complete... so you multiply the 16months by 2 (octave), and you'll get 32 months. Now count the months from the low of July 2010 and you'll reach the low in February 2013. I suppose the closest date of the bottom is 25th of February. You see, there are 15 months between the low of July 2010 and the low of October 2011. The cycle will shift into a high October 2012, and a higher high or a chop sideways move into the August of 2013.

How? You simply do the math... 15*1.5=22.5, which makes the closest date the 19th of August 2013.

To sum up, mind is indeed based on the "universal law" and energy reproduces itself transferring its expression throughout the universe from wave to wave. Therefore, all energy is expressed in waves and all waves are divided into positive and negative. We live in non-linear system, all directions are curved and this curve means spiral... a diatonic spiral with combination of opposing forces.

Feel free to email me your questions...

Ali Firoozi Yasar

afiroozi (at) rocketmail (dot) com.

________________________________________________________________________________

The Final Top In The Stock Market For The Year 2013 Is Likely To Happen Within A Week...

(to watch on youtube: http://www.youtube.com/watch?v=CWwyPwHtnKk)

One of the last comments I made on the previous post was that I see another push higher starting likely on Wednesday the 9th of January and concluding by Friday the 11th... which I still think has the highest odds of happening. The bulls are clearly running out of steam up here at this overbought levels and with hardly any bears short and no more buying from bulls the high is sure close now. My best guess is that they will fall just slightly short of hitting 1500 on the spx by this Friday. The charts are way to extended on the daily chart to give much help for the bulls but it looks like they have reset the 2 hour and 60 minute charts enough to turn them back up and make another run at piercing through the 1470-1474 resistance zone.

While I don't study Elliottwave and I'm certainly not a big believer in it being accurate anymore (it used too be back 20 years ago before us sheep had access to computers to chart stuff), I do still see wave patterns in the market. With that being said I'll speculate on what I think is going to happen over the coming weeks and months. This final move up to around the 1500 area (give or take "falling short" or piercing over it by 10-20 points in some exhaustion move) should be the final high for 2013.

The first wave down should start as early as this Friday or Monday of next week. This really depends on whether or not we fall short of 1500 (which I then think we'll peak by this Friday), or by some unknown "pull another dead rabbit out of Bernanke's hat trick" we manage to go up to 1510-1520 (which pushes the high out until early next week). I give it 60/40 odds that we'll hit the 1490 zone and top versus 1510-1520 area. And with those odd's I think Friday will end the move up and allow this first wave 1 down to start... which should drop 60-70 points if it follows prior "wave 1" moves down in the past. Then we should see the wave 2 up into the week of February 11th... just after the Legatus meeting ends.

At that point I do believe we'll see our wave 3 down similar to the May 2nd, 2012 (a prior Legatus meeting date) that lasted until May 18th and dropped a nice 123 points off the SPX. That move lasted 16 calendar days and ironically Ali's "estimated" low date of February 25th is 14 calendar days from the likely starting date on the 11th... pretty close if you ask me! Now do note that Monday the 11th isn't a "yearly" eleven date where all the digit's add to up equal eleven, but the12th is! So, you have the "daily" eleven date on the 11th (obviously... duh!) and the "yearly" one the date afterwards on the 12th. One of those 2 dates is very likely to be the top of the coming wave 2 up rally and the start of the wave 3 down.

So what will they blame this future sell off on you ask?

If I had to guess I'd say the next big scare in the news will be the "Debt Ceiling" issue. Possibly they will time some future vote on this issue will be centered around the sell off? I don't have any knowledge of any future date but "something" will be blamed for this coming sell off I'm sure. I guess they could bring back the "Fiscal Cliff" crap and spin some kind of panic into that issue as we all know it's not really fixed but just the usual "kick the can" down the road move.

(Last minute find: http://www.washingtonpost.com/business/fiscal-cliff/us-may-default-on-its-debt-a-half-month-earlier-than-expected-new-analysis-shows/2013/01/07/6c3b3b26-590a-11e2-9fa9-5fbdc9530eb9_story.html LOL.. February 15th huh... nice timing!)

But for now let's just focus on this week and trying to find the right spot to get short at. It's not going to be easy picking the top as although I think it will happen around 1490 spx (by this Friday) these gangsters have a evil knack for fooling the most sheep and going up higher then anyone can really believe. But, I think we are already in that "disbelief" mode right now... especially after the insane rally up from the 1400 area low at the end of last year. For you though... make sure you continue to watch the daily comments as "if" and "when" we get close to either one of these probable highs I should be able to make a better guess on which one is like the real high.

Again, I'm going with a 60% that we'll fall just short of the 1500 target by this Friday and top out there... which leaves a 40% chance that we'll pierce through it and go 10-20 over 1500 by early next week. I wish I could figure it out exactly but that huge 2 day up move really screws up any elliottwave count I can figure out (not that I trust it anyway though), so I'll just stick with trendlines of resistance, prior average point moves, and prior time frame cycle periods (along with technical analysis too of course) to pick a point to go short at. If it happens on some final gap up exhaustion move Friday morning then I'll be looking for 1480 on the low side to 1490 on the high side for that topping tail to happen.

Red

P.S. I'll be put out the news for "The Big One" on the HOT Penny Stock in the newsletter this coming Thursday evening.

YAHOO Chart analysis: http://niftychartsandpatterns.blogspot.in/2013/01/yahoo-chart-analysis.html

That was a great video Red.Does Ali have any idea on the depth of the correction into Feb 25 th area? I am now long from approx 1455 level. I sold my shorts a little to early at 1457 level. I will be scaling out of my longs within the next two or three days. The vix is in uncharted territory.

As for the Feb 25th time frame, I see no more than a 9%-11% correction.

I believe Reinhardt thinks it’s going to be about a 5%-8% correction, but Ali doesn’t know about the depth as only the turns are told with his octave periods (as far as I can tell?). He has told me that the August turn (down of course) will be “the big one” as I’m assuming that’s based on which octave periods line up for that date range.

Meaning that the larger one’s (like the larger chart time periods) carry more weight and therefore mean that the sell off will be much larger. I see the August one as a “crash” and it should be bigger then the 2008 one.

I will go on record, and say we will see 1310-1320 level in the later part of Feb.

Why that area Dave? Not that I don’t like it as I really do LOVE it! 🙂

If I told you, I would have to sh–t you. LOLLOL I know that is not politically correct to say in these times. But I know you have a good sense of humor Red. Honestly Red, if I told you, you would probably ban me from this board. LOL LOL. I am very good at knowing the % drops but yet weak at the timing of the drops.

That is why, I was very curious on Ali timing. Again, I see a 9-11 % drop. in the very near future. I am some what disappointed, that it will be some what of a shallow drop.

Red, lets say that god him self told you that their was going to be a 9-11% drop in the near future. I guess we will assume Feb 25 th area. How would you play it. I know you like options, what type of options ect.

Thanks

I’ll be looking for some options on the spy that expire in March and are about 6-10 points lower then the current level when I place the trade. So if the spy is around 145 then (Feb. 11th or 12th) then I’d be looking at the open interest in the 135-139 strike prices for clues. The more open interest the more likely I’d pick that strike price.

Now as for the coming sell off next week I’ll be looking to do a put spread as it could be chopping while going down on this first wave 1 and I don’t want to get killed on time decay. But the Feb. puts will be straight puts… no spread, as that’s a wave 3 and it will move fast I believe.

LOL… there’s a lot of things I find out that don’t post here (for safety reasons of course). But, I still some how let everyone know the important results and outcome of that knowledge… just like you are doing with your 9-11% drop target.

So keep up the good work on helping others out with your knowledge of a downside target… and doing so while keeping your source safe! You can always email me too you know. 🙂

I lost your e mail, where is it on the board Red.

red(at)reddragonleo(dot)com

McDonalds Resistance levels: http://niftychartsandpatterns.blogspot.in/2013/01/mcdonalds-resistance-levels.html

SILVER Support levels: http://niftychartsandpatterns.blogspot.in/2013/01/silver-support-levels.html

Red, if we have a 5th wave up from here. Where would the sp be up to?

Thanks

The SPY is 1/10th the value of the SPX (with a slightly higher bias). So, if the SPX goes up to say 1380 then the SPY would be around 138.00, but it’s usually slightly higher… so maybe 138.10 or 138.20 is more accurate.

Did you mean 1480 rather than 1380 ?

Yeah… sorry about that. Getting too excited as a bear I guess. LOL

take a deep breath, eat a spoonful of honey.

and chant

*tops are rounded, tops are rounded*

LOL

I am going to do my grand DJANGO review some time.

As Leo says, you’re an exceptional 1 in 10,000 xxxxxxxxxxxxx.

Haven’t seen that yet? Is it good?

As a movie, it is probably Quentin Tarantino’s worst big feature movie. It’s generally pretty unpleasant and ugly with too much wordiness especially from the Christoph Walz character. It didn’t remind me of any spaghetti westerns, where the cowboy anti-heroes are pretty much laconic and cynical. But the deranged hipsters seem to love it.

It’s watchable though and things get good when the action moves to MississIP(PI). The Leo and Samuel L. Jackson scenes are the best parts of the movie.

From an enlightened one’s perspective though, it is a fascinating movie trying to decipher all of the codes in the movie. Q.T. uses the N word about 2424 times in the movie obviously using it as an illuminati keyword. 59-77-59 And then the grand numerology soliloquoy at the end.

I’ve never seen QT go this crazy with the numerology before. Uses even some of the Sorcerer numbers.

It’s almost MidJanuary.

http://s10.postimage.org/l2silf5e1/jan.png

it’s getting exciting.

love the Ali (guest?) commentary.

makes it hard to find the comment area.

-Gerb

He doesn’t post here using Disqus Gerb as he works as a math teacher (probably english too?) in Iran during the daytime. Plus the time zone is different too.

ah. gotcha.

i’ve been educating myself a bit.

http://www.youtube.com/watch?v=XLX9ChtWBGo

You should try to make some T charts with different “octaves” as Ali explains. Maybe you’ll discover a pattern?

possibly. the article harmonizes with T theory

As I stated earlier, every movement of energy generates opposing movement of energy or “polar opposite“

T theory is the basis of for every action there is an equal reaction, based in Time, not Price.

ie: if an index goes down 3 months, it will go up for the following 3, again…in Time

the chart above may be a little confusing.

I have learned a corollary in that, if a T refuses to complete an

equal reaction, it will flip into a totally opposite direction, still fulfilling

the time period. [translation, A T may be correct in time, but totally wrong in whether it’s a HIGH or LOW)

Ahhh… but, according to his article nothing in the universe is a straight line. Meaning 3 months to another 3 months isn’t accurate. Instead one should look for the next octave multiplier of it. So if the first 3 months was octave 1 or “Do-” then you would look to use “Re-” for you next target.

Which would be “Do-” by 1/8, or the factor 1.125… which means you would times 3 months by 1.125 to reach the next probably date. I think that’s what he’s trying to say? This assumes an “ascending” octave. If it was a “descending” octave the you would time “Do-” by Ti- 0.9375 or 15/16… make sense?

yes it makes sense.

and this may be the tool I need when starting at a high, use this octave tool

to estimate how far down the slide/music goes.

technique should work equal back up the musical scale.

87 degrees in Musselbrook, Australia tomorrow. I see things are already heated down there.

Another sign of the end times.

I guess tomorrow is today. At 9:07am, it is 89 degrees. Tomorrow (Friday) will be 104 degrees.

Well, I didn’t get all of the Australian references/ rituals on Monday (ie interviewing BAMA fans down under during the BCS broadcast) but then I came across some info that the anniversary to some calamatious events in 1939 is fast approaching. And then shots of wildfires across Australia adorned the front page of the WSJ today and it looks like another sign of the end times but we can get confirmation on Friday.

The Austrailian Open begins next week.

(A local modern rock station is offering an Australian vacation prize promo this week as well which got my attention)

There is an Aussie player #54 on BAMA’s team.

Today is 78 trading days off the 9-14 (95) high. Historic turns have occurred on 8s.

78 trading days = 15 1+5= 6 The 7th Thursday 8th friday Friday the turning date ?

MICROSOFT in a range: http://niftychartsandpatterns.blogspot.in/2013/01/microsoft-in-range.html

APPLE Chart update: http://niftychartsandpatterns.blogspot.in/2013/01/apple-chart-update_10.html

I don’t like the way the market looks right now gang. I get the feeling they are going to push this up tomorrow hard. For there to be a top there needs to be some type of gap up in the morning that fails to hold the high and then falls back down all day putting in a topping tail on the daily chart.

Rallying into the close shows strength… not exhaustion. And the fact that they are already into the 1470-1474 spx zone tells me they are likely going to take this up a lot higher then I expected tomorrow and into next week. The bears are going to get squeeze hard tomorrow I feel… and 1500 is likely to be taken out next week as well.

I would not take any short positions as I think this is a bear trap, not a bull trap. They could even go up and put in a new all-time over the coming weeks before February. So be very cautious here on the short side. I don’t like the long side either so I’m just going to sit this one out and just do my penny stocks for now.

I still have some longs and will hold on to them for a little longer.

We could actually make new “all time” highs if they breakthrough hard to the upside tomorrow. I mean that we could take out 1574 spx from 2007 over the next few weeks before we tank in February.

This actually makes the most sense now as crash usually happen from bubble markets, and bubble market need a new “all time” high to happen first.

Dido on that one….have my targets to sell….but ready to just sell and move on!

Thanks Mr. Red for the above post!

You’re welcome Seawind… things changes from day to day and the current move into the close today has forced me to rethink my post above. Looks more to me like the “Wave 1” down will be the one starting after Legatus, instead of that one being a “Wave 3” down.

Red when is the meeting?

Thanks

February 7th-9th, 2013

I need what those dam computers are running on??? MOONSHINE…….

I drank some moonshine once when I was a kid (18 I think?)… put hair on my chest for sure!

LOL!!!! me toooooooooo LOL!!!

111===13 or 31????? Tomorrow: 1-11-13 or Friday the 11th—13th—

It will be 5 years 3months from the 10-11-07 high or 1919 days later. 53==15, the Tebow number and it will be 4years3days and 1year3days from the Tebow 316 games.

111-13====43?????

It’s just the Australian connection to tomorrow that has me intrigued plus the fact many trolls are adamantly calling for a rally into tomorrow.

A few minutes ago, Yh. listed the temp. in Musswellbrook at 59 degrees even though the forecast for the day had the low at 74 degrees. Very strange.

A youtube clip popped up while over there of the MULE scene in a Fistful of Dollars. The man with no name tells an undertaker to get 3 coffins ready and then tells a group of gunmen that they offended his mule. He then proceeds to kill them all and returns to the undertaker and tells him he was wrong and he needs 4 coffins instead.

Here’s more of the Aussie ritualistic connection:

http://www.news.com.au/entertainment/movies/tarantino-goes-aussie-in-spaghetti-western-django-unchained/story-e6frfmvr-1226537770785

The lame scene in which Tarantino appears as an Aussie in Django makes more sense now. Initially, I was wondering why were Aussies appearing in a spaghetti western that is set in the Old West/ South and then they filmed the scene somewhere near the San Fernando Valley on what looks like the old set of the Little House of the Prairie which hardly resembles a MississIPPI locale. And Aussies working for a mining company is more of an Australian reference than a Western/Southern staple.

They work for the LeQuintDickey Mining Co.

Oh tomorrow is a new moon Friday. Lately, Fridays following a new moon haven’t been turning out too well although the new moon occurs in the middle of the NYSE’s trading session.

Which reminds me of the semi-face of the 4letter’s closing call of the BCS radio broadcast: With championships in 3 of the last 4 years, the TIDE has RISEN.

Roll (featured in some Steely Dan music) TIDE……….20-9-5-5===TIDE

The TIDE’S QB came on the face of the 4letters radio show on Tuesday and mentioned that BAMA has won 3 championships in the last 4 years,and he was involved in 2 of them and he hoped to make it 4 in 5 years. The face and his partner then chuckled. Someone then mentioned of 1 of 3 championship rings or something like that. Looks like they have a world class Occultist trainee program in Tuscaloosa too.

A 9-13 (actually 9-14) final TD daily countdown on the indices plus some nice divergences on the 60 min charts with lower RSIs, MACD lines and histogram bars.

New newsletter update just sent out…

Tomorrow is 11 years 4 months (24 or 44) from you know when or 4140 days later or 591 weeks 3 days later (59-13).

It looks like there was another COUSINS ritual tonight in the Sacramento-Dallas NBA game.

DaMarcus Cousins #15 was getting a lot of facetime at the end of the game (finished at 29pts9rebounds) and then was kicked out of the game for intentionally smacking Dallas’ #25 (Vince Carter) in the face in overtime with the score at 111-109 Dallas. The refs did their usual ritualistic routine lining up at the scorer’s table. The refs were #s 20—14—-73 and they arranged those numbers every way possible both at that moment and another moment just before the end of regulation…..20-14 (25) or 20-73 etc.etc. and 14 seemed to be the center ref each time, getting a lot of facetime on his own.

So now:

DeMarcus COUSINS………Kirk COUSINS……and Catholic vs. COUSINS

Even Steely Dan has song called COUSIN Dupree.

Will I be catching grey men as they dive off the 14th floor tomorrow on PINK Friday????

Or like Nicki Minaj a trois will I be living in my 14th minute of fame?

It looked like the refs in Miami Thrice-Portland game were numbers 59 and 25 but I didn’t catch the rituals in that game. It looked like the final score was 92-90.

TLT with a red hollow bar and a higher low to its Jan 4 low while the Vix put in another hollow bar but above its lower BB.

Rut and NDX also with black bars with a small doji body at the top with a long tail beneath it. Basically the gap up open was the high of the day. It’s supposed to be a terminal exhaustion candlestick and I looked and didn’t see any of those bars on the Dow and SP over the last several months.

FACEBOOK Resistance levels: http://niftychartsandpatterns.blogspot.in/2013/01/facebook-resistance-levels.html

Bank of America chart analysis: http://niftychartsandpatterns.blogspot.in/2013/01/bank-of-america-chart-analysis.html

I am now in cash, waiting for the next set up.

Red, any F.P. in the past week ?

None that I have seen Dave… 🙁

CRUDE Oil update: http://niftychartsandpatterns.blogspot.in/2013/01/crude-oil-chart-update_11.html

The lack of a gap up certainly has me considering the possibility that the high is in today… especially since it’s the 11th. But, I’m not totally convinced yet. Let’s see how the rest of the day plays out.

I will re-enter longs if we exceed this mornings highs.

Makes sense to me Dave. I don’t like this action right now so I’m just in cash for the market. The penny stock is my only position.

what penny is that? I never received a penny play, though I’m signed up.

Well crap Bill… did you check your spam filter?

Bill, I don’t see your name on the list? Try signing up again…

http://reddragonleo.com/newsletter-sign-up/

ES Hour chart analysis: http://niftychartsandpatterns.blogspot.in/2013/01/es-hour-chart-analysis.html

Gotta give it to you on that one so far red. If it goes anywhere near where you think, I’ll gladly cut you a check

EURUSD Chart update: http://niftychartsandpatterns.blogspot.in/2013/01/eurusd-chart-update_12.html

nice calls on the penny stocks so far red.

Thanks Anthony 🙂

Hold on tight to this one is what I’m doing…

QQQ Chart analysis: http://niftychartsandpatterns.blogspot.in/2013/01/qqq-chart-analysis.html

RIMM Weekend update: http://niftychartsandpatterns.blogspot.in/2013/01/rimm-weekend-update.html

Bank of America Weekend update: http://niftychartsandpatterns.blogspot.in/2013/01/bank-of-america-weekend-update.html

Bronco – a horse untrained, unsaddled, a horse who is unpredictable, an element of surprise or wild…..hmmmm….. Since 1999, the super bowl match ups have been highly prophetic or the mascots, a highly current political parallel. hmmmm

Awesome spectacle with the Ray Lewis retirement/ farewell mega rituals last week. Didn’t see his intro dance. Seems like more effort went into the intro ceremony than preparing for the game.

Intro ritual:

http://www.youtube.com/watch?v=tiMbtlNdIWM

http://www.youtube.com/watch?v=PfE-Fsq1HFQ

Then with the game in hand at the end, the Ravens did a final-kneel down with Ray Ray in the backfield:

http://www.youtube.com/watch?v=wEWHtaOqQE8

Ray Ray, Superbowl champ, spiritual leader to his Raven teammates, future Hall of Famer out of Lakeland Florida (ONS Jr. Market!!!!!Riots in the streets of Lakeland Florida!!!) via the University of MIAMI

Ray====18-1-25 or 9-1-25 or 63-1-25

The intro starts with the players emerging from the smoke-filled Ravens stadium entrance. Looks like it was 92-55 then 20 who came out before Ray Ray #52

After the game and his final dance, he pulled off his jersey revealing a sweatshirt with the inscription PSALMS 91. Then he was interviewed by the sideline reporter with the PSALMS 91 in full display. I checked the passage out and couldn’t really see anything on the face of it but RAY RAY is the last person one would think would be quoting Scripture.

ART decals on all Ravens jerseys. A reference I am sure to former Ravens owner Art Modell.

ART====1-18-2 or 1-9-2 or 111??????

The B also on the Ravens jersey for 2…..They emerge from the mouth of the Raven in the intro.

Currently, Ray and the Ravens are squaring up against Popgun, aka Mr. NFL 666, and his fellow Broncos in Denver. Denver the #1 seed and heavily favored against the Ravens but I think the Ravens have all the occultic touches to make them the favorite to come out of the AFC. I would love to see Popgun once again cough up a loss for one of his high seeded teams in the playoffs.

Last I saw, the score was tied at 14-14 and Popgun had thrown a pick six.

I’ll make the SF 49ers the favorite coming out of the NFL. With their 11-7 QB controversy, 11-4-1 final record, 24-24 tie, and #99 dismantling Cardinals QB #19 after TE #87 linedup in the backfield by himself with #19 earlier in the season. (It is almost unheard of for a TE to lineup in the backfield with the QB, especially without a RB back there where he could be utilized as a lead blocker but that is more of the job for a fullback). They play the Packers, but Green Bay, the 1929 Champs, already got their ritualistic Super Bowl championship 2 years ago.

FORD Motor Weekend update: http://niftychartsandpatterns.blogspot.in/2013/01/ford-motor-weekend-update.html

IWM Weekend update: http://niftychartsandpatterns.blogspot.in/2013/01/iwm-weekend-update_13.html

Tom Demark’s sell signal on s&p500 is very close..

http://www.bloomberg.com/video/tom-demark-sell-around-the-world-KdBPeJbXQXqvlShFYHL7Jw.html

I agree with him… we should have that first wave 1 down and wave 2 up into Legatus if we are to expect a wave 3 down afterwards. Nice of him to call 1492 spx as I have 60& odds of a target of 1480-1490 and 40% of 10-20 points over 1500. Glad to see someone wiser then me pick the same area.

Hope you’re both right, will be a gift if it makes it. Would think

there’ll be some luring stops for the gangsters above the Sept high,

before wave 1.

Hewlett Packard Chart analysis: http://niftychartsandpatterns.blogspot.in/2013/01/hewlett-packard-chart-analysis.html

No signs of the Bulls giving up yet…

http://screencast.com/t/5f6xUxp3CtFG

pretty sure we’re going to get to 1500… bought some GS, 140s, and a bit more of your recc

Good entry point on the penny today Anthony. And yeah, I “sadly” see more upside. I don’t really care though as I’ll just play around the in pennies until Legatus is here.

yeah. So far you’ve picked some pretty nice ones, greatly appreciated, looking forward to any new ones/seeing how they all play out. We both know that its going to be a pretty ugly year, so I’ll gladly be patient in this “bull market”.

There are 2 area’s that explode in a depression Anthony. One is penny/junior stocks and the other is MLM/Home-based businesses. I’m going to have 3 more new picks coming up soon, so I’m excited too!

few more and you should charge a subscription…. I’d pay. For now I’ll donate after I close them out

Great time to get more on my penny pick gang as this is just some profit taking I believe. I’m still 100% in and will be for several weeks if needed. 🙂

lol, nice. back to .45

Might chop around this week some and gain strength to rally next week. I’ll be getting more on the weakness throughout this week.

i’m long AAPL. feb 550 calls, 30% stop loss , news is sort of sketchy on AAPL.

some reports are bullish, some are bearish

CISCO Chart analysis: http://niftychartsandpatterns.blogspot.in/2013/01/cisco-chart-analysis.html

FACEBOOK Bearish Engulfing: http://niftychartsandpatterns.blogspot.in/2013/01/facebook-bearish-engulfing.html

This could be the start of the wave 1 down gang? Not sure yet as it could also just be a pullback before one more attempt back up to that 1480-1490 spx area. Today being Tuesday and with the rest of the still left I’m going to lean toward “just a pullback” and expect one more move back up into Friday.

Could be wrong on that as we could be starting the wave 1 down with a wave 2 choppy move back up into February 11th before wave 3 down starts. I’m not even going to play this wave 1 or 2 as they usually just beat me up badly and wish I had stayed out of the market… so this time I am!

I’m simply doing my penny stocks for now and will only short this pig the week of February 11th after Legatus. And by the way, I plan to get more of my penny stock this week and I think it’s going much higher then first thought.

CHeck your email last night…Looking for the latest penny stock quote..

Hmmm… looking for an email from you but don’t see one? Send it again and I’ll look in my spam folder in case it landed there?

Try to send it to red (at) stockmarketbloggers (dot) com

GOLD Update: http://niftychartsandpatterns.blogspot.in/2013/01/gold-chart-update_15.html

does not look like much higher here

http://www.stocktiming.com/Tuesday-DailyMarketUpdate.htm

I think we top this Friday the 18th…

New FP caught by Turbo Tim…

http://reddragonleo.com/wp-content/uploads/fp-iwm-89-74-on-01-15-2013.png

Could be the high before rolling over to start the first wave 1 down?

I notice the Mayans like their 13s and 20s. Tomorrow, 1-16 will be 26 days from the end of the grand Mayan long count on 12-21. 26==13×2…….116==26 or 66……The infamous Simpsons/ True Grit release date (1969 version) 11-6……….

Yesterday, as mentioned over at D.E.’s, NATV:NYTV spiked to one of the highest levels of the past year.

Nice daily TD bear flip on the Dax. It took out about 8 previous lows.

FACEBOOK Chart update: http://niftychartsandpatterns.blogspot.in/2013/01/facebook-chart-update_16.html

APPLE Support level: http://niftychartsandpatterns.blogspot.in/2013/01/apple-support-levels.html

Demark calls AAPL bottom: http://video.cnbc.com/gallery/?play=1&video=3000141314

Not sure how accurate he is, but it’s possible that Apple rallies into Legatus, and then falls again.

started a poistion in the VIX here at 13.25. Not alotta risk for a swing trade on that here, since I can;t watch the market much right now…happy trading

Rarely is there not a brief quick move higher to put in a “topping tail” and scare out the bears… so just be aware of that happening and don’t panic.