Technical Analysis for December 27th, 2012

(to watch on youtube: http://www.youtube.com/watch?v=F6sbrGeTUYg)

Red

_____________________________________________________

Guest Poster for you this time gang

Subject Matter Rarely Spoken Of With Concerns Related To The Stock Market

Written by Ali Firoozi Yasar

I have written this article mainly on “The Law of Vibration”, Sacred Geometry and other stuff in many different fields. I have also touched on the patterns in the charts of the financial markets as they all can be linked to “consciousness”. (Please pardon my lack of specific knowledge with all the stock market instruments). This will simply be an introduction to the study of both.

NOTE: If you would like to share your ideas and feedback with me, I will be more than happy to recieve your them. You may E-mail me at: afiroozi (at) rocketmail (dot) com.

The patterns on the charts of finacial markets are all prefectly ordered by “the” Natural law of the Universe”. You might just doubt it now and think that the moves on the charts are all random and everything, but you will see that these complicated zig zag patterns repeat themeseves over and over as the time goes by. It is the same case in all the time frames. Some of you folks out there may suppose that this is the economic state that moves the charts, creating such complex zig-zag patterns but this is actually the human emotions doing so. When humans feel joy and prosperity we buy, raising the price index but when we start to feel fear and panic then we sell, lowering the price index.

The fact that matters is that this is the structure of human’s behavior graphed out on the charts, just as spyder which is not aware of the beautiful web it builds. Therefore what traders construct in time and price charts are absolutely phenomenal and they should be able to study and research the humans behavior and consciousness instead of focusing on the markets and economic state. You might sound puzzeled now and ask how? Well, you know that human beings are indisputably all part of the nature, so are their consciousness. What they create on the price-time charts is arguably "microcosm” of “macrocosm” in the universe. So their emotions and consciousness are in line with the “natural law” or the “universal order”.

It may sound a little mind-boggling but it is true.

There is overwhelming evidence out there that a “secret society of free masons” are the ones that possesses and preserves the true knowledge of this “Atlantean code system”. As a matter of fact, this is not the info you can easily find in text books in libraries. Such secrets are heavily guarded as it is a pretty complicated system of Atlantean Principles handed to them by the ancient Egyptians who were inheritors of the legacy Of Atlantis.

This Masonic scholar by the name of W.D Gann who was a stock trader and lived before the year 1955, tried to reveal the hidden structure of the markets both in price and time. Actually to him time was more important than price and he tried to link it all to “The Law of Vibration”. Most of you folks have probably heard his name and familiar with his methods. The fact that matters is that there was a lot of secrecy in his work and he always kept things mysterious due to his “Masonic oath”. Actually, he died with only $50,000 to his name but he had already made nearly $50,000,000 in his trading career. It is said that he deviated from his main analysis, trying to depend on “financial astrology” which was the cause of his failure. However, most of his courses have been modified and you may barely find his original courses out there, and on top of that there is ton of secrecy in his work.

This Masonic scholar by the name of W.D Gann who was a stock trader and lived before the year 1955, tried to reveal the hidden structure of the markets both in price and time. Actually to him time was more important than price and he tried to link it all to “The Law of Vibration”. Most of you folks have probably heard his name and familiar with his methods. The fact that matters is that there was a lot of secrecy in his work and he always kept things mysterious due to his “Masonic oath”. Actually, he died with only $50,000 to his name but he had already made nearly $50,000,000 in his trading career. It is said that he deviated from his main analysis, trying to depend on “financial astrology” which was the cause of his failure. However, most of his courses have been modified and you may barely find his original courses out there, and on top of that there is ton of secrecy in his work.

In the Atlantean tradition, time is life is energy is motion and all motion in existence is cyclic. Well, before I directly start discussing the time, I would like to talk about energy and it's behavior. Hindus called it “Prana”. The movie stars war calls it “The Force”. The ancient Greeks call it “Aether”. It is supposed to a powerful fluid like life energy suffusing the universe and structuring the cosmos. It's signature is all around in nature. You have probably seen the shapes of whirlpools, hurricanes, the solar system, the DNA Structure and so forth.

In the Atlantean tradition, time is life is energy is motion and all motion in existence is cyclic. Well, before I directly start discussing the time, I would like to talk about energy and it's behavior. Hindus called it “Prana”. The movie stars war calls it “The Force”. The ancient Greeks call it “Aether”. It is supposed to a powerful fluid like life energy suffusing the universe and structuring the cosmos. It's signature is all around in nature. You have probably seen the shapes of whirlpools, hurricanes, the solar system, the DNA Structure and so forth.

The moving waves in this energy medium get around in spirals of different sizes, from Very small to very large. Actually, it is the energy that makes the planets revolve around the Sun and the sun around the galaxy, thus generating time, space, life and consciousness.

The vibration of this life energy forms seven major densities or levels in entire the universe.

You have probably heard the “seven heavens” by ancient traditions. These densities and levels Are formed by the amount of vibration that is accuring within the aether. It is interesting to learn that within these seven main energy levels, there are seven sub-levels and seven sub- sub levels within each sub level and this process will continue to infinity. The same basic rules of vibration Are also responsible for the seven colors in rainbow and the 7-tone octave of “diatonic scale”.

The entire universe is one and everything begins with one. You may relate it to the “sheer white light” and the sheer sound of the universe. In order for the life to be created, the light and sound vibrated themselves into “the octave”, and actually into seven colors... the same as in rainbow. And seven tones: do,re,mi,fa,sol,la,ti. Now one can infer that how the structure of time and time cycles has a lot to do with the octave.

The third key aspect I need to discuss now after light and sound is geometry which is another aspect of the behavior of the aether and the net result of vibration. You have seen the shapes of mountains, hills, mounds, crystals etc... You are probably familiar with the term “Sacred Geometry” (or not?). Well, it involves the geometric structure of the universe, life and consciousness. The dimensions of the great pyramid of Giza and other ancient monuments represent “The Universal Order” in the universe, (more on this in later articles). In fact, all consciousness including human beings, are only based on this Sacred Geometry. (You'll remember at the beginning of the article I mentioned that these are emotions and thoughts forming such complicated zig-zag patterns on the price-time charts of the financial markets).

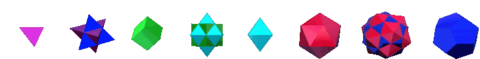

Plato, the Greek philosopher first wrote about five most important three-dimensional geometries called “Platonic solids” which include Tetrahedron, Octahedron, Cube, Dodecahedron and Icosahedron. These geometries are formed in different densities or levels by the amount of vibration applied to the aether. So actually this is the “law of vibration” which is the basis of cyclic motion of the energy. Now you may infer that the conscoiusness is 3-dimensional, and when you add the element of time, it will be 4-dimensional.

|

|

|

|

|

|

|

|

|

Yes... our thoughts and emotions are 4-dimensional in nature!

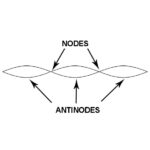

Vibration can be described as a perodic or cyclic motion between two extremes or wings around a mid-point. Lets take a guitar string as an example. When you pluck it... it will generate a cyclic move betwen the two extremes around the mid ponit, causing a sound wave to be created at a specific note or frequency (please google sound wave mechanics for more info). If you view the process by an oscilloscope, you will be able to see that there is an extreme vertical movement at the top or bottom of the wave. At the mid-point of the cycle, there are parts where there is no vertical movement. Actually this is where the “Nodes” or nodal points will be created. The number of the nodes all depend on the amount of the vibration, the higher the vibration the more nodal points.

In a two-dimensional view, when these nodal points are grouped together by lines, geometric shapes such as triangle, square, pentagon, hexagon etc... will be created. These shapes are inscribed within a circle which represents a cycle. Now, in a 3-dimensional view this has three-dimensional shapes. What I mean is, the same five platonic solids I mentioned earlier, (actually, 4 nodes at the mid-points of cycles when grouped together), will form a tetrahedron, 6 nodes create an octahedron, 8 nodes form a cube, 12 nodes create an icosahedron and 20 nodes a dodecahedron.

In a two-dimensional view, when these nodal points are grouped together by lines, geometric shapes such as triangle, square, pentagon, hexagon etc... will be created. These shapes are inscribed within a circle which represents a cycle. Now, in a 3-dimensional view this has three-dimensional shapes. What I mean is, the same five platonic solids I mentioned earlier, (actually, 4 nodes at the mid-points of cycles when grouped together), will form a tetrahedron, 6 nodes create an octahedron, 8 nodes form a cube, 12 nodes create an icosahedron and 20 nodes a dodecahedron.

Now you can infer that our thoughts and emotions move in line with the faces of these Platonic polyhedrons. It is amazing to learn that these structures are formed in a sphere like the two dimensional shapes are formed in a circle. Ancient traditions see the sphere as the highest geometry in the universe. The universe is finally spherical. You can tell this by the spherical energy around the Solar System and if you study the structure of an atom, you will find out that the energy surrounding the Nucleus is spherical, as a matter of fact the structure of atom is the “microcosm” of the energy structuring the cosmos and the universe.

You might just wonder why bad energy exists?

Well, good and bad, rich and poor, etc are actually harmony of the universe. Every movement of energy creates an opposing movement of energy or polar opposite. This is also true for the Platonic solids which also have a “dual” status. Therefore for every Platonic shape, there exists another Platonic shape that is the opposite, and is of course inscribed in each other. You see there are actually two forms you are dealing with. One form is “ out breathing” (outward spiraling energy forming the Platonic solids), and there is another form which is “ in breathing” (inward spiraling energy) forming the dual of the Platonic Solids.

There is a great deal of evidence out there that any research and study toward the discovery of the significance of these structures in the universe is heavily and actively suppressed. True or untrue, the fact that matters is that free masons heavily guard the “secrets of the order”. To sum up, you can infer that that the universe and everything in it is made of moving energy. We Human beings are made of the same stuff as well as their emotions. Consciousness moves in line with the faces of the Platonic solids so that it completes the octave, then creat a new life or cycle. Financial Markets was just an example of how the consciousness is in line with the”universal order”.

I hope this information has been useful and will to try to get into more detail in my later posts.

God bless you all,

Ali Firoozi Yasar

____________________________________________________________________________

Nice post by Ali gang, as I have too say that this stuff is new to me as well.

(to watch on youtube: http://www.youtube.com/watch?v=HduQ95YrN6A)

I look forward to learning more about Sacred Geometry in the future, and specially how it relates to the movement of the stock market. I'm sure Ali will give us more information as time goes forward. For next week though gang I'm expecting light volume and nothing but the usually bullish option expiration week. Generally you see traders run it up Monday through Wednesday and then take Thursday and Friday off as they will have closed out all their positions by the middle of the week. This means that the last 2 days could chop around going basically nowhere.

I look forward to learning more about Sacred Geometry in the future, and specially how it relates to the movement of the stock market. I'm sure Ali will give us more information as time goes forward. For next week though gang I'm expecting light volume and nothing but the usually bullish option expiration week. Generally you see traders run it up Monday through Wednesday and then take Thursday and Friday off as they will have closed out all their positions by the middle of the week. This means that the last 2 days could chop around going basically nowhere.

But, since we have triple witching this Friday (it's where you have 3 different securities all expiring at the same time) we could see some wild swings up and down as market makers manipulate the various markets up and down to steal the most money from the sheep. Don't get sucked into thinking we are going to tank hard during this period as the odds are low of that happening. And after option expiration is over with the rest of the year is usually very bullish. I might even put on my bull suit and go long right after this coming Friday.

But, I do believe we are going to peak out within the first week or so in January 2013 and have a step sell off into the next Legatus meeting (February 7th-9th, 2013) where I thing we'll bottom. Then we could have QE5 put into the market and see some huge crazy rally into late summer before we finally peak... and then CRASH! Look at January to February of 2010 as that's about what I think is going to happen. That bottom was right in the middle of a previous Legatus meeting that happened on February 4th-6th of 2010. And I seen my very first FP (fake print) on January 11th, 2010 (note that the 11th is a "daily" ritual date for these Illuminati pigs).

Now that was awhile back and I was just learning about FP's and Legatus... so I don't have a screenshot of the Legatus meeting, but rest assured it was the date period that the market bottomed. I later did this chart to show what happened afterwards, and I think we could see something similar happen next year again. While it shouldn't be exactly the same it might have similar patterns in it. Don't forget about the FP I have on the cell phone showing the 1419 high and the more important 1068 low! What if they use this fear of the Fiscal Cliff non-sense to scare the politicians and the president into coming to an agreement to save the stock market? I'm sure it's all planned of course but a move down to 1068 in one month is a "mini-crash" and should force these jackasses to agree on something.

Now that was awhile back and I was just learning about FP's and Legatus... so I don't have a screenshot of the Legatus meeting, but rest assured it was the date period that the market bottomed. I later did this chart to show what happened afterwards, and I think we could see something similar happen next year again. While it shouldn't be exactly the same it might have similar patterns in it. Don't forget about the FP I have on the cell phone showing the 1419 high and the more important 1068 low! What if they use this fear of the Fiscal Cliff non-sense to scare the politicians and the president into coming to an agreement to save the stock market? I'm sure it's all planned of course but a move down to 1068 in one month is a "mini-crash" and should force these jackasses to agree on something.

So thinking ahead here I'm forecasting (guessing... LOL) that we will peak up above 1500 in early January and then move down hard into Legatus for a bottom. If this happens it will scare the living hell out of the bulls and make a bunch of bears go crazy shorting every bounce that follows after the meeting ends. Keep in mind that not all Legatus meetings are "turn dates" but since the thugs seem intent on dragging this Fiscal Cliff crap out as long as possible it would make sense to drop the market hard first into the meeting and then at the meeting decide on QE5, QE6, QE7, etc...

Of course in reality all these decisions were already made well before we every heard the term "Fiscal Cliff" anyway... but the meeting is just a way for the satanists to confirm that the plans are still on track as they previously decided months and possibly years ago. Plus these reptilians are probably hungry too and need to sacrifice some innocent "missing children" as they eat them for dinner. Sick yeah... but truth is sometimes harder to believe then fiction. By the way I just found some old picture that I have a screenshot of showing the date for the previous Legatus meeting in 2010 (for any "newbie's" that want more proof).

Of course in reality all these decisions were already made well before we every heard the term "Fiscal Cliff" anyway... but the meeting is just a way for the satanists to confirm that the plans are still on track as they previously decided months and possibly years ago. Plus these reptilians are probably hungry too and need to sacrifice some innocent "missing children" as they eat them for dinner. Sick yeah... but truth is sometimes harder to believe then fiction. By the way I just found some old picture that I have a screenshot of showing the date for the previous Legatus meeting in 2010 (for any "newbie's" that want more proof).

Lastly I want to add that I'm told by my connection that there are going to be 2 more penny stock promotions happen before the end of this year. January 2013 will be full of them I suspect, as the holiday's are usually slow. Each pick is "planned" (not a guarantee of course) to double, triple or maybe quadruple when they run. So if you aren't signed up for my penny stock newsletter you might want to sign up asap, as I'll probably sent out an "Alert" Monday night or Tuesday.

Red

ES Chart analysis: http://niftychartsandpatterns.blogspot.in/2012/12/es-chart-analysis_17.html

NICE LAST POST FOR 2012 RED!!!LOOK FORWARD TO 2013 POSTS!!!

GROAR … BEAR WILL RISE AGAIN!!!!

Yes they will… and early January is the likely time frame.

Ok gang… it looks like a typical slow bullish day. We could see some type of ABC move up into that 1500 plus target. Maybe we do the A wave up Monday-Wednesday, then down some on Thursday and Friday for the B wave, and finally up the following week for the C wave?

SPY Chart update: http://niftychartsandpatterns.blogspot.in/2012/12/spy-chart-update.html

More upside likely tomorrow gang… could be a C wave?

what now, we are back to same

Up tomorrow likely Turbo… with new highs above 1500 by the first week in January I think.

S&P 500 Analysis after close: http://niftychartsandpatterns.blogspot.in/2012/12/s-500-analysis-after-closing-bell_18.html

was watching the sacred geometry videos, years ago.

when my computer crashed in 2006, i lost all the youtube links.

Nice post Red, thanks!

Thanks Raven…

Looks like we might have topped today for the A wave up. We should see a little selling or sideways action Thursday and Friday for the B wave down (or flat). Then the C wave up starting next week.

Yes, certainly by far one of the most interesting i’ve yet to see

APPLE Bullish engulfing: http://niftychartsandpatterns.blogspot.in/2012/12/apple-bullish-engulfing.html

FACEBOOK Chart analysis: http://niftychartsandpatterns.blogspot.in/2012/12/facebook-chart-analysis.html

Just an update concerning the penny stock pick… no confirmed news yet, so I haven’t sent out any new newsletter.

disqus comments is having trouble, red. you might need to update discus.

personally, i’m not a big fan of the new discus update, but i haven’t figured out how to go back to the older version.

TZA has contagion. I suspected so.

anyway, here’s how much it will affect its price.

http://zstock7.com/

LIBOR scandal. connected to 2 mass shootings.

https://www.youtube.com/watch?v=deUZMMQIqnI

In the wake of the mass murders that took place in Newtown,

Connecticut on Dec. 14, information on the shooter, and his family, is

slowly being discovered by law enforcement other sources. One

interesting connection to the tragedy that took place at the Sandy Hook

school is that the father of Adam Lanza has a connection to the theater shootings that took place in Aurora earlier this year by James Holmes.

Both fathers of the shooters were allegedly expected to testify in the Libor scandal that rocked the banking world in June.

http://beforeitsnews.com/alternative/2012/12/libor-scandal-grows-as-the-fathers-of-two-mass-murderers-were-to-testify-national-finance-examiner-examiner-com-2516640.html

You forgot about the father of the 2 children “murdered” by their Dominican nanny is a top executive at CNBC where they were about to run a story upcoming Libor scandal

if you guys find some more info, along the way, put in a link.

this could be a watergate for bankers! what do you think?

Dow Jones analysis after close: http://niftychartsandpatterns.blogspot.in/2012/12/dow-jones-analysis-after-closing-bell_19.html

possible 2nd shooter

https://www.youtube.com/watch?v=TFKDuit8_xU

Police Walked A Man In Camo Pants And Dark Jacket Out Of Woods

https://www.youtube.com/watch?v=ovspEgeMXb4&feature=endscreen&NR=1

they will remove this video. controversy, better watch right away, i think

Nice find Z… I just knew there had to be a connection here. It’s the same old Illuminati tricks. If you can’t get access to the 2 fathers that were going to testify about the LIBOR fraud that the banksters did you go after their children.

That means the Batman shooting wasn’t done by that kid either as they must have had other assassins do the killing for it as well as this Connecticut killing. Both kids were framed first and then killed to stop their fathers from testifying against the banksters.

It’s a shame that more people do see through this and go round up some of these banksters and shot them!

the newspaper in CT has posted the Police and Fire tapes unedited..Over 2 hours long..More questions need to be asked..

http://www.ctpost.com/policereports/article/911-Sandy-Hook-call-shows-early-confusion-4127274.php

Hurricane Sandy and Sandy Hook???

Sandy Hook and Aurora appear in the Dark Knight Rises.

Interesting that the prime time Sunday night game with the best matchup of the year was played in New England this week. Of course the Bozo in Chief took the opportunity to interrupt the game with an extended photo op session…….Too bad nobody cared as most football fans ignored him and just watched the game on their phones.

Tomorrow is Sorcerer day. SL xxx………………St Louis…….

Y

Tebow and Wade (#3of the Thrice) wearing S L on Jackie Robinson (#42) day.

The StLouis Rams’ endzone spelled out St. Louis on Sunday rather than the normal Rams.

Also the (SL)eaze Bar from Dusk till Dawn.

Sanchito 12 for 19 for 111 yards the prior week.

The World Champion StLouis Cardinals opening the baseball season in the new MIAMI Marlins stadium on 4-4. The 5-20 solar eclipse occuring over LA as the Dodgers face the StLouis Cardinals on prime time national TV.

Of course, a certain little indicator is not in the crash zone but this could be the start of the slide over the CLIFF.

Apple update: http://niftychartsandpatterns.blogspot.in/2012/12/apple-chart-update_19.html

GOLD Chart analysis: http://niftychartsandpatterns.blogspot.in/2012/12/gold-chart-analysis.html

This coming Friday is another “eleven” day as 12/21/2012 equals 1+2+2+1+2+0+1+2=11… and many (not all) important highs happen on 11 days. Upside possible target is 1451 on the ES.

SILVER Chart analysis: http://niftychartsandpatterns.blogspot.in/2012/12/silver-bearish-pattern.html

CRUDE Oil triangle breakout: http://niftychartsandpatterns.blogspot.in/2012/12/crude-oil-triangle-pattern.html

Dozens of UBS staff manipulated the Libor rate,

which is used to price trillions of dollars worth of loans across three

continents, in collusion with brokers and traders at other banks,

according to an international investigation.http://uk.reuters.com/article/2012/12/19/uk-ubs-libor-idUKBRE8BI00L20121219

SPX Analysis after close: http://niftychartsandpatterns.blogspot.in/2012/12/s-500-analysis-after-closing-bell_20.html

The market should bottom around 1425 around on the ES tonight I believe. Then it should turn back up by tomorrow morning, but at the open Thursday the SPX and the ES are going to be pointing in different directions.

Not a good day to trade as it’s likely to whip traders around as the ES pushes up and the SPX pushes down. Could be the same on Friday too if the charts don’t line up pointing in the same direction.

Bank of america bearish engulfing: http://niftychartsandpatterns.blogspot.in/2012/12/bank-of-america-bearish-engulfing.html

ES Chart analysis: http://niftychartsandpatterns.blogspot.in/2012/12/es-chart-analysis_20.html

Looking at the market this morning gang it looks very bearish. Lot’s of support levels for the bulls but the charts majorly support the bears. It’s all about whether or not the bears can get some momentum going as if they do those support levels won’t hold. Maybe they tank the market Friday when the world ends?

Morning Mr. Red and bloggers….just in case…smile!

Have a very Merry Christmas one and all!

Thank you all….great blog Mr. Red!

Thanks Seawind…. and a Merry Christmas to you and your family too!

WOW! Talk about defying gravity! I guess pigs do fly!

BIDU resistance levels: http://niftychartsandpatterns.blogspot.in/2012/12/bidu-resistance-levels_20.html

Thanks San…….for all your charts!!!

$GOLD…..How low are they going to take this. Support here @1640 ish or even lower support @ 1600-1610?

Crucial level for Gold is 1630 (100 Week SMA). Sustaining below this level will be bearish.

Thanks…….by the way NICE CAR aka Rocket ship! Smile!

Once again today hitting SPY 144.60 above now as I type!

SILVER Chart update: http://niftychartsandpatterns.blogspot.in/2012/12/silver-bearish-pattern-updated.html

GOLD at Weekly support levels: http://niftychartsandpatterns.blogspot.in/2012/12/gold-testing-weekly-support-levels.html

A Red Pill site….. http://www.zerohedge.com/contributed/2012-12-20/hyperinflation-started-25th-july-2012 Have a great night and a better tomorrow!

That guy Lamoureux is nuts if he think we should not be concerned about the “pull back” (that’s what he calls it… I call it a crash!). Leading the sheep to slaughter is what he’s doing! Looks like a slick salesman too me… maybe even a reptile?

AGREE!

Slightly higher high for the Russell 2000 with divergence on the 60 min RSI (at highish 70) and lower histogram bars—-in this case, negative ones. I am guessing 60 min $nya is similar. SP no new high and didn’t get up to 70RSI on the 60 min.

What’s the news er propaganda????? No fiscal cliff resolution yet????? These boys going to take it to Christmas eve????? Bozo and Boner/Closet Case are getting all touchy feely??? That’s the reason for the optimism as we push the deadline????

That NFL Connoseiuer dude had some cutting edge, real time NFL analysis the other day over at DE’s. On the Monday Elliot Wave thread all the way through Tuesday afternoon. Covered the Sanchito Monday Night debacle as well as the infamous Cardinals-Detroit game on Sunday for you four letter guys in need of material. But that C-Detroit game, way off the beaten track, was covered on the not the fake face of the 4 letter show so maybe they already have seen it.

Tebow now in the news, making headlines for the first time of the year, saying he wants out of NY. His stats were covered over at DE’s.

Jason Gay with an article in the WSJ today on the Jets turbulent situation and he couldn’t get in enough times how the Jets were 6-8 on the season. So I guess that TD pass to #86 from newly entrenched Jets starter #14 in that miraculous come from behind non-thriller 7-6 win against the Cardinals a couple of weeks ago does have some meaning. Hines Ward #86 of course scores the touchdown in the Dark Knight Rises as the stadium implodes around him.

The photo in the article shows Sanchito #6 with coach Rex Ryan but only 2 of the 3 6s on Sanchito’s are exposed in the photo while the stadium clock in the background shows 15:06 or 66. Tebow #15 or 6 as well. So the Jets’ QB threesome: 6-15-14….6-6-14 or 12-14.

Sanchito #6 despite throwing 4 picks with one game-ending fumble still saw his 666 jersey in hot demand at a local “auction” although the auction occurred in many locations undoubtedbly.

This following the last auction, a Michael Vick 777 jersey awhile back when Vick wasn’t even playing.

This Jason Gay article is pretty good but the NFL connoseiuer troll covered a lot of the same stuff over at DE’s. I recommend the article but I can’t reprint it in it’s entirety but here are some of the highlights:

“At times, Sanchez looks less like a professional quarterback throwing a football to his receivers, and more like a hotel guest flinging chair cushions off of the balcony into the pool”

“A day later, Ryan announced that Sanchez would not be the quarterback for the season’s penultimate game, that this Haz-Mat assignment would go to third stringer Greg McElroy.{(the former Tuscaloosa based QB–editor)} McElroy is young and did lead New York to a modest 7-6 victory over Arizona a couple of weeks ago, but the team didn’t even make him eligible to play against Tennessee. Watching the Jets make personnel decisions is like watching a manic person make a casserole out of items found in his car’s glove compartment. It’s all madness, no method.

Naturally, the big take-away wasn’t Sanchez’s benching or McElroy’s ascension but the conspicuous snubbing of the team’s quarterback understudy, Tim Tebow. Tebow was a bizarre acquisition for the Jets….Tebow was off-loaded to the Jets, happy as ever to hoard insanity. But after making loud noises about a “wildcat” offense and employing Tebow as a kind of special ops backup, the Jets haven’t made much use of Tebow at all……..Presumably the Jets have seen enough of Tebow in practice to decide he’s not capable of leading them to four-interception losses…..

This is the point at which common sense should take hold and the detached observer should ask, WHY ARE WE STILL TALKING ABOUT A 6-8 FOOTBALL TEAM? This is a reasonable ask–and to state the obvious, the over-obsession with the Jets is mostly driven by New York’s profound, irritating love affair with itself…..

The Jets play the San Diego Chargers on Sunday, another tormented franchise that essentially operates as Jets West. This game was originally scheduled for prime time, but NBC has decided to downgrade it from 8:20 pm to 1 p.m. {(obvious numerological insertion—ed.)}, like a wedding planner callinga bride and regretfully explaining the wedding has been moved from the grand ballroom to the parking lot.”””””

New prime time game now features the 49ers again against the Seahawks.

We’re fast approaching the 1900 day mark off the 10-11-2007 high.

Wow!

What do you think about that? Was real, not a FP!

NO FP Morpheuz… I watched it happen! It’s real…

Seems like a new flash crash…

New Newsletter Update sent tonight…

Tonight we just saw a flash crash as a late meeting was schedule for around 7:30 EST tonight but not announced until after the market closed. No deal was reached on the Fiscal Cliff so the market tanked.

Just don’t get too anxious to short tomorrow morning as a think they just did this to take out everyone’s “buy stops” so they can have enough money to take the market up more into the end of the year. Wait until we see what happens tomorrow morning.

Yep. as you say, they don’t let people on the bear bus so easily.

if the smart money really did dump on this stop run, the next several days up

would be a ‘buy all the puts for any price” kind of moment. AKA, it’s going to be

a loooong 2013 (downhill).

-Gerb

Remember this print from 2010?

http://reddragonleo.com/wp-content/uploads/2010/01/97-point-misprint-on-SP-1024×684.jpg

And what happened afterwards?

http://reddragonleo.com/wp-content/uploads/my-first-fp-showing-a-97-point-drop-on-the-spx-on-01-31-2010b.jpg

Legatus is February 7th-9th, 2013 and January the 4th, 13th, and 31st are “eleven” dates, with the 13th being on a Sunday when the market is closed. Which date do you think the top will be one?

January 13th.

a friend of a friend gave me this one.

(you know how I like T’s, even if they’re upside down!)

http://s10.postimage.org/l2silf5e1/jan.png

What date is that T on? The last line up in January? I’m guessing the week of the 4th.

yes, mid January.

it’s a large chart, and I admit, some weeks are off by one.

so it’s a fuzzy mid Jan for me.

I’m trying to to time it down NOT to a day but more of a tide change.

loving this move. bought the Q puts today with half my account 🙂

looks like a bit of reality is setting in on the fiscal cliff, though I expect if its down too far, there will be alot of Am buying to bring it back up a bit

There will be buying tomorrow Bill. They don’t want the market down going into the end of the year. They stole everyone’s money by hitting their buy stops and will now use it to pump up the market. Watch them spin this positive tomorrow morning…

Sorry gang I forgot to hit the right button to send out the newsletter. It’s sent now…

Remember WB’s Dubai Roger Federer video? Was perusing it yesterday. 12-20?????

I just saw an 84-20 flash in that SD State—BYU game.

Here it is: http://www.youtube.com/watch?v=Mq31fmKwh-4

Obviously, the circle around 20 is solar related.

5-20====solar eclipse 7-20=====Dark Knight Rises and the cinematic release of its namesake…….7 and 5 months later is 12-20…….

Don’t worry about the stock market tomorrow gang as the world ends and you’ll never get your bear profits to spend anyway! LOL

P.S. Another “eleven” day tomorrow… funny things can happen?

If the market opens at this high print tomorrow I’d be looking for the low print to follow…

http://reddragonleo.com/wp-content/uploads/my-iphone-at-613-am-July-20-20121.jpg