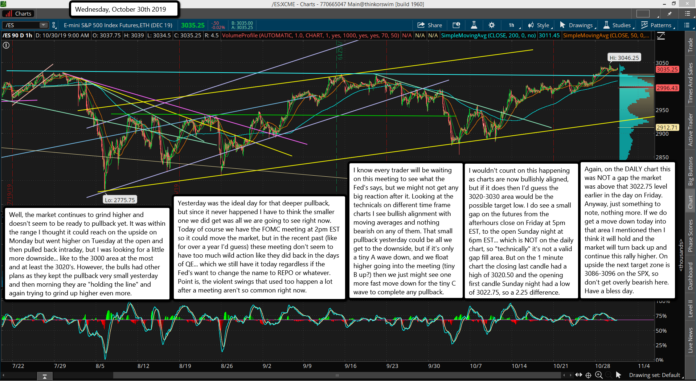

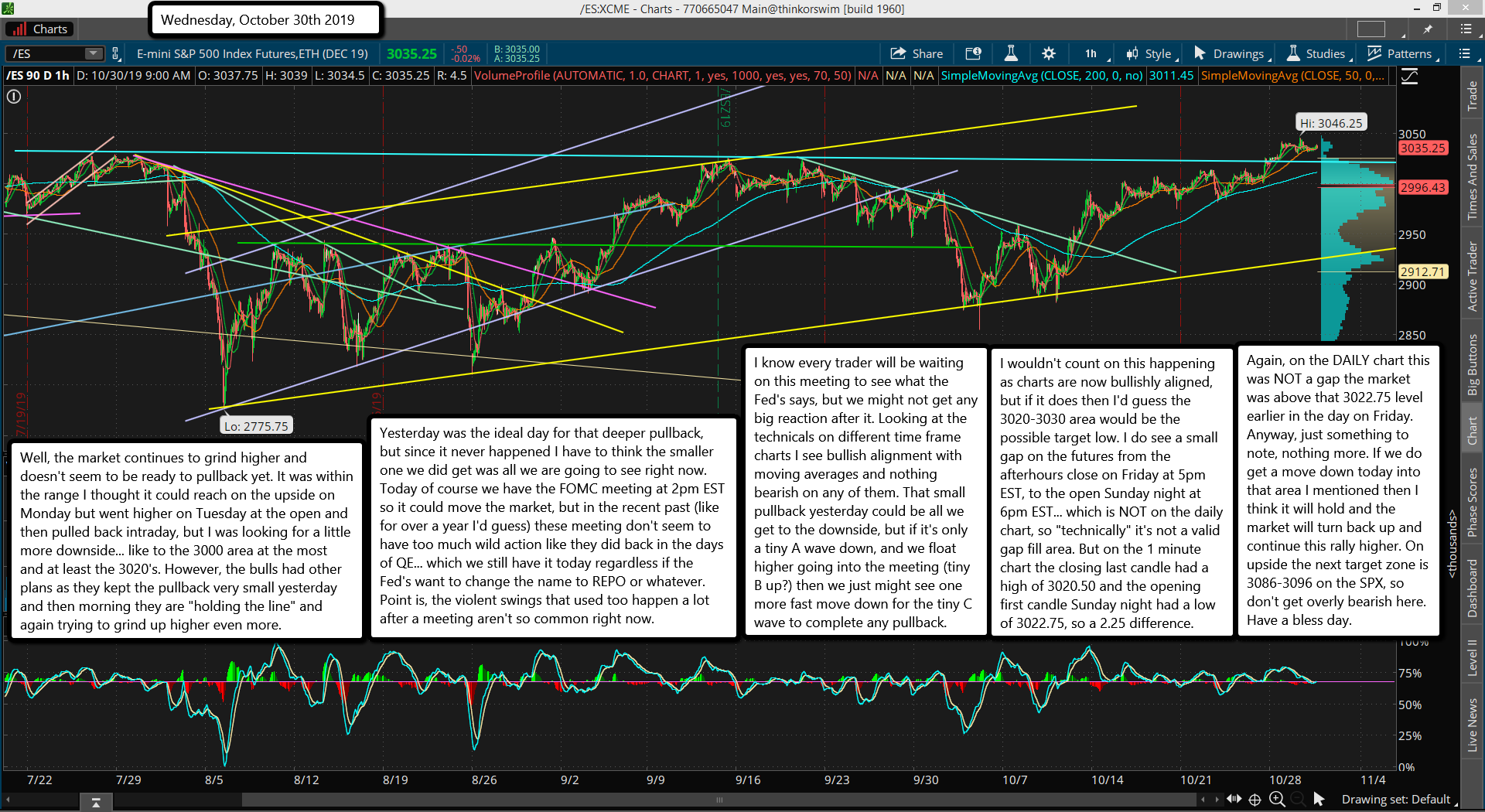

Well, the market continues to grind higher and doesn't seem to be ready to pullback yet. It was within the range I thought it could reach on the upside on Monday but went higher on Tuesday at the open and then pulled back intraday, but I was looking for a little more downside... like to the 3000 area at the most and at least the 3020's. However, the bulls had other plans as they kept the pullback very small yesterday and then morning they are "holding the line" and again trying to grind up higher even more.

Yesterday was the ideal day for that deeper pullback, but since it never happened I have to think the smaller one we did get was all we are going to see right now. Today of course we have the FOMC meeting at 2pm EST so it could move the market, but in the recent past (like for over a year I'd guess) these meeting don't seem to have too much wild action like they did back in the days of QE... which we still have it today regardless if the Fed's want to change the name to REPO or whatever. Point is, the violent swings that used too happen a lot after a meeting aren't so common right now.

I know every trader will be waiting on this meeting to see what the Fed's says, but we might not get any big reaction after it. Looking at the technicals on different time frame charts I see bullish alignment with moving averages and nothing bearish on any of them. That small pullback yesterday could be all we get to the downside, but if it's only a tiny A wave down, and we float higher going into the meeting (tiny B up?) then we just might see one more fast move down for the tiny C wave to complete any pullback.

I wouldn't count on this happening as charts are now bullishly aligned, but if it does then I'd guess the 3020-3030 area would be the possible target low. I do see a small gap on the futures from the afterhours close on Friday at 5pm EST, to the open Sunday night at 6pm EST... which is NOT on the daily chart, so "technically" it's not a valid gap fill area. But on the 1 minute chart the closing last candle had a high of 3020.50 and the opening first candle Sunday night had a low of 3022.75, so a 2.25 difference.

Again, on the DAILY chart this was NOT a gap the market was above that 3022.75 level earlier in the day on Friday. Anyway, just something to note, nothing more. If we do get a move down today into that area I mentioned then I think it will hold and the market will turn back up and continue this rally higher. On upside the next target zone is 3086-3096 on the SPX, so don't get overly bearish here. Have a bless day.