Post Number 199... Yes,it really is my one hundredth, and ninety ninth post since starting this blog last year. (However, I think I'll skip the 666 and 999 post... just too be safe - LOL)

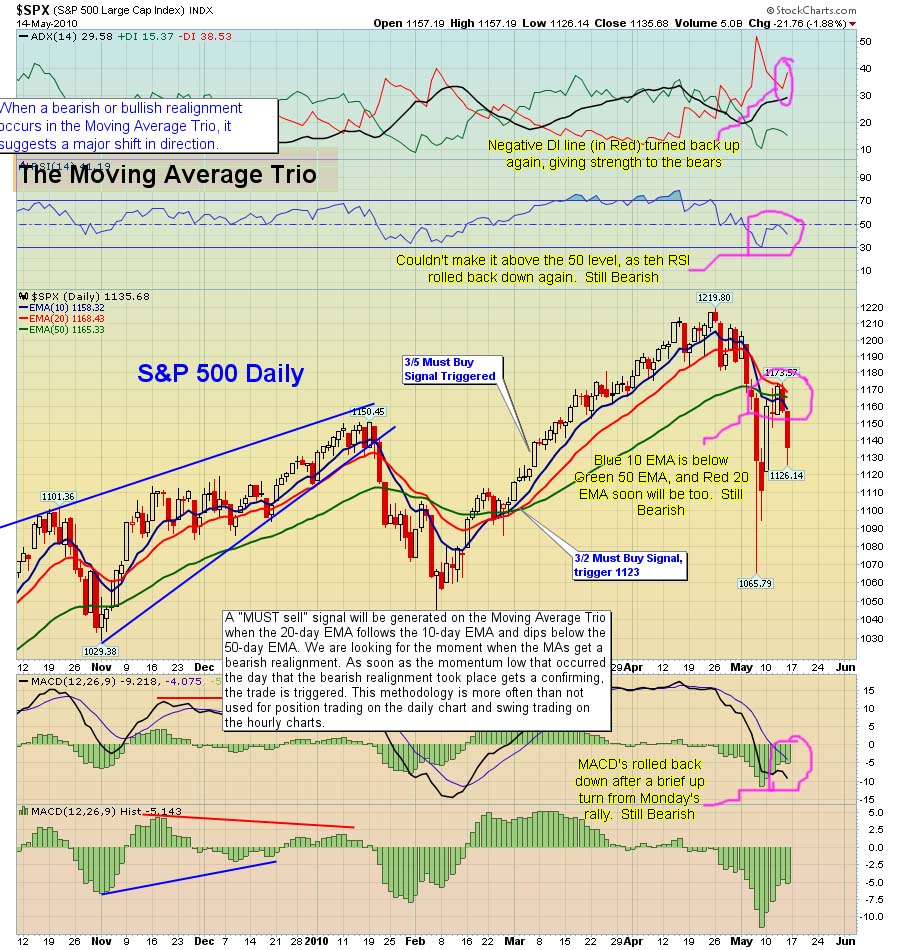

I can't find a single reason to be bullish next week, from any technical point of view. The only thing I can see positive... is that the typical option's expiration week is usually bullish, but past history doesn't always play out the same in the future. The charts are still very bearish right now, and I think that will overshadow the past history results for a bullish opx week.

With that being said, I don't necessarily think that we will crash on Monday. We could rally up a little on Monday, and create a smaller wave 2 up, inside of a larger 3 wave down (some call it a 5th wave?). And then plunge down on Tuesday with a smaller wave 3 inside a larger wave 3, which is what I think will happen.

We are still pointing down on the daily chart, which will continue to put overhead pressure on the 60 minute and 15 minute charts. Looking at the chart below, you will notice that the MACD lines rolled back down, after briefly pointing up on Monday's rally. The 10 EMA is still below the 50 EMA, and the 20 EMA isn't too far away from crossing over it too. The histogram bars are still in negative territory too.

The RSI is still below the 50 level, which means that the bears are still in control. Plus, the ADX line is now rising again, with the negative DI line (in Red) hooking back up now. More downside is coming next week... how far is anyone's guess?

Let's look at the 60 minute chart now. It's has both the 10 EMA and the 20 EMA now below the 50 EMA, which again puts the bears in control. The RSI is still well below 50, but did hook back up at the close Friday. This could give the market the smaller wave 2 up on Monday. However, I don't think it will get back above the 50 level with the daily chart still pointing down.

Look at the MACD on the 60 minute chart too, as it's still pointing down, and hasn't hooked back up yet. It did put in a lower histogram bar during that last hour that the market rallied a little on. But again, with the daily chart putting downward pressure on it, I don't think it will make it back up to the zero level on Monday. Maybe it will put in lower histogram bars, but fail to crossover into positive territory.

Now let's look at the 15 minute chart and try to forecast what will happen on Monday. First off, the early sell off, and then sideways movement, forms a perfect "bear flag" pattern. Not that they all play out, but if this one does, then an early morning sell off (possible gap down open) could happen. Notice that the MACD has successfully rallied back up above the zero level, and into positive territory. There is no way of knowing how high it will form it's histogram bars, before rolling back down, but if you match it up with the RSI above... I'd say it's pretty close too topped.

Looking at the RSI, you will notice it rising back up toward the 50 level. If it can get above it, and push up toward 70, then the histogram bars on the MACD could continue to rise, and the market would too. The ADX line is rolling back down, and so is the negative DI line (in Red). The positive DI line (in Green) is rising, giving strength to the bulls. But remember, this is only the 15 minute chart, at it still has a ton of overhead pressure above, with the 60 minute chart, daily chart, and weekly chart pushing down on top of it.

I think the best scenario a bull could hope for on Monday, is that the 15 minute chart rises back up and forms a smaller wave 2 retracement rally... allowing them to get out of their positions, before it rolls over into smaller wave 3 inside larger wave 3 (or 5?).

Baring that there isn't any negative news about another country (or state... aka California) going into default, then maybe there will be a smaller wave 2 up on Monday? However, it could have already completed itself on the late day rally (mainly short covering), which in that case... the bear flag pattern will play out, with a possible gap down on Monday.

After this correction is done, I think we will go back up for one final high. The monthly chart looks almost topped now. It should roll over in 1-2 months, and then P3 down would be started. But, for now, we are close to putting in a bottom for this current down turn. I would estimate that next week (or the following week, at the latest) will put in the bottom for this sell off, and the following week will start a big rally back up again.

So for Monday, it's either going to be a gap down from some negative news, or we rally up a little bit while we continue to form that smaller wave 2 retracement. Either way, Tuesday and Wednesday will look horrible for the bulls, as a wave 3 of a wave 3 down will occur. It's going to be Bloody...

Red

Well folks, if the possible bloody downturn does happen, it's thought that the carnage will weigh on the metels, but “probably” for only a very brief time. this would make a great entry point to catch a perhaps historic rally in silver (and gold)

If I do see a huge spike down in stocks with vix way up next week (?wednesday) I'll take the profits on the shorts and then put some of it in silver and gold.

The Weekly view from Americanbulls

Three weekends ago, TNA was up 60% from it’s buy, and was rated a HOLD

Two weekends ago, TNA had fallen but was still up 43% from it’s buy, and was rated a possible sell.

Last weekend, TNA had fallen a lot, and was an official SELL – only 7.7% up from the buy. Up 60% to 43% to 7%. Ouch.

This weekend, TNA has moved up a bit, and is a possible but unlikely buy this week.

Unlikely or not, if TNA rises above $56.62 this coming week – it will be considered a BUY. If it falls below $56.62, it’s not a BUY.

TZA was a confirmed BUY last week, dropped a ton this past week (from last week’s close), and is a possible but unlikely sell this week.

The TZA buy price was $5.92, and closed this week at $6.13 – up 3.5% from the buy (last week’s open).

Unlikely or not, if TZA falls below $6.13 this coming week – it will be considered a SELL. If it rises above $6.13, it’s not a SELL.

Of the stocks & ETFs I follow, these are ok to own for this week:

UUP(US Dollar)

GLD (gold)

UGL (2x Gold)

SRS (-2x RE)

DRV (-3x RE)

SCO (-2x Oil)

DTO (-3x oil)

ERY (-3x energy)

SKF (-2x Financials)

FAZ (-3x Financials)

EPV (-2x Europe)

SPXU (-3x $SPX)

DXD (-2x DOW30)

These are to be avoided this week:

USO(oil)

UCO(2x Oil)

GS

QID (-2x QQQQ)

DZZ (-2x Gold)

These are not likely to rise this week, but they are buys if they do:

IWM (1x $RUT)

UWM (2x $RUT)

TNA (3x $RUT)

IYR(1x RE)

URE(2x RE)

DRN(3x RE)

ERX(3x energy)

AAPL

AMZN

DRI

GOOG

DIA

SPY

QQQQ

QLD (2x QQQQ)

EWG(Germany)

EWQ(France)

EWU(England)

EWX(emerging mkts)

These are not likely to fall this week, but are sells if they do:

RWM (-1x $RUT)

TWM (-2x $RUT)

TZA (-3x $RUT)

SLV(silver)

The weekly view was very Bearish last week, and only a bit less Bearish this week.

Good morning all – anxious to see whether we backtest that red containment this morning at 114.37 although one of you (can't remember who) saw a fake print last week a little lower (114.15) so maybe we hit there instead if containment has shifted? Anyway, hope everyone had a good weekend.

Sundancer, if you are here, do you think your ritual dates of tomorrow and Wednesday, signify an interim bottom?

Just bought more puts. Let's see what happens.

Man trade triggers suck – I got a horrible execution.

Carl’s morning call:

June S&P E-mini Futures: I think that last week's low at 1056 ended the correction from 1216. Today's range estimate is 1125-45.

1120.25- 1140 range last night (19.75 points)

1125-1145 estimate for today (20 points)

1138 currently, so estimate is -13 to +7 from here (bearish)

Good Morning gang…

Overnight futures were down to 1120 spx. Not a good sign for the bulls today.

Good Mornin…

clouds and cold…so much for sunny CA

coffee cold

market up….maybe I should go back to bed not a good start so far….

Have a little faith!

ok….sorry a little grumpy in the mornin…

ok just prayed to the market gods….market coming down and coffee out of the micro and burnt my tongue…

lookin good

This morning I canceled an order to liquid my short inventory @ gold weekly containment($SPX 1050's) & re-entered the order to liquid short inventory @ teal weekly containment($SPX 990's)

Yesterday I made a post explaining some changes in market dynamics over the past week.

Sun, Is the chances reduced less than 13% that SPX 1050 will hold?

No, @ last weeks close the probability shifted from 68 to 13.

I have a rare congruence among stat. probability, daily containment pts., daily TL's, numerical sequences that all point to a big slip zone below 1070

Thanks Sun.

Thanks Sundancer.

OK. I am a dummy as you know but how does one display all the posts on this site. I can not figure it out since the re-design.

Thanks

If you click on the “home” button up top, you will see the current post, and you can scroll down to see older one's. Once you click on the “comment” button, you will only see the current post, and the comments posted with it.

You can also click on the different dates on the calendar to see what I posted on that day. Or click on the month to go back quite a bit in the past.

Thank!

But when I click on the calendar button all I see is your post for that day and 2-5 comments below it.

It used to be that I could scroll down and see the complete thread.

That no longer is the case; for me anyway.

Gere,

Must be something strange going on in your browser? Try FireFox, Opera, or Google Chrome, as I see all the comments from that day. Of course I have to click on the “comments” link beside the post title, after I find the post by clicking on the date from the calendar.

But after that, see everything just find. Older version of IE, like version 6 don't work well, but version 7 does. I don't use IE much, as I like Opera the best, and then Chrome and Firefox about equally.

Safari browser is OK too, at least the newer version of it. However, I found that it crashed a lot for me, as I open up a lot of tabs at one time. Opera seems the most stable for lots of open tabs.

Like right now I have 30 tabs open on Opera with my Laptop, and another 18 tabs open on Firefox, and 8 tabs open on IE 7, and it's works on all of those browsers.

On my destop, I have 44 tabs open on Firefox, and it works there too. It's probably related to your computer, or browser. Hope that helps?

If anyone else is having problems viewing past posts or comments, please let me know. Maybe there is something wrong in the new design, and I can try an fix it.

I use chrome on all my computers as well. ETF corner is fine and Serge uses DISQUS as well. So I am thinking it is something unrelated.

Oh well, thanks for taking the time to answer.

I will try Opera 🙂

Well this is a fast moving day….I'm guessing 112.30 for today…

lower lows than friday and vix going through containment.

If 113.00 breaks, the next support is 111.50 spy.

thank you. may face some support at 112.65 i think based om sun's next containment.

Here we go 🙂

Hey Red, you were right congrats!!!!!!

Firefox crashed on me, and I had to restart it on my desktop. That's why I disappeared in OBB. I'm back now though. I guess it's not FireFox's problem really, as I have 44 tab's open on it, in 2 different windows. LOL

ya, you may want to close a few dozen of them 🙂

Down Down we go 🙂

Not what i expected for opex monday.

Thought we would get a more sizable bounce.

So are we in 5 down or C down???

Not sure on the wave count Jim, but it could be a smaller wave 3 inside a larger wave 3 (or 5?). Either one spells more downside coming tomorrow and Wednesday.

The Ritual never changes…

http://www.flickr.com/photos/47091634@N04/46152…

Backtest of Red containment followed by a flush

Red containment on the 120 is next

http://www.flickr.com/photos/47091634@N04/46152…

Do you think we will end the sell off this week, or do you think it will carry over into next week… with the 980-990 likely target?

Early next week at the latest

Speculative capital won't start liquidating their long positions until $SPX busts through feb. 2010 lows.

This next step will be a punisher…. my guess is 1102, and probably a decent backtest after.

Once 1100 breaks, I believe there will be some panic selling to happen.

$SPX hanging on by a thread…

This thrust into 11:45 CST had to do with the 195 min setup

Should the $SPX lose the White ENV then a 35 pt. plunge will ensue to the purple ENV

http://www.flickr.com/photos/47091634@N04/46153…

Unbelievable but somehow I believe it!

I just seen a 1135.25 spx print show up, but nothing on the spy. Not sure if it's just a late fill, or a possible target for tomorrow? (10 minute chart @ESM10 is the symbol).

I don't think it's like to rise back up there today, as all the charts are still pointing down, but it's something to keep in mind… just in case of a rally tomorrow (which I find unlikely… but anything is possible)

It just disappear…

thanks red.

Well…I see you hanging out here more than there 🙂

By the way regarding a discussion we had weeks ago, many weeks, I reserve the right to say I told you so AND about being right in the long term 🙂

However, I am not ready to say that yet. Although it is tempting with all the new found bears. To my way of thinking, and I respect all others we need to take out the February lows to declare the cyclical bull dead. At that time, I expect a reverse divergence as a confirmation on my volume based indicators.

I am still in a quandry regarding the volume figures. Were they always wrong which makes them right or are the recently corrupt which makes them wrong. Since occurance percentages are often quoted here, I guess the feeling is that it does not matter.

I like both places but only have time for one these days so yes, I have been spending more time here. Yes, you were right but unfortunately timing is important. I have been short pretty much for 7 months which was really detrimental to my account. The retail trader doesn't control this market so the volume no longer matters. I learned the hard way that you can't hold triple ETFs. Since I have switched to options, my account has improved dramatically. Options, and Sundancer that is!!! The market and the world are corrupt. We are just going to have to accept it and be grateful that we are better off than most.

It is very sad that someone so young, with two babies would embrace that thought. I would heed EC's advise. He a wise soul.

Yes, I don't know how I became so cynical but evidence of late has made me even more so. Funny – a year ago, I was going door to door campaigning for Obama. My how I have changed! I think it is because I have two little ones and have always been fortunate that I am afraid of it all being taken away if I don't protect myself. Probably better to just enjoy the moment, but my brain doesn't work that way!

Looks like 1120 is hard to break and hold. They cannot let OPEX Monday be too bad. they will pull out all stops IMO.

guess they wanted to get everyone long to create some momentum to the downside!

The 15 minute chart was oversold. It's at the zero mark now and rising. I'd estimate that it peaks around 3pm, which could cause more selling into the close? I say “could” because the 60 minute is getting pretty oversold, and might roll back up anytime now.

That might make tomorrow a “pause” day, as the 2 charts cancel each others' momentum out, resulting in not moving too much in either direction tomorrow.

Red, if we get much lower than this, then we will have to hold onto our hats! Maybe it will wait until tomorrow or Wed or maybe it will happen today?!

Yeah, I agree…

I'm not saying that tomorrow is a big up day, but maybe a flat day… before all the charts line up pointing in the “Down” direction. That would be another wave 3, or something? More selling is coming, that's for sure. I'm saying put for now (no pun intended)

could be but it looks like it is really trying to break this level today. If we are to make it to 990 by Wed. (don't know if this will happen), we have to move fast.

I thought they fired that guy with the “fat finger”? LOL

Relax, I think there will be time to get out, and go long. Yes, it will move fast, but you will be able to hit the sell button in time. I just don't think they will pull another “1,000 point drop” in 20 minutes.

I think it will be multiple days of selling, with the last day triggering the bot's to buy around 980-990 level. It should look like the February 5th low, with the huge “bottoming tail” on the candle.

I could have got out then, and went long, with time to spare. It did move fast, but not so fast that you couldn't get out and back in. Of course, stupid me kept thinking it would go lower… but it never did.

I won't make that mistake this time around…

Well I have skinny but inefficient fingers! I will just set the triggers so I don't have to worry. You could be right about moving up from here it looks now. I'd imagine though if we go back down to test that 1120 level today, that we'll go through it.

talk about volatile. We just halved in about 2 minutes.

I believe this up move will last until 3pm (maybe 3:30?), and then the 15 minute chart should roll back over to the downside. The 60 is still looking like it wants to turn back up, but hasn't yet.

That leaves us with a possible flat close, from the high that the 15 minute chart puts in. That's only if the 60 rolls back up and props up the 15 while it rolls back down? We could sell off into the close, if the 60 doesn't roll back up to support the 15?

Remember, the daily is still pointing down, and putting all this overhead pressure on the market. So is the weekly right now too. If we don't sell off into the close, then I think tomorrow is more likely to go sideways while the 60 rolls up and back down.

It's really about the 60 minute chart, from what I can see. It can see go lower… but again, it could turn up sharply at any time.

Could be and thanks. I guess it doesn't matter as I am hanging onto my positions. I did close out the 26 may vix calls a little earlier. Still have the may 24 vix calls and the may (just the 114s) and june spy puts.

Daily containment view

1120's: purple&yellow

112.89 Jan. TL

http://www.flickr.com/photos/47091634@N04/46162…

so we are backtesting the Jan trendline.

yep

the close today ought to be interesting

seems to be a real fight between the bulls and bears. Back and forth between these two lines.

The 113.00 level was good support going down… now it's resistance.

Yesiree Red! When all of this is said and done, you, me and gere should get together and celebrate (if we do actually get lucky) since we all live in Florida!

And don't forget Anna too, as she lives in Tampa.

Definitely!

But I am counting my eggs before they hatch and that is always dangerous!

LOL…. me too! Let's wait until it works.

Mr. Topstep…

http://www.youtube.com/watch?v=j4rz8hANhgA

Fear is Back in the Market Monday

Fear, What a joke

The only fear ever present in the market is missing the up move.

The market is a nasty $1,000 hooker to most people.

LOL…

Hey, I didn't name the title to the video… those guys did! But yeah, not much fear in the market right now.

I guess the overnight futures told us the lows of the market today.

Looks like we are going up to that fake print from early today, at 1135.25 spx.

Great minds think alike!

i wonder what happens after that. I hope we close below the jan. trendline.

are u quoting ES or $SPX

The operators left a 1138.31 from the 8:42 cst candle

if 1135.25 is ES then it's co-relational to 1138.31

Symbol is @ESM10

wasn't that filled this morning?

Just got through 113. Maybe I jinxed us.

Red, I guess that fake print you saw earlier meant something after all!

Yeah, I went from being up big to down big… go figure! Damn fake prints!

amazing red. I just bought some more puts.

I called for a short squeeze to go long down over 100 points and went long calls

Good for you!

thanks Monica Tomorrow will be up most likely and big there are too many 115 puts to pay out in May so they will close at the very least above that by Friday

Hi all,

I agree with Anna! About 400K OI in SPY May 115 puts. Bought SPY May 114/115 call spread as an OPEX pin play.

GLTA

Prammmmmmmmmmmmmmmmmmmm !! good luck to us babe! come visit hob doing a complete new look and moving back there

will do 😉

yeah missed you!! 🙂 and our earnings powwows

Hi Anna,

I have been trading options mostly during OPX week and been doing good so far. Trying to stay disciplined 🙂

You know we love earnings!! 🙂 Glad to hear your doing well babe 🙂

Good call on your part Anna… You know I'm a little stubborn. I just didn't see it coming today.

I tried to get you to sell earlier…yes you are a stubborn dragon.. lol

I also have a bottoming tail on EUR daily so the dollar should see a nice corrective wave.

I did an audio call on optionsblackboard.com

Will add more calls on dips now 🙂

The 60 minute chart is now turning back up, so I do agree with Anna that tomorrow is likely an UP day. But, I still see more downside in the coming days.

http://stockcharts.com/def/servlet/Favorites.CS…

Gotta stick with my conviction even if it makes me stubborn.

The dynamics of the market is not going to give u an up day tomorrow, then more downside

teal containment on the 60 min is in the 1150's should that break you'll see 1208, so $SPX either continues down or 80 pts. to the upside.

@ Sundancer is not or is?? TIA

tomorrow can be a up day for the $SPX, but if it breaches teal containment on the 60 min you'll see 1208

thanks Agreed, your post said not, but I thought you meant could be 🙂

Well I definitely don't believe we will get back up and over 1150 spx tomorrow. I could see 1140 area, but not 1150… but just in case you didn't know it, Anna is a swing trader (which sometimes turns into day trading), and you are on a longer time frame.

That's probably the differences in opinions, as she switches back a forth a lot to trade both sides. I think the overhead pressure on the daily and weekly chart will keep any rallies from the 60 minute chart contained to only a few points.

I don't see it up big, but a sideways day was more what I was thinking would happen. But, I've been wrong many times before, so why should this time be different…

Adding calls here

Good luck! I guess you know what you are doing so that means Red and I are in trouble 🙂

thanks Monica 🙂 just think the selling is done for the short term (next few days :))

Knowing you – you are probably right.

watch out for short squeeze into the close!

Thank you Anna, RDL and Sun. I bought BGU – first time I am making some money.

anytime 🙂

Well, we hit that 1135.25 fake print on the ES… not exactly what I was expecting to happen today. Maybe tomorrow, but that was on helluva short squeeze. Now what?

Anyone see anymore fake prints?

more upside tomorrow Red and most likely Wedesday long MON for a corrective Wave

You are amazing! You are always on the winning side!

When i grow up, I want to be just like you! lol

heheheh not always 😉 your so sweet!

or join OBB and you get to see her do it in real time, we've been banking $$

You wanna be a girl? ….. lol

oh haha… very funny. No opera for you then. How about a midnight stroll in South Chicago instead? hehe

i want to see the 1138.31 gap from this morning get filled before EOD

Carl at day’s end:

1125-1145 estimate for today (20 points)

1112.75–1140.25 actual range today (27.50 points )

Market was 4-12 points below Carl’s range.

Trades: No trades

Grade: C (lost no money)

I am still short and comfortable. If we breach 1150 I will reassess.

Confusion is running rampant again as people are getting whipsawed out of their positions trying to figure out which way the “trend” is.

This may help figure out which way the “trend” is.

http://www.flickr.com/photos/47091634@N04/46166…

Setup is real clean for the rest of the week. Consecutive hourly closes above teal hourly containment & you'll see 1208. *IF* $SPX takes out daily purple containment($SPX 1120's), then 1080 & below.

I have to travel a bit the rest of the week, so I won't be around as much.

It's just a time element for me, as I'm in May puts, and they expire this week. I still see more downside coming, just not sure that it's going to continue tomorrow. Maybe? But I expect a “pause” day… meaning it could go up or down a little, and end up flat.

I'm still short, but did close out the 110's as they are the lowest strike price I have. I still have my most puts in the 112's. We'll see tomorrow I guess. Have a safe trip, and do drop by when you can.

Thanks – have a good trip. Good to get away from the market.

TNA opened up 2.0%, and the opening gap was filled. TNA was up 4.4% at it’s high, and closed up 0.7%.

An earlier gap from $58.98 to $60.04 was trimmed a bit and now is from $59.03 to $60.04

We are now in a New Moon Trade, which tends to favor TZA.

AmericanBulls had TNA with a possible sell today, and TNA closed up, so TNA was not sold. The TNA buy was at $55.66. TNA closed at $56.92, up 2.2% from the buy.

AmericanBulls had TZA with a possible buy, and TZA closed down, so TZA was not bought.

Will have to wait and see how AmericanBulls treats these two for tomorrow.

Volume for TNA today was down from yesterday, but above normal.

$RVX (VIX for $RUT) closed up 2.2% with TNA up 0.7%. ****A divergence**** Bad for TNA

TNA had been down 4 days, up 3, down 2, now up one. Chop. Neutral for TNA.

The low for TNA was from six days ago at $42.29. Today’s low was $52.25, 23% higher. Good for TNA.

Today, Ultimate Oscillator for TNA rose from 55.95 to 58.7 (+2.75) while TNA was up 0.7%. No divergence. Good for TNA.

MACD fastline is below zero and falling. MACD slowline is above zero and falling. Not helpful for TNA.

Bollinger Bands for $RVX (VIX for $RUT): Today, $RVX climbed to the top Bollinger band and fell sharply. MACD both lines are rising. Good for TNA.

Bollinger Bands for $RUT: Today, $RUT had a long tail doji candle that closed below the 50day moving average. MACD appears to be falling. Good for TNA, assuming the long tail represents a reversal upward.

TNA had a higher high & lower low & higher close (good for TNA)

Money flow for the Total Stock Market:

$ 270 million flowing into the market 2 days ago.

$ 2,900 million flowing out of the market yesterday.

$ 21 million flowing out of the market today.

Neutral for TNA.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, Good for TNA for tomorrow.

I should have pointed this out intra-day to folks

Remember this de-lever tick from 5.10.2010 Pre-Market

http://www.flickr.com/photos/47091634@N04/45947…

Check the low on the SPY today (111.77)

Folks the script is already written, don't bet against the Sun not rising in the morning.

Not sure I follow you that one? Yes, we hit 111.77 as the low today, but on May 7th the market went did go below 111.80 and above it. So what does that mean for the rest of the week?

this de-lever tick was est. on 5.10.2010 so I'm not sure why you're thinking of 5.7

de-lever tick are from where the operators dump inventory, that's very critical that you understand that

After the 20 pt. afternoon ramp the VST operator is now net neutral

All the inventory the operator absorbed on friday & then the lower low today allowed the operator to lower his cost avg. knowing the terminal de-leverage pt. was 118.00 so from 15:24-15:57 guess what inventory the suckers were buying?

The date on the print says May 7th, 2010… I don't see May 10th anywhere on the screen?

I guess the “suckers” were buying the inventory that was bought by the operators when they tanked the market on Thursday, and trigger all the stops.

But, I'm still confused on what to expect over the next few days? Up, down, sideways? I'm still short, but getting mixed signals on the next few days.

attention to detail is imperative

5.7.2010 was the trading day before 5.10.2010 pre-market… LOL

Where it says pre-market last it shows 115.72

The operators dropped a clue @ the end of the day

Had it not been for the late day rally $SPX would have had 3 consecutive lower closes than opens

This will help give some more clues

1219.8 Local Min Value

-3.14% 1181.50

-6.28% 1143.20

-9.42% 1104.89

-12.56% 1066.59

(note the 5.6.2010 came @ 1065.79)

From last fridays close

1135.68 Local Min Value

-3.14% 1100.02

-6.28% 1064.36

-9.42% 1028.70

-12.56% 993.04

Sundancer – can you explain what you mean by terminal de-leverage point …

basically you are saying that they i.e. operators / MM bought spy lower on last friday and today and sold at the de-lever tick of 111.77 … ie. they dumped at 111.77 – sorry but i think I am confused …

The Daily view from Americanbulls

TNA was a likely sell for today, and was up 0.55% today. The likely sell is being carried over for tomorrow. The particular candlestick formation before today – Bearish Three Inside Down Formation – was considered highly reliable. The buy price was $55.69 & the close today was $56.93, up 2.2% since the buy.

There is more to it than this, but basically, If TNA falls below $56.93, it’s considered a sell. If it stays above $56.93, it’s not a sell.

TZA was a likely buy for today, and was down 0.5% today. The likely buy is being carried over for tomorrow. The particular candlestick formation before today – Bullish Three Inside Up Formation – was considered highly reliable.

There is more to it than this, but basically, If TZA rises above $6.10, it’s considered a BUY. If it stays below $6.10, it’s not a buy.

Of the stocks & ETFs I follow, these are to hold on to:

SCO (-2x Oil)

DTO (-3x oil)

ERY (-3x energy)

SPXU (-3x $SPX)

DXD (-2x DOW30)

DZZ (-2x Gold)

The list to avoid:

DRN(3x RE)

GLD (gold)

UGL (2x Gold)

SLV(silver)

USO(oil)

UCO(2x Oil)

ERX(3x energy)

GOOG

The following are possible (but unlikely) buys tomorrow:

IYR(1x RE)

URE(2x RE)

AAPL

AMZN

GS

EWG(Germany)

EWQ(France)

EWU(England)

EWX(emerging mkts)

The following are possible (and likely) buys tomorrow:

DRI

RWM (-1x $RUT)

TWM (-2x $RUT)

TZA (-3x $RUT)

SRS (-2x RE)

DRV (-3x RE)

The following are possible (but unlikely) sells tomorrow :

UUP(US Dollar)

FAZ (-3x Financials)

EPV (-2x Europe)

QID (-2x QQQQ)

The following are possible (and likely) sells tomorrow:

IWM (1x $RUT)

UWM (2x $RUT)

TNA (3x $RUT)

DIA

SPY

QQQQ

QLD (2x QQQQ)

Today was slightly less Bearish than yesterday.

Action for TNA or TZA for tomorrow: Possible buy of TZA, Possible sell of TNA

I took the afternoon off, figuring to come back to some very nice numbers, and was disturbed to find not only my morning gains wiped out, but a loss for the day!

Things don't look so bad, though. You can drive a truck through the MACD curves, VIX and put/call ratios are poised for a comeback. On my principal (well, only these days) short vehicle, SDS, volume was largely upside, i.e., downside for the market.

Hey, if we have a rally in the morning followed by a sharp decline, we could have a Hindenburg Omen. 30 new highs today vs. 99 last Thursday. We're in the ballpark.

Re: May expiration puts, the operators could be holding a lot of them by this time. They were very cheap around 1170.

I may change my tune if tomorrow is not a bearish reversal, but I plan to stick through the day at least.

well, A donation goes a long way on a small … muddy flood waters ebb from torrential

If they don't allow asking for gold payment in the heading line, just write in the description that you will accept payment in gold only. If enough people start doing this, well, you get the picture.