OK... so what's the plan for next week? Well, I was off on my Thursday forecast, as I expected a flat day on Friday and Monday. I guess you can't be right a 100% of time? The volume was 325 million on the spy. That means a down day of course... and what did we have? I huge down day! Fortunately, I wasn't in any position... short or long. So, no harm done I guess. I hope all of you weren't long either.

Anyway, I'm looking at 3 possible scenarios...

Note: All charts are from "The Chart Patten Trader". You can find the link to his site, and his charts on my blog list to the right of this website. Hopefully he doesn't mine me borrowing his chart. I just added my thoughts in purple, and the black text with yellow background around them.

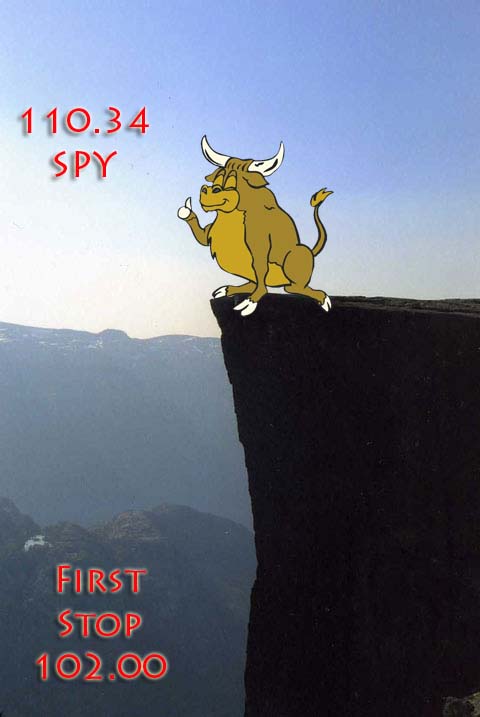

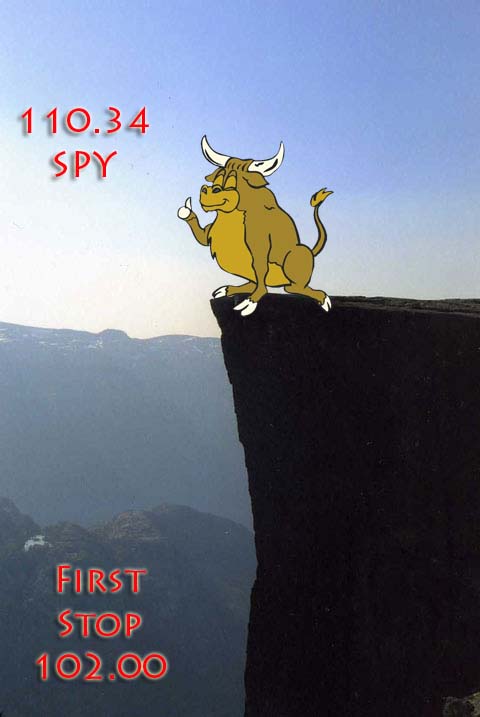

One. We continue on down to the 1020 spx support level and bounce back up from there. We could just bust on through 1020, as this will be a second major hit at that area. On the first hit of any support area there is about an 80% chance of a bounce. Each time it is hit the chance of a bounce lowers. I'm giving the 1020 area about a 70% chance of a bounce on this attempt.

If we bust on through then the next level of support is 998-1000. There is an 80% chance of a decent bounce there, and I will be looking to go long at that level. I'm just not sure if we bust through 1020, as it is also the lower trend line of what could be a "head and shoulders" formation forming, with the left side low at 1020 on the first of the October.

Now, if 1020 holds, then I'm still expecting 1073-1076 area to be about the highest possible retracement level on the way back up. There is a gap from 12th-13th at about 107.60 to 108.35 (spy). I believe we will get close to it, but not fill it. Much like the way the market would gap up in the past, and not fill the gaps on any correction down. I think we will now start a series of gap downs and not fill the gaps on the retracements back up. The reverse of what happened from the March lows to the current high of 1102 spx.

I remember how many times I waited for a gap fill to happen on any corrective move down in the past, only to be disappointed when the market stopped just shy of it, and started rallying back up. The markets likes to tease people... especially those that follow technical analysis. The old trick... bring in close, then snatch it away from them!

Everyone was looking for 1120 to be the top, and it fell just short of it at 1102. The same may happen on the way back up. Many will expect 1080 to be hit, and they will be waiting to go short at that level. All the more reason not to get back up to that point.

Now, on to Scenario Two...

This one has us rallying on Monday from the current level. Which, could also run up to the same level around 1073-1076 spx in a few days. Notice how that area would break the upper downward sloping channel line on the chart above. How many times have you seen a channel that gets broken out of... only to fall back in it again? It's another way the market likes to trick you into going long, and then reversing in the other direction.

Notice also that he has marked a 1,2, and 3 on each move down. If we mark 4 as the 104.35 to 106.86 move, and 5 as the 106.86 to 103.44, then we have a 5 wave move down. Is it complete? That's the real question. Certainly it could just continue down some more to the 1020 area, which I believe would be the end of wave 5. Or, it could be complete right here, and start a larger wave 2 back up... which wave 1 being the entire move from 110.31 down to 103.44.

I'm not an elliottwave expert, but I do know that the wave 2 back up should be higher then the top of the smaller wave 4 at 106.86. Since Monday's are usually light volume days, then a rally seems to have the best chance of happening on that day. Once started, short covering would come in a push the market back up on Tuesday. Many people will put their stops at the 104.35 low... which could be easily hit if Monday has light volume.

Then, the 106.86 would also have lots of stops there waiting to be taken out my the market makers. That could be enough to push us up again to just under the 1080 area. In the past, there would have been a whole lot of bears that shorted the market, and any short covering rally would have really pushed the market much higher. However, I believe that many bears missed this correction down. So, that means that there isn't a whole lot of them in the market to "short squeeze". Hence the reason that I don't really see us reaching the 1080 level... only close to it.

Withthat being said, I do believe that whatever level we retrace back up to, the bears are going to all pile on and drive this market down in a big wave 3 move. With this scenario, 1020 won't hold but maybe intraday, and the next level down at 998-1000 will be hit.

This means that Monday is a "wildcard" day, as it could complete a smaller 5 wave move down, or it could just continue the 5th wave until 1020 is hit. So, how do we play this move... that is the big question?

OK, if scenario one is what happens, then I will wait for 1020 to be hit, and then go long for the move up to at least 1060 again, but I'm expecting that 1073-1076 area. I'll just be very cautious at 1060, as it could dump again there? Any long position should only be deep in the money calls, or spreads, as time value and volility will kill your option value on the way up.

Next, if scenario two is in play, then I'll wait for 1073-1076 to be hit and then go short, looking for 1020 as the first support on the way down and then 998-1000. I will determine which as we get close to that time period. So, I play the "wait and see" game. By far, the safest bet is to wait until the retracement back up to just under 1080 is hit, and then go short expecting 998-1000. The next safest move is to wait until the 998-1000 level is hit and go long.

As I said early, I'm not an expert in elliottwave. I believe they have their place, but unfortunately they can't accurately predict the next move... only tell you possible moves. That's why I focus on major support levels, and volume in the market. Bounces occur at the support levels, which makes the EW ABC and 12345 wave counts. Anyway, let's move on to one more possible scenario.

Scenario Three. We concluded a larger wave one down at 104.35. It would have been an ABC move down. Next, we completed a larger wave 2 up at 106.86. And now we are in the first smaller wave inside the larger wave 3. This larger wave 3 should conclude at the 998-1000 support level. It could have 5 smaller waves inside it, which could mean a bounce up on Monday for wave 2 (or A), then down to 1020 for wave 3 (0r straight down to 998-1000 for wave C), back up to about 1040 for wave 4, and then down to 998-1000 for wave 5.

I don't really favor this scenario, as it doesn't give the 1020 much chance of a decent bounce. If scenario 3 happened, then we are in a larger wave 3, and the 1020 would be right in the middle of a smaller wave 3 (or C), inside a larger wave 3. Two waves 3's would bypass 1020 like it wasn't even there! I don't see that happening.

We've fell pretty far in the last week and we are due for more of a bounce then just the 105-106 area that scenario 3 presents us. I really think we will bounce back to just under 108. Now, the question is... from where? That's either at 998-1000 (80% chance of good bounce), 1020 (70% chance of good bounce), or from where we currently are now.

That means that we should be looking to go long a 998-1000 for the best chance of success, and long 1020 for a good chance of success. And, we should be going short just under the 1080 area for another great chance of success. Waiting for either of those levels to be hit is the hardest thing to do, as the market loves to fake you out. Patience is learned, not giving!

Red