Wednesday Update: Our FP on the DIA of 118.16 has been hit and is now fulfilled. Primary Wave 2 is likely done now. Welcome to Primary Wave 3!

(to watch on youtube: http://www.youtube.com/watch?v=aHrxp4rwpPQ)

>

_____________________________________________________________________________________

Monday Update... FP Hit, Now What?

(to watch on youtube: http://www.youtube.com/watch?v=srLE1UrVBag)

>

_____________________________________________________________________________________

So close, but no cigar! But are we playing horseshoes?

(to watch on youtube: http://www.youtube.com/watch?v=vrXnBX003VI)

Friday's close at 117.77 DIA was disappointing, as I really expected it to tag our upside target of 118.16 and then open on Tuesday with a nice gap down. While that's still possible, the odds are against it... from a historical point of view. All most all of the cases in the past, that had a long white solid candle pattern, had at least a quick break up above the close on the next day the market was open.

Which means that the odds are that the next candle will go above the current closing price at some point in the day. While we could still open down a little, it is likely that the market will rally back past the 117.77 level and go above it at least a little bit.

In almost all cases, this has happened. So, what we are now looking for is a quick gap up (to the 118.16 level hopefully) and then a sell off the rest of the day, putting in a long "topping tail" candle pattern. Will it happen like that? Who knows? Odd's are against it...

I did go short anyway, as we were so close that FP, that I didn't want to chance a gap down on Tuesday without being short. I know we didn't hit the target exactly, and I'll probably be kicking myself next week for not waiting for a better spot... but I'll survive.

Regardless of not catching the exact top, next week is a bull's worst nightmare... at least from a historical point of view. I'll refer you to Cobra's chart on that, as he does great work with prior data, and history.

Everything is now lining up perfectly for a very nice sell off in the market. From every Technical point of view, to historical data, put/call extreme ratio's, sentiment reading, and of course the FP on the DIA... it all spells "TANK", which should make every bull worried.

I've actually been pretty well disciplined the last several weeks, as I've set out all this sideway garbage (which would have killed any option's players like myself). While I still expect the DIA print to be hit, I just couldn't risk the the possibility that I've given it too much exposure, and the print not being hit this time... so I caved in and went short (kicking myself if we go higher on Tuesday).

Anyway, this hasn't been easy on the bears, in fact many bears have fallen prey to the evil bear hunter Elmer Bernanke, who used too hunt only rabbits, but move up to larger game after finally killing bugs bunny I assume.

But, some did survive... and I am one of them. While wounded, I'm still alive (and hungry), and I've learned enough to avoid being shot by the evil hunter. The hunter has now entered bear territory and I believe he's running out of bullets. Next week we bears will make a sneak attack on the hunter, and hopefully shove that shotgun of his up his you now what!

Looking at the news, Richie caught a very interesting article that may confirm my suspicions on Wikileaks. As I'll stated previously, I think that the gangsters either fully control Wikileaks, or are using them to release damaging data on a timeline that marks the top of the market.

While I still don't know whether Julian Assange is a hero (if so, he's also be a "patsy" for new laws to censor the internet), or a plant by TPTB? Either way, the release of the data seems likely to happen at the top of the market as I expected.

This article "could be" the "event" we've all been waiting for... to tank the market! You should always remember too be cautious of any and all news that is reposted heavily in the Main Stream Media (msm), as that area is still in control by TPTB (the powers that be).

Since Wikileaks has gotten a ton of news media coverage by the MSM, you should have your "Dangling Carrot" eyes open, as the MSM is there for one purpose... to distract you, mis-inform you, and mis-lead you. There is always a hidden agenda behind what they tell the sheep watching.

Remember, George Soro's his helping Julian Assange with legal fee's and funding Wikileaks. It's hard too stay clean (Wikileaks) when you are rolling around in the mud with the pigs (George Soro's). But for now, I'm going to give Assange the benefit of the doubt, and still say that he's a HERO (but not a bright one... if he doesn't know he's being used).

For us traders though, we just need to focus on the FP's and try to tie them together with the possible news events that could trigger the next sell off to happen. In this case, it's looking likely to be Wikileaks and not a "false flag" event (like a nuclear bomb... aka "the Simpson Video").

I'm much happier that it's just some economic event and not a physical one, as I don't want to see people die for the market to sell off like it needs too. Instead, I'd love to see the gangsters exposed and hopefully arrested, convicted, and publicly hung for crimes against humanity. (Wishful thinking here) Although it does say something in the bible about people losing their heads in the end time, I think? (could be wrong on that? Maybe that was a Nostradamus prediction?) Let's hope it's the banksters and not the sheep.

Anyway, we are now within 39 cents of hitting the FP on the DIA. I expect it to be hit next week (probably Tuesday), and for the top to finally be in. This should end the Primary wave 2 up from the March 6th, 2009 low of 666 on the SPX. What follows should the the nastiest move down in the history of the stock market... even surpassing the first Great Depression in 1929!

Once it finally bottoms in the coming years, I expect hyper-inflation to rocket this market up well beyond the current high, probably hitting 20-30,000 on the Dow... while Gold hits our FP of 3500! But, that's a few years away from now. Looking more short term, I'm expecting a nice move down next week... how far, I don't know?

There are a lot of people long in this months' coming expiration next Friday, which leads me to believe it will be at least the 1260 area, if not 1240. I can't see them paying off all those calls, as you know how they like to pen the market at a level that they pay out the least amount of people... both on the calls and the puts.

While I don't know the numbers of calls/puts, to determine the "maximum pain" level, I do expect it to be much lower then the current closing price on the spy. All I can say is that everything favors the bears next week. If we fail here, then it's clearly never going to go down! (Kidding there... you know it will correct at some point).

This will be tough on the bears though, as we all know how they like to fool us. They sell off just enough to get the bears licking there chops, thinking that it's going to crash... and BAM, squeeze time! So just be sure to exit your shorts when you get a nice profit, which should be at some good support level too. You can always re-enter later.

This could play out with a small correction down next week, and then back up into the Legatus Pilgrimage date... followed by a much larger move down. So be prepared for some wild swings, and don't get married to your shorts. Exit with a profit, and don't wait for "the big one", as you'll likely be whipped out before it happens.

I'll let everyone know when I exit as well. I'll be looking at the charts to tell me when the market is heavily oversold and due to rally. I expect that it will end the coming week down nicely, which will be a nice exit point before the coming weekend. You know how they like to trap bears on a "rare" Friday sell off, by squeezing them out the following Monday.

So, should we sell off most of next week, and into Friday too, I'll likely exit my shorts before the weekend. Nothing goes straight down, especially in the early stages of a correction. When we hit the Wave 3's of 3's of 3's... then yeah, it's going straight down! But until then, be on the cautious side and take profits when given.

Good luck bears....

Red

LINKS:

Bob Chapman Newsletter Jan 15,2011 – Slush Fund of top politicians found at Vatican Bank, Obama, Clinton, Roberts? Legatus split!

Swiss whistleblower Rudolf Elmer plans to hand over offshore banking secrets of the rich and famous to WikiLeaks

Lindsey Williams Returns: Get Ready for $5 a Gallon Gasoline! Alex Jones Tv (Sunday Edition) 1/2 (NEW INFORMATION)

http://www.youtube.com/watch?v=noegMFZVzw0&feature=player_embedded

Lindsey Williams Returns: Get Ready for $5 a Gallon Gasoline! - Alex Jones Tv (Sunday Edition) 2/2

http://www.youtube.com/watch?v=M3i6UP4ZGXg

NOTES:

107 million ounces of physical Silver (as of now... January, 2011)

720 million ounces contracts out on Silver (again, as of now... currently)

On 01/07/11, 4 different "super wealth" people withdrew 4 million ounces of Silver (1 million each person) from the Comex Silver Exchange

First 12 days of January the us mint sold 3,407,000 ounces of Silver! Record Sales! Sales increased 50%!

Quote: "It wouldn't surprise me one bit if Silver was $50.00 an ounce by February the 1st" (Lindsey Williams)

>>>>>

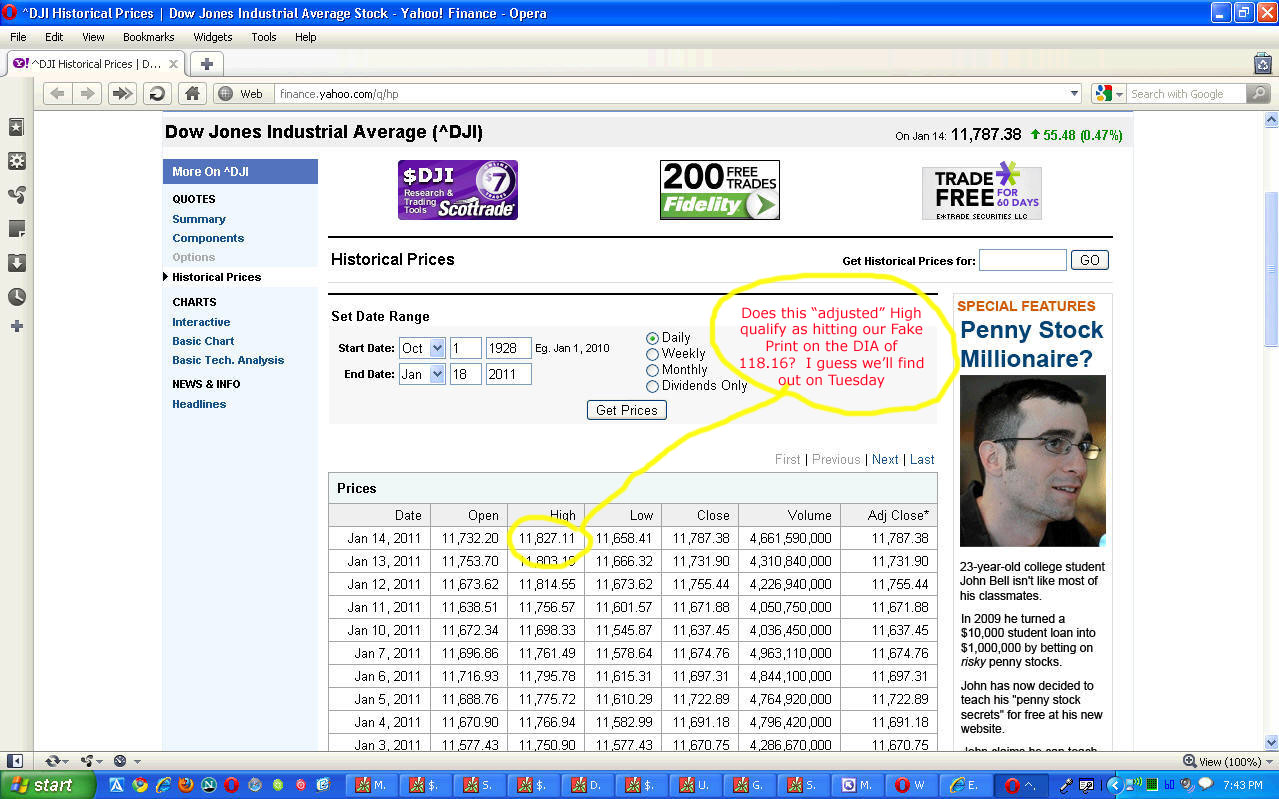

On another note, several people caught this print showing that the FP of DIA 118.16 could have been fulfilled?

_____________________________________________________________________________________

APPL taking a hit today – Bloomberg and reports down 7% in Germany – Jobs taking a health leave. Earnings tomorrow after bell. The link is from a blog that I follow – several useful links within.

http://www.facebook.com/permalink.php?story_fbid=103287796413296&id=100001962273891

Link not working for me! Am I the only one?

Probably because it is a facebook page… sorry

red,

other than steve jobs – it is eerily ‘quiet’ out there on this MLK day….i can hear a pin drop! i dunno – the hairs on the back of my neck are tingling…….

China’s Hu Jintao: Currency system is ‘product of past’:

http://www.bbc.co.uk/news/world-asia-pacific-12203391

good article…the way in which i ‘decode’ these types of articles is simple…..if the chinese leader boldly stating they are moving toward being the reserve currency far in the future – “MEANS” they have already completed what is necessary and the transfer is 6 months away…. ..5.1% controllable chinese inflation MEANS 20% runaway uncontrollable inflation… so expect to see the yuan the reserve currency in 6 months and the revaluation will reverse the tremendous inflation china has been expereinceing…

Dow Jones Industrial Average on 14 jan max was a 11 827,11. So that means we hit a 118,16 FP.

How do you mean? I don’t show that as a high (on cash)… was that AF futures??

Mate i did a link above its again http://finance.yahoo.com/q/hp?s=%5EDJI+Historical+Prices

That’s interesting…DJIA did hit 11818—I guess it’s time to short something—maybe IWM….the weakest link, imo.

http://finance.yahoo.com/q/hp?s=%5EDJI+Historical+Prices

why do my charts reflect the high at 11794.10 with the close at 11787.40 – that chart says close price adjusted for splits and dividends – interesting and I like that we hit the FP

thanks

its a link from yahoo.finance downloaded from a history sheet. Its like incorrect date lol some sort of fp:)) if you look at chart its not the same high as a numeral date.

I think that was another FP for sure and today we may hit the 118.16 for sure… then what???

I don’t know who trades KSS, but I’ve determined, I’d rather short it, than go long, next couple of waves.

http://zstock7.com/wp-content/uploads/2011/01/kss-1-17aa.jpg

My Man…

FAKE SPX Rally and FAKE Gold rally

http://www.safehaven.com/article/19670/gold-and-spx-both-faked-it

GlaxoSmithKline is going to take a dump tomorrow.

The q’s are down 1% in overnight trading, but the dow is down 6. Looks like the 7% drop in AAPL in overnight, is hurting the q’s

morning red,

bid/ask on the DIA is 118.03 right now…we will no doubt be hitting that FP today….

ES Chart before opening bell

http://niftychartsandpatterns.blogspot.com/2011/01/s-500-futures-before-opening-bell_18.html

Almost there !!!! Good luck mate!!

Dollar support line is being tested

http://niftychartsandpatterns.blogspot.com/2011/01/dollar-violating-its-support-line.html

RED …

we are almost there!!!!!!!!!!! AHHHHHHHHHHHHHHHH!!!! sweaty palms…DIA 118.07

its funny cause the indexes are negative right now…

DJIA is still positive. The question is: Are we going to make it that last .1 up on the DIA? Or is 118.07 all she has?

my gut says they try and run it…… this is kind of divergence we saw back in april where the DJI was the last of the indexes to drop as money flowed into ‘safety’.

How about this…. 118.07 = 118.16

the 1+6 = 7… Just a thought… I am no numerology expert

LOL …sounds good to me d…. :-))

Well you know about the number seven right?

all i know about 7 is that it comes after 6, and right before 8… but i am assuming symbolically there is more….. what would that be?

It is a bad, bad number… i.e. the seven seals in Revelations. Most things associate with seven are not good… but here we go 118.13…

yeesh…. who knew….. why 118.13…. i thought the fp was 118.16??

Actually I googled it and it also has significant good meaning

http://wiki.answers.com/Q/What_is_the_significance_of_the_number_seven_in_the_Bible

i just saw a 118.12 print…we are so close

108.11 now.

…108.13

overshoot… 118.20

Well 118.22 and still going up….. SYOP please!

I meant STOP – fat fingers

this is that last burst overthrow as people crowd into a safety trade…. lets see what happens

isnt this just sick! The dow.

Red, here is the summary of my info collection from various Gann traders …Most have Jan 19th as a turnaround date (always give few days around the date)… few are saying, this year will be “V” likely with year bottom, late May, June to early July….bounce into Sep, maybe somewhat down into end of the year (but higher than mid year lows)…Some can’t believe they are saying we can see March 2009 lows this year, but that what they are seeing…So I think, given 5 waves down, we should see the worse by the end of March, early April…I’m long April –June puts, will add as move is confirmed…so Dow 8300 by end of March, early April…IMHO…thank for sharing you FPs, if we turnaround today or tomorrow, I’ll be a full convert…LOL

Gann trader are not perma bull or bears, but at this time, there isn’t a single bull, all are very bearish…

19th is a full moon!!!

How about those gangsters? They keep the S&P under 1300 to not allow the bears a good point to short, but yet take it screaming past the 118.16 DIA. Gotta give it to them, they do a good job stealing! Let’s see if we reverse from here. (I sure hope so, cause if not my wife will kill me! LOL!)

This just out… we knew about it but here is an update

http://visiontoamerica.org/story/wikileaks-to-release-secret-swiss-bank-account-info.html

APPLE Below 50 hour moving average

http://niftychartsandpatterns.blogspot.com/2011/01/apple-gaps-down-below-50-hour-moving.html

Massive dollar manipulation today, as though Europe’s problems just went away. Just an attempt at a shakeout. They went slightly lower than the low prints also.

That’s all she wrote folks!! we can now focus on the two downside FP’s RED has – 8300, and a 345 FP VIX, a $13 GS FP, and a ………

I hope so. this rotation crap is irritating.

remember the FP indicates a script,,, the whole markets are scripted.. there is nothing random about them….. see it for what it is. We overshot the FP to 118.34 on momentum, and already we have backed off…..

Fuck I hate this why can’t we just fall off a cliff already.

i think clifff diving on the full moon is most fun! tommorrow is a full moon – who knows…. today will be a good looking topping candle

I was thinking a topping candle too, we’ll see.

thx for reminding me of the full moon tomorrow. given that we’ve not had any sort of pullback for 2 full moons, it’s likely today will close out at it’s highs, and that’ll be the top for this cycle. I’d actually like to see a big day today as it would almost solidify my theory.

Red, I was thinking about your thoughts on the market crash and then later Hyperinflation possibly in a couple years. While that is one path, I’m trying to keep open to others. I really think your FP’s on gold will tell the path.

From where we are at today, if we go down and hit the 935 FP on gold first, then yes, it sets up a scenerio for hyperinflation.

However, I can see a scenerio where we get a market crash, political turmoil, and possibly war creates a rush to safety of gold/silver (thus pushing it up to 3500/84) – in particular with a VIX print of 349.

After all that settles down, no consumers will have money left and we continue with the deleveraging that should be happening now. To our final low of ??? SPY 20 something (or is there a FP in the 10’s now?) and gold of 935.

http://www.youtube.com/watch?v=eKd37fiZ6po&feature=mfu_in_order&list=UL

great EW video…P[3] starts about now!

Sorry gang, I had to run some errands this morning. Looks like we hit our FP and went past it a hair. Now we wait, and see if she pulls back off.

The 60 minute chart is rolling over now, so we could put in a nice topping candle on the daily if we go negative the rest of the day. Patience is the key now, as everyone else is still expecting 1300 and 12,000… which again, I think won’t happen.

But I’ve been wrong before, so use your “mental” stop wisely.

Where did you place your SPY stop? Just curious..

Sorry gang, I had to run some errands this morning. Looks like we hit our FP and went past it a hair. Now we wait, and see if she pulls back off.

The 60 minute chart is rolling over now, so we could put in a nice topping candle on the daily if we go negative the rest of the day. Patience is the key now, as everyone else is still expecting 1300 and 12,000… which again, I think won’t happen.

But I’ve been wrong before, so use your “mental” stop wisely.

IF there is a ‘script’ and if there are ‘ganstas’…..then would GS not be with them ? I mean, they are the bag holder for all the FED intervening activity in March 09…..they are the ones who were ‘saved’. We msut agree The FED must show a pretty good profit on all its intervention, at least publically. Therefore, they cannot sell assets (which they hold in a big way) at depressed prices….conseuqently evevated prices can and should be sustained in their minds eye.

I do not agree. Increasing debt from 9.5 trillion to ov13 trillion and GDP increase only 180 billion which almost nothing does not sound like a successful investment.

Possible late sell off?

POMO should be about done but its a small one today 1-2billion

AAPL and IBM AH earnings.

My bet is they both beat. There just does not seem to be anything to help us bears.

jim,

do you question ‘WHY’ apple came out with JOBS new YESTERDAY, rather than announcing it during the conference call. What they have set up is a scenario whereby the entire questioning on the call will be about steve…. maybe it was a tatical distraction. maybe some margin compression will show up in there numbers after the bell which is the reason behind the early announcement. The street wants BLOW out numbers,,,maybe they only are at blow right now….? who knows….we will find out soon.. just something to think about…

Interesting point on Jobs. I was curious why they did not wait until after earnings. But the distraction may have been set up as you suggest.

I am shocked that the sp has been able to sustain past 1293 fib fan

From the looks of today, it appears that the DOW will close up a little and the current “low of the day” will be 11,777.99… which matches up nicely with the 117.77 DIA high last Friday. I think the “Unstoppable” train has arrived.

Last chance to board the train to hell… all aboard!

red,

i agree…. but i am going to ride my bike instead…. i never DID like trains anyhow…….

And Dow broke above upper BB

Did you say train? (7’s & 11’s)

http://en.wikipedia.org/wiki/11_July_2006_Mumbai_train_bombings

RED,

IDIA close – 118.28 let me see (11+8 = 19) and (2+8 = 10, or rather 1) does this point to 1/19 tipping point reversal???

IBM beat on all counts.

AAPL blows out. No recession there.

hey, makes sence. everyone else but myself went out and bought their crap. This is so strange because most people I know are hurting or are broke. Yet, these big companies who produce junk keep “surging”. Oh well. Holiday volume.

No holiday volume at TGT or KSS—safer to short those, than go long.

Hello Z, you got that right. But sco looks ripe to me. Good posts. dont forget to hit some ads.

Not paying a mortgage, increases discretionary income…I read blog post once, someone’s daughter working at Apple store (outside of Manhattan) said people sometimes use 3 credit cards to complete a purchase…and not a rarity…

People in US will blow, every last bit of credit on I-crap…I’m not surprised…it’s not like banks will ever get paid anyway…look at their earnings, a la C this morning…

Red, that turnaround better come tomorrow, or my faith in Gann traders and your FP will be gone forever…that along with any other TA, that didn’t work last year…LOL

you’ll get it, within 48 hours.

Look at the NASDAQ BB breaks.

http://stockcharts.com/h-sc/ui?s=$COMPQ&p=D&yr=0&mn=2&dy=0&id=p70433372832&a=221452831

there’s no chance the q’s can get to 60, before a pullback.

Unless the dow sells off on its 100+ point open tomorrow, I’d say that print was revised…

I think I’m in way too early on MRK. adding puts tomorrow as a hedge.

When I miss, it’s usually by 8%—

http://zstock7.com/wp-content/uploads/2011/01/mrk-1-18aa.jpg

I’m finally going to have some decent short sell signals on the 15 minute charts—within the next couple of days—The overnight’s have been useless for about a month now.

I’m short gasoline—never going to $5, WMT would call the president! Then the president would order shoot to kill orders at the gasoline pits. and then the gasoline pits in response, would bring the price back down.

That’s my conspiracy theory, about that!

and if that didn’t work, then WMT would call the Chinese national security agency, and you’d just see gasoline pit traders, disappear on their way to work.

Wow, earnings blew away estimates by a longshot. Could see a major gap and go go tomorrow. All bears should be extinct by tomorrow. Looking for a pullback starting Thurs. Don’t fight the Fed……….

Are you talking about AAPL? Usually rallys into earnings and sells off after – right now it is below where it traded on Friday… we will see where it goes now.

There is always the possibility of a sell the news. With massive Pomo and other factors I seriously doubt it. Bears probably are gonna get crushed……

there are no “other factors”, just pomo. thanks though.

UNP reports thurs pre-market—that can kill-off a lot of sectors–it has octopus tentacles that reach into almost every sector.

Just visited http://www.apmex.com/ and they are giving away a 1 ounce Gold American Eagle every month. I think all you need to do is register.

http://i7.photobucket.com/albums/y258/redripple2/WINAGOLDAMERICANEAGLE.jpg

We hit a significant (multi year) DOW TL today. it held, for now.

no telling if POMO will break it. A reverse on the 19th would fit ‘perfect’.

http://www.uploadgeek.com/share-67EB_4D358D71.html

-GG

need explaining please! I don’t get it!

I miscounted tds from August 25low to Nov 4 high. It was 49 days like I always thought but somehow it counted out differently numerous times last week. Today would then be 49tds from Nov 4 high. Thus 1(85)tds from April 26 high. 138tds (69×2) from July 1 low. So we have a sequence of 134tds from July 8,2009low to Jan 2010high. Then a high high 136tds period from April 26to Nov 4 highs and now 138tds from July low…..

SP has also now achieved a 69%retrace of the 2007-2008 decline. 1987 B wave rally off Sept lows to early October achieved a 69% retrace….

And the Jets juggernaut (along with the Bears, the “enlightened ones” favorite team) reprising its role from the 1969 superbowl (3 or III) by upsetting another Goliath, the Patriots (who weren’t as good as their record though….Jets really have more talent except at quarterback)…..

Golden Globes awarded all of the “enlightened ones” favorites. Social Network swept most of the awards and Natalie Portman got the best actress award for being “The Black Swan”.

I don’t want to bet long on the USD , but I will bet against the other guys, hehe

Short Cable Short Yen

http://oahutrading.blogspot.com/2011/01/short-cable-short-yen.html