Wednesday Update...

(to watch on youtube: http://www.youtube.com/watch?v=JT9MaJ3fn9c)

Red

It's not "if" the Euro will default, it's "when"?

Over the coming weeks the world is getting closer to "The Big ONE"... as in, the next big stock market crash! When is the hardest question to answer of course, but we know it's coming... and probably this month. This week old article (http://www.dailymail.co.uk/news/article-2041201/George-Osbornes-eurozone-crisis-warning-6-weeks-save-euro.html#ixzz1Ysp8pT2F) gives us a time frame to work with, and now we only have 5 weeks left.

Five Banks Account For 96% Of The $250 Trillion In Outstanding US Derivative Exposure; Is Morgan Stanley Sitting On An FX Derivative Time Bomb? (http://www.zerohedge.com/news/five-banks-account-96-250-trillion-outstanding-derivative-exposure-morgan-stanley-sitting-fx-de)

However, nothing is ever as simple as it looks. We all know that the market reacts to news in advance and sells off first (or rallies first) before the actually news is released. Hence the old phrase "Sell the Rumor, Buy the News"... and if the news is expected to be good, then it's "Buy the Rumor, Sell the News". So, since everyone is expecting more countries to default, causing the Euro to collapse, I'd say we have a valid reason to "Sell the Rumor"!

But, are we going to "Buy the News"?

From a technical analysis point of view the charts still remain mixed on whether or not we have completed the 5th wave down, inside major wave 1 down? On the NYA chart you can see a 5th wave down that was clearly lower then the August 9th low. But the SPX didn't make a lower low yet, but instead just put in a slightly higher low (almost a double bottom). So, does that mean we still have a 5th wave down yet to come?

From a technical analysis point of view the charts still remain mixed on whether or not we have completed the 5th wave down, inside major wave 1 down? On the NYA chart you can see a 5th wave down that was clearly lower then the August 9th low. But the SPX didn't make a lower low yet, but instead just put in a slightly higher low (almost a double bottom). So, does that mean we still have a 5th wave down yet to come?

This question is impossible to answer, but very important in trying to figure out what's coming over the next few weeks. If we completed that 5th wave down on September 22nd at 1114 spx, then we are now in a major wave 2 up that should take us up for several months now. But, I really find that hard too believe as we don't appear to have bottomed in my view. So, that has us still waiting for that 5th wave down to complete this first major wave 1 down.

If we continue to sell off for the next 3-5 weeks (waiting on some good news preventing the Euro's death), then we should complete the 5th wave down inside this larger major wave one down from the May 2nd high. This would again imply that the market would rally for several months carving out that major wave 2 up... probably into January of next year. But again, I find that hard too believe as well.

How can we rally though the rest of the year with the Mayan Calendar ending on October 28th?

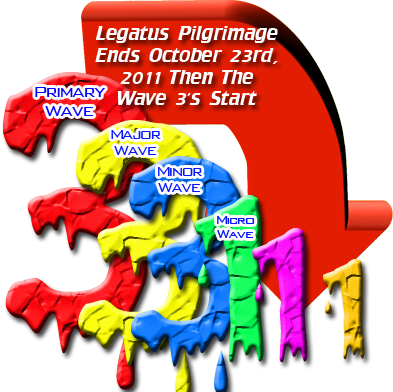

Plus, we have the once in a hundred years date of 11-11-11 coming up, and you know that the gangsters are going to stage something bad on that ritual date. You also have the good guys taking about a "financial shutdown and reboot" on 11-11-11... which is a "tentative" date according to Ben Fulford, but still of importance to mention. Any way you look at it... It just doesn't make sense to rally after the Legatus Pilgrimage ends on October 23rd, and continue up for several months into next year.

Plus, we have the once in a hundred years date of 11-11-11 coming up, and you know that the gangsters are going to stage something bad on that ritual date. You also have the good guys taking about a "financial shutdown and reboot" on 11-11-11... which is a "tentative" date according to Ben Fulford, but still of importance to mention. Any way you look at it... It just doesn't make sense to rally after the Legatus Pilgrimage ends on October 23rd, and continue up for several months into next year.

So, what if all the Elliottwave chartists have got it all wrong? What if the 5th wave down (inside the first major wave 1 down) ended on August 22nd with a double bottom on the SPX, and since then we have been carving out a major wave 2 up? It would meet the requirements for it lasting several months like major wave 1 down did, and allow for major wave 3 down to start this coming Legatus turn date. Remember, wave 5's can be "truncated" waves... ending short with a double bottom or double top. This theory would change the entire picture and support my thoughts of a "HUGE" crash starting on October 24th!

While most people will be looking for a 5th wave down to complete this first major wave 1 down, they could actually be seeing part of major wave 3 down starting...

If this theory is right, then we completed major wave 1 down on August 22nd with a truncated 5th wave ending at 1121 spx. Then we started the "A" wave up in major wave 2 that ended on August 30th at 1230, followed by "B" down to 1136 on September 12th, and finally "C" up to 1220 ending the entire "ABC" move up that completes major wave 2 up. That then implies that we have started major wave 3 down from that 1220 high and appear to be in the first sub wave of that major wave 3 down.

Counting this is of course subjective, as all elliottwave counts are. They are easy to figure out after the move is over, but predicting them in advance is really just a guessing game. I favor this count because of all the evidence I've presented about all the important dates coming up the next few months. With all those ritual dates, (and the monthly chart just now dropping below the zero line on the MACD's), I just can't wrap my head around this coming move down completing a final 5th wave down inside the first major wave 1 down, and then allowing a multi-month rally to start late this month and into early next year.

While all this negative news about more defaults in Euro land seems like it could be a "sell the rumor" event, I just don't see the market "buying the news" when the actual defaults are announced and the Euro really collapses! I can't forget how many times Lindsey Williams stated that we have less then 2 weeks to get out of all paper when the Euro collapses... which doesn't sound like a "Sell the Rumor, Buy the News" event too me!

I think we are looking at a "Sell the Rumor, Crash the News" type event!

If I'm right on my subjective elliottwave count, then we could end this first minor wave 1 down this week (inside major wave 3 down), rally back up for a couple of weeks, to put in a lower high for minor wave 2... which should end by option expiration on Friday, October 21st (and that weekend of course ends the Legatus Pilgrimage on Sunday the 23rd), and finally start...

"Minor Wave 3 Down, inside Major Wave 3 Down, inside Primary Wave 3 Down"!

Holy Smoke's Batman, I think you've got something there! This is all just my gut feelings, along with the ritual dates, crazy news of a financial reboot, timing of Elenin, end of the Mayan calendar, Legatus Pilgrimage date, and of course the monthly chart looking like it's ready to puke! I'm sure there are other reasons I've missed, but I think you get my point... "I can't see a rally starting in late October into early next year for major wave 2 up"!

If my theory is correct, then there will be a lot of bulls that get smoked on buying this next leg down that takes out the 1101 spx low. They will all think it's the final 5th wave down, ending the first major wave 1 down, and will be looking for that multi-month rally up for major wave 2.... only to discover later that it was likely just minor wave 2 up inside major wave 3 down! Uh oh... that means a lot of bulls are going to panic when minor wave 3 down, inside major wave 3 down, inside primary wave 3 down starts! (And if I'm right, that will be the week of the Legatus Pilgrimage).

The last several months I've been trying to figure out where the market will be when the Legatus meeting is over, and it's now looking like it could be at the starting point of at least a combination of 3 big "Wave 3's"! Now I don't know what the actually price level will be at on this coming opx, but it's doesn't look like that FP of 127.07 SPY is going to be hit anytime soon, and probably not even this year! (Of course if my theory of this alternate EW count is wrong, and we rally up for the next 3 weeks and hit that 127.07 print by opx, then I'll be an even happier Bear and short this pig with all my fingers and toes!).

Anyway it looks, I still see the next largest move down to start that week of October 23rd...

(to watch on youtube: http://www.youtube.com/watch?v=emFpu8OC6qo)

I have to say that I just seen that possible count in the charts today while writing this post, and I don't know if that meets EW guidelines and rules or not... but then again, when do the gangsters every play by the rules? I only know that they will do everything in there power to trick the most amount of bulls and bears before the next plunge starts.

When we look at astrology and moon cycles, we see that the next Full Moon is October 12th, followed by a New Moon on October 26th. Usually, the Full Moon produces bottoms on that date (+/- 2-3 days) and the New Moon produces tops it's date. Since the 12th is on a Wednesday, we could expect the bottom to be as early as that Monday the 10th, or as late as that Friday the 14th, (if you add 2 days before and after to expand the window to match the plus or minus 2-3 days criteria).

My best guess would be that it would end 2 days prior on Monday the 10th, which would allow for a 2 week rally into option expiration on Friday the 21st to squeeze out the bears and get plenty of new bulls onboard expecting this rally to be the first sub-wave inside major wave 2 up. They will expect this to last all of the rest of the year, with only minor pullbacks to create "B" waves down inside the expected "ABC" up (or possibly a 5 wave push up, with waves 2 and 4 down inside that major wave 2 up).

Thinking outside the "retail sheep's mind" here, and thinking like a wolf... I'd rally the market up hard into that Legatus Pilgrimage date, and option expiration Friday, leaving almost NO dips for the trapped bears to get out, or the retail bulls to get long at. Then starting on Monday the 24th, I'd turn it back down for what the retail bulls would think would be the first buying opportunity before another larger wave up into the holiday season of November and December. Most everyone will be expecting a Santa rally, and believe the worst is behind us.

After all, we should have put in a lower low then the 1101 spx low, completing that final 5th wave down that everyone was looking for... right? Oh, but there lies the trap that few will see... "it wasn't the final 5th wave down they saw, but the first minor wave 1 down inside major wave 3 down". While they will be expecting some type of "B" wave down (or wave 2 down) to be happening that week of October 23rd, instead they will be in minor wave 3 down, inside major wave 3 down, inside primary wave 3 down... taking everyone by surprise!

Talk about a Panic, just wait until those "Wave 3's" start!

Moving on to the short term, I see a new FP of 116.05 SPY afterhours Friday. This is probably the upside target for Monday or Tuesday of next week. While I do expect the market to gap down on Monday and put in a lower low then Friday, I also think it will turn back up shortly afterwards and rally up to work off the oversold conditions on the short term charts and make them get overbought. Possibly that new FP is the upside target before they get overbought and turn back down?

As for the 127.07 print, I don't see that happening if we are in the EW count I'm speculating about, as that would throw that count out the window if that print is hit by opx (not that I care, as I'd still short it). Back to Monday though, I do expect a positive close after an early morning push down. As for Tuesday through Friday, I'm unsure right now? We'll have to cross that road when we get there. I'll just say that I expect the selling to end possibly by the end of this week or early next week, being close to the Full Moon date of the 12th. We should put in a lower low then the 1101 spx low in order to fool the bears and bulls into thinking that we have put in that final 5th wave down and should now start major wave 2 up.

Ok, assuming we have started major wave 3 down from the 1220 high on August 20th, then first micro wave 1 down completed at 1114, and then micro wave 2 up to 1195, which puts us in the first smaller sub-wave of micro wave 3 down right now. If we go back up to hit the FP of 116.05 spy (about 1160 spx) by the close Monday or Tuesday, then we would have completed the 2nd smaller sub-wave up of micro wave 3 down (This is all inside minor wave 1 down)

This would leave Tuesday/Wednesday to start smaller sub-wave 3 down, inside micro wave 3 down, inside minor wave 1 down, inside major wave 3 down, inside primary wave 3 down. Getting confused yet? I know I am... LOL! Alright, if that actually plays out like that, then we should bounce back up Thursday/Friday for micro wave 4, and then roll back down Friday/Monday (the 12th) to finish micro wave 5 inside minor wave 1 down.

This would allow minor wave 2 up, inside major wave 3 down to rally into option expiration on Friday the 21st, and possibly Monday the 24th. When done, it should align up with the start of minor wave 3 down, inside major wave 3 down, inside primary wave 3 down. This count, if correct?, should fool all, the EW chartists out there, and the technical analysis people too! It would certainly fool me, and has been fooling me until today when I discovered this alternate EW count.

Predicting the low for this move down before the 2 week run up into opx is hard too do... but a possible low is one just below the 1077 ES afterhours print we got from several weeks back. Often times, the market will retest these afterhours and premarket prints at a later date. This would make the SPX put in a lower low then the 1101 low on August 9th, and fulfill everyone's expectations that the final 5th wave down inside major wave 1 down is now complete.

Ok, I think I've about covered everything I can think of for my predictions over the coming days and weeks, so I'll close for now and simply wish everyone good luck as usual.

Red

“can I get a wawa”, can you guess what the actual song is, as I changed the text of the rap song

I’m clueless? “can I get a hinta”?

there was a rap song, ‘can I get a what what’, rap song about 5-7 years ago. I made it into ‘can i get a wawa’

Well, maybe I’m reaching for straws here, but I just don’t think the selling will end here in the next week or so, and then start a multi-month rally. Everything tells me we are going to fool everyone with a crash even bigger then the previous move down we just had. I wouldn’t be surprised to see that Dow 8300 FP hit before the end of the year… anything is possible.

http://www.youtube.com/watch?v=mYrVev2cKRI

Possibly a fake out to the upside tomorrow morning , than down into the close. Should be very interesting day.

They should gap it below previous support at 1101, the reverse modus operandi for the previous two years.

My head is spinning from all of the numerology flashed into today’s NFL games. It must be getting close. Everywhere I turned there were 87s 29s 29 7s 58s 777s 21 718s 88s 24s. The topper was during the Patriot- Raiders game when Raiders K#11 nailed a field goal with 9:22 left on the scoreboard. His holder #9 so a nice little 9-11 combo but one should check out what the score was on the scoreboard at the time of the field goal. Then later players #85 and#18 were shown standing behind the Belicheat when Brady and the backup QB Hoyer approached and consulted with him. Brady#12 but Hoyer’s number couldn’t be seen so I am thinking that they should pan out until Hoyer’s number could be seen. The broadcast promptly complied and pulled the camera back to reveal Hoyer’s #8 or 8-12, a key date for the insiders as well as #29 in reverse. A Rooster Cogburn date as well. So so much more.

I am going to be traveling today, so I won’t be around. Tant pis. Honestly I just wish I had stayed short from the very top and could watch all this develop with a smile. Arthur my assistant isn’t giving his opinion yet.

Geccko23, maybe you should just go all in short, might make you feel a little better. You guys know that the majority of us will probably be looking on the outside when the fall happens. Just the way the game plays.

And by the way, there is massive leverage in silver and while my partner has not been consulted yet, Sir Arthur, I see a pretty obvious a b c in it and think a big move can be coming. A very small amount of money can turn into seven zeros with this baby. As long as you don’t get whipped. LOL.

But seriously, a few thousand could lead to a retirement to a small country with a good move.

In what direction are you expecting it to go to? I see the weekly and monthly charts still pointing down, while the daily is oversold and looks to be pointing up. The 60 minute chart is about near the zero level from being severely oversold and could turn back down, but looks more like it wants to go up.

There is also a triangle pattern that formed and with the current opening price of silver today, it has now broken out of that triangle to the upside. The current situation with silver looks bullish too me right now, as the 27.50 low to the 32.00 high appears to be an “A” wave up, with “B” down to the 29.00 level and now we could be starting “C” up?

Good morning gang…

There is a 112.01 FP on the SPY at 8:00 am this morning, and the 116.05 print from Friday. Those are your upside and downside targets I believe.

The ES worked off a lot of the oversold conditions on the 60 minute and 2 hour charts. The SPX is also ready to go back up. So, if I was a guessing man, I’d say we go down to the 112.01 print first and then up to the 116.05 print by tomorrow or Wednesday at the latest. We also have an overnight low of 1111.25 on the ES, which is probably about the same level as the 112.01 SPY print.

Went long here for a short term trade.

Got lucky and bought at the 1122 sp level. 10 seconds later it shot up.

Thanks Red for the FP

We hit 112.08 spy… close enough to the 112.01 FP I believe. The low for the day could be in? Remember, the FP’s don’t have to be hit to the penny. We had a 112.08 low so far. I think that’s close enough. Now we could be on our way up to the 116.05 FP from Friday?

I do not know how high the sp will get to, but I do not like the feel of the market at the end of the day.

What are your thoughts about my alternate EW count? It’s not a perfect fit, but the other counts that every other blogger has, are just to obvious too me. I just don’t think we will rally in late October and November.

I am more in line with your count. I still see possibly new lower lows before heading up into the Oct 23 time period

As long as we stop around that 1077 ES level from several weeks back then we should be able to rally into that Oct 23rd period. If we crash down to sub-1,000 then that is probably off the table.

I think we are going to do an “ABC” move up today, with the start of A up at the current low of 1121 spx, and the predicted end around the resistance area of 1140-1142 spx. Then a B wave down to an “unknown” level, followed by a C wave up to about 1160 spx (about where the 116.05 spy is)

nice post

Thanks Anna,

Wow! What crazy wild swings up and down! Hard for anyone to stay short or long in this environment, as the moves will shake out the best traders.

Sold out earlier, hoping for another double bottom here to go long.

The market is ready to move up now, and should rally shortly. It’s coiling now… all the short term charts are pointing up together.

Looks like hit the 112.01 print and pierced it now… will it reverse here or continue down?

Looks like the ES has now hit it’s premarket low (1111.25) now too…

Thanks Red for your insight and hard work on this site. I balance your site with several others that I read and always stop by RDL for the Sunday News.

Did not buy long, waiting for the lower lows as mentioned earlier.

From the looks of things right now, we could hit the “lower low” (guessing it should be around 1077 ES) today and then turn back up tomorrow and rally toward that 116.05 spy print.

Your 116.05 feels like a good possibility. I do not see a massive crash here.

If the sp 500 goes down thru the 1104 I will be on board

indeed 1020 is up next black KATZ archaic indicator 19 39 ema leads me along with 200 day

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=3&mn=0&dy=0&id=p16222234152

Thanks Chic for your guidance

Just emailed to me…

http://reddragonleo.com/wp-content/uploads/hong-kong-FP-oct-31.png

dont u have one for 16k also

I have to say the 3 wave idea seems to me the most likely scenario. This would be a far more significant and elegant way to demonstrate their control and align themselves with the most power. Well done Red.

Hi Peter,

Glad to see you stop by and post on the blog. Love reading your emails by the way… 🙂

I have to say that Red presents a very compelling view, as always, but my investing for the next few months is based on Minor Wave 5 and Intermediate Wave (1) bottoming out in the next week or so, followed by a long a-b-c up to Intermediate Wave (2) – probably into the 1250 range.

How long (2) will take I don’t know – it could finish this year or go into January. Then I can’t wait for the real fun to begin!

Either way, I have had a great ride with the VXX and will probably exit out very soon.

I hope not Jed, as I had bull markets. I really don’t want to wait 2-3 months for wave 2 up to finish before going short heavily again. We need it to crash this October and November to fool everyone. Tell Santa to take a vacation this year as we don’t need his rally this time. LOL

MAY BE CAPITULATION 2DAY. WILL CASH IN SOME SHORTS IN THE MORN. THEN BUY SOME LONG PROLLY THIS WEEK. NEVER TOO EARLY TO TAKE A BIG PROFIT

We should be getting close to a short term bottom Chic. Today could be that day? Looking at the charts right now I do see the possibility that we could start to turn back up as early as tomorrow.

We hit (and pierced) the 1077 ES level that was hit several weeks back in the afterhours session. This, and the charts, indicate that we are getting close to bottom. Maybe 1050? Hard to pick the bottom exactly, but we are close…

I bought a stock last friday tha actually went up over 100% yesterday, amazing considering the day. NPWZ, its just a penny stock but it actually might go up 2,000% IF Red’s scenario isn’t correct.

Gotta say I was tempted to go long yesterday and Arthur stopped me cold in my tracks and said lower. I will consult him today to see if this is Reds scenario or just the end of wave one.

Red’s scenario is what I was thinking as well, so as to leave ALL behind, both bull and bear, but as we know, I don’t do anything without Arthur. lol.

And Red, Arthur is going to be visiting you real soon.

Very cool… love to meet Arthur.

As for you penny stocks, I’d try again after we bottom in the market and have a multi-month rally.

Microsoft Weekly triangle: http://niftychartsandpatterns.blogspot.com/2011/10/microsoft-triangle-pattern.html

Good Morning gang…

Well, we finally hit the 1077 ES afterhours low from weeks back. Whether this is the temporary low or not is unknown, but in order for my alternate EW count to play out we need to bottom some time this week. This would allow a 2 week rally into the Legatus meeting. Of course if we go below 965 spx this week, then the alternate EW count is totally wrong and we will likely rally for several months then.

Google Testing weekly support line: http://niftychartsandpatterns.blogspot.com/2011/10/google-testing-weekly-support-line.html

Looks like we are going up for wave 4 now, and could last for 1-2 days. I spotted a 110.00 spy FP at 8:00 am this morning. If this is an ABC move up for this wave 4, then that level could be the A wave high? We should then go down for B wave today, and back up for C wave tomorrow. Then that 116.05 FP could be the high for the C wave, ending the 4th wave up.

Just narrowly missed a trade on TZA.

“The Whole World is Watching” Marines Heading To Wall Street To Protect Protester, as JP Morgan Gangsters make a $4.6 Million Dollar Bribe (err… donation) to the NYPD!

http://mycatbirdseat.com/2011/10/semper-fi-marines-heading-to-wall-street-to-protect-protesters/

Is there an ETF short for the hong kong? And what is the timeline on that one redski?

I wish had a crystal ball to answer that one, but I don’t. I’ll only say that it’s a “New FP” that was emailed to me yesterday. The time frame is unknown, but I’m sure we’ll be heading that way over coming rest of the month and next month.

BEHEAD the Bastards I say!… all of Wallstreet needs to go down!

I’m specifically talking about Goldman, JP Morgan, Citi, BOA, and the thugs that own them… like Soro’s, Buffet, Rockefeller, Bush, Cheney, Kissinger, Clinton, etc…

The ETF question I can answer myself now,its FXP. The one and only. Fairly liquid. Trades about a million a day. Certainly enough.

How do I get the index symbol for hong kong.

In that FP you’ll see it shows $HSI up in the left hand corner, but I can’t get that to pull up in Ameritrade, so I don’t know how to chart it… unless I use the stockcharts.com site that was used to capture the FP with.

That is the best I have found myself. Didn’t the time frame, show end of October?

The screen shot doesn’t show anything more then that the print was taken on October the 3rd. There isn’t any time frame that I can figure out? Only the insiders would know the date that it would be hit… and unfortunately, I’m not one them.

One the other hand, I still think we will soon start a rally into the October 23rd time frame, then top out, and proceed to crash the following week. Maybe that print will be hit on December 7th when the Illuminati.org countdown ends and the date of my Wilshire FP?

By the way Red. You may want to test trial a fellow that I used when he was free. Regrettably, I abandoned him when he suddenly went commerical. But he taught me one thing in particular that was really, really good. The one two, one two in Elliott Wave.

In other words this wave three that daneric and everyone else is anticipating could JUST be a second ONE WAVE, that would account for hong kong ONLY dropping 15%. Heh, ONLY. His site is http://www.the-elliott-wave-practioner.com

He is pretty good, but he was too early on the top, way too early. So he definitely has a bearish side to him.

By the way, congrats on a great FP today Red. Almost to the tic once again

Now if they would only give me the top of Major Wave 3 and the bottom I would be happy as a bear during trout season!

GOLD chart: http://niftychartsandpatterns.blogspot.com/2011/10/rectangle-of-gold.html

Red, we are waiting for parts right now. So your Arthur is dependent on that. Additionally, Arthur as usual, coupled with your FP, made me a real score today. Thanks to you and thanks to arthur. What a combo.

I cannot wait for two guys to have access to Arthur, gets a little lonely.

I can’t wait either… 😉

Lol, when are you going to go commerical?

Hopefully Red will not have to If every one, once in a while chips in.

Probably never, more likely to go private… “by invite only”, if I ever get that good at trading! LOL

what does 116.00 equate to in the SPX ya think?

About 1160 spx

I see a one two, one two developing here. Which explains WHY that FP on hong kong wasn’t as massive as you expect from a three. But it means that THREE would be apocalyptic.

Arthur is in FULL agreement with this by the way. As defer to him almost always. Sure wish I had listened to him at the top in silver and sold my physical.

By the way, Red, I think this is the best site on the planet now. Free OR commercial. Sorry to all your competitors, but you are the best of the best imo.

Thanks… I try.

You are going to make him BLUSH now. LOL

And 1160? Are you sure? That is awfully high for a C wave of a wave four don’t you think?

The other target is 113.13 spy or 1131 spx.

Going to have to consult Arthur on that one. Planning on going all in at the top of the C here. Need a JOLT.

You could be waiting for a two weeks or so.

We are around 110 on the SPY, 5 or 6 points higher means 1160? No.

Yes, but this move today could be a smaller set of waves with wave “A” up hitting 113.13 spy and then “B” down, followed by “C” up to 116.05 spy.

suppose so, that would be one heckuva four. More like a 2.

That is more like it btw.

AAPL Near 200 SMA: http://niftychartsandpatterns.blogspot.com/2011/10/apple-near-200-sma.html

I used to be a bird watcher, still am to some degree, so I am pretty good at waiting.

It looks like we completed a smaller “A” wave up to 110.00, then a “B” wave down to 108, and we are waiting for the “C” wave up tomorrow. We could hit the 113.13 spy afterhours print from yesterday for the end of that C wave. After that I’m not sure? We could complete the 4th wave at that point, and go back down into a 5th wave… or not? The next upside target is 116.05 spy.

If this is accurate, then a gap up tomorrow is possible (and likely). We need to gap over the downward sloping trendline of resistance to make it up to 113.13 if that is the target for this move up. A possibility is a gap up in the morning around that 113.13 level, and then an early morning sell off for a larger “B” wave down with “C” up to follow on Thursday. That would be around the 116.05 spy level.

If not, then the move down from the 113.13 level would be the start of the 5th wave down, with only a smaller “ABC” move up from 107.50-110.00 (A), then 110.00-108.00 (B), and 108.00-113.13 (C)… all completing wave 4 up. I’m not sure which will happen, but I’m leaning toward the first ABC up to 113.13 spy as a little larger wave A up, then a B down, followed by a C up to 116.05 to complete this 4th wave up.

At that point, I’ll re-access to see if we are going to continue rallying into the October 23rd-26th time frame, or if we have one more 5th wave down? I could be counting the waves wrong, and there might not be a 5th wave down? I’m not an Elliottwave guru you know… LOL

LOL… someone stated in the chatroom about some positive Greek Debt News. I haven’t heard it yet, but it’s funny how they release news when the charts were pointing up anyway.

As for the 113.13 spy gap up tomorrow, I’d say that’s a given now that we have closed at 112+ on the SPY. This means a continued move to the upper print of 116.05 is also likely. My eta on that would be Thursday.

The bears are running for high ground.

That was breath taking, to watch. As I said earlier Red, I believe you will be correct in your longer term vision on the markets into the 23rd week.