Light Volume Melt UP Still Continues...

(to watch on youtube: www.youtube.com/watch?v=ye9vs_any6Y)

The market is currently experiencing some of the light trading volume days I've seen in a very long time. It's preventing the bears from having any pullback at all. While we "should" have had a 2-4% SPX pullback recently it just hasn't happened and doesn't look like it's going to happen anytime soon. Possibly we'll get some "one day wonders" of 20-30 points down in the near future but I wouldn't count on it. The old saying is "never short a dull market" and this is the dullest market around.

I'll go over the charts in the video but any bearish case (and there's a whole lot of them) will probably NOT play out due to the light volume we are having that keeps the market up in spite of everything else. Some even say it feels like the 1999-2000 run up in the market... just a slow grind every day to put everyone to sleep as it defies gravity and just never has any decent pullback to get long at. Everyone was forced to chase it... at least until the END!

While I'm not expecting this year to crash like it did back then I am expecting a 10-15% correction later this second half of 2014. The real crash is around 3 years away I think. However, I was expecting some pullbacks of 2-4% that I would like to play on both the downside and the upside rally that would follow. It's just not looking like I'm going to get it until we see some more volume in the market. We are very far away from all the moving averages below and various support levels, which normally CANNOT be sustained for very long without a correction. But we are NOT in a "NORMAL" trading period as the volume probably the lightest we've had for the last 5 years or more.

It tells me that the Fed's have instructed the big institutions NOT to sell, which will allow this light volume float up to continue much longer then it should. It's obviously not the Fed's QE money pushing this market up as they are taking more and more of it out the market at every FOMC meeting, so it's got to be the small retail sheep buying it up here as there's no one left but them.

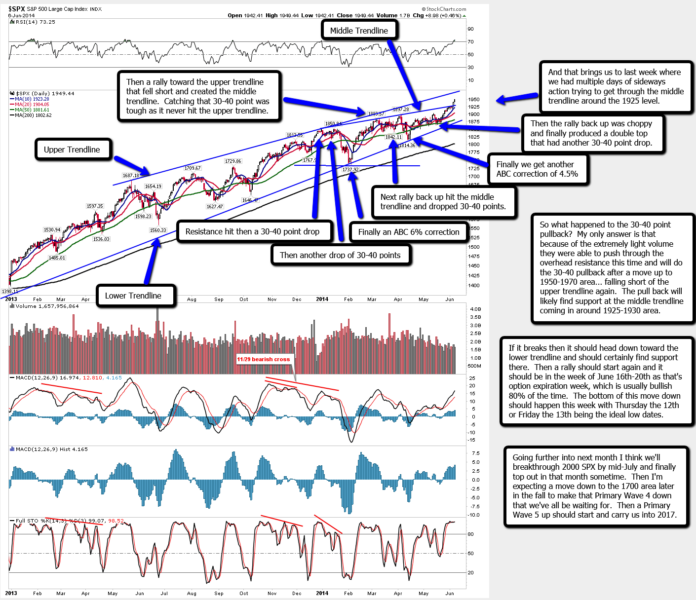

Lets examine this daily chart of the SPX for a minute...

Looking back to December of 2013 you'll notice how the market hit overhead resistance, pulled back for a couple of days (30-40 points), went back up and hit resistance again and then pulled back for a 2nd time for another 30-40 points.... and finally rolled over for about a 6% correction to bottom at 1737 SPX in February of 2014. Then we rallied up until March before tiring out and after several days of chopping sideways we dropped for a few days... again 30-40 points.

Then back up to peak at 1897 in late March, which was then followed by about a 4.5% correction. Each time the market dropped to hit the rising trendline of support from 2011 and bounced back up from it. That's why I was expecting only a 2-4% correction this time as the market was making smaller corrections each time as it was coming to the end of the rising wedge.

This most recent time the market chopped along that rising trendline of resistance in the 1920 area for many days and couldn't get through. Everything looked similar to the prior 3-4 times except that we were actually more overbought this time thing previously. So what changed? Why didn't the market rollover again? The only answer I have is "EXTREMELY LIGHT VOLUME!".

So what's next?

My best guess is that we continue higher with that next overhead resistance line being the next upside target. It looks to be near 2000 SPX on the chart but it's hard to tell for sure as it rises every day. But if there are a lot of bear stops still left after Friday's breakout move then the bulls could put a nasty wave 3 squeeze on the bears and run this up higher then we could believe this week.

However, the more likely scenario is that we backtest the broken trendline of resistance in the 1925 area that will now become support. This week is usually the pause or down week with the bottom being put in on Thursday or Friday, and then next week is usually the super bullish week as it's the month option expiration week.

With that said I'd look for a long position on a pullback to backtest that broken trendline as the odds are strong that we will now continue higher with 2000+ being the upside target area. Once we hit that rising trendline (which again is in the 2000 area currently) I could then see a pullback to the middle rising trendline that we just broke out of late last week. It could rise up to 1930-1935 by then... depending on how long it takes us to first hit the upper rising trendline near 2000.

Catching a bear move is during a cattle drive isn't exactly the easiest thing to do!

One might view this slow grind higher as cattle (the bulls) being driven by some ranchers (banksters) from one coast of America to the other coast with some random bear attacks at night when the cattle are sleeping and the ranchers are passed out from drinking too much Whiskey. The bears get a few of the cattle but the rancher always wakes up the next morning to protect the herd.

So until these cattle are delivered to their final destination and read for slaughter I'd be cautious on the shorting, and instead you might just want to go long once that middle rising trendline is backtest this week. My best guess is that we peak out on Tuesday in the 1960+ area and then drop back into Thursday or Friday for the low... which again should only backtest the middle rising trendline that we just broke out of last week. It should be in the 1930 area by Tuesday but with the 10 day moving average at 1923 we could see that hit to trick the bears by piercing the trendline of "now support" (former resistance) on an intra-day move.

It's common for them to briefly pierce through support and resistance levels I've noticed as it lures in the suckers just before the turn and go the other direction. I think that area just below 1930 is a good entry for a long into the 3rd week of this month as it's option expiration week and is bullish 80% of the time. You could probably get long and this Thursday or Friday (June 12th or 13th) and ride it up to that 2000 area which could come as early as by the following Friday the 20th (no guarantee on that time frame though).

Naturally everything I'm speculating on here can change (and usually does... like 100% of the time! LOL), so keep checking the comments for updates as time goes forward as I post any changes there which also get reposted on Twitter and Facebook.

Hang in there bears, you only have another month or so to go...

Red

New email about a penny stock pick went out just now…

Just a side note, today is a 22 day and the high on the SPX was 1955.55… which is a lot of 5’s! Could mean nothing or it could mean the short term top was today? Just throwing that out there to think about. Since we never hit Dow 17,000 today they might want it first before selling off a little… or they know all the bears are waiting there so they fall short of hitting and make the bears chase the move down (which implies the high is in today and not on Tuesday).

thanks for the new post RDL. lots of interesting things in there.

Yeah, and from the looks of the action today in the market I’d say we are either already topped (today) or will be tomorrow sometime. Even if it’s tomorrow I don’t see any big move up. Probably another small up move at best.

Or we start to sell off nicely, which is my preferred choice. If all goes well then we’ll bottom this Thursday or Friday.

thanks for the update. – feels like we may be in tight range for bit the way today went. – lets see what they give us in the morning. 🙂

Silver chart analysis: http://niftychartsandpatterns.blogspot.in/2014/06/silver-chart-update.html

For those the play the penny stocks there’s a new pick coming out this morning around 9:20am and it looks to be a really hot one. Be sure to check your email for the update.

APPLE Chart analysis: http://niftychartsandpatterns.blogspot.in/2014/06/apple-analysis-after-stock-split.html

I hope some of you got in on the penny pick sent out as it’s up 250% this morning!

The penny stock we alerted our newsletter members to is up today almost 400% from yesterday. Anyone buying today at the open could have easily doubled (or tripled) their money. For those not on the list and just want to know more just go look at the chart of INOH (http://inovationsholdings.com) and see for yourself.

My partner and I are passing on many other hot picks we get alerted to as most don’t preform as well as others forecast. We only want to alert people to the best of the best picks so everyone will have a great chance to make money. This was one of those picks. Here’s the chart I sent out this morning….

http://reddragonleo.com/wp-content/uploads/2014-06-10_0848.jpg

INOH Chart: http://screencast.com/t/oY9puTZT7zh

S&P500 Futures Chart Update: http://screencast.com/t/wyctRjAzegmx

Tough call here on the market gang. The volume is so light that they could easily rip this higher tomorrow even though the charts are just now rolling over and becoming bearish. So while we have a bear flag on the charts it could easily be manipulated with the light volume we are currently having.

On the bullish side the market is riding the 10, 20, 50 EMA with no signs of breaking them. So until it does we can expect the bulls to remain in control. Today’s bear flag could play out or be negated and the rally continues. I just don’t know either way.

i agree RDL.-feels like we are not going very far either direction at the moment. no engine,no sail and no wind.- hopefully that will change soon.

Yeah, but on the other hand this EXTREMELY low volume means there aren’t anymore buyers up at this level and no one has hit the sell button yet. All that is needed for a nice move down is some panic from some news related item and then you’d see a nice drop happen.

well i think a select group of very wealthy well connected insider funds own the lions share of all the good stuff that they were able to get in on at bargain 2009 and 2010 prices…and sitting on huge gains.- not many middle class folks can buy anything here now..as not much is what you’d call cheap here. if i were an investment adviser for lower level millionaires just getting started..i’m not sure what i would recommend for a starting portfolio and feel real good about it.-so based on that theory..i could see the volume stay real low here..either way.- not a lot of buyers..but also very few sellers as i think the funds feel confident about holding here still with the fed policies staying in place for now.- frustrating for those of us that want some real volatility in a wide trading range.

maybe i’m wrong and we’ll be down 300 dow pts tomorrow..and then 500 pts more on thurs.- the very low vix says otherwise but ya never know. 🙂

Yep… I agree with you. We’ll know tomorrow and Thursday. Whatever low they give us I still see it happening on Thursday or Friday morning.

sounds good.- thanks.

EURUSD Weekly support levels: http://niftychartsandpatterns.blogspot.in/2014/06/eurusd-weekly-support-levels.html

Well, it’s pretty obvious where the markets are right now. I guess it’s just time to sit and relax and wait for denouement. World Cup starts tomorrow in Brasilia so I guess kick back and enjoy.

Today was 12years 9 months from you know when……guess how many weeks we are coming up on?

SPX Update: http://screencast.com/t/w324hgl0g

thanks RDL

The charts are still bearish looking even though I “feel” like we should get a bounce soon… maybe into the close today? I’m so used too the bears getting screwed that I’m afraid to hod short for very long in fear of a rip higher on some manufactured news.

i hear ya. i think with todays follow through decline..and having an important index like the transports getting killed today down a 170 pts so far…the odds for going lower..and maybe even getting south of spx 1900 just got a little higher. we can be sure spx 1920 will be tough,so we’ll watch that if we get there today or tomorrow-this newest negative iraqui news and oil rally seem to be an issue for the market today. we should know pretty well by monday.

GOLD Resistance levels: http://niftychartsandpatterns.blogspot.in/2014/06/gold-resistance-levels.html

Hmmm, no DeMark analog references these days. We have an obvious one now. The analog would require the SP to make a slightly higher high with a lower RSI divergence. 60 min RSI levels were extremely overbought on Monday so a divergence is needed there with a new high but the solar flares did knock out stockcharts data feed on Tuesday so there might not be a proper RSI reading at new highs.

Brazil beat Croatia in the opener today 3-1. A lot of 11-10 s flashed in that game. I’ll have a review later, possibly. Some obvious fakery in that game. Or Croatia has an extremely incompetent goaltender who apparently can’t get to slow dribblers or lets a penalty kick go through his hands.

Oh forgot about Mercury retrograde which might have had an effect on communications. Usually a stock market top is put in within a few days of a retrograde. A high in 4 trading days would match the move off the low in early February and the next decent bottom back in April??? 46 tds later.

ES Chart update: http://niftychartsandpatterns.blogspot.in/2014/06/es-chart-analysis.html

SPX Update: http://screencast.com/t/Xns1hjSYd (If you like these updates please let me know with a like or comment)

Possible wave count? http://screencast.com/t/UkACkYRJzx

SILVER Testing long term resistance line: http://niftychartsandpatterns.blogspot.com/2014/06/silver-testing-weekly-resistance-line.html

Gold at resistance levels: http://niftychartsandpatterns.blogspot.in/2014/06/gold-at-resistance-levels.html

ES Futures Update: http://screencast.com/t/y4zdXRXyyGJ

SPX Update:http://screencast.com/t/htJtrBIB6

You guys should know the deal by now… wild swings on Fed Day (tomorrow, June 18th, 2014… another 22 day, or eleven), but in the end it’s a rally. Then “if” it closes at the high of the day a brief follow though into early Thursday should happen. Then we see the market rollover into later that day and into Friday.

That down move should continue into next week and “if” it’s a C wave down (with 1955 to 1925 being the A wave down and 1925 to the high coming this Wednesday or Thursday being the B wave up) we should see a move down to around 1900 to complete the ABC pattern.

That 1900 area is still huge support from that rising trendline going back to 2011 around 1074 SPX and should hold again as we approach the July 4th holidays. We should rally up from it and make a higher high then 1955 with 2000+ being the goal. Don’t know if it will fall short of it or go through it a little but the time frame should still be mid-July for a top.

Not sure how this is going to end but considering the fact that we brokeout to new highs I’d think any pullback we have will be small… meaning that C wave down to 1900 area is probably out of the question for now and we should be continuing to move up (with small pullbacks) until mid-July.

The only wildcard here would be a breakdown of that 1945 SPX area where we just brokeout out of… which I don’t see happening. At this point I’d expect more upside within the next 2-4 days before a move back down to retest this horizontal support level from the double top. Meaning that 1958 area (give or take a few points) should act as support on the way back down from some higher level just under 2000.

Some exciting World Cup play so far. I am guessing the World Cup champ leaves the euro. Italy is my favorite to win because of my 1987 connection to Italy. They are quietly flying under the radar. Doesn’t look like defending World Cup and Euro champs Spain will be leaving the euro as they have been eliminated from advancing after abysmal performances against the Netherlands (5-1 loss) and Chile (2-0 loss today).

Once again the famed Netherlands’ 9-11 duo/forwards led the way in their 3-2 win against Australia each scoring once in the match although #9 will miss the next match after receiving his second yellow card. This after the 9-11 combo scored twice apiece in their thrashing of Spain last friday. #9 was replaced in the 87th today minute by #17 for 9-8 combo.

Some numerological highlights included Australia’s and Netherlands #7s running into each other for a 7-7 combo with Netherland’s #20 immediately running up to Aus.’s#7 to confront him for 7-20/20-7 combo.

In the Spain-Chile game, there was a Chilean 11-10 substitution (an 8-6, and 6-11 one as well). In yesterday’s Brazil-Mexico game, I noticed a 9-11 (Spanish side) substition and of course there was a 9-11 substitution in last Friday’s Netherlands-Spain game after the famed 9-11 Holland duo finished their thrashing of Spain.

The Miami Thrice were quietly eliminated in the NBA finals Sunday amidst all the World Cup fanfare. Now it looks like LeBron is setting up an “opt-out” Decision which could see the destruction of the Thrice.

Spain’s subs 9-11 came in together on Friday for #19-14s in the 62nd minute.

http://www.cbssports.com/world-cup/matchtracker/WCS-20140613_NED@ESP

There’s a nice photo there of the 9-11 duo with a 111 interspersed between them.

They show all the goals in that link too. Some embarrassing play by Spain’s#1 (goal keeper). Strange for a goal keeper on the world’s most dominant team.

A pseudo foul by Netherlands’ #9 on Spain’s #19 set up a penatly kick for Spain’s only goal.

Today’s high in the SP seems numerologically significant. The high 1957.74-666.79=1290.95. Today would be a 46 td low low high although a certain analog could see the markets put in a down day tomorrow with a slightly higher high on Friday. New lows jumped to 33 today for such a historic close.

EURUSD Support and Resistance levels: http://niftychartsandpatterns.blogspot.in/2014/06/eurusd-support-and-resistance-levels.html

I’m looking for 1965-1970 SPX to complete a 5th wave up with today’s choppy sideways move being the wave 4 down and yesterday’s big move up being the wave 3 up. At that point I’d consider a short, but I’m still looking for mid-July as the final high and best shorting opportunity.

Double top on the ES “could” stop the bulls but I really doubt it. (And the SPX has already made new highs). The light volume helps the bulls keep it from selling off. So I’d expect this resistance to be broken as the bulls continue their run for 2000+ on the SPX (and the ES futures too I’m sure).

However, I do see some overhead resistance on the SPX from a rising channel. And I count 5 waves up with the current move up today being the 5th wave up. But if wave 5 equals wave 1 (which was 70 points from 1814.36 to 1884.89 from 4/11 to 4/22) then wave 5 might not end until 1997 SPX with it’s starting point at 1927 on 6/13.

Not saying that it’s going straight up from here but with no bears in sight I doubt if any pullbacks are very deep and will of course be bought up. I’d say we’ll hit 2000 SPX (or more) by July 3rd of next week. Yeah, crazy huh? But it is what it is…

We all know the market is 100% controlled and manipulated to the upside so you just have to go with it and enjoy the slow moving turtle race (the bulls) until it ends in 2017 and the big bad bear returns to annihilate the bulls. But by then the SPX could be 3000-4000, which is basically what they did in 1929 and of course the 1999 high.

They WILL take this up to extremely insane levels before they crash it to steal all the sheeps’ money. Between now and 2017 we should see them trick the last sheep back into the market with their hard earned savings as that’s what they always do. When the last sheep buys the bullshit you’ll know the party is near the end.

Right now we still have tons of bearish talk on the main stream media, which means it’s going to do the opposite. Now don’t get me wrong, I’m still expecting a primary wave 4 down this year but I don’t know when it will start. I’m guessing mid-July but we need to hear the main stream media become extremely bullish before we actually top and start a down move again.

So I’m not taking any shorts until I see some decent volume return to the market, which might even be dragged out until August? Hopefully we’ll see some cracks in July and then a bigger move down in August.

But on the short term it’s just a “buy the dips” until 2000 SPX and/or July 4th holiday weekend is over with (but again I think we’ll see 2000 prior to the holiday weekend starting as it will look really good plastered all over the media going into it)

From the looks of things it appears we are having our pullback now. I’d guess it’s an ABC pattern down and once complete we’ll resume the uptrend. It hit right in my 1970 area range and appears to have ended the 5th wave up that I commented on previously.

So now this should be a larger wave 4 down that could go as low as 1945 SPX are in an ABC pattern move. I wouldn’t count on it going that low but it’s possible. This could just be another bear trap like so many we’ve seen in the past.

Regardless, it should still play out in an A move down (right now happening), B wave up (to lure in the bulls) and another C wave down… which should then end the wave 4 down and allow a wave 5 up to 2000+ to start.

Since we all know next week is a shorten holiday week I’d expect the low to be put in by this Thursday and then a rally into next week for that larger wave 5 up. Target is 2000+ on the SPX.

Based on the time of day, still very light volume and the technical support that the market is resting at right now I think we’ve seen the low for the day. While we “should” go down lower in some ABC pattern with this whole move being just wave A down I wouldn’t be shocked to see this be the only wave down, which can be broken down into 5 smaller waves.

Then we “could” (I only say that because of the holiday coming up, the desire to hit 2000 prior to it, the light volume and of course the extreme manipulation to the upside) have seen all the downside we are going to get for awhile. Meaning we’ll NOT go up tomorrow for a B wave and then down again for a C wave, but instead just continue on our merry way up…. chop, by chop, by chop, by chop, by chop…

ES Charts update: http://niftychartsandpatterns.blogspot.in/2014/06/s-500-futures-chart-analysis.html

Well, Italy was eliminated from the World Cup yesterday but there was a nice 3-9 ritual with the mind-controlled psycho from Uruguay #9 biting Italy’s #3 in the 79th minute. Uruguay did win the World Cup the last time it was held in Brazil but it’s doubtful they will get anywhere without their psychotic leading scorer (who put up a 29 or 99 ie 2 goals for #9 against England his first game back….amazingly, he ran very well for a guy with a serious injury against England).

I guess I won’t need to put any Depeche Mode videos from 1987 up here. It wasn’t likely that Italy would leave the euro. The leading candidate is Germany per the Rammstein Meine Land video/song. But Greece did make it through to the elimination round yesterday when it appeared all odds were against them….on a penalty kick but I didn’t see it so no discussion of a possible ritual) Maybe Greece can replicate its success from a few years ago when they unexpectedly won the Euro cup but it is very doubtful.

In the Italy game, famed mind-controlled striker #9 proved once again that he is in the game primarily to perform rituals. He was very ineffective all tournament long other than picking up yellow cards which he did again yesterday. They like using the 39 combo with him. He was benched to start the second half in a 9-9 combo or 29 when Italian player #18 came in for him (#9—also adds up to 27 or 999). I beleive there was another 11-9 substitution in the game on the Uruguay side.

The famed 9-11 duo from team Orange, the Netherlands was unable to perform together as Daniel Day Lewis, #9 was unable to play after accumulating 2 yellow cards but they still managed to flash a 9-11 on #11 s go ahead goal albeit in a complicated format. #11 joined players #13 and #5 after his goal.

The US Portugal game saw Portugal come back inexplicably to tie the game in the 95th minute off a beautiful cross by famed soccer actor #7 that lead to a header. They did start the game with a 8-7 combo as US star #8 met Portugal soccer actor #7 at midfield to start the game and flashed the number a few times during the game. There’s too much to discuss with this game and so little time to do it.

And tomorrow we have the U.S. -Germany game where the rituals should abound as current US coach Klinsmann and his 4 German born American players go against his former team (both as a player and a coach). I can’t see Germany losing but who knows what is planned. All 4 teams from the Group of Death are technically still alive. FIFA managed to put 4 quarterfinalists from the 2010 World Cup in the same bracketd while creating a Group of Crap headlined by a Colombian team with potential Euro exiter Greece making it through to the next round as the #2 team.

Index put call ratio went through the roof while equity put call ratio dropped on a decent up day.

Tomorrow will be the 27th anniversary of the release of Stanley Kubrick’s grand ritual and lesser grand ritual classic Full Metal Jacket.

Did you notice last week was 666 weeks from a certain little event 12 years 9 months earlier. Maybe the 666 week cycle is kicking in.

Well, looks like we’re finally having that ABC down. I was beginning to wonder if it would ever happen, but here it is. I said earlier this week I was expecting a bottom by Thursday but I have to admit this move took me by surprise as it was very fast with little bounces along the way. Hard too predict in advance.

But now that’s we’ve had it I’m expecting the move back up to start soon and to continue all next week as we all know they want this market much higher going into the 4th of July weekend. While I don’t know if the bottom is in yet today or not it is at an important support level, so we “could” be bottomed?

The projected bottoming area is around 1930 SPX but they always seem to fall short of hitting the low targets while piercing through the upside targets. So while I’m a bear at heart I also know the market is bullish 90% of the time. Therefore I have to think we’ll find a bottom today and rally into next Thursday with 2000 SPX being the goal.

Yeah, that’s a crazy call from me but I think it’s the one that would fool the most people. I hear a lot of others calling for 1929-1930 (some much lower) before this sell off ends. They never give us what we expect, so either they stop short of that or drop below 1900 in big hurry to kill all the bulls and make the bears miss out on the drop.

Which one do you think will happen? Personally I don’t recall any 4th of July holiday’s where the stock market was tanking in front of it, but maybe this time is different? (Doubt it…)

The mind controlled psycho from Uruguay, #9 was suspended for 9 games by FIFA after his biting incident with Italy’s #3.

I didn’t really see any numerology flashes or rituals in the USA-Germany games except just before Germany’s goal when two German players #11-5 s set up in front of the US goal on a set piece. I did think uh-oh/ some ominous foreboding there but they did manage to ricochet the ball a bit after the corner kick before Germany’s #13, his fourth(13-4) goal of the tournament, kicked in the goal on a rebound off of the US goal keeper’s save. The scoring goal came in the games’ 55th minute.

Only caught glances of the Ghana-Portugal game where it appeared the rituals were taking place. They managed to get a goal for Portugal’s famed soccer actor #7 which ended up being the game winning goal for Portugal when Ghana’s goal keeper managed to get a weird popup kick come down into his hands but instead of catching the ball he guided/ slapped it to Portugal’s #7 who made the easy shot. Ghana gave up its other goal when one of its defenders kicked a ball into its own net. This outcome allowed the US to advance despite losing. So they weren’t too subtle in “managing” the outcome of this game.

Portugal’s #7 had some weird formation cut into the side of his head/ hair. Maybe a S. And I did see another Portugese player with a 7 carved into his head. So maybe he has overwhelming adoration for his famed soccer actor teammate or it means something else. Need to look more deeply into the gametape.

US gets to advance despite giving up the last minute goal in the 95th minute to Portugal on a turnover by the baldy who also missed a point blank shot with the goal tender out of the way. (he kicked it right at the defender) And with Portugal’s win, Portugal and soccer actor #7 get to save face by exiting the tournament with a win and a tie.(and a goal scored for #7)

Both Portugal and Germany had 11-10 substitutions. A 11-14 (115)substitution on the US side after #14 made his first start for the US team and headed the ball out of bounds that set up Germany’s game winning corner kick/ set piece.

Something tells me you are really,really,really into this soccer thing.

Team 911 plays Sunday morning against Mexico. When I cheer for the Orange, I yell 911.

Ok gang, I think we started some kind of larger wave 3 up today with a smaller wave 1 up to the 1978.58 SPX high and then a smaller wave 2 down into the close. I suspect this wave will end around the 11am EST period Wednesday when Janet Yellen speaks.

Then I’d look for a smaller wave 3 up inside a larger wave 3 up to happen. This should take us to 2000 or more on the SPX by this Thursday. Do note that the market closes at 1pm on Thursday July 3rd for the 4th of July holiday weekend.

So while in the past I’d expect some type of top here as I let my bearish side effect my judgement I won’t make that prediction here now. I have to look at past history of this holiday week and say that it’s bullish probably 90% of the time, so I expect the same thing here to happen.

If Yellen was speaking afterhours on a Thursday when the market was closed and traders couldn’t short the market then that would be the time period when something negative would be released. Why? Because they’d have 3 full days to calm the market down while it was closed and you’d see Monday open up only slightly down instead of really tanking hard.

Leopards don’t change their colors they say and it’s not likely the people that control and manipulate the market will change their way of thinking or doing things. When they want a rally they release news during market hours and when the news it negative they wait until the market is closed.

So since Yellen is speaking at 11am and the market is still open we should expect the news to be positive and for the market to rally the rest of day after she speaks and into Thursday as well from some more good news (made up of course) with the non-farm payroll numbers.

I’d give this scenario a 90% chance of playing out… why? Because it has already played out many, many times in the past like this. They rally up to some important number for sheep to hear it all over the media during the 4th of July weekend so they will spend money they don’t have thinking happy days are here again.

All we need now is for them to take the ES Futures down a little afterhours and into tomorrow morning to reset the overbought charts and then we can rally tomorrow after Yellen yells that all is well… buy, buy, buy!

I don’t about getting to SPX 2000 today..but by next week looks real good.-And so much for Dow 17,000 being an issue.- As we all just witnessed..they blew the Dow thru 17K like it was hot butter.

They failed to hit 2000 SPX though, but at least the 17,000 DOW call was correct. Now I’m looking for some small selling next week with a bottom on Thursday or Friday. Then we should continue the rally the next week into option expiration Friday the 18th.

But….

If they hit 2000 and clear it a little (maybe 2010-2020?) going into that week I’m expecting a very important top on the 17th, which at that point I’ll be turning bearish again.

Until then I’m still bullish as 2000+ is a must have for the bulls. I “might” take a small short next week though to play the pullback into Thursday or Friday. But then I’d switch back to going long into the 17th.

Yea..amazing strength here in so many indexes…so I don’t think anyone can say with much confidence now that a “real” top is close.Most of the key indexes as we know..like the Dow,SPX,Transports,RUT,etc..have all made many,many new all time highs in 2014 and don’t appear to be fading.- The last index still looking for a new all time high would be the NASDAQ/COMP.-And as we’ve seen..it is really trying to get back to that all time high from the year 2000 at just over 5000.- With it up almost another 30 points today at 4485..a 14 year high..it doesn’t have that far to go.- A very scary market for anybody trying find a major top for some short trades. With us being at new all time highs in so many areas..charts are starting to be pretty worthless up here…as there is no reference points.I remember the 90’s being like that. We went straight up more or less from Dow 3000,an all time high at the time….to a staggering Dow 12,000 by 2000. Way more “unknowns” here than “knowns” NOW.

Looking forward to seeing what we do Monday.

EURUSD Resistance levels: http://niftychartsandpatterns.blogspot.in/2014/07/eurusd-resistance-levels.html

The enlightened ones are sending more signs of the “end times” signalling that denouement is upon us. In 1969, a film called IF THIS IS TUESDAY, THEN IT MUST BE BELGIUM was released, a grand ritual flick disguised as a light romantic comedy that definitely has been forgotten over the years about a group of US tourists taking a packaged summer tour across Europe, covering 9 countries in 18 days (9-9 or 9+18 for 27…which by the way was the substitution numbers for Italy’s Balotelli in Italy’s last World Cup game and they definitely liked flashing 39 with Balotelli). Then they released a TV remake/ spinoff to commemorate the lesser grand ritual 18 years later, IF THIS IS TUESDAY, THEN IT STILL MUST BE BELGIUM, which was played on September 21, (93), 1987.

On Tuesday, the US played Belgium but the US tourists lost 2-1. Belgium hadn’t been in a World Cup in many years but the little red headed dude #7 for Belgium just dominated scoring their first goal and then providing the assist for the other. Green#16, the US’s young phenom was finally given some World Cup time and provided the US’s only goal after they went down 2-0.

And they flashed a number dear to my heart on the first Belgian goal which came in the 93rd minute.

Team 911, the Orange/ Dutch barely squeeked by Mexico. Netherland’s #9 was non-existent against Mexico so he was subbed for by #19. The Dutch tied the game in the 88th minute on a hard shot by #10 off a rebound. Then the Mexican captain fouled famed Dutch striker #11 in the box setting up a penalty kick in the 92nd minute but curiously enough, the Dutch had the sub #19 take the penalty kick rather than their renowned striker #11 who was fouled. So on this day team 911 became team 19-11 or 10-19 based on the scorers. Oh I forgot the 10-19 is another disguised 29 or 119.

Tomorrow, July 4 will be 93 years from the date on Jack Nicholson Overlook Hotel July 4 1921 party photo from the end of the Shining seen in the middle of the middle of 3 rows of 7 photos on the hotel wall.

How about that Dow closing over 17,000 for the first time ever today ! (?)

I see 2 scenario’s here… one is that we gap up tomorrow but fail to make a new high (double top likely or just a point or so above or below 1986), which I think could be shorted into an expected low on Thursday or Friday. At that point I’d look to go long into next week with 2000+ SPX being the target.

Second is that they gap down and finish this small pullback tomorrow and then resume the rally up the rest of the week and into next week. This scenario seems unlikely as history tells us that they commonly put in the lows on the Thursday or Friday the week prior to the monthly options expiration (which is Friday the 18th… so we are in the week prior now).

If the first scenario is correct then I think we are having the first wave down today with the expected gap move Tuesday to make the wave 2 up. That leaves the wave 3 down (and 4 up and 5 down) to happen into this Thursday or Friday. This whole 5 wave move should make up some type of larger wave 4 down with the larger wave 5 up yet to come (which should take us to 2000+).

I’m not sure if this can all be done by next Thursday the 17th or not but anything is possible I guess? If we do manage to carve out a larger wave 4 down and a larger wave 5 up into that date and we clear 2000 SPX (and put in a double top on the Nasdaq) then there’s a good chance this will end the bull rally and we should see a pretty large correction right afterwards.

This correction should be 200-400 SPX points and last several months. It should be labeled Primary Wave 4 down and look similar to Primary Wave 2 down from 2011 that seen a nasty mini crash wave inside it that happened on August 8th of that year. But for now I’ll say we are still likely to go higher before anything like that will start.

It looks like there trying to set up a West Germany-Argentina World Cup final which would be a repeat of the 1986 World Cup Final which was won by Argentina with Messi performing in the role of Diego Maradona. The 1986 World Cup was played in Mexico (originally for Colombia but Colombia couldn’t handle it financially); this one in Brazil.

Brazil’s star #10 will be missing from the Brazil-Germany game tomorrow after suffering a “catastrophic” injury to his back caused by slight blow to his back from a Colombian player’s knee.

#10 performed WWE levels of overracting as he lay on the ground writhing in pain but that is standard for the course I guess for soccer injuries. Generally when one has a back injury, he doesn’t writhe all over the place on his back.

So Brazil has an excuse to lose now despite playing at home.

But then team 911 might have a say in matters as they moved on on penalty kicks against Costa Rica winning the pkicks 4-3. Interesting lineup they used for the penalty kicks.

#9-#11-#10-then #15 In the last game, #9 was removed for #19 but 9 remained in this one. They did a #4-#19 substitution for #19 this time covering all the interesting numbers (4-19 day of infamy number, Mayan pyramid configuration number ie 4 sides of 19 terraces). Remember last game, they had #19 come in for the penalty kick for the fouled world class player #11. This time #19 didn’t make the penalty shooter lineup unless he was the closer.

With a penalty kicking lineup like that maybe team 911 is a team of destiny.

In the German-France game which was a total snoozefest as both teams put forth uninspired play, the only notable highlight appeared to be Germany starting its all time World Cup scorer #11 ostensibly so he could be replaced in a 9-11 substitution by Germany’s #9 in the 69th minute. #11 never starts for Germany and hasn’t since the last World Cup since as a 36 year old, he isn’t considered to have the pace to play an entire long game. He also doesn’t flash those 666 hand signs anymore after he scores. After the 9-11 substitution, Germany produced a .

July 3rd’s bolt to new highs to SP 1985 actually saw a contraction of new highs and very weak positive breadth. Index put call ratios also skyrocketed but they have been elevated for a week now.

Federer made it to the Wimbledon final and we have the Donald Sterling/ Clippers ritual to hit the courts soon as he challenges the “forced selling” of his team to the MSFT big man taking up some aspects of Le Carre’s OUR KIND OF TRAITOR.

From the looks of the charts I think we’ll chop around most of the day and stage a late move up into the close. As long as it doesn’t make a new high I’d look to short it into Wednesday with the expect low to happen on Thursday or Friday in the 1955-1960 area.

So much for choppy around… LOL! I guess we just go down first?

ES Futures update and wave count: http://screencast.com/t/tnI5qMiFnB

Germany destroyed Brazil on its home turf 7-1. When I saw that Klose #11 was going to get the start, I knew he was going to get the World Cup alltime record-breaking goal that he shares with the Brazilian Ronaldo against Brazil in Brazil. I would have tweeted it out if I had a twitter account.

#11 scored Germany’s second. The first was by #13, his fifth goal of the tournament so 5-13. After #11 scored they flashed a 9-11 with #18 coming over to #11 and even a 16(7)-11 as #16 came over to hug #11 after his goal. Of course, it was #11’s 16th World Cup goal. He did his usual running slide to the side after scoring the goal but the TV coverage broke away but some replays showed that he didn’t appear to flash his signature 666 hand sign which he routinely did until I mentioned it (last Euro cup or World Cup?). Then #18 immediately went on to score two more goals, ie 9-9, then #6 scored the final goal for Germany in the first half.

As expected, Germany did a 9-11 substitution(58th minute), but the TV coverage framed it as a 11-9. #9 proceeded to score Germany’s next two goal for another 99 or 29. Once they got to 6 goals, i figured Germany was headed to 7 goals.

At one point, I thought there was a chance Belgium might face Germany in the final for a ritualistic Germany Brussells standoff that would see the Germans upstage Brussells but I guess they were more interested in 1986 redux angle. Belgium did make the semifinals of the 1986 World Cup probably one of their most recent World Cup appearances.

On Germany’s 7th goal, the Brazilian goalkeeper didn’t make much of an effort to reach for the ball and deflect it. Of course, he promptly was writhing on the ground reaching for his shoulder as if he had a jammed shoulder that prevented him from reaching for any balls. But he stayed in the game.

Very reminiscent of #10s theatrics against Colombia.

Interesting, Deutsche Bank drops to a new 52 week low today while Greece is down 3+%.

CRUDE Oil chart analysis: http://niftychartsandpatterns.blogspot.in/2014/07/crude-oil-support-levels.html