The transportation startup is trying to make a pod levitate in a tunnel, but can it rise above founder clashes and employee lawsuits?

Hyperloop tubes are displayed during the first test of the propulsion system at the Hyperloop One Test and Safety site on May 11, in Las Vegas.

In December 2014, an engineer with the unlikely name Brogan BamBrogan was in the driveway of his clapboard Los Angeles house, loading up his car for a holiday road trip to Northern California, when venture capitalist Shervin Pishevar messaged him for a favor.

The two were founders of Hyperloop One, a startup building futuristic tubes to zip people from city to city. Shervin Pishevar, a partner at Sherpa Capital, was the money guy; BamBrogan the chief technical officer. Pishevar's brother, Afshin Pishevar, was driving west from Washington to join the company as general counsel, and needed a place to stay. BamBrogan and his wife stopped packing, cleaned the bathroom, and tucked a spare key under the front mat of his Los Feliz home. When they returned a few days later, Afshin Pishevar was still there. Their houseplants were littered with cigarette butts.

Twenty months later, neither BamBrogan nor Afshin Pishevar work at Hyperloop One, and in June, BamBrogan and three other former employees filed a lawsuit against the Pishevar brothers and the company, also naming Chief Executive Officer Robert Lloyd and investor Joseph Lonsdale in the suit. It alleges the men didnt have the companys interests at heart, and also makes claims of assault and defamation. In its countersuit against BamBrogan and the other ex-employees, Hyperloop One said the insurgent employees were trying to start a competing firm. One dispute surrounds a long, looped rope BamBrogan discovered on his office chair one morning, in the shape of a noose or a lasso, depending on your perspective. There is no mystery over who left it there: his former houseguest, Afshin Pishevar.

Startups, including success stories Facebook and Twitter, often suffer founder clashes, executive churn, and squabbles over equity. But at Hyperloop One, a high-profile company spawned from an idea by Tesla founder and CEO Elon Musk, things got very toxic, very fast. The dueling lawsuits and lurid accusations threaten to sully the company's idealistic mission to create a new form of transportation.

A lawyer representing Hyperloop One, Orin Snyder, a partner at Gibson Dunn, said: "We are confident that at the end of the day it will be obvious that their entire lawsuit was a crass publicity stunt based on lies and smears intended to cover up a failed coup and illegal plot to steal intellectual property and create a competing hyperloop company." BamBrogan and his co-plaintiffs deny they were attempting a coup. Through his lawyer David Willingham, Afshin Pishevar denied leaving the cigarette butts in BamBrogan's home.

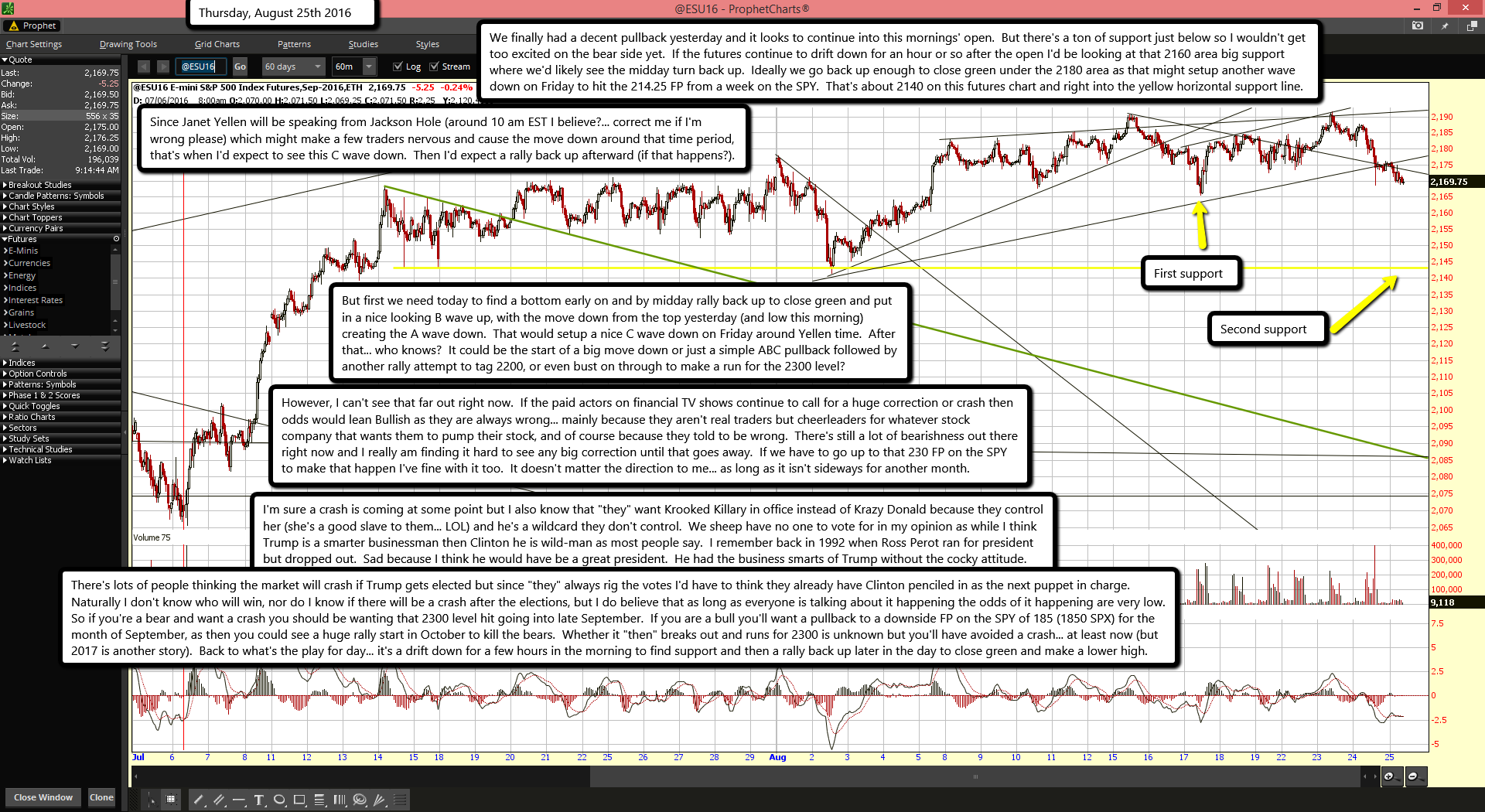

The company, now run by Lloyd, former Cisco president, is moving forward with plans to make a viable transportation mode out of large pods zooming through tubes. Early next year, Lloyd said, they'll have their "Kitty Hawk moment," aiming to levitate a pod inside a tunnel. The test is crucial for persuading investors to sink more money into Hyperloop, whose projects will likely each cost billions of dollars.

These are big steps for a company thats only 20 months old, he said. Although the events of the past few weeks are not something I would have hoped for, Lloyd believes they will ultimately make the company stronger. We all come together more closely when somebody surprises us, or we feel attacked, he said.

Photos from BamBrogan's lawsuit: BamBrogan, finding the rope on his chair, and security footage of Afshin Pishevar walking through the office with a rope.

In his proposal in 2013, Elon Musk dubbed the hyperloop "a cross between a Concorde and a railgun and an air hockey table, and dared engineers everywhere to build it.

The Hyperloop idea resembles magnetic-levitation trains: magnets levitate driverless circular carriages, a few centimeters above a track, propelled along by an electric motor. Operating inside a low-pressure tube, the theory goes, the Hyperloop would encounter so little resistance that the carriages could whisk along at airplane speeds. If the technology works, commercial Hyperloop routes could open in a few years.

Shervin Pishevar, a well-connected entrepreneur turned venture capitalist, made his name through an early investment in Uber, after having moved to the U.S. from Iran as a child in the late 1970s. He likes to name drop his famous friends, and once flew to Cuba with Musk and actor Sean Penn to try, unsuccessfully, to negotiate for a U.S. political prisoners release.

Inspired by Musk's vision, Shervin Pishevar searched for a technology prodigy to execute it, settling on BamBrogan, a wiry, handlebar-mustachioed former SpaceX engineer. Until 2014, his name had been Kevin Brogan, but he legally changed it to merge names with his wife, Bambi. At Musk's SpaceX, BamBrogan was employee #23, and a polarizing figure. Known back then as K-Bro, he was the cool kid among the brainy engineers. BamBrogan would organize parties and other diversions for the over-worked 20-somethings. He had plenty of enemies there, though, particularly those who did not feel like part of the BamBrogan clique.

Shervin Pishevar offered him six percent of the company and started raising funds, bringing in Lonsdale, co-founder of the data-analysis behemoth Palantir Technologies. BamBrogan began drawing up designs.

BamBrogan instilled a hard-charging, fast-moving culture at Hyperloop One. He angered quickly, but commanded considerable loyalty. Many employees kept fake million-dollar bills with his image on them taped to their desks. A few months after the company had moved into a former factory in Los Angeles, BamBrogan announced another expansion by bursting through a wall wearing a Kool-Aid suit.

Shervin Pishevars brother Afshin worked as a lawyer near Washington for years, with one of his cases landing on Washingtonian Magazines 2014 list of top personal-injury verdicts. That year, tragedy struck when his son died in a flying accident, according to the countersuit. Hyperloop offered a fresh start.

Afshin Pishevar eventually found his own apartment, but he and BamBrogan started butting heads. BamBrogan chafed when he thought Afshin Pishevar was slow with paperwork, according to a person familiar with the situation. Through his lawyer Willingham, Afshin Pishevar said startups sometimes act hastily, entering into agreements against their best interests, and it is the chief legal officers role to make sure actions are within the letter of the law.

Hyperloop One could sometimes feel like college. Workers stayed late, batting around ideas, playing board games, and eating leftovers from the day's catered lunchtacos, curries, burgers. But tight deadlines and regular changes of plan also created stress and led to tiffs, according to former employees. Hyperloop employees often had to tidy up for VIPs arriving for tours. Hosting celebrities like Katy Perry has its perks, but the visits and parties started to wear thin on some. A spokesman for the company, Farrell Sklerov, denied that the events were frequent.

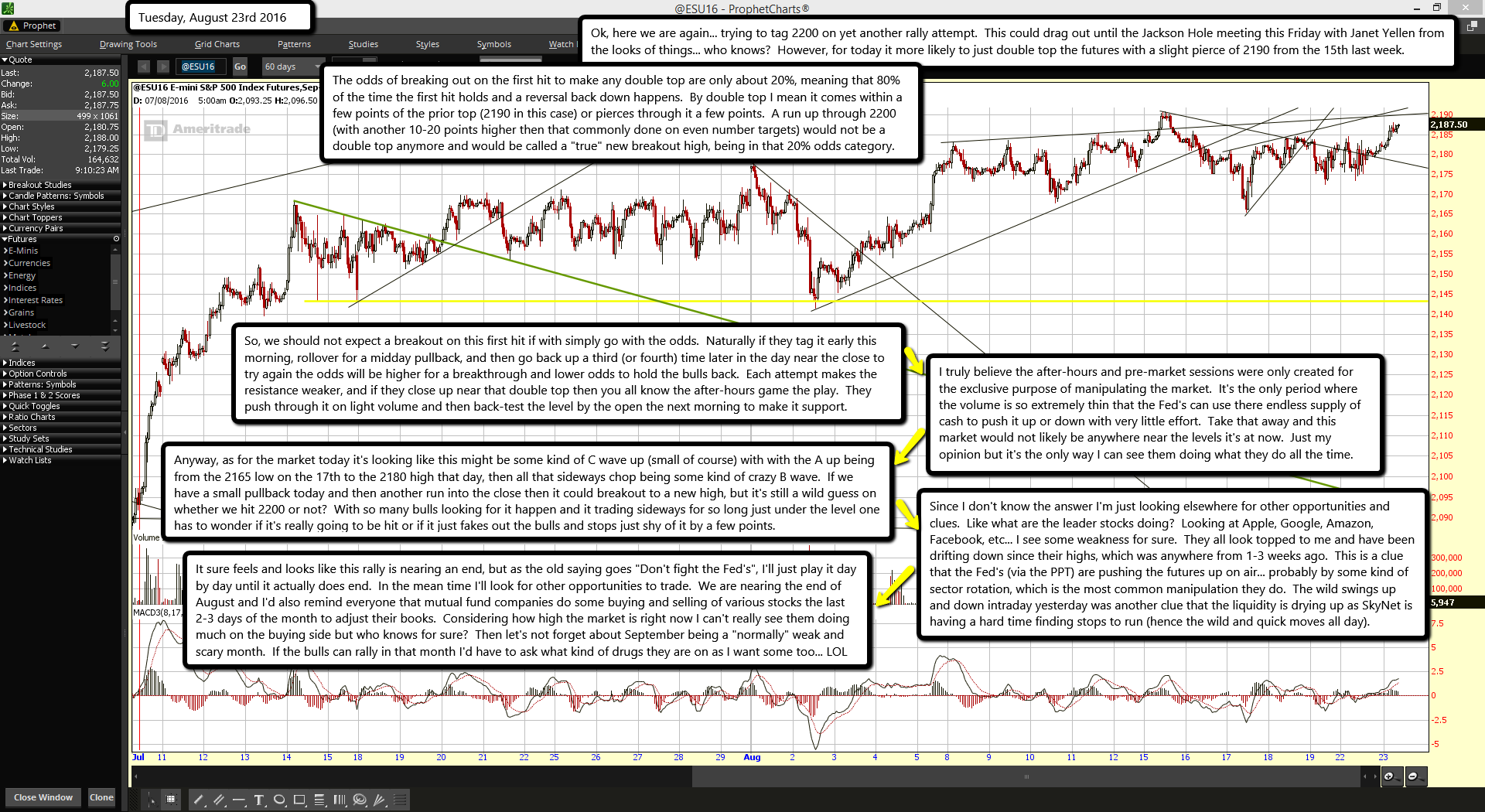

Shervin Pishevar, Lloyd, and BamBrogan at the first test of the propulsion system in May.

Last summer, the board hired Lloyd, who started in September. The staff had just received raises, and spirits ran high. To celebrate, everyone whacked at a piata that spilled out fake bank notes emblazoned with images of Lloyd and other executives.

Meanwhile, Afshin Pishevar was the subject of several complaints alleging unprofessional outbursts, according to the July lawsuit filed by BamBrogan and other former Hyperloop employees. In one instance, learning of an internal meeting that didn't include him, Afshin Pishevar joined the gathering and in a raised voice demanded to know why he wasn't invited, where one of the participants went to college, and when he had graduated, according to a person present at the meeting. BamBrogan and others hoped Lloyd would rein in Afshin Pishevar. Lloyd declined to discuss Afshin Pishevar's tenure. Through Willingham, Afshin Pishevar denied behaving unprofessionally.

At first, Lloyd promised overhauls, and some hoped that meant the departure of Afshin Pishevar, people familiar with the situation said. Sklerov denied Lloyd ever said he would fire Afshin Pishevar.

In an interview, Lloyd was reluctant to rehash the past, but made plain he preferred spending time on areas where his big-company background makes a difference, such as negotiating partnerships and hiring top-notch staff. You focus on the things you can control, Lloyd said, speaking generally.

Lloyd oversaw a major funding push, raising an additional $80 million this year, bringing total capital raised to over $100 million. But to some, the fundraising exacerbated another grievance: employee equity. BamBrogan had received additional shares as the company arranged the $80 million fundraising round, according to Hyperloop Ones counterlawsuit, but most employees had not. Some wanted more.

Meanwhile, Lloyd had his own frustrations with BamBrogan, meeting with him on at least five occasions to discuss negative and disruptive behavior," according to the countersuit. BamBrogan said the meetings were to discuss Lloyds performance, not his.

In one instance, BamBrogan smashed a beer bottle when angered, according to the countersuit; BamBrogan acknowledged smashing the bottle outside.

By late spring, BamBrogan believed the time had come to hold a frank discussion with Shervin Pishevar to press him again on the employee equity and other issues. He was able to corner Shervin Pishevar at the test site in the Nevada desert where the company was gearing up to show off its propulsion system. The two exchanged "tough words" about equity, the tours, and other concerns, BamBrogan said, but they agreed to work things out.

The propulsion system test in mid-May was successful: They managed to accelerate a sled on a track to 116 miles per hour in just over a second. Reporters gathered around BamBrogan, Lloyd and Shervin Pishevar embracing. But things were still tense. And back in Los Angeles, little seemed to change.

By late May, a group of top employees decided to take action. They convened in Ripley, a conference room named after the monster-battling character in the movie Alien." They drew up demands, including engineering representation on the board in the form of BamBrogan and engineering president Josh Giegel, more equity for staff, and an end to Shervin Pishevars tenure as executive chairman, according to the litigation. The group hoped that Lloyd, just back from a China business trip, would sign the letter, too. They called him, but he declined.

The company has its own take. In its countersuit, Hyperloop One said BamBrogan, former vice president of business development Knut Sauer, former assistant general counsel David Pendergast, and former finance vice president William Mulholland were seeking to take over the company or start a rival company, even purchasing the domain name Hyperlooptoo.com. The plaintiffs issued a statement labeling the countersuit complete fiction, but added that once their attempted intervention antagonized board members, it wasnt surprising they considered looking for other work.

Lloyd wasn't caught off guard by the letter's demands, but something else gnawed at him. I was surprised by the tone, and the aggression, he said. And suggested there were better ways to work things out.

Board member Justin Fishner-Wolfson was deputized to patch things up.

On May 31, he met for seven hours with the disgruntled employees, having worked over Memorial Day weekend with other board members on a response that incorporated many of the employees demands, including changing equity provisions, according to the countersuit.

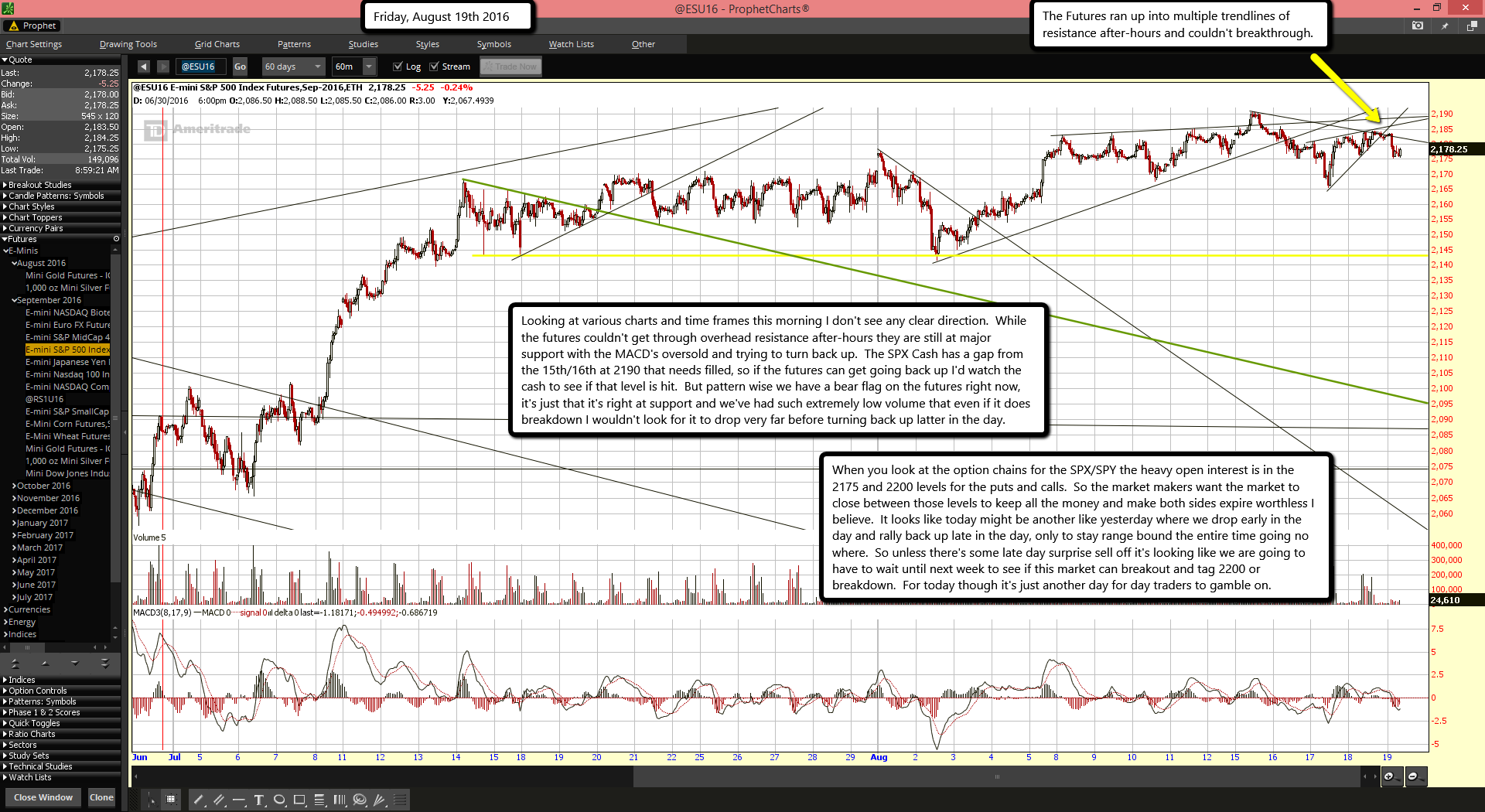

The group kept coming to work. On the morning of June 15th, employees who signed the letter were gathering once again in Ripley, preparing to meet with Fishner-Wolfson and Lloyd. BamBrogan entered, wheeling his desk chair. On it rested a rope, looped at the end. To BamBrogan, it was a noose and a threat. The company insists it was a lasso, saying in its countersuit that Afshin Pishevar intended it for someone acting like a cowboy. Through Willingham, Afshin Pishevar said designating the rope a noose amounts to an ill-fated attempt to bolster a meritless lawsuit.

Gathered around the reception desk reviewing security video footage, several staff members watched a grainy image of Afshin Pishevar walking toward BamBrogans desk late the night before, rope in hand. He was angry that BamBrogan had notified Russian investors of the groups grievances shortly before Shervin Pishevar was due to meet with them, according the countersuit.

The countersuit cited a text Shervin Pishevar had sent his brother on the night of the incident: One comment and guidance. Act completely calm and dont show any emotion. Dont say anything negative or provide any ammunition for them to use against us, our family, or our company. Thanks. Willingham declined to comment on the text.

Afshin Pishevar admitted leaving the rope, according to the countersuit. Another person familiar with the situation characterized the rope as a "prank." Prank or threat, within the hour, he was fired and escorted out of the building. The police arrived. Lawyers convened.

By days end, Pendergast was also fired. The next day, BamBrogan, Sauer and Mulholland resigned, and weeks later, they and Pendergast filed their lawsuit alleging breach of fiduciary duty and other claims. Within days, the company responded with its countersuit, also alleging claims including breach of fiduciary duty.

Today, engineering head Giegel holds a board seat and the equity plan for staff has improved. Giegel and six other signatories of the May letter still work at the company. During a recent visit, engineers tinkered with designs on their computers, some hunched over pages of handwritten calculus. In large sheds out back, technicians were cutting through sheets of metal. Hyperloop employs 170 people, set to rise to as many as 250 by years end, Lloyd said.

Lloyd is moving full bore on projects he had been developing long before the employee rebellion, including landing a new chief financial officer. He said he has doubled down on negotiations to enlist new partners, in addition to existing ones such as French railway SNCF and engineering giant Arup. We are the team thats got the capital, thats got the capabilities, he said.

Afshin Pishevar, still in Los Angeles, is taking some time off. So is BamBrogan, who said he still believes in the concept of the hyperloop. The lawsuits are winding their way through the courts.

The world’s largest retailer hit its dollar store competitor, hard.

The world’s largest retailer hit its dollar store competitor, hard.

A

A