[ad_1]

|

| JPMorgan chief executive Jamie Dimon |

US banks reported last month stronger-than-expected revenues

and much better profits for the fourth quarter of 2015, showing

that pro-longed cost-cutting efforts have left them resilient

earners.

As they now hope finally to emerge from an era of large

regulatory fines and legal bills, banks could become once again

a useful payer of dividends to investors.

For the full year 2015, JPMorgan delivered its record net income

of $24.4 billion. Bank of America produced its best profit

since before the financial crisis, at $15.9 billion. Citigroup brought in $17.1 billion of

profit for 2015, its best result since 2006.

Shareholders – and the analysts who had failed to

predict these strong results – reacted in quite

predictable fashion. They dumped the banks’

stocks.

Citigroup’s share price fared worse, falling 7%

after results and dragging the bank’s market

valuation down to just 0.7 of tangible book value per share.

JPMorgan’s stock fell a more measured 2.5% and

Bank of America’s fell just 2%.

However, even stock-market darling Wells Fargo saw its share

price fall by 5.5% in the days after it announced $23 billion

in net income for 2015, a year in which, after 13 consecutive

quarters of declines in non-performing assets, it generated so

much capital that regulators allowed it to return around $3

billion in dividends and stock buy-backs each quarter.

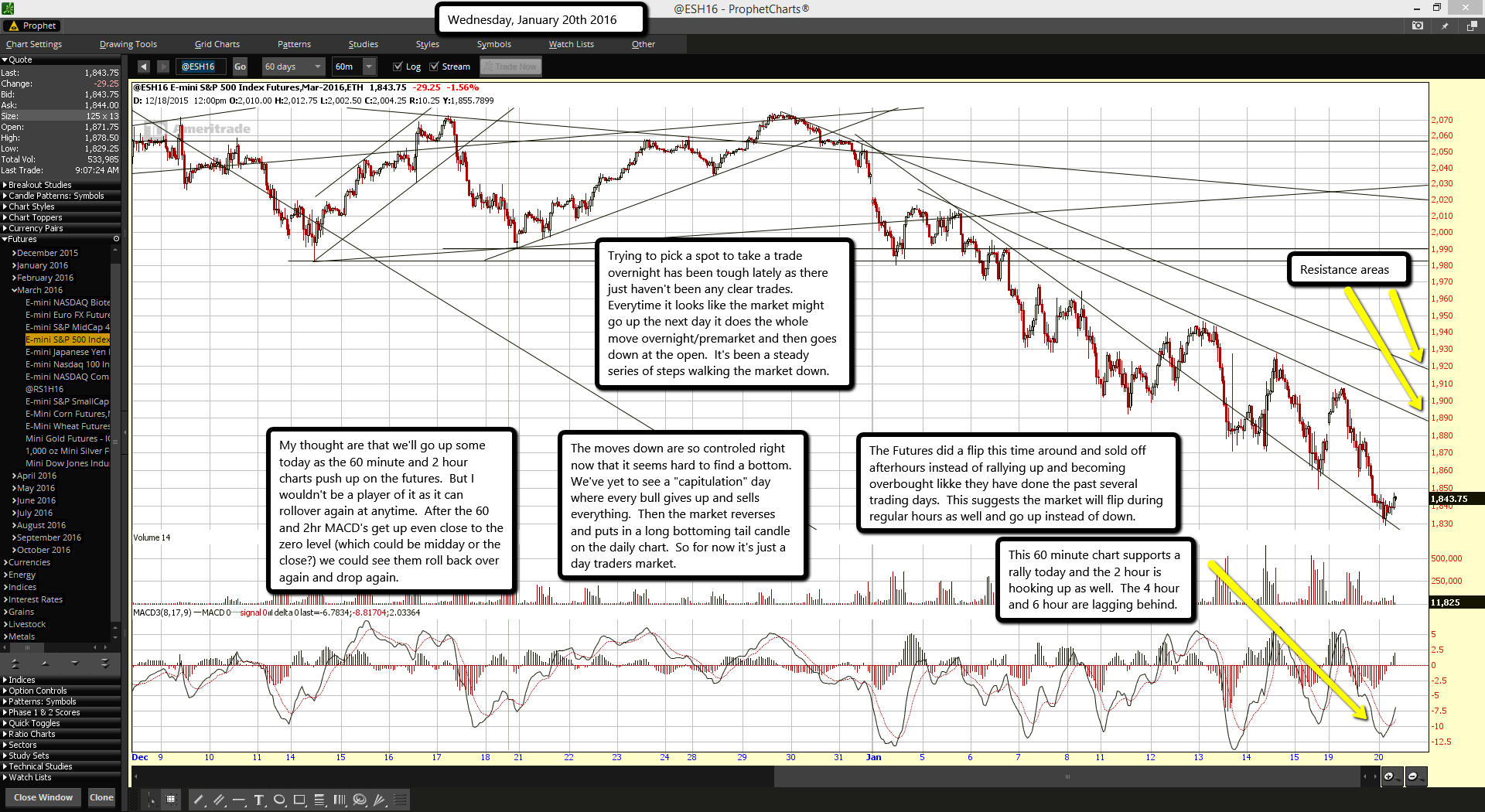

In part, the banks simply got caught up in the general stock

market sell off at the start of the year, amid fears over

slowing Chinese and global growth and further possible declines

in the oil price.

The International Energy Agency

(IEA) estimates that weakening growth will subdue

demand for oil, even as Iran returns to an already

over-supplied market as a big producer. It sees supply

exceeding demand by 1.5 million barrels per day in the first

half of this year, with global inventories rising to a notional

1.285 billion barrels and straining storage infrastructure.

As the oil price fell below $30 per barrel in January,

analyst began to predict further declines to $25 or $20.

"Unless something changes, the oil market could drown in

over-supply," says the IEA. "So the answer to our question [can

the price fall even lower] is an emphatic yes."

Investors are focusing on banks’ exposure to

the

oil and gas sector, as well as to second-order effects on

other types of credit. JPMorgan reserved $550 million against

exposure to the oil and gas sector in 2015 and expects to add

more in 2016.

New credit crisis

Analysts are starting to worry that, as companies have

leveraged up once more to reward shareholders with the benefit

of cheap debt, a new credit crisis is upon us and that banks

might not be building reserves fast enough.

JPMorgan chief executive Jamie Dimon told analysts: "You

know me, I’d put up more if I could but accounting

rules dictate what you can do."

Dimon seemed to suggest that banks would almost be compelled

to keep lending to oil companies to prevent a crisis as other

market sources of funding disappear.

"The oil folks have been surprisingly resilient," says

Dimon. "Remember, these are asset-backed loans. A bankruptcy

doesn’t necessarily mean your loan is bad."

He admits: "If banks just completely pull out of markets

every time something gets volatile and scary,

you’ll be sinking companies left and right."

If the stresses now hitting the oil and gas and metals and

mining sectors are the canary in the coal mine, JPMorgan

isn’t sucking gas just yet, according to chief

financial officer Marianne Lake.

"We’re watching very closely industries that

could have knock-on effects like industrials and

transportation, but we’re not seeing anything

broadly in our portfolio right now," she says.

Citigroup might be, though. More exposed than its peers to

emerging markets – which the World Bank suggests suffered their weakest

growth since 2001 last year, and where it fears spillover

risks in 2016 from

weak growth or recession in Brazil, Russia, South Africa and

China – Citigroup built $300 million in

reserves related to oil and gas in the last quarter of

2015.

Mindful of second-order effects, it built another $300

million across the rest of its portfolio and predicts credit

costs in its wholesale business of $600 million for the first

half of this year. And that is based on oil at $30 per

barrel.

John Gerspach, Citigroup’s chief financial

officer, admits: "If oil were to drop to say $25 a barrel and

then stay there for a sustained period of time, then that

first-half cost of credit number that I gave you [$600 million]

might double."

Citigroup’s overall exposure to the oil sector,

including funded loans and unfunded commitments, is $58

billion, with 80% of that to companies for now-rated investment

grade.

Bank of America chief financial officer Paul Donofrio says

that while the bank has $21 billion of utilized exposure to the

energy sector, that represents just 2% of total loans, and of

that $21 billion just $8.3 billion is to borrowers in the two

high-risk sectors of exploration and production and oil field

services.

The bank has reserves on those exposures of $500 million and

believes that if oil stayed around $30 per barrel for nine

quarters, losses would be about $700 million.

"Outside of energy, we are not seeing asset-quality change

nor are we seeing a reduction in appetite for our credit," says

Donofrio.

The banks are desperately trying to make the case that if

the oil price falls simply because of over-supply –

and not because of more worrying collapse in demand –

then contagion will not spread form the oil sector and that

other sectors might well benefit.

Their problem is that the market just doesn’t

buy it.

"We estimate that US high-yield market is pricing a 6.1%

default rate in 2016 versus a current default rate of 3.2%,"

says Alberto Gallo, head of global macro credit research at

RBS.

"However, defaults could spread beyond the energy sector,

into retail and manufacturing – each 5% of the US

high-yield market. We estimate that 10% of high-yield

manufacturing firms have exposure to the energy sector."

[ad_2]

Wealth of Common Sense

Wealth of Common Sense

Oxfam

Oxfam

Oxfam

Oxfam Getty Images

Getty Images Reuters

Reuters