The market is certainly not giving up easily... but neither am I! It's "do or die" time now, as every chart I can find, on all the different time frames, is now set up for a Wave 3 Down. From the smaller time frames to the larger time frames... we have a whole lot of wave 3's coming up next. That's what I see in Elliottwave term, but I also see the same charts forming Bear Flags from a Technical Analysis standpoint. Let's go over the Technical Analysis first...

Technical Analysis point of view... first up, the Monthly Chart

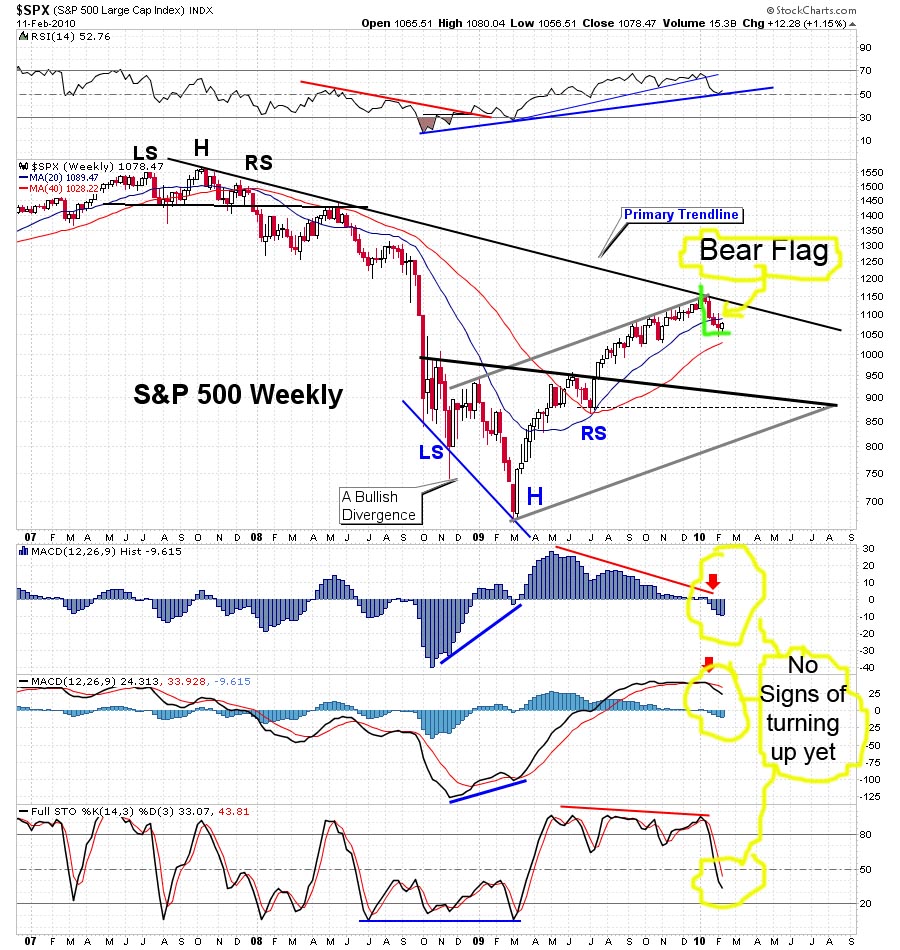

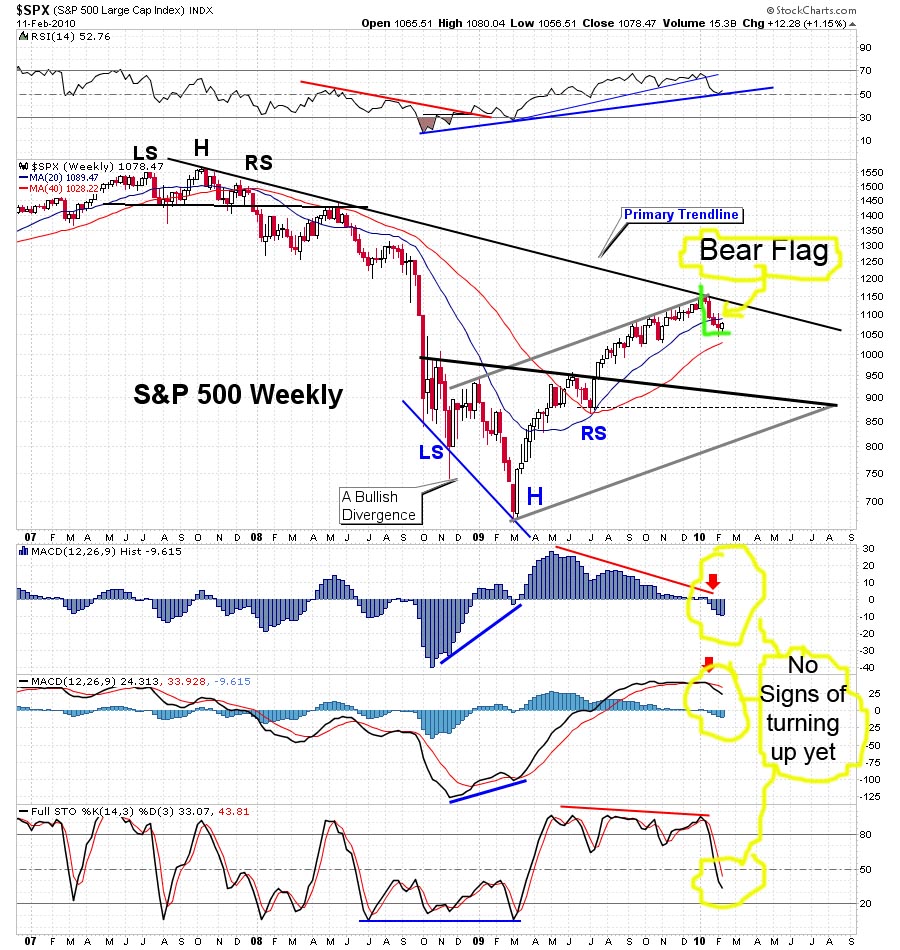

Technical Analysis point of view... second up, the Weekly Chart

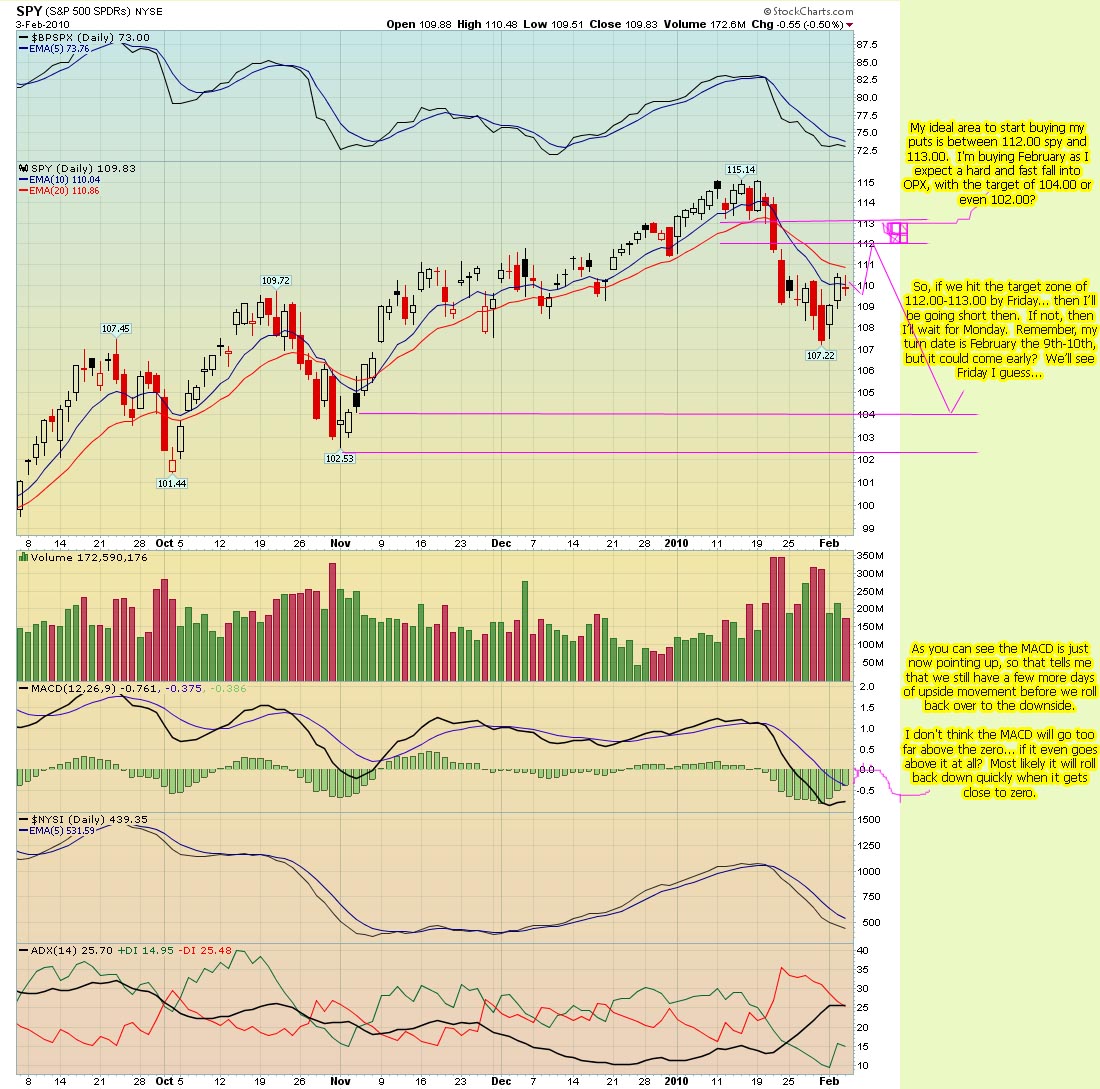

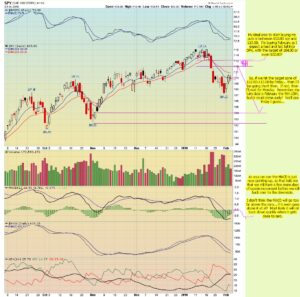

Technical Analysis point of view... third up, the Daily Chart

Technical Analysis point of view... fourth up, the 60 Minute Chart

Technical Analysis point of view... last up, the 15 Minute Chart

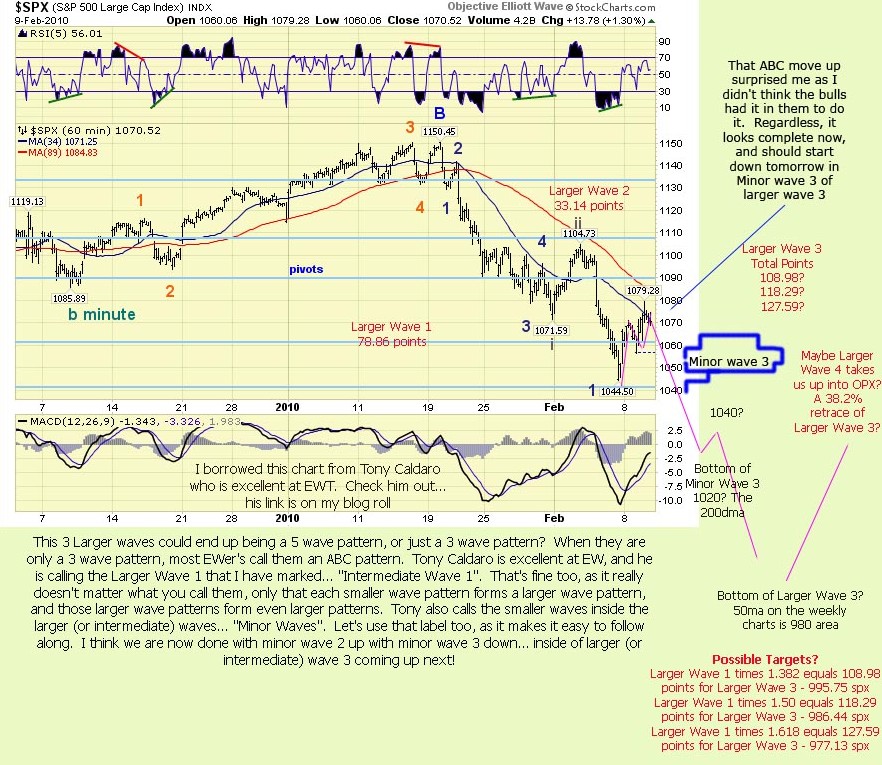

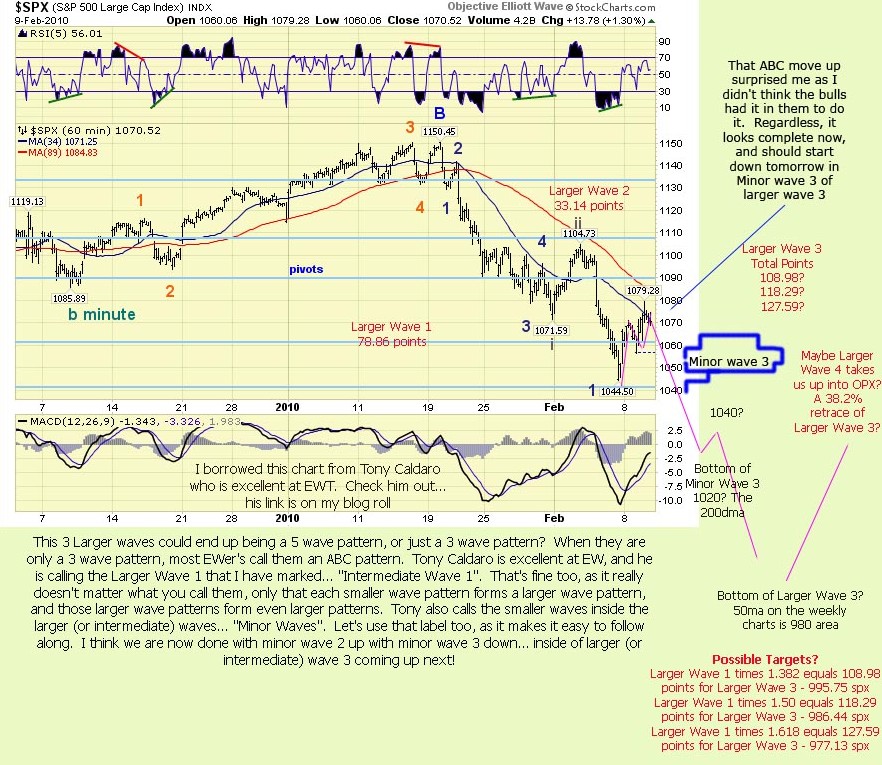

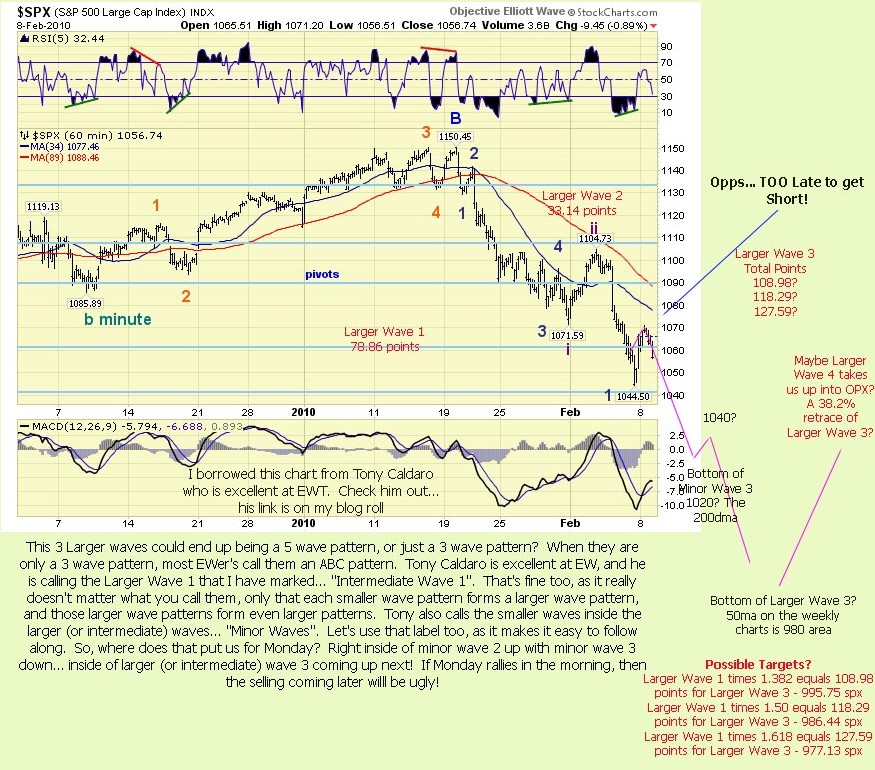

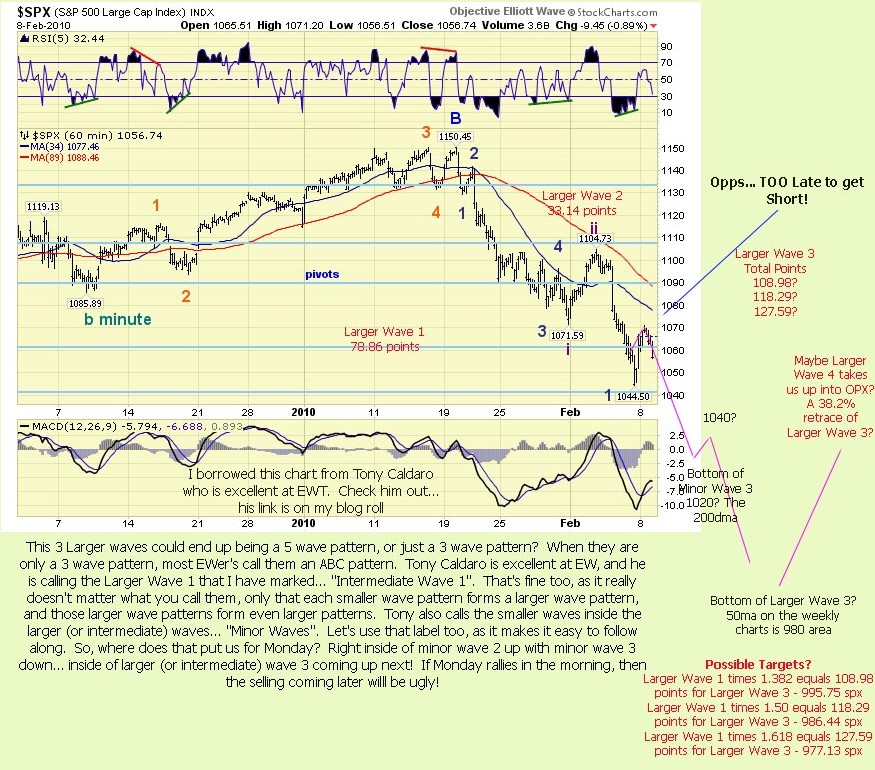

Now, let's tie all the Technical Analysis charts into Elliottwave, and try to figure out the next move, as well as what wave we are now in?

Elliottwave point of view

The Monthly Chart has us in Primary Wave 3

Elliottwave point of view

The First Weekly Chart has us in Major Wave 1

Elliottwave point of view

The Second Weekly Chart has us in Minor Wave 1

Elliottwave point of view

The Daily Chart has us in Intermediate Wave 3

Elliottwave point of view

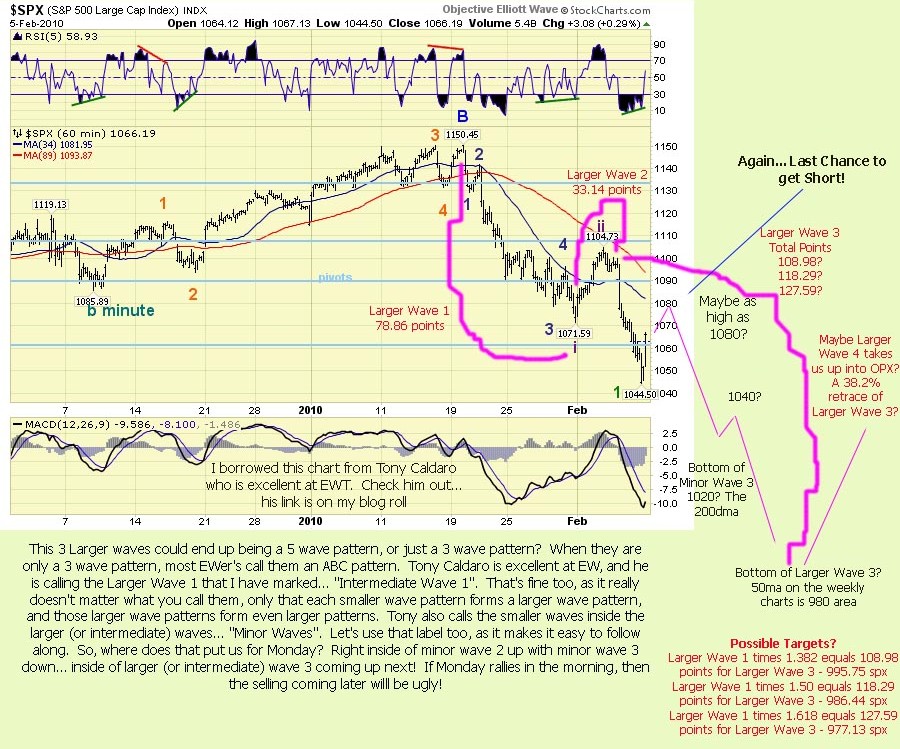

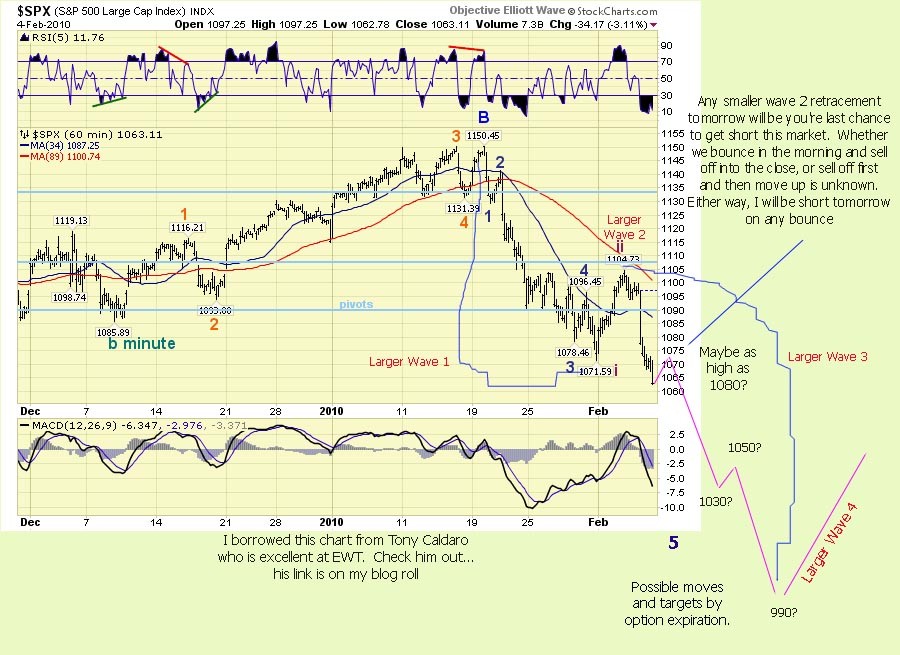

The 60 Minute Chart has us in Mini Wave 3

Elliottwave point of view

The 15 Minute Chart has us in Micro Wave 3

So, that means we now are starting down into (from the larger wave to the smaller wave) Wave 3,1,1,3,3,3... Whew! That's a lot of 3's! If you don't know how powerful wave 3's are, go do some research on it and you'll get the big picture. I'll really be excited when they all turn into Wave 3's! That should start this late September, and will truly be a "Once in a Lifetime" experience.

So what's up for tomorrow you ask, and why am I still holding my put spread? Because I'm expecting a move down to at least 1020 to start as early as tomorrow. I must admit that this has been a learning experience for me, as I'm only now starting to see how all this all ties together. I didn't see that last week, and missed several important pieces to the puzzle.

That doesn't mean I'm going to get every call right... of course I can't do that. But, as I learn more and more about how TA's, EW's, and news events... all tie together, I'll start getting much better entry points. I wasn't able to see that last week, and missed out on all these smaller wave patterns developing. I could have waited until today to go short, and would have been in a lot better position.

Now, my current position is underwater due to the time decay, and the small move up. I purchased a 106/101 vertical put spread on Friday when the market was around 106 (spy), and now we've moved up a point, and lost 4 days of time. I would have caved in and sold them for a lost a month ago, when I didn't understand the charts as well as I do today. But not now, as the more I learn, the more patience I become.

Since I'm learning how to read these charts much better, I hope to get a whole lot better entry point in a couple of weeks, when Minor Wave 3 starts down. Timing in this game is everything. The TA's tell me which direction, and then I try to match the EW patterns up to match with that. I believe it's easier now, as we have started a new trend down. During the sideways market time periods, you had might as well throw EW out the window, and use only TA's. But, for now, they are both lining up perfectly.

It's up to you to make your own decision as to "how to trade" this market of course, and I'm only showing you what I see. I was wrong on calling Monday a big down day, and wrong again on Tuesday and Today. This isn't easy you know... if it was, everyone would be rich. I putting more and more pieces of the puzzle together, which should allow me to narrow down the exact time to get in short... at least for the next time I hope.

I do appreciate all you who visit, and I'm glad you have patience with me while I learn. Study the charts above and come to your own conclusion. Let me know what you see... as I see a big down move coming, starting tomorrow most likely.

If I didn't believe in what the charts tell me, I'd have already bailed on my position now. In fact, a week ago I would have! Why? Because I've been studying my ass every day now for the last week, and I've learned a lot more about the market in that short time period then I learned in the last 6 months. Whether I'm right or not, I don't know? But, I feel like I'm able to assemble this puzzle much better today, as everything was scattered out in pieces months ago.

Anyway, I'm just rambling now. Best of luck to all of us tomorrow... and a big thanks goes out from me to all the great chartists that I read regularly (and borrow their charts from them... hope they don't mind?)

Red